Both the Fed and Biden had big meetings this week. Biden gave a “this-is-not-a-state-of-the-union” state of the union address on part 2 of his “infrastructure” plans. The Fed had a “we’re-not-tapering-and-inflation-is-temporary” meeting on monetary policy. Let’s quickly dive into both to see if we and the markets learned anything new for the economy.

The Fed met first this week and left policy unchanged. This was not a surprise and had been telegraphed out to every economist, trader and politician ahead of time. What this means is that the outcome was pre-ordained, and no surprises were had. (I’m guessin’ Sen. Cruz would’ve dozed off at this meeting as well and who would blame him.) The Fed maintained targeted interest rates at zero, purchases of US Treasury securities at $80B a month and purchases of MBS at $40B a month.

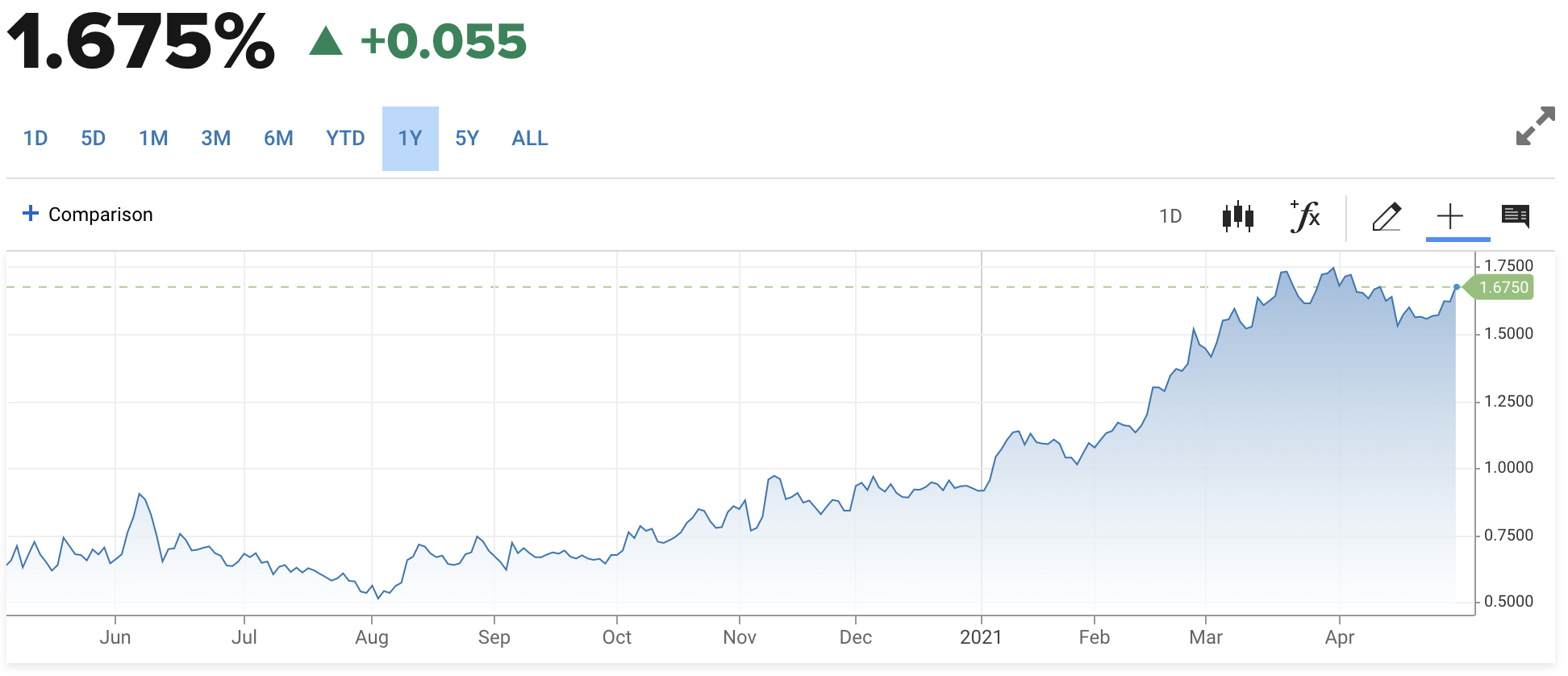

After the announcement, interest rates didn’t move significantly and there were no major resets of expectations for future rate hikes. But this is misleading as interest rates have moved up prior to the announcement this week. And the US 10yr note yield has risen significantly over the last 8 months from an August low of 0.5% to a March peak of 1.77%. The three drivers of higher interest rate have been massive US government spending ($12.4T), the miracle of vaccines (10 worldwide) and the reopening of the US economy from the shutdowns. All three have driven a surge in economic growth, a rapid drop in unemployment and an increase in inflation.

By the Fed staying on hold despite this, the central bank is signaling they will attempt to run the US economy hotter for longer to drive unemployment below pre-pandemic levels to achieve max inclusive employment. Translation: Fed will not react to higher inflation by raising rates until all groups in the US get jobs. Markets should react by keeping short-term rates anchored at zero but driving long-term rates higher to reflect the inflation risk.

What will take us above 2.0% or 2.25% on the 10yr and 4.0% on mortgage rates?

Glad you asked, because you got the answer last night.

After getting a $1.9T stimulus plan approved earlier this year, President Biden is moving forward with a spending plan for both transportation infrastructure and social infrastructure. On April 23rd, President Biden released information on his American Jobs Plan (AJP). Here’s the fact sheet. Last night, Biden gave a speech to a joint session of Congress on what the administration is calling the American Families Plan (AFP). Here’s the fact sheet on it.

Like the Fed, the White House has telegraphed the content for weeks to allow Congress to digest it and to build momentum for legislative approval. Quite simply, this is a $1.8T proposal to provide social benefits, like access to community college, preschool, affordable childcare, paid leave and more, by increasing taxes on the rich. To simplify the spending, $1T goes to new spending and $800B goes to new refundable tax credits. This spending plan is consistent with the campaign promises we wrote about last year but goes further on the size and scope.

There are about $1.5T in revenue raisers or tax increases. These include increasing top tax rate to 39.6% from 37.0% for those earning above $400k; raising capital gains tax to ordinary income tax level (20% to 39.6%); eliminating step up basis at death for capital gains; and applying 3.8% Medicare tax to all forms/levels of income. There are more (including maybe a future VAT tax) , but you get the idea where the focus is going to be.

Through both the AJP and AFP, the White House is signaling they want to dramatically increase federal spending over a wide range of policy priorities. At the same time, they want to significantly increase taxes on the upper income earners and on capital gains. Translation: President Biden wants to drive spending higher to increase jobs and social spending despite just passing a $1.9T spending bill that hasn’t worked its way through to the economy. Nor have all the previous spending bills finished hitting the economy. Markets are reacting by pricing in higher economic growth and higher inflation on top of an economy running at 6%+ GDP.

In the history of the US, there are few times when fiscal and monetary policy are unified for stimulus when there is a high level of economic growth already occurring. Not surprisingly, this creates an environment for growth and upside pressure for risky assets like stocks (or BTC or NFTs). Not surprisingly, this creates an environment for inflation and higher interest rates. Surprisingly, neither Biden nor the Fed appear to be concerned about economic impact from pushing for rapid growth and the aftermath of a potential rapid fall.

And that’s what we learned from both.