On Wednesday, the US Federal Reserve raised its short-term interest rates by 75 basis points, to a range of 2.25% to 2.50% from a range of 1.5%-1.75%, their highest level since December 2018. If you’ve been following the economic events in recent times, this was expected. It was literally old news as the central bank has for weeks been telegraphing to the markets (WSJ Nick Timaros) what they would do at this meeting.

Background

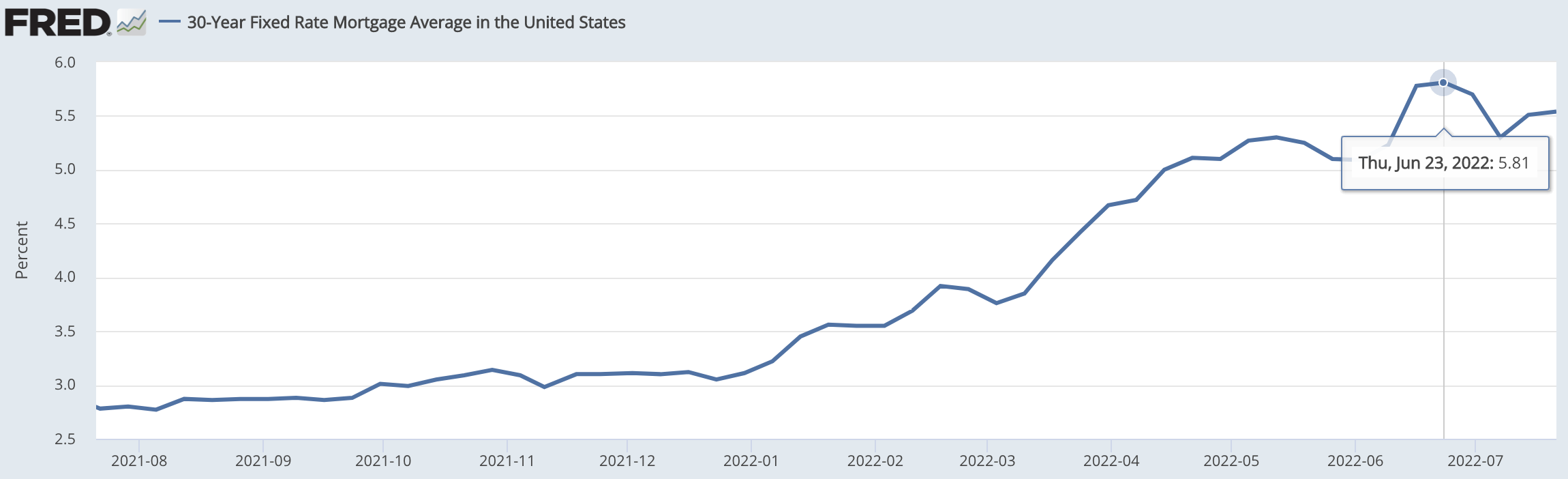

To provide context to this, let’s look at the stock market and mortgage rates. For both, this action by the Fed was, again, not new news. These two significantly moved in June due to raging inflation numbers and the initial surprise 75 basis point rate hike by the Fed. At one point, the US 30-year mortgage in June was 5.81%, up from 2.78% just last August. (Currently, it’s at 5.3%.)

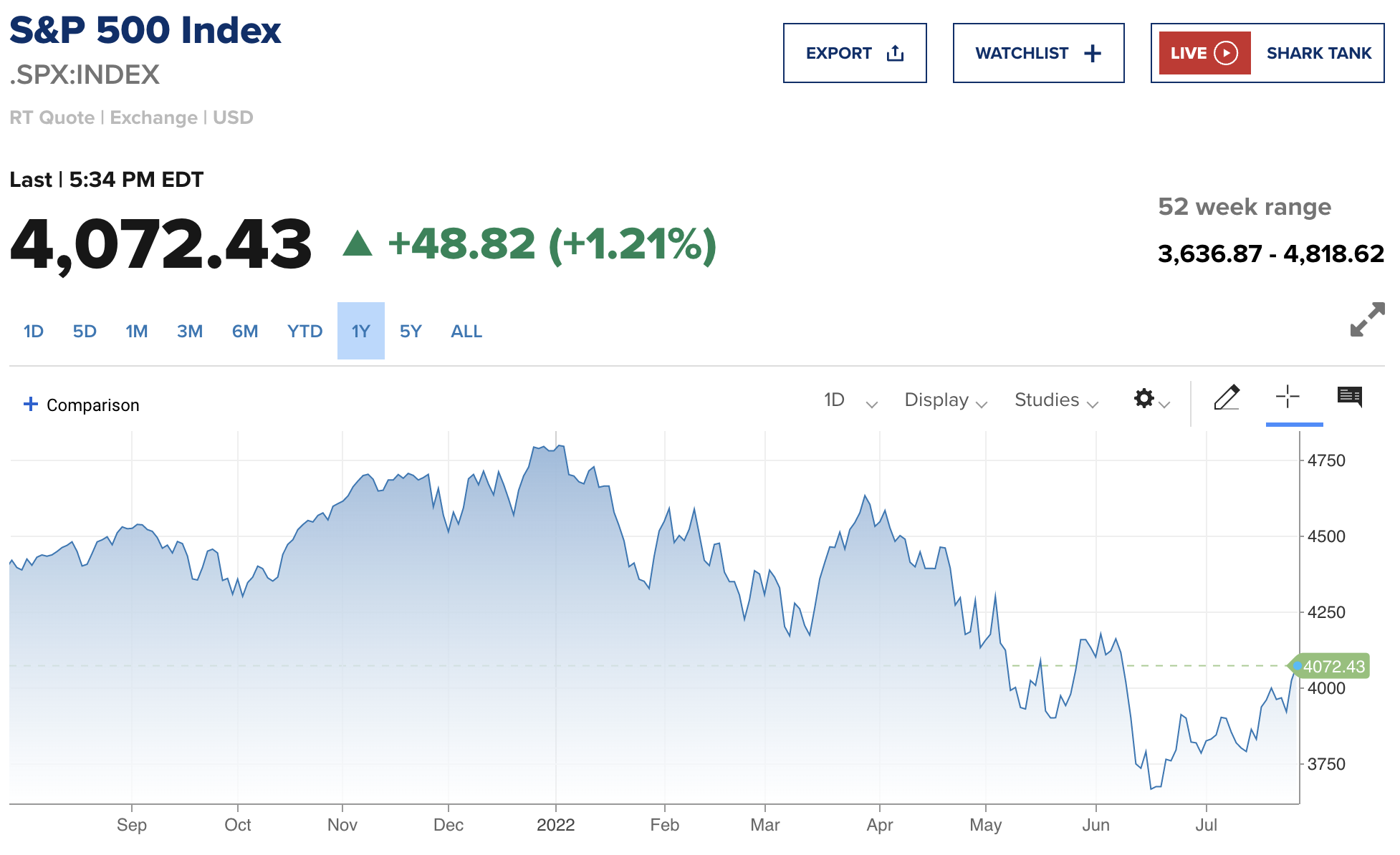

As for stocks, the S&P 500 dropped from a 4,818-record high in January to a low of 3,636 in June. Both these markets anticipated the central bank would continue to aggressively raise interest rates throughout 2022 and into 2023.

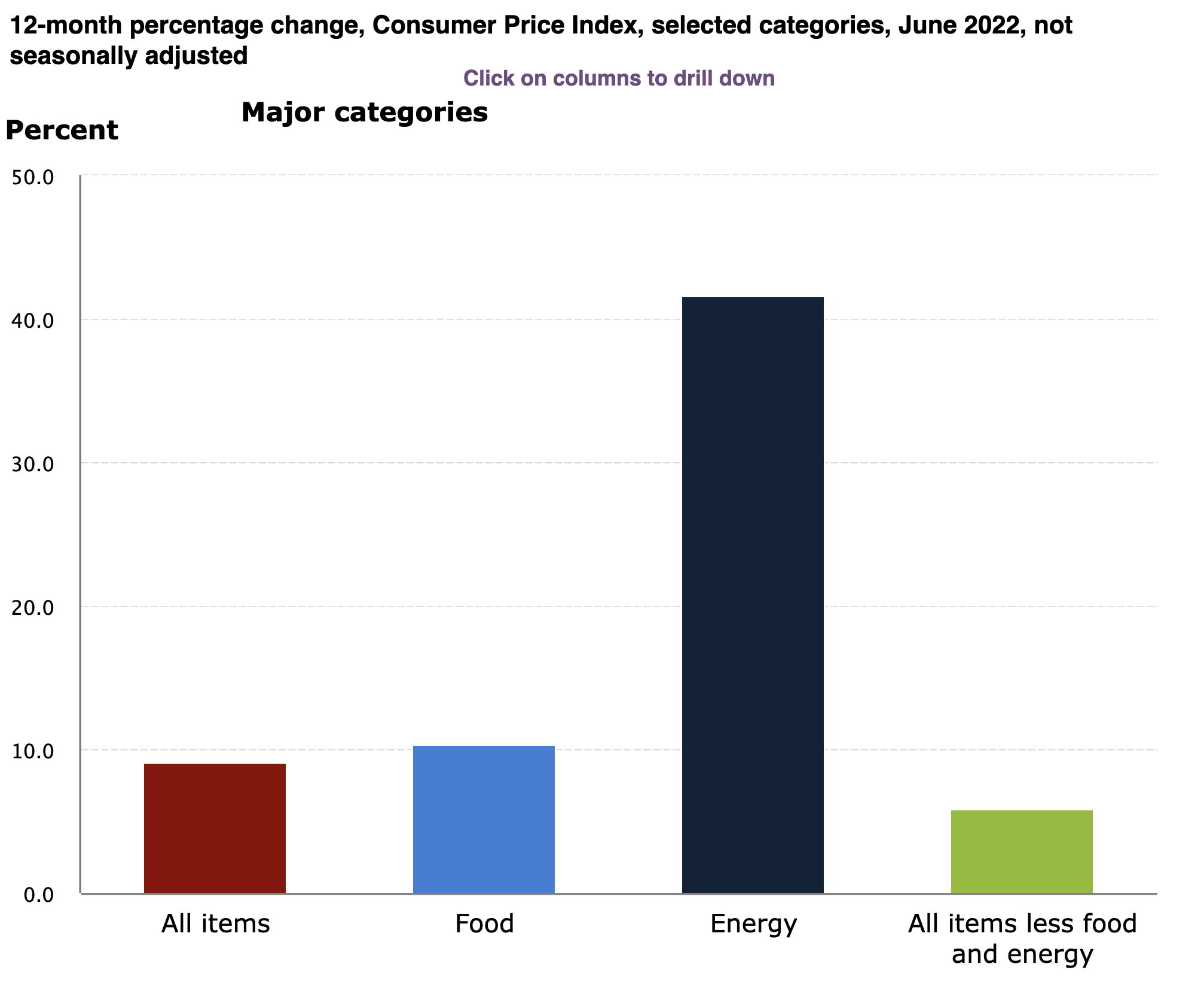

Stating the obvious, inflation and the central bank’s approach to it were the biggest drivers behind these markets convulsing as quickly as they did. Per the BLS, “In June, the Consumer Price Index for All Urban Consumers rose 1.3 percent, seasonally adjusted, and rose 9.1 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.7 percent in June (SA); up 5.9 percent over the year (NSA).” The chart below shows the increases with energy and food being the major drivers.

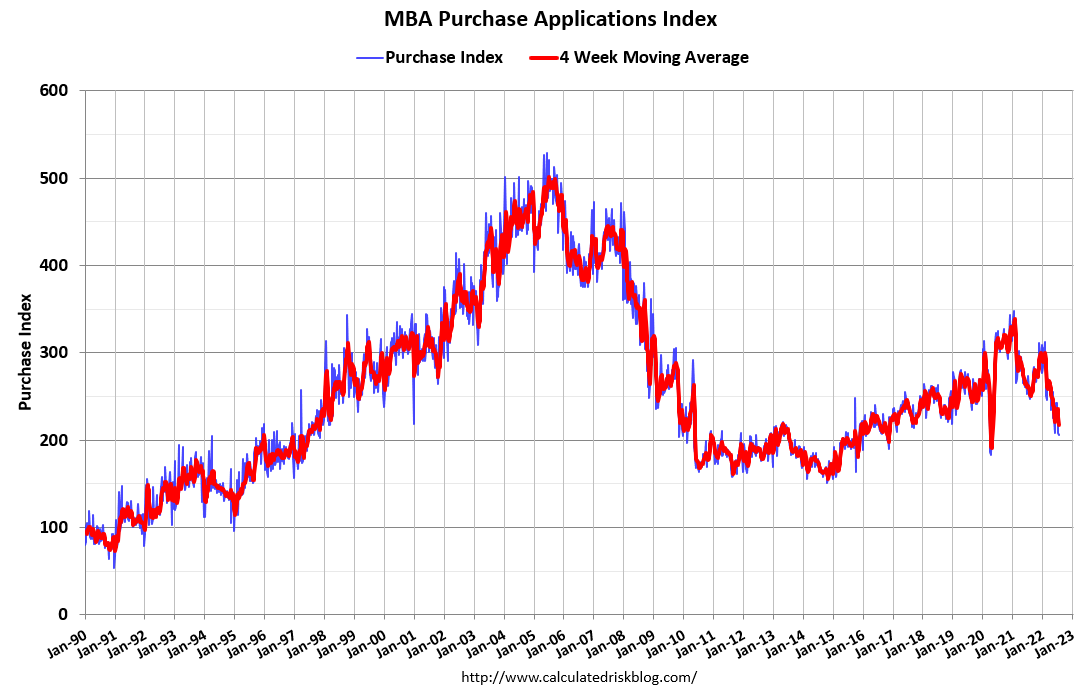

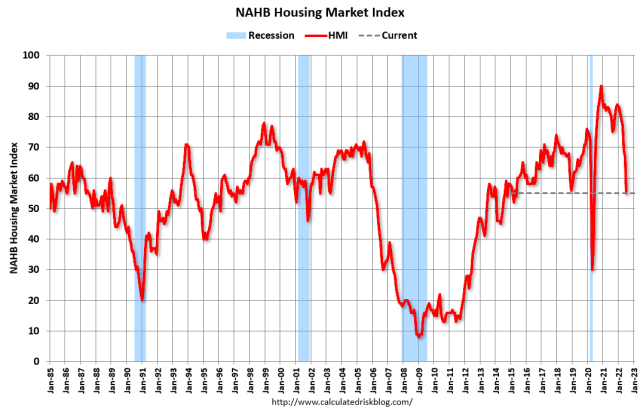

These have been dramatically influenced by supply chain disruptions from the Ukraine War and China’s COVID shutdowns. Their prices will not likely fall immediately by raising interest rates. However by raising interest rates aggressively, the Fed has impacted the housing market and auto market by making new loans much more expensive for consumers. As an example, the combined effect of housing inflation and significantly higher mortgage rates has generated a significant drop in the MBA Purchase Applications Index and the National Association of Homebuilders (NAHB) Housing Market Index.

What’s Next?

In the S&P 500, there was a 2%+ relief rally on Wednesday and another 1.21% on Thursday stemming from the comments made by Chairman Powell which gave the impression to some that he was less hawkish on further rate hikes. His comment that Fed Funds at 2.5% was neutral policy apparently lit the flame. In the past, neutral monetary policy was achieved when the inflation rate equaled the Fed Funds rate. Irrespective of what inflation measure one chooses today, the central bank is still significantly below the rate of inflation. Therefore, the rally in stocks is curious. The move from the lows is part a retracement of an overreaction to bad inflation news/how far the Fed would go to address it and part a belief the central bank will stop raising rates soon, beginning a reversal sometime in 2023.

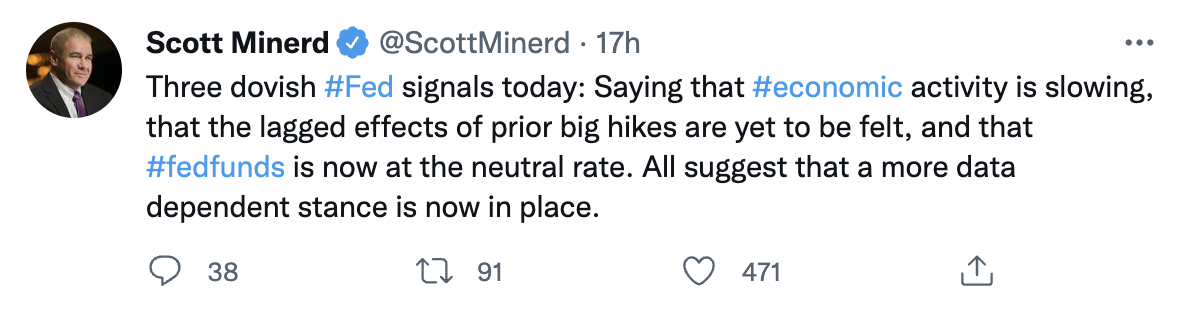

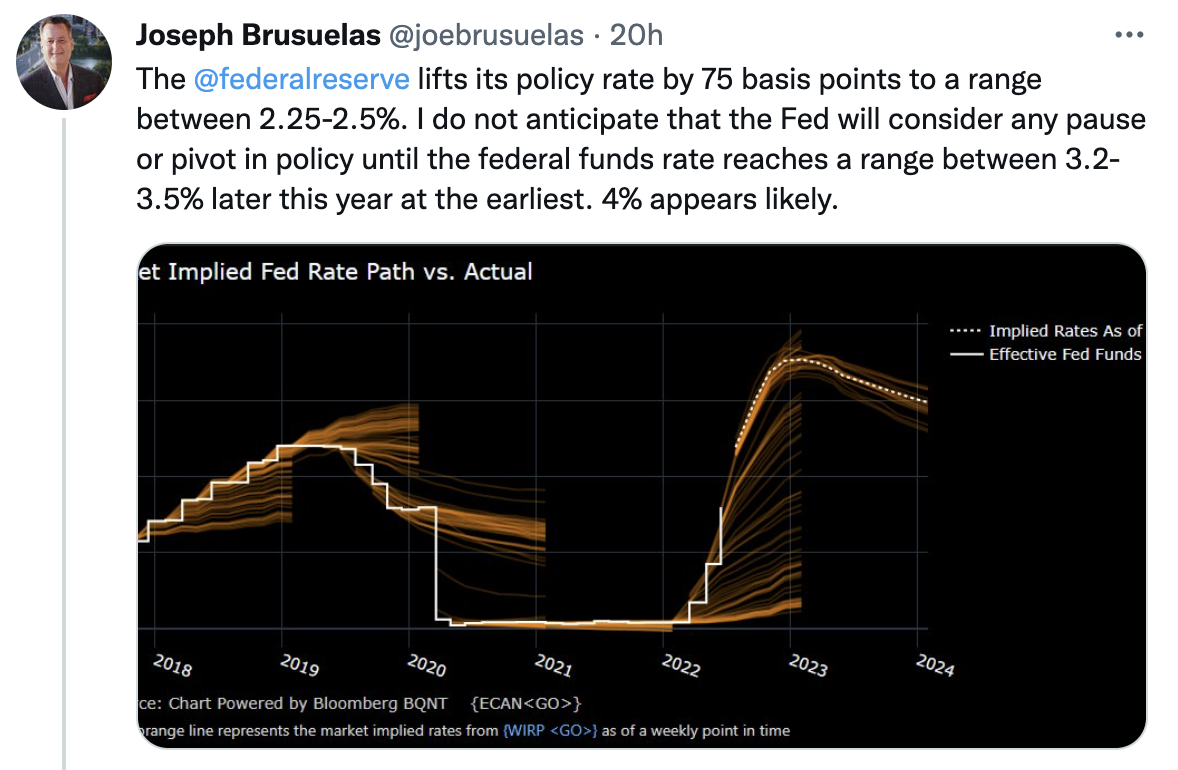

Here are a few of the Tweets I saw on Wednesday from experts I respect.

Confused? Let’s add more layers to it. Chairman Powell, at a post meeting press conference on the 23rd of June, said the central bank is, “…highly attentive to the risks high inflation poses to both sides of our mandate, and we are strongly committed to returning inflation to our 2 percent objective.” This language would lead one to believe the Fed was going to continue to be aggressive going forward and in opposition to Powell’s comments of 2.5% being neutral.

He also said, “We will continue to make our decisions meeting by meeting and communicate our thinking as clearly as possible.” This last statement is key and highlights the mixed nature of the FOMC statement and Powell’s subsequent press conference comments.

This simply means the Fed is keenly focused on bringing down inflation, but they have no ability to see further than the next meeting.

Stating this as clearly as possible, the central bank could raise rates by 75 basis points, 50 basis points, or 25 basis points, or sit on their hands at the next meeting depending on what inflation is doing intermeeting.

To this end, our first data point on intermeeting inflation arrived on Thursday. US Q2 GDP sank 0.9% and US Q1 GDP fell 1.6%. Here’s the key inflation data: The price index for gross domestic purchases increased 8.2 percent in the second quarter, compared with an increase of 8.0 percent in the first quarter (table 4). The PCE price index increased 7.1 percent, the same rate as the first quarter. Excluding food and energy prices, the PCE price index increased 4.4 percent, compared with an increase of 5.2 percent.

Going by the ex-food and energy index, inflation appears to be falling. And we also know that recently gasoline prices are already falling. Overall, it’s likely inflation has peaked. But this is only part of the problem. How far down will it go and what level will it stabilize? If it falls to 4%, then a Fed Funds of 2.5% needs to go another 150 points higher to be neutral. If it falls to only 5%, then the rate needs to go higher by 250 basis points. If either scenario occurs, the recent stock market rally is on shaky ground and mortgage rates will exceed their previous peak.

The take-home message from this is that there is still a vast amount of uncertainty ahead for interest rates, the economy, and the markets. The market, in its current state, is erratic and highly unpredictable at this point. Don’t be inured, neither should you be placated by the recent interest rate or equity market movements after the Federal Reserve rate hike and comments.

Given the central bank made a grave error in gauging inflation (temporary), why should market participants or consumers trust they will make correct decisions in the future?