ChatGPT, Web 3.0 and VR are examples of the explosion of new technologies and how the digital revolution is transforming the business landscape. Five years ago, the most prescient market analysts would have struggled to forecast the extent of the proliferation of web and mobile-based enterprises happening across the globe. According to many scholars, we potentially stand on the brink of a transformative fourth industrial revolution that promises to implement digital capabilities into the fabric of our economy, society and our bodies.

This raises an important question, “How do we see through the current change to understand the next wave of innovation?”

Simply, we place our bets with the smartest people putting their money at risk with big bets that generally payoff 5 and 10 years down the road: venture capital.

Across the globe, these firms scour startups for the next great opportunity. As the primary financiers and strategic partners of fledgling companies, VCs (venture capital firms) play a critical role in catalyzing the growth and success of some of the world’s most promising products and services. Our goal here is to see the future via their investments today. Not all these bets will pay off or make it to the finish line. Yet, the value is seeing what problems the startups are trying to solve, in what sectors and how much funding they received.

In this analysis, we will dive into the top 25 venture capital investments of 2021-2022 in 3 industries poised for significant change: finance, insurance, and agriculture. These industries are characterized by significant opportunities for digital, technological, and biological evolution. As we explore the trends and developments shaping these sectors, we will gain a clearer picture of the possibilities and challenges that lie ahead.

Our goal is not to be exhaustive or to cover every component of these sectors. The scope is to broadly peer into the future and give the reader an opportunity to do more research on the companies.

FinTech: Welcome to the age of mass personalization

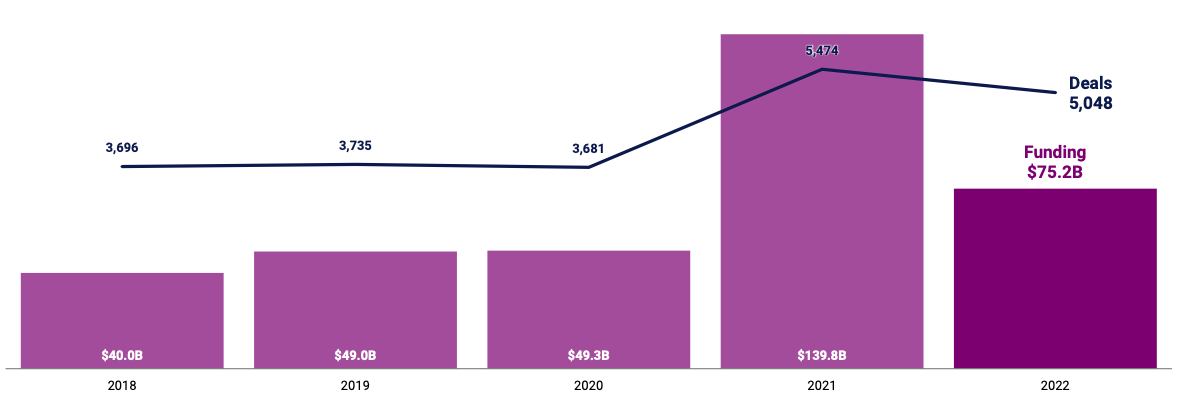

The financial technology (FinTech) industry is no newcomer to the realm of grand fundraising rounds and media attention. In recent years, venture funding in this space has surged to unprecedented heights, propelled by innovative solutions in personal finance and retail stock trading. While total FinTech funding experienced a dip of 46% in 2022 as compared to the previous year, the industry still garnered a substantial sum of over $75 billion in investment. Prior to 2021, this sector had never before breached the $50 billion mark. Despite the occasional headline decrying a broader tech slowdown, it is clear that FinTech entrepreneurs are rapidly closing in on their market targets, determined to claim their share of the financial services landscape. One note, we’ll not be exploring digital currencies or their ecosystems in this report.

Source: Adapted from CB Insights, State of Fintech report.

The FinTech landscape is a dynamic and rapidly evolving space, encompassing a multitude of investments across six distinct categories: payments, banking, digital lending, wealth tech, capital markets tech, and insurtech. In the final quarter of 2022, the payments sector emerged as the clear leader in investment funding, with a substantial portion of capital flowing into this space. Closely following the payments sector were banking, wealth tech, and digital lending, all boasting investments of over $1.5 billion. While the funding figures for insurtech lagged behind, the pace of innovation in this sector remains brisk, reflecting the transformative impact that technology is having on the insurance industry.

Banking and digital lending pivot to small business

The world of finance is undergoing a profound transformation, driven by technological innovation and a growing demand for digital services. One of the most captivating developments in this space is the rise of neobanks – digital-first banks that are upending traditional banking models and offering customers a new and more convenient way to manage their finances. With their focus on innovative technology, seamless user experiences, and a customer-centric approach, neobanks have become the darlings of the financial sector.

In recent years, neobanks have also begun to pivot their focus to small businesses, recognizing the significant opportunities that this market presents. As small businesses struggle with traditional banking systems that are often inflexible and slow to respond, neobanks are offering new and innovative solutions to support their financial needs. From digital lending to cash management and everything in between, neobanks are shaping the future of small business finance and helping entrepreneurs access the capital and resources they need to grow and succeed.

In Europe, the neobank industry boasts formidable contenders such as N26, Revolut, and Brex, while Brazil showcases the likes of Nubank and C6. In the United States, Chime caters to a specific user base. Interestingly, even seed financing investors are keen to get in on the burgeoning neobanking trend, recently endowing two African startups, Tanda and Telda, with a substantial $20 million each in capital. In addition to easy sign-ups and smooth functionality, neobanks typically waive or omit fees that are common headaches for consumers, such as overdraft charges and minimum deposit amounts. Unsurprisingly, younger consumers are more open to using these platforms. According to one recent study, roughly 1/3 of millennials said they are likely to use fintech or neobank services in the next year.

At the same time, venture capitalists in the banking and digital lending arena are turning their attention to the next frontier: small business.

Today many entrepreneurs and small businesses find themselves trapped in a banking system unresponsive to smaller companies and startups. Worse, many banks require in-person visits for critical operations, relegating entrepreneurs to the constraints of “normal business hours.” Larger banks tend to focus their attention on larger corporate clients, leaving smaller companies without personalized service. The status quo inflicts real harm on entrepreneurs of all types, but for those without stable cash flows, the stakes are particularly high as it can hinder economic dynamism and stifle faster job growth.

Investors clearly see an opportunity to chip away at the problem using FinTech platforms. Over the last two years, an impressive $2.7 billion has been infused into seven dynamic companies, all intent on revamping the industry. New York-based OnDeck has emerged as the clear frontrunner, having secured a staggering $1 billion in funding to fuel their mission of expediting lines of credit for small and mid-sized enterprises. With a swift and streamlined online application process, clients are promptly matched with the financing they need.

Other noteworthy contenders include Bloom Group of London and Oxyzo of India, each focused on tackling the same pressing dilemma. Some companies in this small business FinTech space target an even smaller niche. Ark Kapital (Stockholm), Arc Technologies (USA), and Rho Business Banking (USA), all focus on providing services for software and digital technology companies. Their value propositions recognize the unique challenges faced by technology entrepreneurs. For example, Ark Kapital’s mission is to complement private equity funding by helping companies accelerate growth without diluting equity.

E-commerce payments serve as a beachhead for niche FinTechs

The emergence of e-commerce platforms has paved the way for niche FinTech companies to provide specialized payment solutions that cater to the specific needs of online merchants and consumers. Coming on the heels of a pandemic-induced online shopping boom, the continued investments in e-commerce should come as no surprise. Manufacturers and distributors were investing heavily in warehousing and logistics real estate well before the Covid-19 pandemic, contributing to positive price growth in the global commercial real estate market between 2009-2019.

The FinTech firms dedicated to e-commerce boast a remarkable attribute: the creation of an ecosystem of complementary services that propel online merchants to success. These firms have carved out an enviable niche by providing services such as advanced real-time fraud detection, streamlined checkout processes, and pioneering payment methods that improve customer experience and fortify security.

Established e-commerce platforms such as Amazon and Shopify have paved the way for the digital commerce revolution. Now, venture capital firms are homing in on firms that are constructing unparalleled financial infrastructure for online sellers. Key components of this novel infrastructure include enhanced management of working capital, support for online merchandising, and fresh financing options for customers during checkout. All these features will bolster the overall triumph of e-commerce by furnishing merchants with the necessary tools to elevate sales and streamline operations.

Collectively the 6 surveyed firms in the e-commerce segment secured $1.9 billion in financing over the last two years. What’s even more impressive is the geographical diversity of this funding, signaling the undeniable staying power of e-commerce across the globe. These six juggernauts – SellersFunding in New York, EBANX in Brazil, Tamara in Saudi Arabia, Ritmo in Spain, VNLIFE in Vietnam, and Kushki in Ecuador – represent a melting pot of cultures, values, and visions. As venture capital funders continue to place their bets on the future, it’s clear that well-positioned FinTech firms are poised to ride the wave of e-commerce well into the future.

As the online FinTech ecosystem continues to develop, creative financial services could help unleash more entrepreneurial talent. In the process, the FinTech upstarts will create more business-to-business opportunities for themselves. Long heralded as the backbone of economies by government policymakers, small businesses may find real saviors in the emerging banking platforms seeded by venture capital.

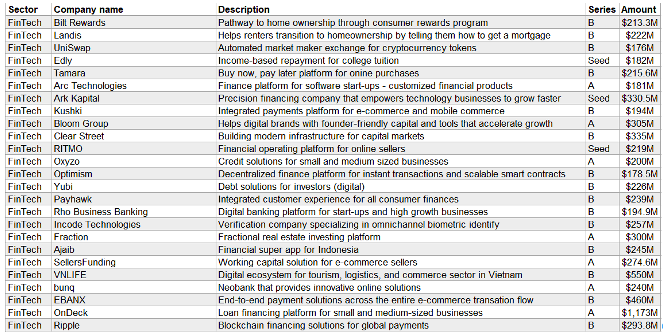

Top 25 FinTech VC Investments in 2021-2022

Source: Crunchbase data compiled by the author

InsurTech: More than just automating processes

Renowned for its labyrinthine structure and antiquated paper-based systems, the global insurance market is ready for a major disruption. Insurance technology (InsurTech) firms, driven by a fierce determination to usher the industry into the digital age, are revolutionizing claims administration and enhancing customer experience (CX) in unprecedented ways. However, the true potential of InsurTech can likely only be realized through a fundamental reimagination of the insurance marketplace, addressing climate and cyber risks. And InsurTech investors are placing their bets on precisely that – the successful creation of a thriving ecosystem offering a new approach to risk management, underpinned by digital advancements.

The dynamic competition is being propelled by the symbiotic relationship between innovative InsurTech startups and established market players. The influx of fresh, unique entrants with ambitious visions for the insurance marketplace is reshaping the industry landscape. Simultaneously, the year 2022 bore witness to an unprecedented 81 InsurTech exits through mergers and acquisitions, reflecting a high demand for CX and risk-modeling innovations. However, it is the emergence of new platform-based business models that could potentially restructure the industry.

Building a platform-based business model for insurance

Transplanting ideas from Apple and Amazon, venture investors are recognizing the vast potential for creating platform-based business models in the insurance industry. These platforms are not merely seeking to streamline existing processes or transition insurers to cloud computing. Rather, their goal is to revolutionize the way insurance policies are bought, sold, and distributed.

One standout player in this arena is Bolttech, based in Singapore, which has set its sights on creating the world’s largest insurance exchange. With access to 180 leading insurers and over 5,000 products available worldwide, Bolttech has already made an impressive impact in the industry, securing a Series B round of approximately $200 million in October of last year. But Bolttech is not alone in its ambitions. Insurify in the US and Getsafe in Germany are two other formidable players with similar aspirations to disrupt traditional industry models.

Of course, any platform-based insurance exchange faces significant obstacles in achieving sufficient scale. Established companies have a vested interest in maintaining the status quo, and navigating the complex regulatory landscape can prove challenging. Nonetheless, it is not difficult to imagine one of these nascent platforms becoming a game-changer in the industry, in the same way that Expedia transformed the travel industry. By shifting travel purchases towards online, third-party platforms, Expedia forever altered business models and forced travel providers to elevate their customer experiences in order to remain competitive. A similar revolution in the insurance industry could be just around the corner.

Dealing with emerging risks: climate and cyber

InsurTech start-ups are driving an important shift in the insurance industry by redefining the underlying risk management fundamentals. In essence, the insurance business thrives on the accurate assessment of risks and the determination of their associated prices. However, despite decades of research and the availability of a plethora of data, insurers are struggling to manage the risks associated with climate change and cybersecurity. To tackle this challenge, InsurTechs are exploring new approaches to gather, analyze, and assess data. The improvement of risk management and pricing is expected to result in better business outcomes and increased customer satisfaction.

Among the InsurTech companies surveyed, 8 were found to be working on new risk management approaches, attracting a substantial amount of $730 million in venture capital. While each of these firms represents only a small piece of the intricate analytical puzzle, they serve to underscore the diverse approaches being taken by InsurTech start-ups. With the advent of innovative technologies such as connected devices, frequent policy reviews, and advanced artificial intelligence and machine learning, these leading-edge firms are rewriting the rules of the game and setting new standards for prediction accuracy.

Cowbell Cyber, a firm based in the USA that focuses on cybersecurity insurance for small businesses, published a white paper that explores the concept of “Adaptive Insurance.” Unlike typical cyber risk insurers who re-evaluate policies on an annual basis, Cowbell employs technology systems to adjust risk premiums more frequently, with quarterly updates being the standard. Premiums can also be adjusted for ad-hoc events, such as a new computer virus. Analysts predict that the severity of cybersecurity issues will rise, with both state and non-state actors being involved. Small businesses are particularly vulnerable, and the market for leading cyber risk solutions looks primed for growth.

As the InsurTech sector continues to evolve, savvy investors are recognizing that traditional insurers are plagued by critical blind spots when it comes to managing risk, a flaw that could have devastating consequences for the insurance market. However, emerging InsurTech firms like Descartes Underwriting, which specializes in climate risk modeling, and Foresight Commercial, which leverages safe workplace practices to generate savings, are steadfast in their belief that innovative technology can facilitate mutually beneficial solutions for all parties involved. In short, the future of the insurance industry may rest on the shoulders of these trailblazing InsurTech companies.

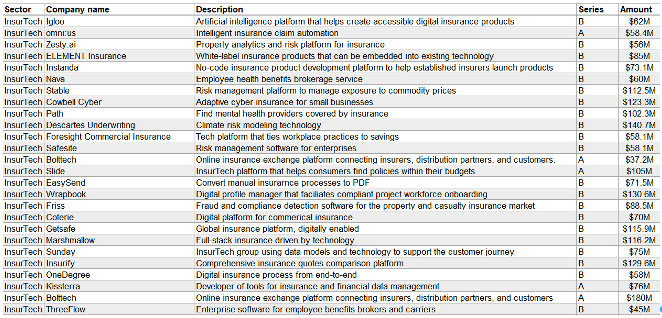

Top 25 InsurTech VC Investments in 2021-2022

AgTech: How to feed China, India, and the rest of the world

In 2022, the impact of the Ukraine war on global food supplies dominated the agriculture sector. Luckily, the world avoided the worst possible outcomes, but volatile spikes in the price of grains, vegetable oils and fertilizer took their toll on hungry people around the globe (to say nothing of the Ukrainian people and farming sector, which will take years to recover).

Over the long term, the global agriculture industry faces an even more daunting challenge. By 2050, our planet will be home to nearly 10 billion people. The existing resources, already under strain, will be pushed to their limits by this staggering population growth. Moreover, climate change is wreaking havoc on agricultural production, further complicating the challenge. To make food production viable, we must tackle several critical issues. Specifically, how we will feed the rapidly growing populations and demand of China and India. These two countries alone represent a colossal task, as they are home to nearly 3 billion people (and growing). Agricultural technology (AgTech) must also grapple with the vexing challenge of farm labor shortages, the need to develop more productive crops, and the ever-increasing demand from consumers for natural inputs.

Venture capital investment provides the clues on how to make this happen. From the pursuit of alternative proteins and vertical farming to revolutionary breakthroughs in robotics and the bioeconomy, early-stage investors are making bold bets that are poised to transform entire industries. This palpable shift has not gone unnoticed by governments across the globe. For leaders in countries like China and India, who understand that hunger is the harbinger of civil unrest, this trend presents a momentous opportunity to make history by finding innovative solutions to age-old problems.

China’s pork addiction

Chinese consumers have an insatiable demand for protein, particularly pork. As the country grows more prosperous, consumers are following a predictable pattern and adding more protein to their diets. In response, savvy investors are taking a dual-pronged approach to feed this demand. Firstly, they are directing substantial capital towards technologies that optimize the efficiency of pig farming and meat distribution. The past two years have seen several high-profile AgTech funding rounds, with the crown jewel going to Zhongxin Breeding – a staggering $345 million – which harnesses advanced breeding techniques to cultivate the most meat-rich pigs with the least number of inputs. Meanwhile, Wangjiahuan, a fellow Guangdong-based firm, secured a colossal $266 million to bolster its business-to-business food distribution platform and scale up its operations. With China’s voracious appetite showing no signs of abating, such investments in innovation are sure to pay off handsomely.

The second approach to the exploding demand for pork in China is to find alternative sources of protein. Starfield Food & Science Technology pulled in $125,000 to develop plant-based protein products that appeal to the tastes of Chinese consumers. It is a modest sum compared to the other two Chinese companies, but the search for alternative protein sources goes far beyond China’s borders.

In addition to plant-based alternatives, several firms are working on “cell-cultured” or “cultivated meat,” which uses stem cell technology to grow meat alternatives in a controlled manufacturing environment. In the last two years, Ivy Farm Technologies (United Kingdom) joined the ranks of other firms that have attracted venture capital funding to further develop cultivated meat products. The key for plant based or lab-based protein is cost and scale. To compete, these products need a price significantly below farm-based meats to get consumers to shift.

Reforming India’s food supply chain

India’s commendable progress in food self-sufficiency has been overshadowed by the nation’s persistent problem with food insecurity, affecting an astonishing number of individuals. With an estimated 190 million malnourished citizens, accounting for a quarter of the world’s hunger population, the crisis is deeply concerning. While the country’s agriculture industry is highly safeguarded through immense tariff barriers and governmental wholesale monopolies, production efficiency has remained relatively stagnant. However, with the emergence of ambitious homegrown start-ups, the industry’s transformation is eagerly anticipated and needed.

8 Indian AgTech companies have attracted nearly $500 million in combined venture capital funding in the last two years. These firms boast cutting-edge technological platforms. Among them are DeHaat and FarMart which both effortlessly facilitate online product transactions for farmers. We also have Jai Kisan and ReshaMendi which have both masterfully devised credit and lending solutions for agricultural businesses. Furthermore, Vegrow and Bijak have honed groundbreaking platforms that not only streamline the aggregation of farm goods, but also expedite the process of identifying suitable buyers. These impressive feats represent a phenomenal achievement for India’s thriving AgTech sector.

Enhanced digital connectivity via mobile devices is driving much of the market opportunity for Indian AgTech start-ups. Younger farmers are more open to adopting new technology and business practices. There is no telling how much runway for growth might present itself if new business models can take hold, especially among the smallholder farmers that make up 82 percent of India’s farming population today.

Future farmers will use more robots and fewer inputs

Beyond India and China, farmers across the globe share many similar challenges. Aging farmers and depleted workforces are just a couple of demographic trends threatening the agricultural industry. With urbanization engulfing more land, there are fewer individuals available to work the fields. However, the solution lies with the rising AgTech robotic industry, each competing to solve how to automate harvests and reduce costs. Distinguished companies, such as Verdant Robotics and Blue White Robotics, have secured an incredible $107 million in investment over the past two years. Monarch Tractors, a farm equipment company with an all-electric tractor, among other groundbreaking products, have added an additional $81 million to the overall investment.

Forward-thinking farmers are also finding that, in addition to labor, other critical inputs may be increasingly in short supply. That is why several firms are drawing on the emerging concept of the bioeconomy to optimize the use of resources and provide novel solutions drawing on the natural environment. Three U.S.-based firms in particular – Farmland LP, Regrow Ag, and Pattern Ag – hauled in $223 million in venture funding to scale up their solutions that help farmers use fewer synthetic pesticides and fertilizers.

The future of food production will look very different from today as advances in engineering and agronomy combine with digital technologies to unlock powerful new tools. But for all the focus on the emerging bioeconomy, investors should not lose sight of more immediate food supply chain challenges that plague many markets. Consumers in more prosperous countries tend to take basic food infrastructure like cold chain networks for granted. But the interconnected systems that allow fresh food to be transported at low temperatures throughout a multimodal journey are not found everywhere in the world. The food and agriculture sector will need the full use of both new and existing technologies to adequately feed a burgeoning population.

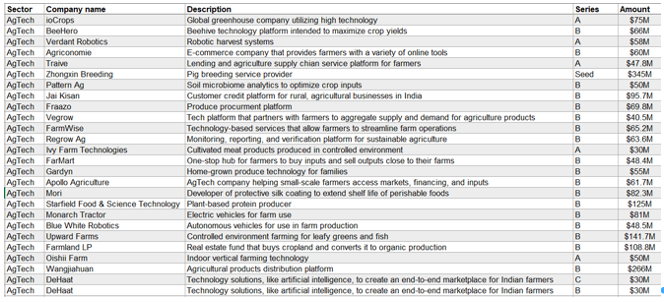

Top 25 AgTech VC Investments in 2021-2022

Source: Crunchbase data compiled by the author

Wrapping it up

With the world economy buffeted by the COVID and Ukraine war tempests, it’s difficult to see through the chaos towards the opportunities the future provides. Venture capital firms are playing a crucial role in fostering the growth and success of new startups across a wide range of industries, particularly in the FinTech sector.

Despite headlines suggesting a slowdown in the broader tech landscape, the FinTech sector is receiving unprecedented levels of investment, thanks to innovative solutions in areas such as personal finance, retail stock trading, and small business banking. Neobanks are emerging to challenge traditional banking models and offer consumers a more convenient way to manage their finances.

Also, the agriculture and insurance sectors are experiencing transformative change through technology, with VC firms supporting startups that are helping to feed the world and mitigate risk for insurance companies.

Take time to research the companies provided in this report. See the niches they are picking for development and see what the future holds.