Key takeaway: Given the inability of central banks to accurately assess risks, one must question their ability to manage policy in a manner that produces a soft landing or avoids a global recession. Our belief is the Fed and other central banks err on the side of higher inflation while trying to avoid a recession and maintain relatively low unemployment. The benign outcome is stagflation, the hostile outcome is global recession.

Introduction

Nothing seems normal again. The future doesn’t look bright as the global economy struggles with multiple crises. Lingering pandemic distortions, the Russia-Ukraine war, soaring inflation rates, and strict lockdowns in China have all brought global economic activity to a halt. Despite the COVID reopening economic recoveries in 2021, huge stimulus packages coupled with enormous monetary stimulus have heated the markets in advanced economies, putting upward pressures on prices. With supply shortages following the pandemic on one side, and the energy and food crisis caused by the war in Ukraine on the other, global inflation increased to a record high. In its latest July projections, the International Monetary Fund (IMF) estimated the global real gross domestic product to grow at 3.2% in 2022 and 2.9% in 2023, representing 0.4 and 0.7 percentage-point downward revisions from earlier projections in April. Global inflation rate projections were revised upwards, to record 8.3% and 5.7% in 2022 and 2023, respectively, almost 1 percentage point higher than earlier projections in April. The hope for better times after the pandemic hasn’t gone as expected. The reality appears to be a choice between a global recession or stagflation.

Quick Primer on Stagflation

Stagflation means a simultaneous occurrence of economic stagnation (high unemployment) and inflation. Stagflation is an extremely unpleasant combination because it is doubly harmful: rising prices reduce purchasing power, while low economic growth increases unemployment. This contains economic and political explosives. The losers are not only those who have been laid off, but also all those who do not have the financial reserves to cope with the short-term rise in energy and food prices. The last time we experienced something like this was during the oil price shock of the 1970s. Today, we have not yet seen a strong rise in US unemployment indicating a high probability of stagflation, but tech layoffs are rising.

Central Banks Policies

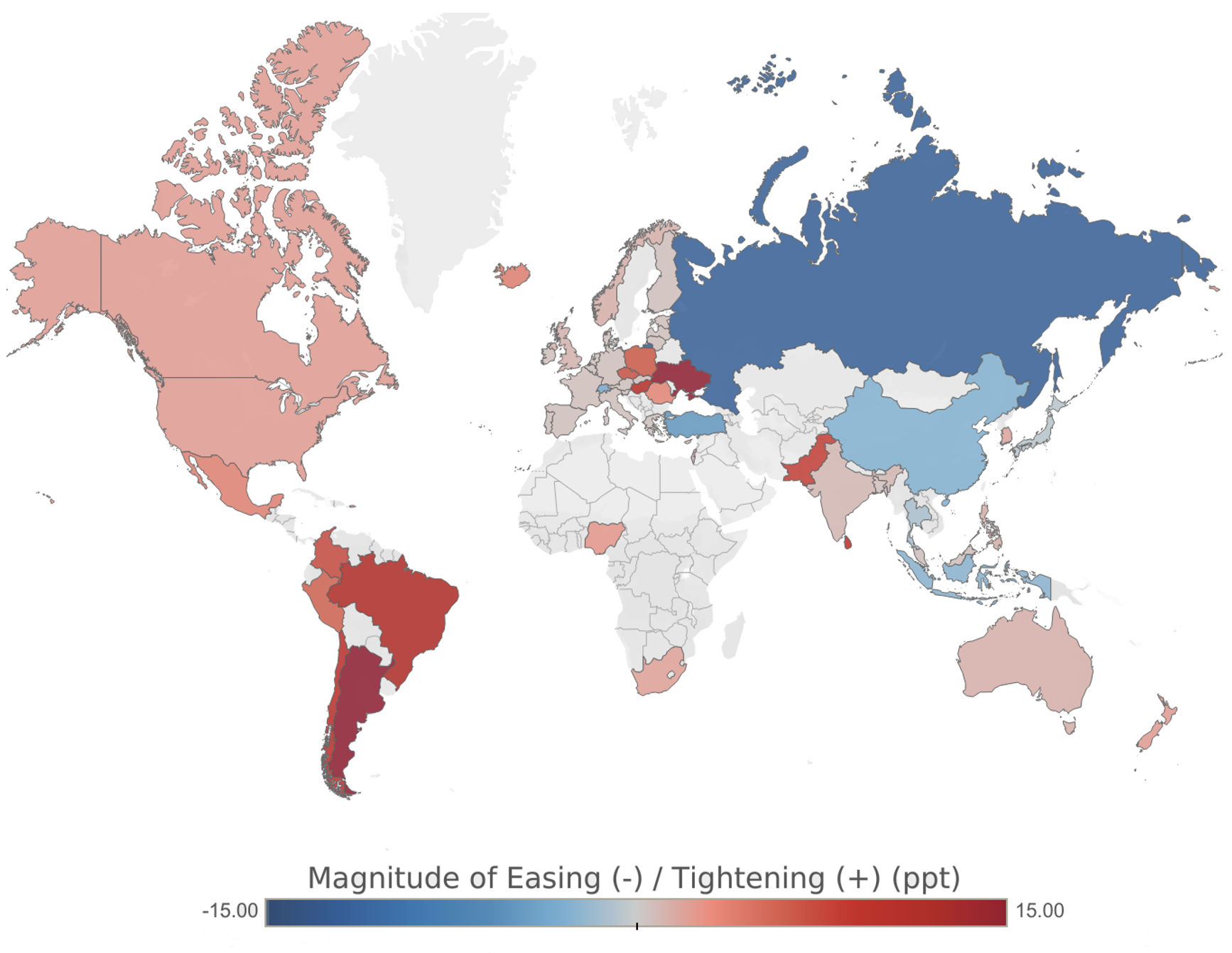

Today, many central banks are tightening their monetary policies to tackle high inflation. Almost 80 countries have lifted interest rates to fight inflation this year, of which more than 50 have hiked rates by at least half a percentage point. As of July 2022, the Council on Foreign Relations’ Global Monetary Policy Index recorded a tight 8.83, up from 3.99 in June 2022 and a negative 8.7 in December 2021. The index compiles data on monetary policy from 54 countries and ranges between -10 and 10, with zero indicating neutral policy and 10 indicating that all countries are tightening. The graph below shows the state of monetary policy in different countries, with red indicating tightening and blue indicating loosening policy.

Figure 1 – Global Monetary Policy Tracker, index

Source: Council on Foreign Relations.

In this article, we review the global economic performance in the major economies of the U.S., U.K, Euro Area, Japan, and China. We look at their growth and inflation outlook, in addition to how their central banks are reacting to domestic and global inflationary pressures and slowing economic activity. Higher than expected inflation rates in the U.S, U.K., and Europe are triggering a streak of global monetary tightening and threatening economic growth. Moreso, strict lockdowns in China and diminishing exports in Japan are exacerbating the matter. Spillovers from the war in Ukraine and rising commodity prices continue to be amongst the top risks facing the global economy today.

United States: Economic Slowdown and Tighter Monetary Policy Amidst a Risk of Stagflation

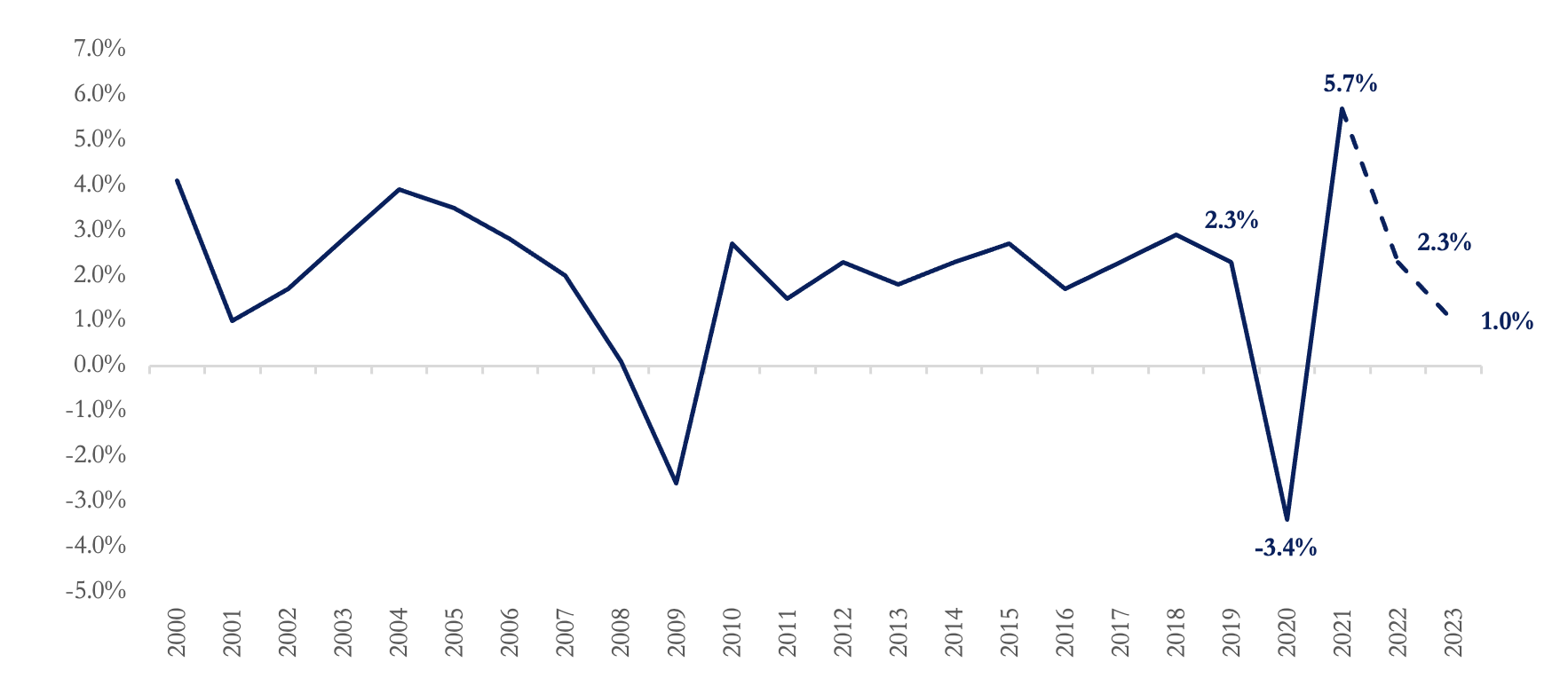

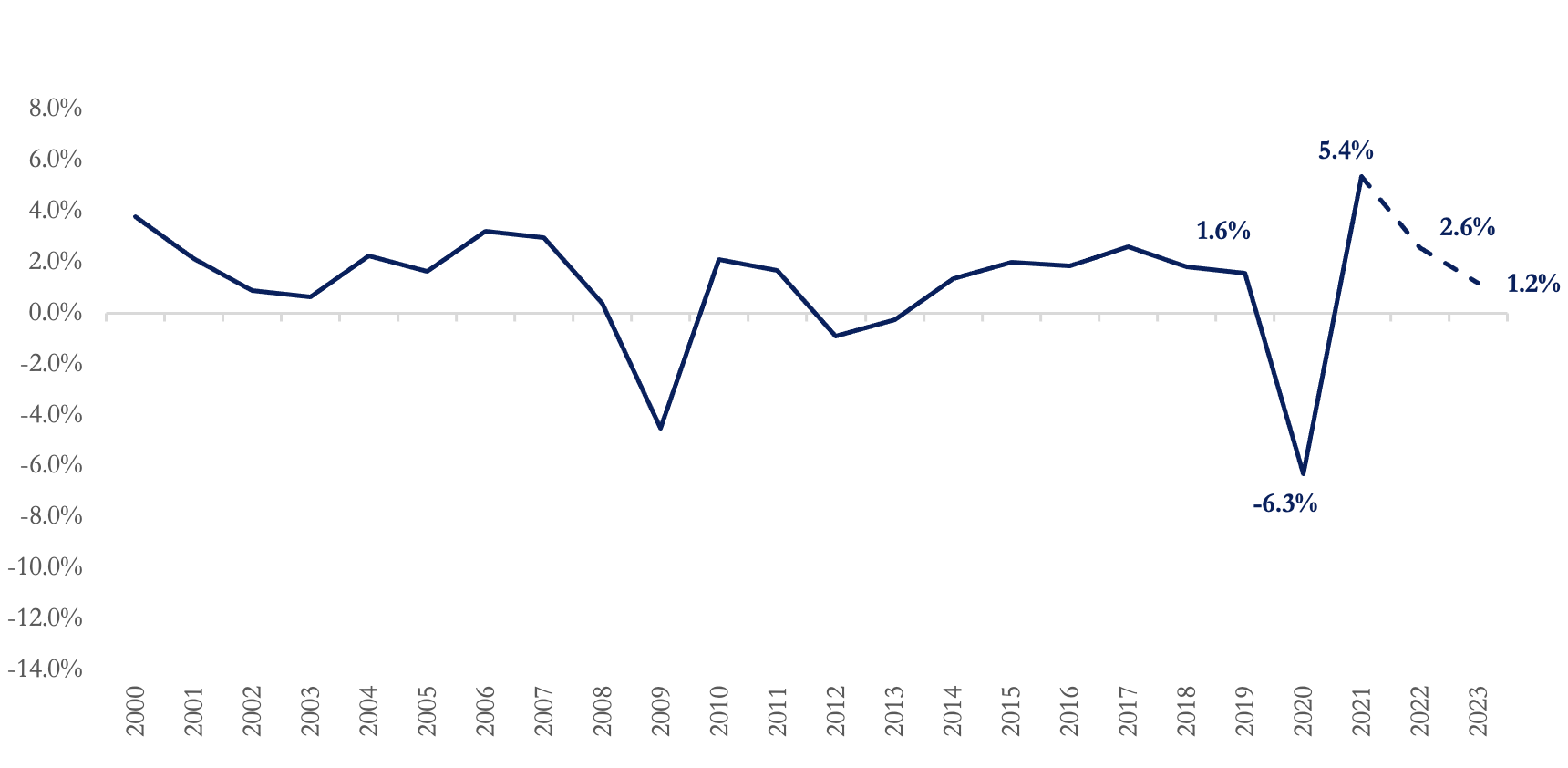

In the wake of rigorous monetary tightening by the Federal Reserve (Fed), economic activity in the U.S. has been slowing down. As shown in the graph below, following the pandemic-driven contraction in real GDP of 3.4% in 2020, the U.S. economy quickly recovered at an unprecedented rate of 5.7% in 2021, the highest rate since 1984. Indeed, the huge stimulus package and expansionary policy led to stronger consumer demand and private investment that fueled the fast recovery and impressive economic growth. However, as the economy quickly heated up, inflationary pressures also increased, especially with the global disruption in supply chains and the Russia-Ukraine war. As the Fed started to tighten its monetary policy to control inflation, economic performance decelerated. According to the IMF, real GDP in the U.S. is projected to grow at an annual rate of 2.3% in 2022 and a mere 1.0% in 2023, as depicted by the dashed line in the graphic below.

Figure 2 – U.S. Annual Real GDP Growth, %

Source: U.S. Bureau of Economic Analysis and IMF July 2022 World Economic Outlook.

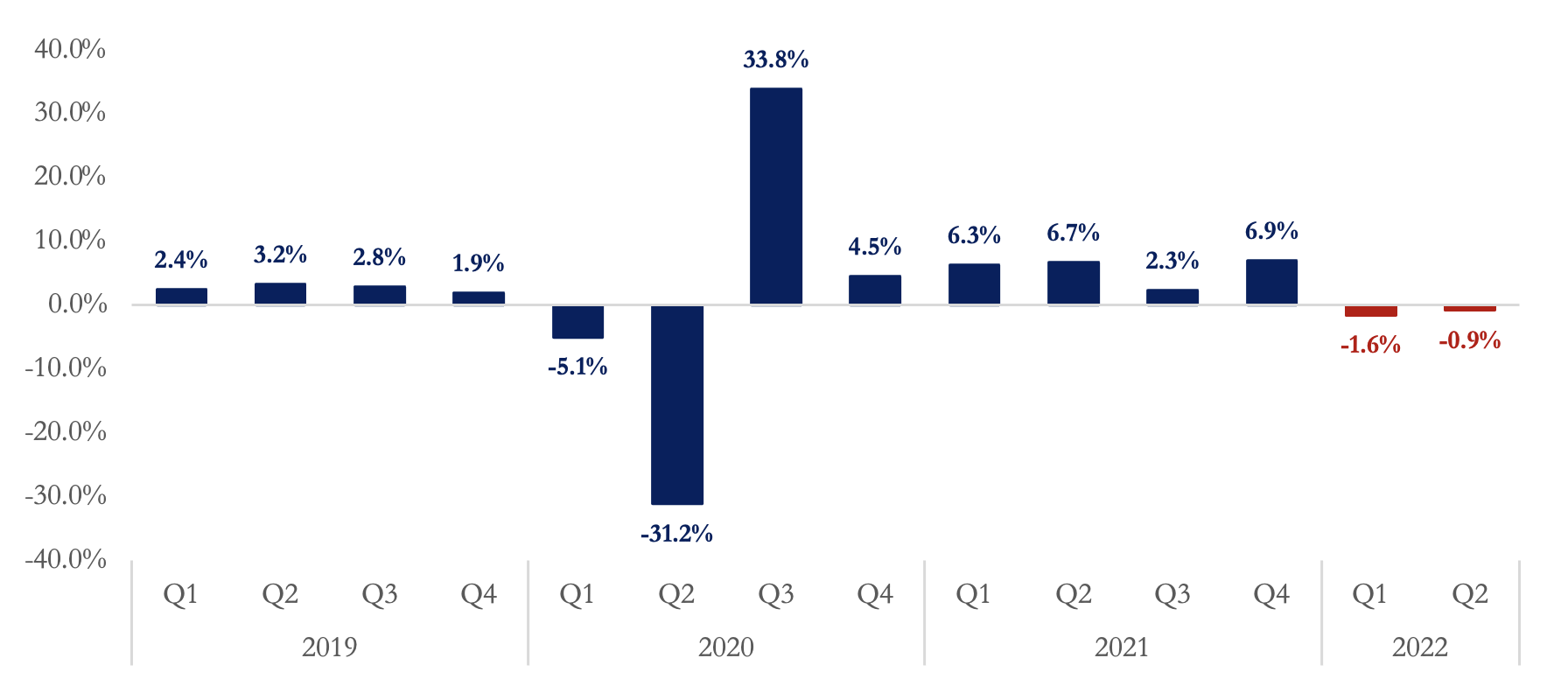

So far, we’re halfway through the year and the situation already looks bleak. According to the Bureau of Economic Analysis, real GDP decreased at an annual rate of 0.9% in the second quarter of 2022 as presented in the figure below, marking the second consecutive decline after a shrinkage of 1.6% in the first quarter. While exports and private consumption increased in the second quarter, the decline in GDP was driven by larger decreases in government spending, private inventory investment due to a drop in retail trade, residential and non-residential fixed investment, as well as an increase in the value of imports.

Figure 3 – U.S. Annualized Quarterly Real GDP Growth, change over previous quarter %

Source: U.S. Bureau of Economic Analysis.

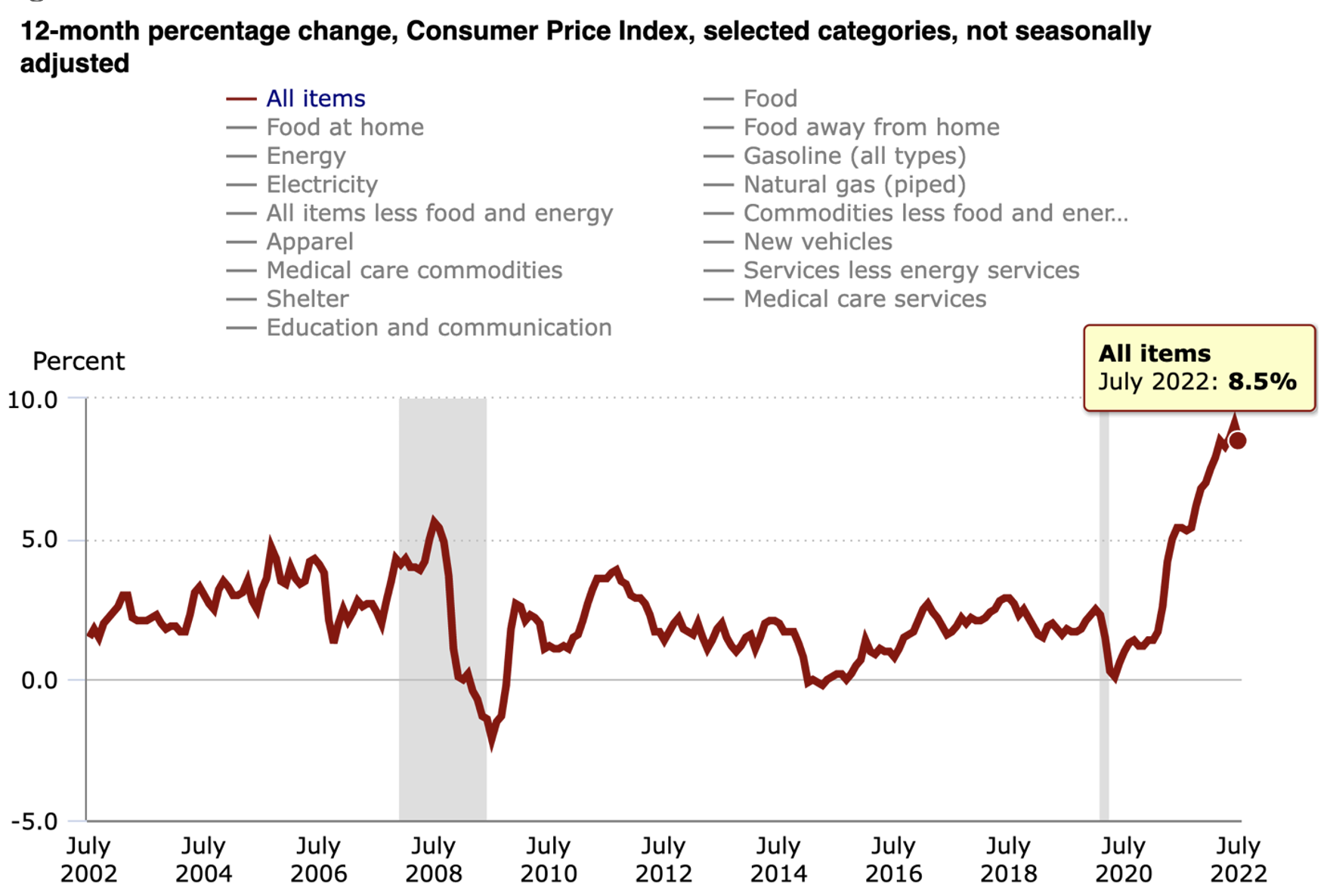

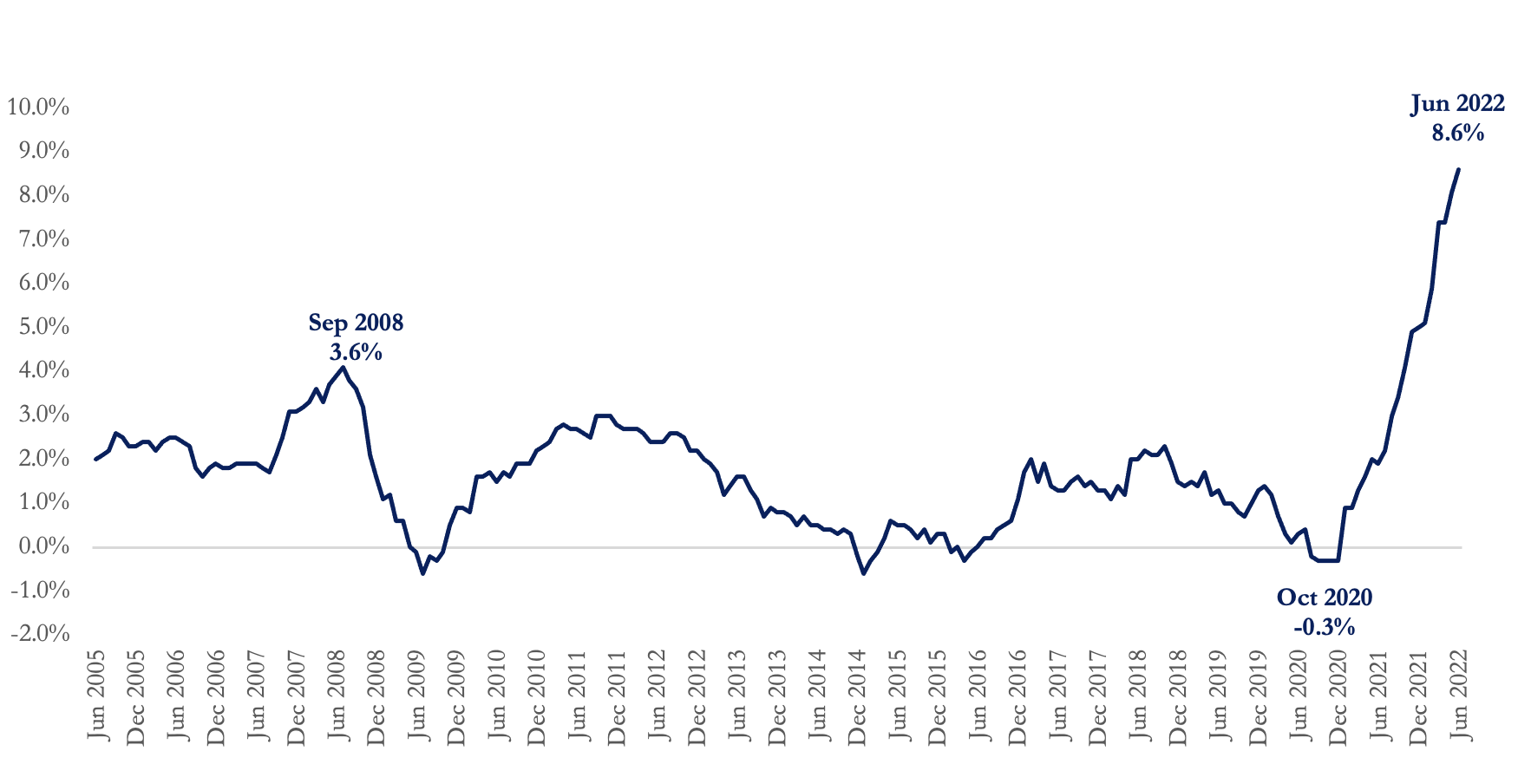

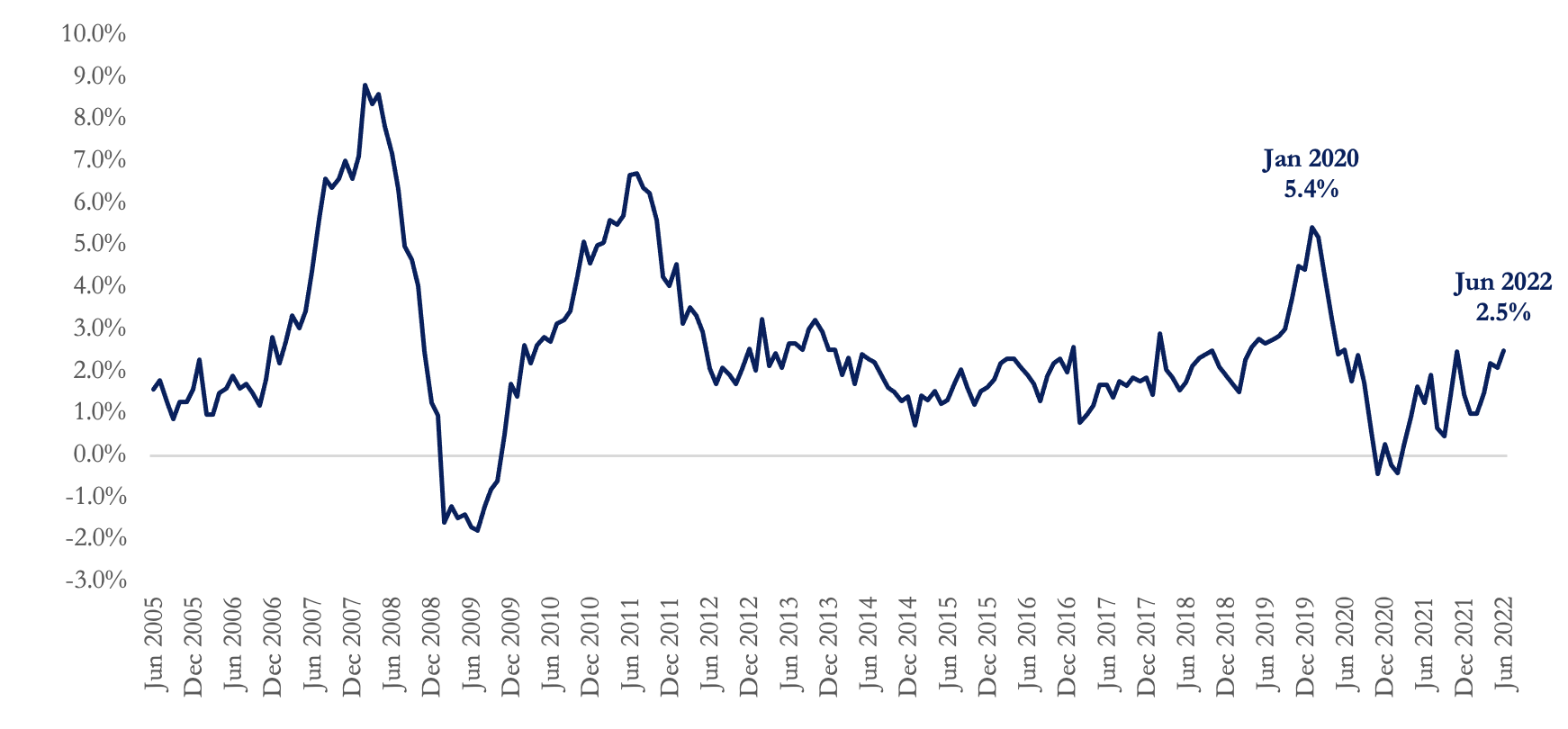

U.S. Inflation has been on an increasing trend since its low of 0.3% in April 2020, as shown in the graph below. Consumer prices increased by a record high of 9.1% in June 2022, the highest rate in 40 years. July data showed a slight decline to 8.5% yoy led by energy with a misleading 0.0% month-to-month. US non-food/non-energy or core inflation rose 5.9% yoy, unchanged from June. Inflation is expected to reach an average of 7.0% in 2022, before it declines to around 3.5% in 2023, according to data from the Organization for Economic Cooperation and Development (OECD).

Figure 4 – U.S. Consumer Price Inflation Rate, %

Source: U.S. Bureau of Labor Statistics.

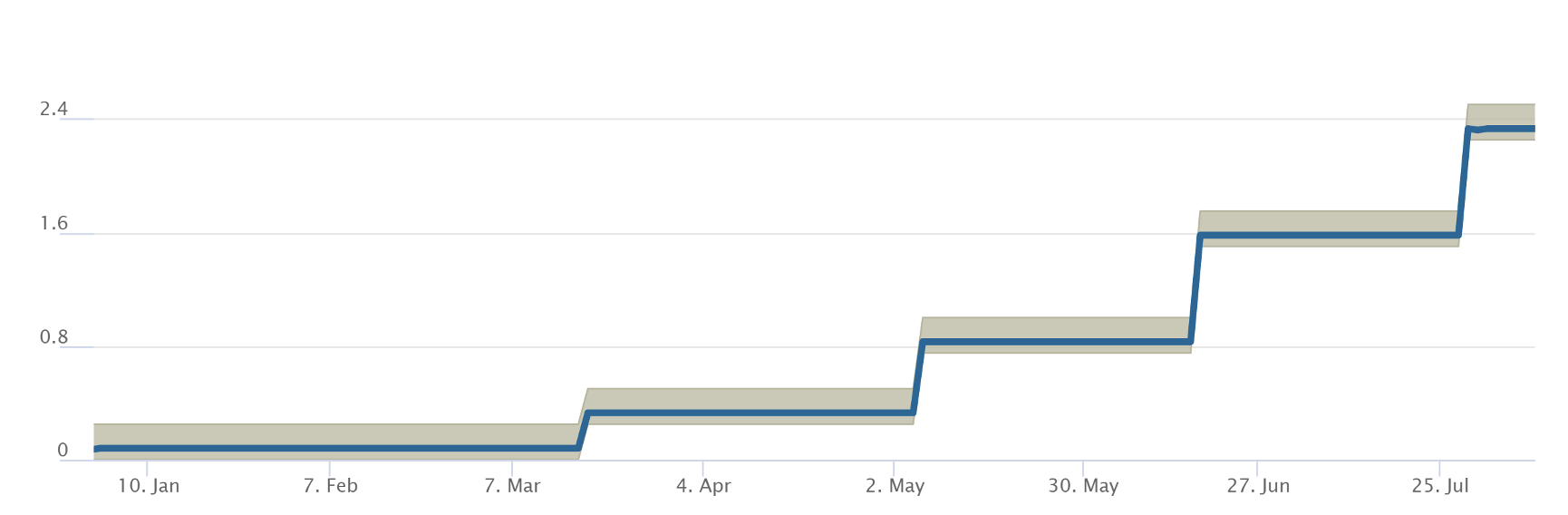

To tackle rising inflation, the Fed embarked on a dual approach to monetary stimulus reduction or tightening. The central is simultaneously raising short-term interest rates and reducing their balance sheet. They have engaged in a series of interest rate hikes since March 2022, the last being on July 27, when the monetary policy committee unanimously decided to raise the federal funds rate by 75 basis points. This marked the fourth consecutive hike this year, and the second 0.75-percentage-point rise in addition to the one in June, the most stringent hike since 1994. The central bank has previously increased the rate by 0.25 percentage point in March and 0.50 percentage point in May. This last hike in July brought the benchmark rate to a target range of 2.25%-2.5%. The evolution of the funds’ rate is presented in the below graphic.

Figure 5 – Effective Federal Funds Rate and Target Range, %

Source: Federal Reserve Bank of New York.

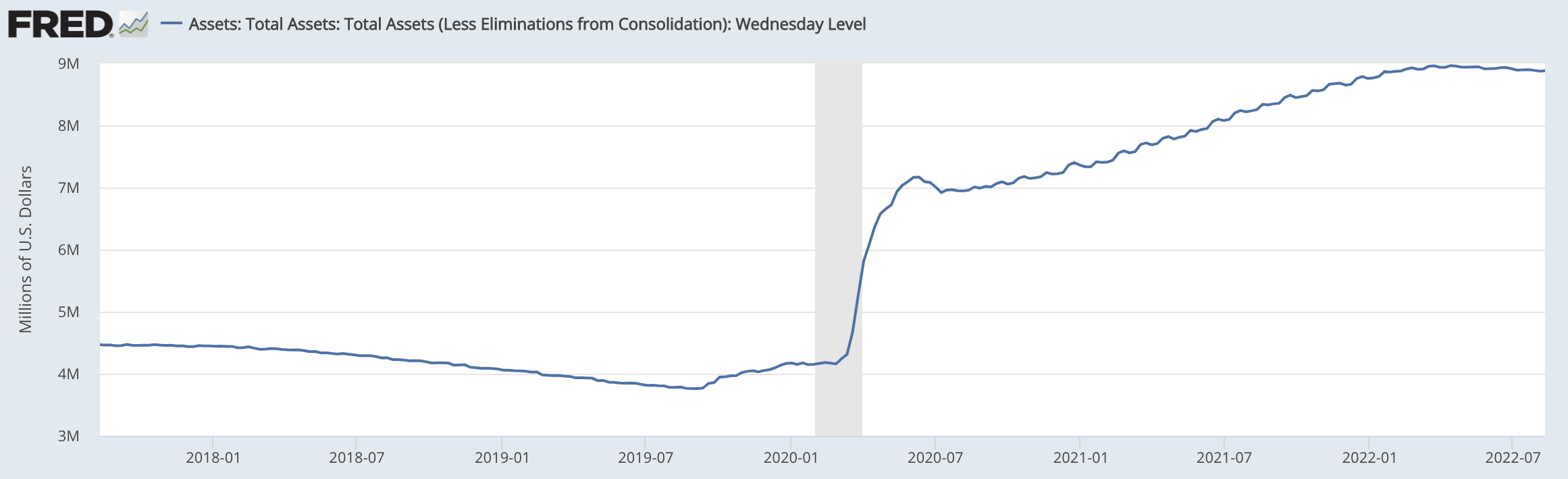

The Federal Reserve is also reducing its bloated balance sheet. In response to the economic shutdown to promote growth, the central dramatically increased its holdings of US Treasury securities and GSE debt. The balanced sheet ballooned from $4 trillion to $8.9 trillion. The reduction in securities is running at $95 billion a month split between $60 in US Treasury securities and $35 billion in GSE debt.

Figure 6 – Federal Reserve Balance Sheet, Total Assets

Source: Federal Reserve Bank of St. Louis.

Eventually, the central bank would have to ease the severity of the interest rate hikes, as was indicated by the Fed Chairman, Jerome Powell. In his statement, he left the door open on the Fed’s next move in September. While there might be another 75-percentage-point increase, this will largely depend on the data. “As the stance of monetary policy tightens further,” he noted, “it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.” Following the interest rate increase and this statement, markets reacted positively as stock prices improved, with the Dow Jones Industrial Average gaining 1.4% and the S&P 500 jumping by 2.62%. The markets rallied further after they interpreted a peak to US inflation after the July CPI data. Since the June 16th S&P 500 low of 3,667, the index has rallied an astonishing 16.7%. While markets are never wrong, they do over-shoot frequently. Both the rapid decline from the January peak and rapid rebound from June are emblematic of this phenomenon.

One key question to be answered is whether such robust tightening can trigger a recession in the U.S. and globally. The Fed funds rate acts as a benchmark for various credit instruments, including consumer loans, interest rates on credit cards, and adjustable-rate mortgages. Accordingly, raising the Fed policy rate will directly worsen credit conditions and suppress activity in the market. This in turn can reduce economic growth as investment and consumption stall. Talks are circulating about a possible risk of stagflation if the U.S. enters a recession with the current high inflation rates.

While GDP has been declining for 2 consecutive quarters, many economists argue that the country has not yet reached the point of a recession. The timing of recessions in the U.S. is indicated by the National Bureau of Economic Research (NBER), which determines when a sustained reduction in economic activity starts and ends, by assessing multiple monthly time-series variables. Despite the negative growth, employment grew by 528,000 jobs in July, and the unemployment rate dropped to 3.5%, a 50-year low. Moreover, Nondefense capital goods shipments continued their increasing trend into June.

While such trends indicate an ongoing economic activity, Mohamed El-Erian, president of Queens’ College Cambridge, argued that “away from that, job openings are declining at an historically rapid rate, weekly jobless claims are increasing and several companies have signaled their intention to slow hiring and/or lay off workers.” Indeed, the last figure for job openings shows a decrease in the number of job openings by 605 thousand to stand at 10.7 million in June. According to El-Erian, the government bond market is already reflecting recession expectations, shown by an inverted yield curve as short-term interest rates exceed longer-term ones. “Investors are unusually willing to accept lower compensation for allocating their money to a longer maturity investment. This is a traditional signal of a rapidly slowing economy, and the inversion intensified to some 40 basis points following the release of the jobs report,” he added.

At this point, neither the markets nor the central bank knows the interest rate level needed to be neutral, neither stimulative nor restrictive. In the past, neutral monetary policy occurred when the overnight Federal Funds rate matched the rate of inflation. With today’s US core inflation running at 5.6%, it would appear the needed level of interest rate increases is substantially higher than 2.5%. The Federal Reserve will continue to raise interest rates based on this analysis. The only question is the speed at which the central bank wants to achieve neutrality. If the Fed continues to act aggressively to achieve neutrality, they run the risk of causing a recession and generating large employment losses. If they act too slowly, they run the risk of entrenching a higher level of inflation with slow growth or stagflation.

Sadly, the Federal Reserve knew of the inflation risk in February of 2021 and believed the risk was transitory. Having been proven wrong in their analysis, the central bank is engaging in monetary catch-up. The policy is creating incredible volatility in the financial markets and tremendous uncertainty for business. While there is some cushion in the labor markets via high levels of job openings, the likelihood of a soft landing is chimerical at best. Financial markets react rapidly to changes in interest rate policy. The economy takes longer with a delay between six to eighteen months to fully feel the effects. Therefore, many economists are predicting a recession with rising unemployment in 2023.

Eurozone: Economic Growth and Inflation Amidst a Risk of Energy Crisis

Economic activity in the Euro Area was hard hit by the COVID-19 pandemic as its real GDP shrank by 6.3% in 2020, as shown in the graph below. In 2021, the region witnessed a remarkable recovery as it grew at a rate of 5.4%, the highest since the establishment of the Eurozone. For 2022, the IMF forecasts an annual growth rate of 2.6%, to be followed by only 1.2% in 2023.

Figure 7 – Euro Area Annual Real GDP Growth, %

Source: IMF July 2022 World Economic Outlook.

While economic activity has relatively decelerated compared to the previous year, the first and second quarters of 2022 unexpectedly witnessed positive growth. Second quarter real GDP was up 0.7% in the Eurozone and 0.6% in the European Union (EU), compared to the previous quarter, with a Year-over-year (YoY) growth rate of 4%. In the first quarter, GDP growth rates were 0.5% and 0.6% in the Euro Area and EU, respectively, over the previous quarter. Economic growth in the Euro Area was partly driven by an increase in the demand for tourist services, which pushed up aggregate demand. Given that Europe applied stringent lockdowns during the pandemic, people were eager to resume their travel activities once such restrictions were lifted. Europe’s major tourist destinations, such as Spain, Italy, and France experienced GDP growth rates of 1.1%, 1%, and 0.5%, respectively. YoY GDP growth in the three countries recorded impressive rates of 6.3%, 4.6%, and 4.2%, respectively.

Economic growth came as a surprise to many experts as the European continent continues to struggle with its worst energy crisis due to the Russian war. The risk of a severe gas shortage is imminent for Europe if it faces a harsh winter this year, which would probably push the region into a recession. Whether this positive performance will remain or not is unknown. Signs of dwindling economic activity and a possible recession on the horizon are starting to show. Private sector activity contracted in July for the first time since the pandemic lockdowns, as was shown by a decline in the S&P Purchasing Managers’ Index (PMI). PMI dropped to a 17-month low of 49.4 points from a previous 51 in June. The PMI is a monthly survey of purchasing managers that measures business activity in the private sector. Values below the 50-point benchmark indicate a contraction in activity. This decline was fueled by diminishing activity in the service sector and lower manufacturing output. This shrinkage came in contrary to an expected mild expansion by economists, following the positive second-quarter growth performance. Chris Williamson, an economist at S&P Global, explained that “a steep loss of new orders, falling backlogs of work and gloomier business expectations all point to the rate of decline gathering further momentum… Of greatest concern is the plight of manufacturing, where producers are reporting that weaker-than-expected sales have led to an unprecedented rise in unsold stock.”

The Euro Area is not immune to inflation either. Consumer prices increased at a record-high rate of 8.6% in June and an estimated 8.9% in July. The European Central Bank (ECB) expects an annual inflation rate of 6.8% for 2022 and 3.5% for 2023, still above the 2% medium-term target. Inflation is estimated to only slow down to 2.1% in 2024.

Figure 8 – Euro Area Consumer Price Inflation Rate, %

Source: Eurostat.

Energy prices are the main force behind the surging inflation in Europe. We’ve discussed in a previous article how Europe is especially dependent on Russia for its energy sources. In 2019, Russia’s share in EU energy imports was almost 41% for natural gas and 27% for crude oil. Moreover, the EU supplied 47% of its solid-fuel imports, mainly coal, from Russia. With the increased demand for air conditioning in summer and heating in winter, coupled with a decrease in the supply of energy due to sanctions in Russia, the European continent will continue to struggle with an unprecedented energy shortage and price increases. In June, Russia cut the volume of natural gas supplied through the Nord Stream 1, one of the major pipelines carrying gas into Europe, by almost 60%. Germany and Italy are especially vulnerable to the crisis, as Russia supplied almost 66% and 43% of their natural gas imports in 2020. Following the war, Italy was able to reduce its Russian gas to almost 25% of imports, while Germany still sources almost 35% of its gas imports from Russian.

Italy is also facing an existential crisis of its own, which possibly could threaten the fate of the entire European Union. The Italian economy is among the most indebted in Europe, with a total debt almost three times its GDP. Moreover, with its aging demographics, the country has been running out of people as its population has been shrinking since 2015. Italy is also facing a dangerous case of political instability, with its Prime Minister Mario Draghi offering to resign and being refused by the president on July 14 of 2022. Instability heightened further on July 20, when Prime Minister Mario Draghi won a confidence vote in the upper house of the Senate, but three of his main coalition parties refused to take part in the vote.

Joining the global streak of monetary tightening, the ECB increased its key policy interest rate by 50 basis points on July 21, bringing the deposit rate to 0%. This marked the first hike in almost a decade and the biggest since 2000, as it was double the magnitude of a 25-basis-point increase expected by most economists. According to the ECB, future meetings will most probably hold more hikes to further normalize inflation. The situation looks grim according to Christine Lagarde, the ECB President, who stated that “most measures of underlying inflation have risen further. We expect inflation to remain undesirably high for some time.”

Like the US, the ECB faces a dilemma of extraordinarily high inflation with a potentially cooling economy driven by high energy (natural gas) prices. Again, the neutral ECB interest rate is unknown and a late 2022/early 2023 recession is anticipated.

United Kingdom: Soaring Inflation, Imminent Recession, and Currency Depreciation

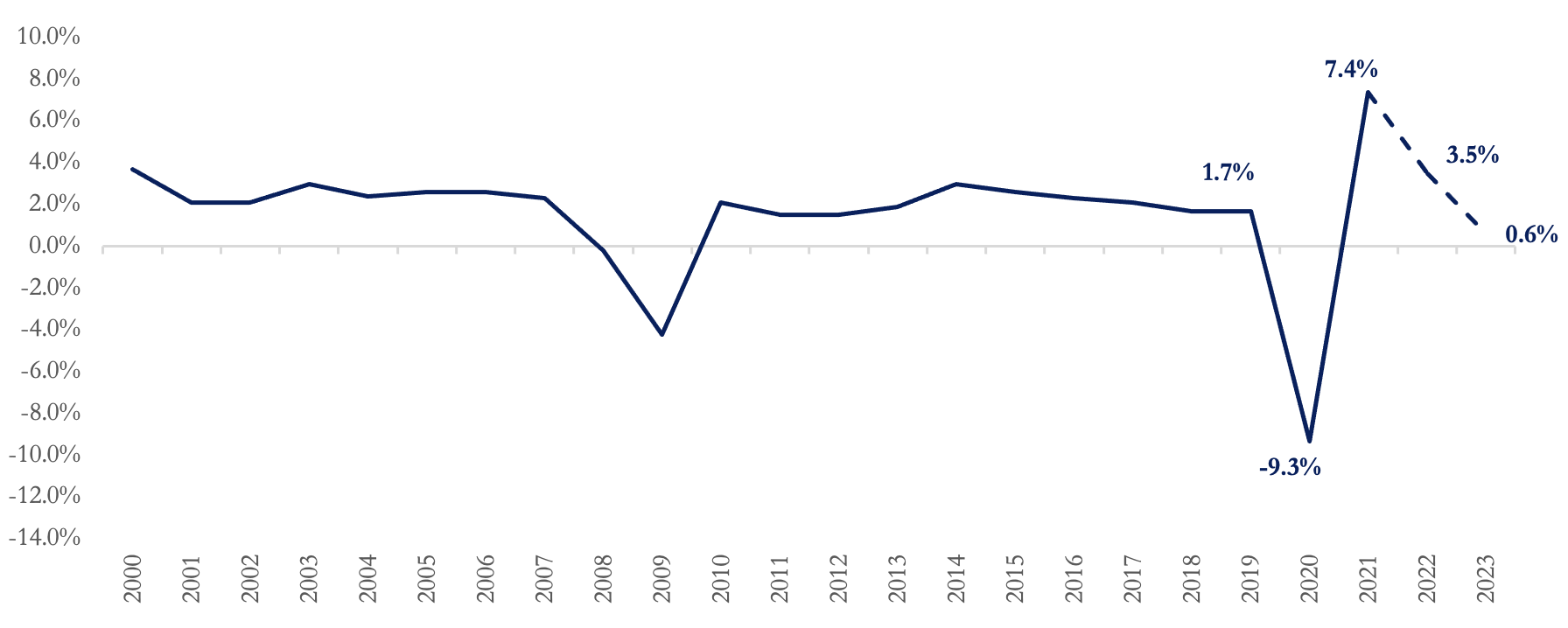

The British economy was amongst the worst affected by the pandemic when its GDP witnessed a massive decline of 9.3%, as depicted in the graph below. Recovery came fast in 2021 with an economic growth of 7.4% in 2021, before unexpected global events started to drag down the economy. Economic outlook remains bleak as GDP growth rate is expected to drop to an average of 3.5% in 2022 and sharply decline to 0.6% in 2023, before slightly recovering to 1.2% in 2024.

Figure 9 – U.K. Annual Real GDP Growth, %

Source: U.K. Office of National Statistics.

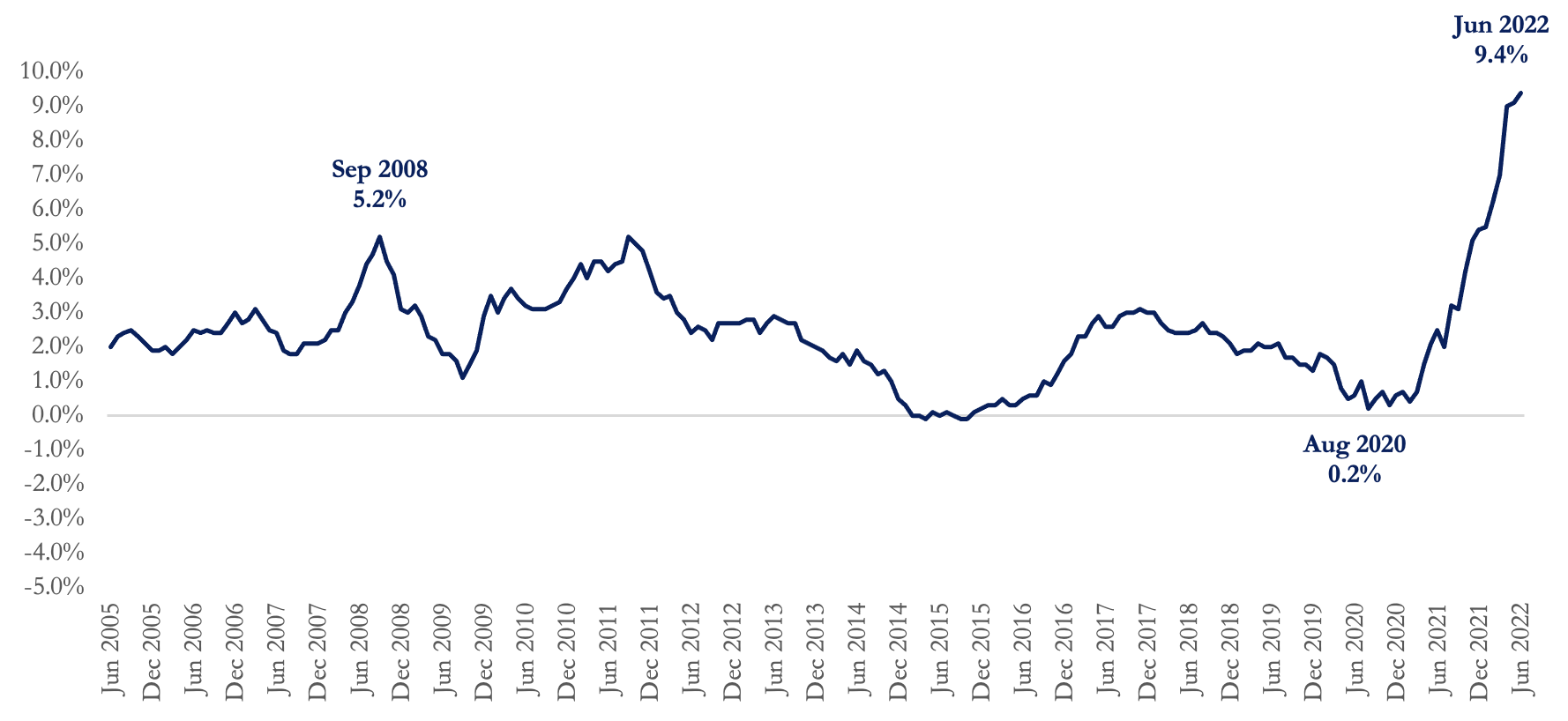

Amid a deteriorating economic outlook, Quarter-on-quarter (QoQ) GDP growth rate stood at 0.8% in the first quarter of 2022 and is estimated to further slow down to 0% in the second and third quarters, before falling into the negative territory at -0.2% in the fourth quarter. This economic deterioration is driven by a sharp increase in inflation, weaker business activity, tax increases, and global economic shocks from the Russia-Ukraine war. Inflation in the UK reached a 40-year record high of 9.4% in June 2022, as presented in the graph below. Annual inflation rate is forecasted to average at 8.8% in 2022 and 7.4% in 2023.

Figure 10 – U.K. Consumer Price Inflation Rate, %

Source: U.K. Office of National Statistics.

The Bank of England increased its key interest rate by a full 50 basis points on August 4, to reach 1.75% up from 1.25%. This came as the sixth increase in a series of hikes that started in December 2021. The last interest rate rise marked the largest increase since 1995, in an attempt from the central bank to curb inflation that is now forecasted to hit 13% in the fourth quarter of 2022.

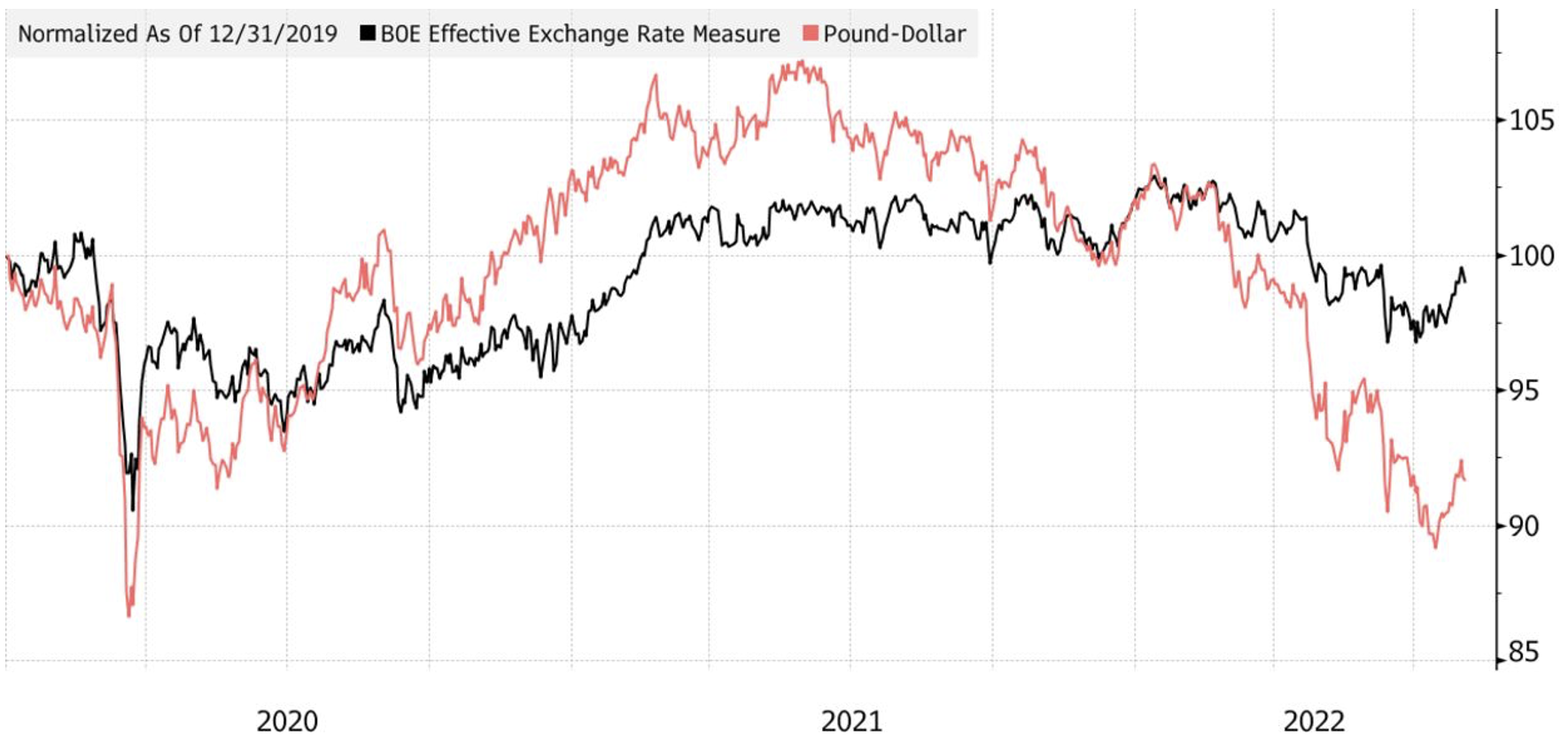

The monetary policy committee also warned that the UK will probably enter a recession by the fourth quarter of this year, as it stated that “the latest rise in gas prices has led to another significant deterioration in the outlook for activity in the United Kingdom and the rest of Europe. The United Kingdom is now projected to enter recession from the fourth quarter of this year. Real household post-tax income is projected to fall sharply in 2022 and 2023, while consumption growth turns negative.” The central bank is expected to increase the policy rate even further as the inflation rate continues to diverge from its 2% target. A process of quantitative tightening is also expected to start soon as the central bank starts selling the previously accumulated government bonds. With the grim economic outlook in the UK and a faster-increased tightening, the British Pound is now expected to fall to below $1.2 next month, the lowest since the pandemic crash. As shown in the chart below, the Pound’s value has been on a decreasing trend for quite some time. This decline will continue to place pressure on inflation for the central bank.

Figure 11 – Declining British Pound

Source: Bloomberg.

China: Strict Lockdowns, Slowing Economic Growth, and a Real Estate Crisis

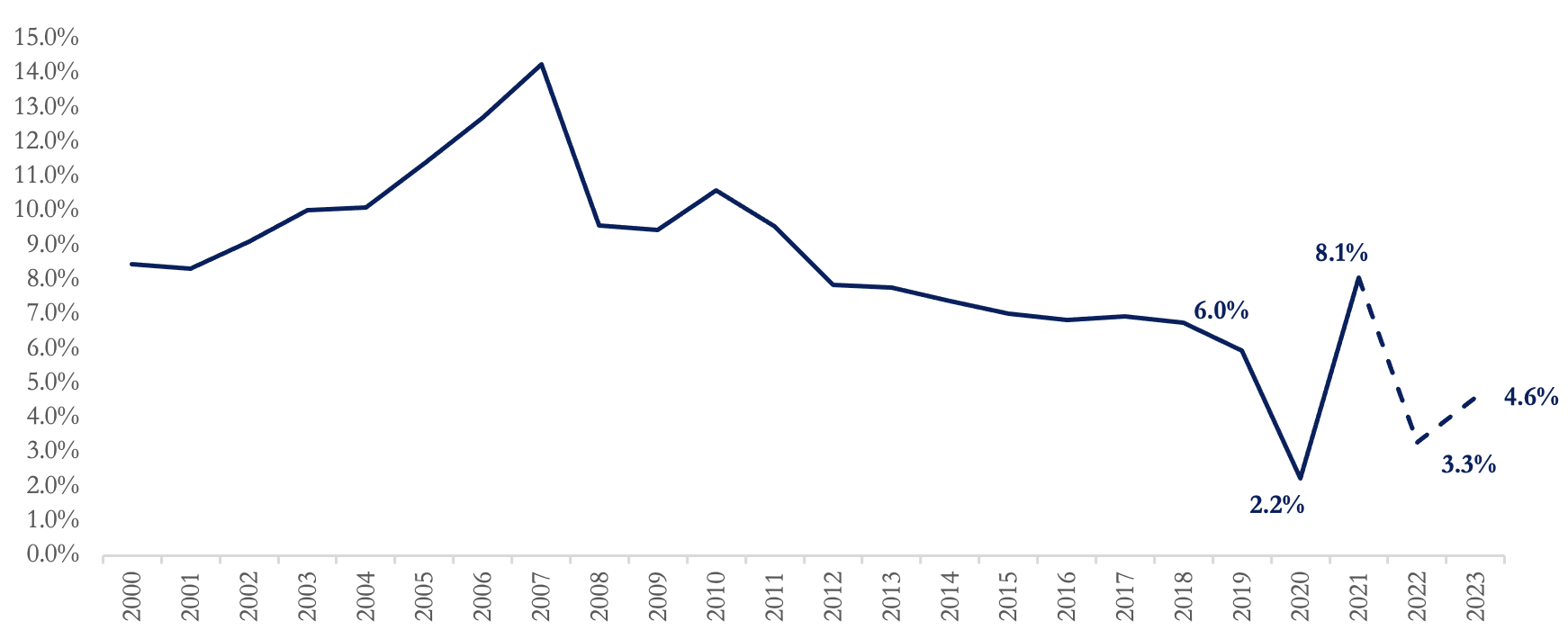

In 2020, at the start of the pandemic, China was one of the few countries to record a positive growth rate of 2.2% (below graph), which increased further to 8.1% in 2021. Yet, this success might not last long. With the stringent lockdowns amidst China’s largest COVID-19 outbreak and the real-estate crisis, economic growth is coming to a halt. In its latest release in July, the IMF revised downward the growth projections for China to stand at only 3.3% in 2022 and 4.6% in 2023.

Figure 12 – China Annual Real GDP Growth, %

Source: IMF July 2022 World Economic Outlook.

With China’s pandemic outbreak and strict Zero-Covid policy, stringent lockdowns have hampered demand and slowed down economic growth. Confirmed new cases in China reached a peak of more than 30 thousand a day last April, leading to massive lockdowns in major regions of the country. Those included Shanghai and Beijing, which witnessed YoY declines in real GDP of 13.7% and 2.9%, respectively, in the second quarter of 2022. Despite a strong start at the start of 2022, economic growth stalled as we moved further into the year. While the first quarter witnessed a YoY growth rate of 4.8%, real GDP growth dropped to a mere 0.4% in the second quarter, which was 0.6 percentage point lower than projected. QoQ growth rate was in the negative territory, recording -2.6% in the second quarter, compared to a positive 1.4% in the first three months, marking the first contraction since the first quarter of 2020.

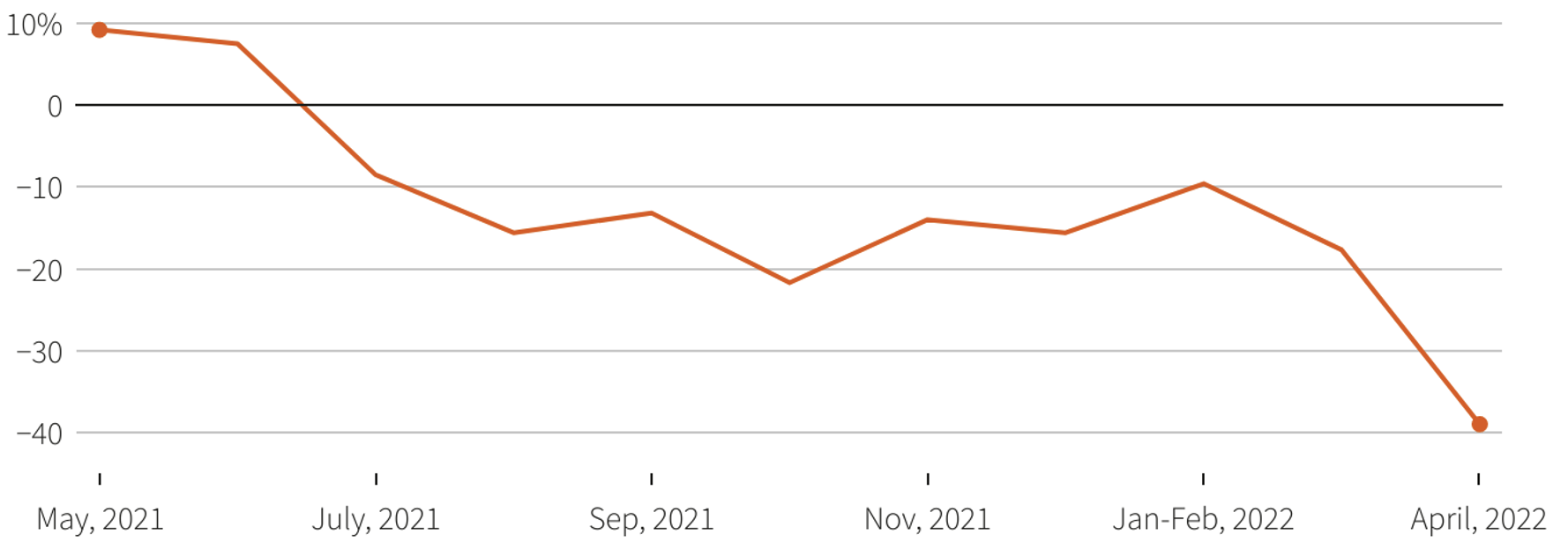

Adding to the shrinking economic activity are challenges in the Chinese real estate sector, which is facing a debt crisis of its own. Major property developers in China have been increasingly accumulating debt to fund their projects. As lockdowns halted economic activity and inflationary pressures increased, sales for their projects declined and pushed them into a liquidity problem. Today, construction in most real estate projects has come to an end, driven by lockdown disruptions and developers running out of cash. With economic and home price uncertainties, buyers have stayed away from the property market as seen in the chart below.

Figure 13 – YoY Change in Chinese Property Sales, %

Source: Reuters.

The toll of the property crisis could be high on the Chinese economy. A shrinking real estate sector could largely impact the Chinese economy, given the property market is estimated to contribute no less than 20-30% of GDP. Moreover, in 2020 almost half of the investment in fixed assets in China was driven by real estate, with new development accounting for close to 30%. Moreover, with insolvent developers and angry buyers refusing to pay their mortgages, the sector could enter a cascading ball of defaults. It is estimated that Banks in China could face close to $350 Billion in losses from this real estate crisis, which could worsen the economic situation further if the banking system were to hit a crisis.

In an attempt to revive the economy and ease the liquidity problem in the property sector, the People’s Bank of China (PBOC) cut its benchmark reference rate for mortgages twice this year, the last being in May. So far inflation in China has been controllable as it recorded 2.5% in June, still within the target rate of 3%. Nevertheless, inflationary pressures have been increasing in the country for the last couple of years. The OECD projects that annual inflation will average at 2% in 2022 and rise to 3% in 2023. Whether the PBOC will continue cutting interest rates to revive the economy remains a question. Given the global price pressures and global monetary policy tightening, if China continues to cut interest rates, it might soon have to face larger inflationary pressures and an increased risk of capital flight. According to Terry Chan, a senior research fellow at S&P Global Ratings, “Now that China’s growth is slowing down, they’re taking a double hit, both from slowdown in growth and price pressures coming up from overseas because some of the components are being imported … And that’s why under the stress test, they seem to perform the worst.” The graph below shows the historical evolution of inflation in China.

Figure 14 – China Consumer Price Inflation Rate, %

Source: IMF International Financial Statistics and National Bureau of Statistics of China.

Japan: Slowing Economic Activity, Deteriorating Currency, and A Watch for Rising Inflation

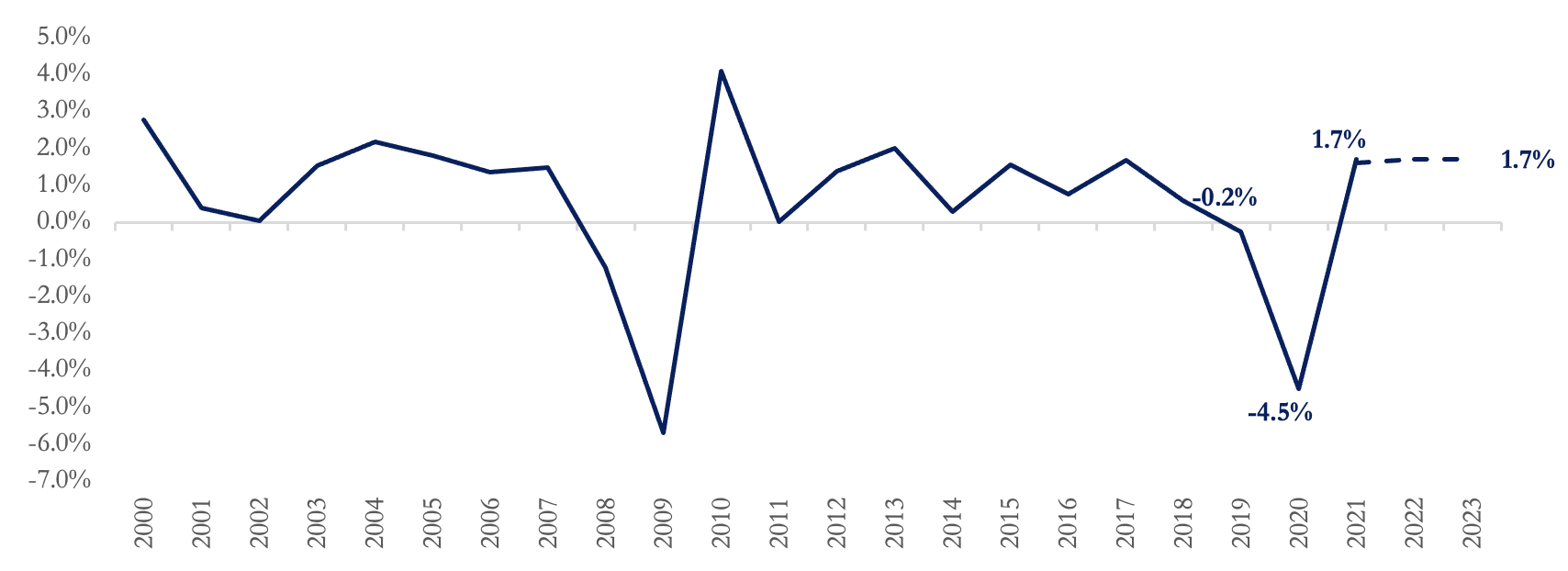

In Japan, the future does not look any more promising as its real GDP growth rate entered the negative territory, recording a QoQ rate of -0.1% (or an annualized rate of -0.5%) in the first quarter of 2022. The country has previously witnessed a contraction of 4.5% in 2020 with the spread of COVID-19, to then recover at a rate of 1.7% in 2021. The IMF forecasts the annual GDP growth rate to remain at 1.7% for both 2022 and 2023.

Figure 15 – Japan Annual Real GDP Growth, %

Source: IMF July 2022 World Economic Outlook.

A major force behind Japan’s economic contraction was a dwindling trade balance. China is Japan’s major export market, as it accounted for almost 23% of its exports in 2021. With weaker demand from China due to stringent lockdowns, Japan’s exports could not catch up with its rapidly increasing imports. Exports increased by only 15.3% in the first quarter of 2022, compared to a 32.3% increase in imports that was driven by pent up demand and rising imports of medical products. Whether the Japanese trade stance will improve or not largely depends on the future development in China, the U.S. and Europe. While a future easing of the lockdown in China would probably push up demand for Japanese exports, the weaker economic activity and higher risk of recession in the U.S. and Europe might counteract such recovery.

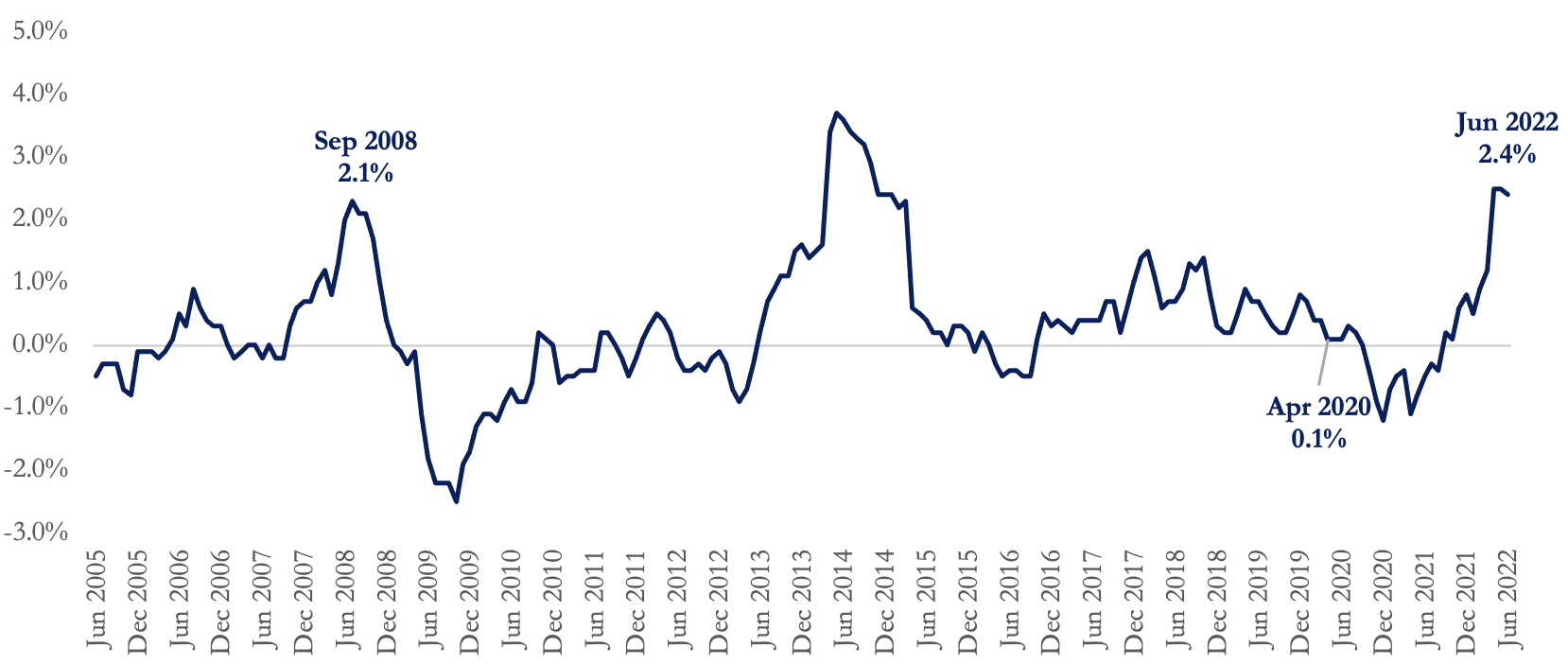

While inflation has surpassed the Japanese central bank’s target of 2%, the situation is much more controllable than in other advanced economies. Inflation rate stood at 2.4% in June 2022, which although high relative to Japanese standards, is still lower than the record-high 3.7% in May 2014. Nevertheless, there is quite a high possibility that inflation might rise further shortly, as consumer spending recovers. Pent-up demand and increasing foreign demand for touristic activities could push up prices in the country. Moreover, if the Russia-Ukraine situation worsens and commodity prices increase further, this could push inflation even higher. Indeed, most of the increase in consumer prices is driven by an increase in energy and food prices, which if excluded the inflation rate drops from 2.4% to 0.8%.

Figure 16 – Japan Consumer Price Inflation Rate, %

Source: Japanese Government e-Stat Portal.

To date, the Bank of Japan (BOJ) has not joined the global club of hikes. The BOJ still maintains an ultra-low short-term interest rate of -0.1% and a 10-year government bond yield capped at 0.25%. The central bank’s monetary committee has publicly expressed that there is no need to rush a tightening monetary policy, so as not to risk a recession given the still-weak Japanese economy and the slowing global economic activity. This dovish stance came at the time when the BoJ raised its inflation forecast for the fiscal year ending March 2023 to 2.3% from a previous projection of 1.9%, while reducing its fiscal-year real GDP growth forecast to 2.4% from a previous 2.9%.

Despite the relatively lower Japanese inflation, going against the tide of monetary tightening is signaling a higher risk of economic decline. This has been evident in the falling Japanese yen that hit a 24-year low, losing almost 20% of its value over the last year. Ironically, this is feeding more into inflation as it puts more pressure on the already-high import prices, which in the end might force the BoJ to turn hawkish.

Conclusion

The global economic outlook is not optimistic. It hasn’t been for a while. A myriad of consecutive crises has led most countries into difficult situations. Compounding the disruption from the earlier pandemic, the Russia-Ukraine war and the rise of COVID-19 cases in China have slowed down economic activity. With rising inflation rates worldwide due to soaring food, energy, and other commodity prices, central banks are aggressively tightening their monetary policies, further slowing down economic activity. The longer this non-virtuous cycle goes on, the more expensive it becomes to break it. Talks are everywhere on whether the U.S. and global economy have started a recession or will enter one soon. What about stagflation?

Economic forecasts are often notoriously inaccurate and lack an X or exogenous factor in their models like COVID or Ukraine War. More humility is needed. Likewise, consensus opinion and reality are often not congruent. The mere fact that we are discussing a scenario that has not occurred since the 1970s shows how fundamentally Covid-19 and the war in Ukraine have changed expectations. If a recession starts with current record-high inflation rates, outlooks might even get grimmer. Given the inability of central banks to accurately assess risks, one must question their ability to manage policy in a manner that produces a soft landing or avoids a global recession.