Home ownership is a core pillar of the US economy. With soaring interest rates, the dream of owning a home for many US Millennials appears out of reach. What may put it further out of reach is the cost and lack of home insurance. What’s driving it?

Besides war, climate change is one of the most pressing global challenges. The devastating impacts are increasingly evident as the world experiences extreme weather events. From Arizona heatwaves to Florida hurricanes to New York City floods to Canadian wildfires, these occurrences wreak havoc on infrastructure and properties across the globe. When these events occur in the US, homeowners expect their insurance to cover the damage and the rebuilding costs. Yet as these costs increase, insurers must either raise rates or pull out of markets. This could have massive downside implications for the US housing market and the US economy.

*Here’s my disclaimer on climate: it doesn’t matter if you believe in it or not. What we have to watch is how the markets and governments are responding to it. By watching their actions, we can make better decisions about our own approach to the risks.*

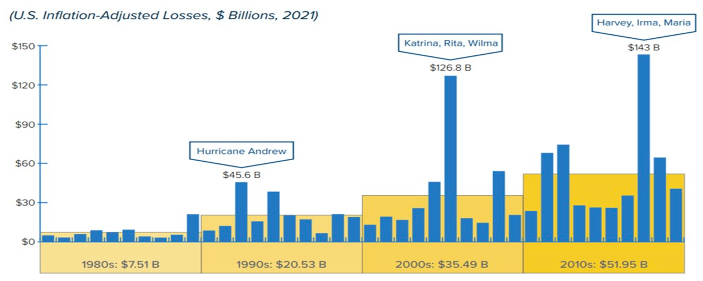

Over the past three decades, the frequency of climate-related disasters, known as “billion-dollar events,” has shown a startling surge. In 2022, the United States had weather events that cost a massive $165 billion in damages, with Hurricane Ian alone contributing a formidable $113 billion to this burden. Between 1980 and 2022, the nation dealt with an alarming tally of 341 billion-dollar events, accumulating an astronomical cost of $2.5 trillion.

Figure 1 – Billion-Dollar Natural Disasters in the U.S.

Source: Council on Foreign Relations, Based on National Oceanic and Atmospheric Administration.

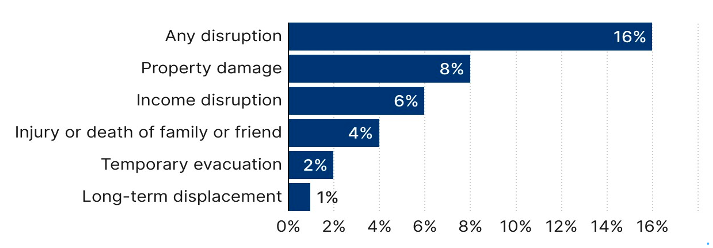

Climate change particularly poses threats to the country’s property market. Property damage is among the most significant disruptions reported due to natural disasters (Figure 2). In the West, States such as California are facing increasing risks of property damage from extreme wildfires. Along the Gulf Coast, States such as Florida, Texas, and Louisiana struggle with increasing risks of damage from hurricanes and the related flooding and windstorms. In other Inland States, such as Kentucky, the rates of damage from flooding are rising due to heavier and lengthier precipitation.

Figure 2 – Percentage of Adults Reporting Disruptions, by Type, in the Previous 12 Months

Source: Brookings Institute, Based on Federal Reserve Board Survey of Household Economics & Decision-making (2022).

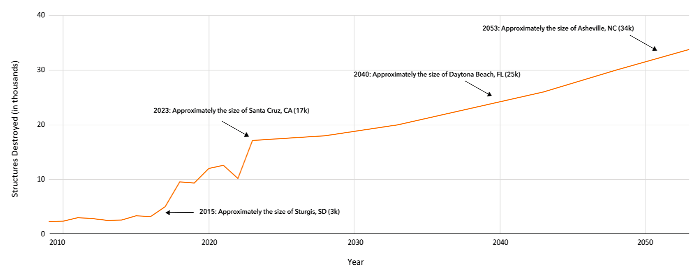

For example, it is estimated that between 2009 and 2023, the cost of wildfires increased by 270%, more than tripling the annual number of destroyed properties (Figure 3).

Figure 3 – Average Annual Structures Destroyed Nationally

Source: First Street Foundation.

The increasing risk of exposure to climate hazards is expected to affect property valuations and insurance premiums. This intrusion into the supply-demand dynamics and the risk-adjusted pricing of insurance coverage underscores the need for evaluation. While certain high-climate risk locations continue to experience growth in property values due to US population migration, the conditions for a major shift are growing. In the long run, continued extreme climate events will pull down property values and dramatically increase the cost and availability of insurance.

In this article we will study how climate change has affected property values and insurance premiums, how trends are expected to continue or change in the future, and possible policy recommendations to address the issue.

The Nexus of Climate Change and Property Values

How Climate Change Can Affect Property Values: The Economic Mechanisms

Climate events, such as sea-level rise, coastal erosion, hurricanes, floods, and wildfires, can impact property values by increasing the risk of physical loss. Higher climate risks can feed into property prices as they interfere with the market’s supply and demand dynamics.

On the demand side, the higher likelihood of damages could reduce the overall appetite for houses in high-risk locations, especially if the perceived losses from climate hazards outweigh the perceived benefits from amenities (e.g., access to the ocean). Moreover, as will be explained later, higher climate risks might lead to higher insurance premiums when realized. Such higher insurance costs and the inability of some homeowners to afford coverage might depress demand even further.

On the supply side, while in the short-run, climate events might damage properties, leading to temporary shortages, hence short-lived spikes in prices, values should drop in the longer-run. A reduction in long-term demand and migration from affected areas could eventually feed into lower investment trends in high-risk locations. Although this might lower the supply of houses, the drop in demand would typically outpace supply adjustments, leading to a long-term drop in property prices. Moreover, lower investment trends could imply lower-quality buildings with fewer amenities, reducing demand even further.

The Case of Hurricane Katrina in New Orleans: Short-Term Rise in Property Values

The city of New Orleans was among the most impacted areas by Hurricane Katrina in August 2005, with almost three-quarters of homeowners reporting damaged houses. According to the Census Bureau, the damage from the extensive flooding caused by Katrina is estimated to have reduced the housing stock in Orleans Parish by a devastating 50% in 2006. It wasn’t until three years later that it started to rebound, reaching only 80% by 2009 and 90% by 2010 of its pre-Katrina level.

Figure 4 – Housing Stock in Orleans Parish, Louisiana

Source: First American, Based on Census Bureau Data.

One might expect that such widespread devastation would have a profoundly negative impact on property values. However, what unfolded in the immediate aftermath of Hurricane Katrina was a paradoxical phenomenon that defied conventional wisdom.

Owing to the dynamics of supply and demand, this shortage increased house prices for a full year following the hurricane. House prices in New Orleans increased by close to 20% between November of 2005 and 2006, to later moderate in 2007.

The surge in property values in New Orleans during this period can be seen as a testament to the resilience and determination of the local community. In the face of such overwhelming destruction, an influx of financial aid and investments poured into the city, leading to a flurry of rapid rebuilding and reconstruction efforts. These efforts, in turn, drove up the demand for housing and commercial spaces, resulting in a significant and counterintuitive boost to property values.

Figure 5 – House Price Index (Feb. 2004 = 100) for Orleans Parish, Louisiana

Source: First American.

The Case of Flooding Risk in Florida and Texas: Long-Term Fall in Property Values

Conversely, the case of Florida and Texas paints a sobering picture of how long-term climate change impacts property values. As these states face increasing flooding risks, residents and investors are confronted with a grim reality.

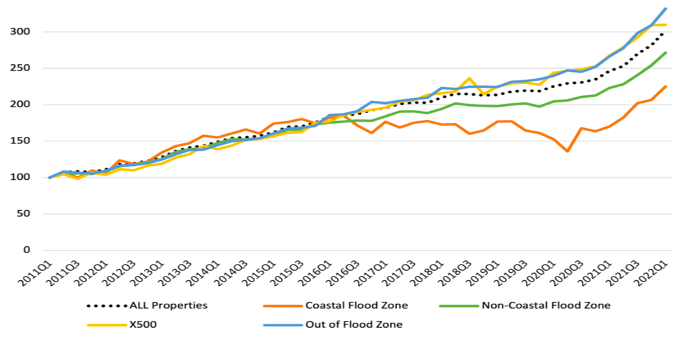

Frequently hit by severe hurricanes, the States of Florida and Texas especially face high climate risks. The cities of Miami (Florida) and Harris (Texas) are among those with the highest risk of flooding. While it is natural for properties in flood zones to sell at a discount due to the higher risk and higher insurance cost, other house qualities might also play a role. For example, flood zone properties can offer attractive amenities – such as ocean proximity – that might push prices up. A study that looked at housing data over 2011-2022 in Miami, explored the effect of flood risk on property values, while controlling for other price-related property qualities. Results showed that once controlling for relevant house qualities, locations with higher flood risk indeed reduced property values. For example, house prices in areas with a 1% annual chance of flooding tend to be 9-18% lower per square foot. On the other hand, prices tend to be higher by 7% in locations with only a 0.2% chance of flooding, where the price premium of being close to water can feasibly outweigh the minimal flood risk. In addition to lower property values, the study results also found that the growth in value was lower over time for high-risk flood zones. Figure 6 below shows price indices for properties in the different flood zones. Prices for properties out of a flood zone or those with a very low risk of flooding (X500) appreciated by more than 300% between 2011 and 2022. Meanwhile, the price growth for properties in flooding zones was much lower, especially for coastal areas with the shortest distance to the shore.

Figure 6 – Home Price Indices by Flood Zone – Miami-Dade County

Source: CoreLogic.

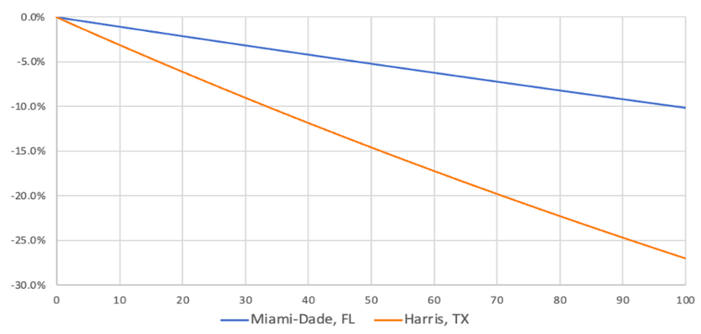

In an extension study, the researchers more precisely quantified the flood risk of different areas by calculating a Flood Risk Score (FRS), considering specific factors such as elevation and distance to water to measure the incremental levels of risk for properties within and outside of floodplains. Results showed that, on average, property prices per square foot are 1% less in Miami and 2.5% less in Harris, for every 10-point increase in the FRS. To put that into context, a property worth $300,000 would sell for only $268,000 in Harris and $288,000 in Miami, if it was in an area with an FRS score of 40 compared to 80, due to climate risk.

Figure 7 – Percentage of Home Value Declines Versus FRS, Miami (FL) and Harris (TX)

Source: CoreLogic.

The chronic inundation of coastal areas, property damage, and insurance premiums have combined to erode the long-term desirability of properties in flood-prone zones. A sense of uncertainty has permeated these regions, deterring potential buyers and causing property values to stagnate or even decline.

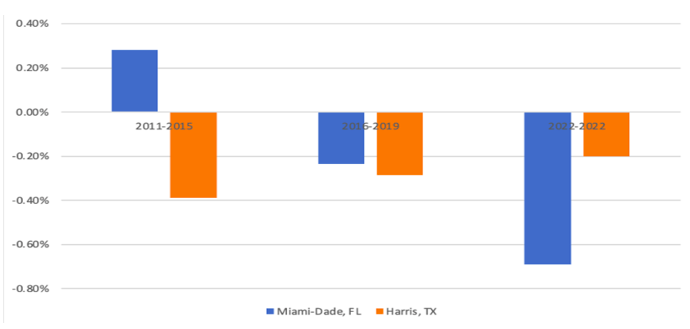

One major factor that determines how much climate risk is passed through to property values is people’s perception and knowledge of the risk. Thanks to the increasing severity of climate events and wider discussions in the media and policy front, climate change is a hotter topic today than it was 10 years ago. In Miami, where climate-risk perception has increased over time, the price penalty related to an increase in flooding risk has also increased. During 2011-2015, the price premium of being close to the water outweighed the perceived flooding risk, resulting in a net positive price effect in flood zones. Following the increased risk perception after 2016, the price effect of higher flooding risk has reversed. In Harris, Texas, on the other hand, where the perceptions of flooding risk are more consistent over the last decade, the impact on property values has remained negative and relatively stable.

Figure 8 – Percentage Price Change for Every 1 FRS Increase, Miami (FL) and Harris (TX)

The Nexus of Climate Change and Insurance Premiums

How Climate Change Can Affect Insurance Premiums: The Economic Mechanisms

At its core, insurance is a mechanism of risk transfer. Policyholders pay premiums to insurance companies in exchange for protection against unexpected events. Insurance premiums are based on a mechanism of risk-based pricing, through models that factor in historical, current, and future risks. The premiums collected are designed to cover the cost of claims and to generate a profit for the insurer for accepting the risk. The higher the risk level of a property, the higher would be its insurance premium. As the expected risk exposure and insurance loss claims due to climate hazards increase, so would the risk-based premiums on property insurance. The impact on rising premiums would especially be pronounced as the uncertainty around the expected magnitude of climate risks rises, pertaining to the rapidly increasing frequency and severity of climate events.

Insurers rely heavily on historical data and actuarial models to predict future losses and determine premium rates. Yet, climate change has rendered much of this data obsolete. As such, insurers are struggling to accurately assess the risk associated with climate-related events. In response, they are adjusting their premium structures to account for the new reality of more frequent and severe climate-related disasters.

Other market factors can also play a role in pushing up insurance premiums for climate-related hazards. For example, the recent rise in inflation and the corresponding rise in reconstruction costs have reduced the solvency of insurance companies, making it harder for them to sustain loss coverage without adjusting prices. It is common for property insurance companies to seek reinsurance to mitigate their risk exposure on sold policies. In the face of rising inflation, reinsurance premiums have become more costly, further limiting property insurers’ solvency.

In the case when the property risk from climate change becomes too high to maintain profitability, private insurance companies might resort to pausing new policies or withdrawing from high-risk locations, such as what happened in California and Florida.

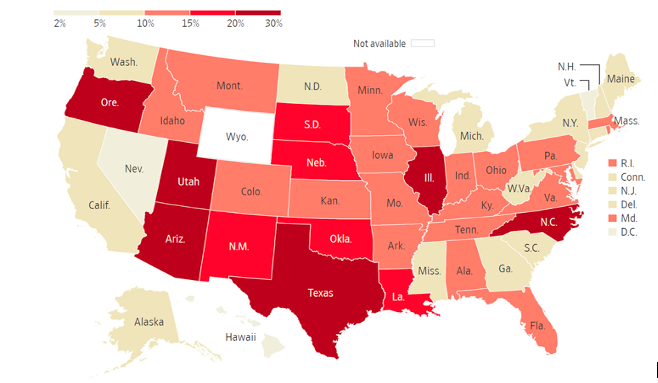

Extreme weather conditions have impacted both the affordability and availability of property insurance. Thanks to rising climate risks and inflation, insurance companies have reconsidered their pricing and increased premiums. Home insurance prices have risen rapidly across the U.S., with 31 states witnessing double-digit increases between January 2022 and July 2023 (Figure 9). While Arizona and Texas witnessed the highest price increases of close to 30%, other states such as Utah, Oregon, Illinois, North Carolina, Oklahoma, New Mexico, and Louisiana saw increases of close to 20%.

Figure 9 – Home Insurance Rate Increases Approved, Jan 2022 to July 2023

Source: Wall Street Journal, Based on S&P Global Market Intelligence.

In other states such as California and Florida, the impact of climate challenges was not restricted to price increases. Although premiums between 2022 and 2023 increased to a lower extent by close to 10-15%, several insurance companies have chosen to reduce or halt business. While some insurers have chosen to limit coverage of certain damages, such as by increasing the deductible on wind and hail damage, others have exited high-risk markets and halted new policies, such as in California, Florida, and Louisiana.

The Case of Insurance Premium Inflation Following Hurricane Katrina and Harvey

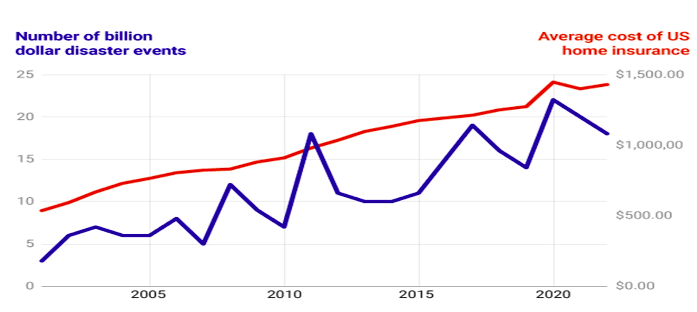

Following the huge losses and damages from Hurricane Katrina in August 2005, many insurance companies reassessed their exposure, factoring in higher future climate risks. As shown in Figure 10, the average cost of U.S. home insurance has almost doubled since 2005.

Figure 10 – Frequency of Natural Disasters and Cost of Home Insurance

Source: GZERO.

It is estimated that the 2005 Hurricane Katrina and the 2017 Hurricane Harvey cost the U.S. the highest insured losses since the 1980s, amounting to $127 billion and $143 billion, respectively. This has particularly pushed up home insurance premiums, especially in vulnerable areas.

Figure 11 – Average Insured Natural Disaster Losses in the U.S.

Source: Insurance Information Institute.

Following Hurricane Katrina, between 2005 and 2007, home insurance premiums increased by an average of 7.6% nationwide, with homeowners in coastal areas experiencing double-digit rises. For example, during the same period, average premiums soared by 41% in Florida, 22% in Louisiana, 12% in Rhode Island, and 11% in New York. Similarly, following Harvey, between 2017 and 2020, premiums increased by an average of 11%. During the same period, flood insurance premiums in Texas, which bore the brunt of the Harvey fury, jumped by around 18% on average, and close to 23% and 54% in Harris and Fort Bend Counties, respectively.

The Case of Insurance Companies’ Withdrawal in California

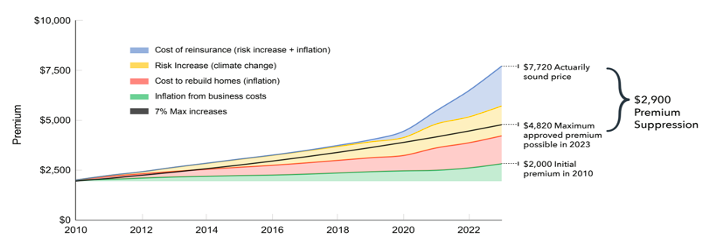

A unique feature of California’s insurance market dynamic pertains to the strict policies that regulate pricing. Under Proposition 103 of 1988, insurers are only allowed to price their products based on the actual costs, while prevented from factoring in the increasing climate risks. Given the increasing risk of climate change and downside risks to the outlook, several companies have chosen to halt new policies or completely withdraw from the market as it became difficult for them to profit.

Despite having the highest rate of wildfires in the U.S., insurance premiums in California have increased by less than 10% between 2022 and 2023. In early 2022, worried about wildfire exposure, the American International Group (AIG), stopped selling new policies in California and informed several of its clients that it wouldn’t be renewing their insurance. Several insurers later followed, including the State’s largest homeowner insurance company State Farm.

To understand the negative impact that strict price controls can have on insurers, imagine the hypothetical example where a house insurance policy in California costs $2000 in 2010. Assuming that the insurer is allowed to increase its premium by 7% annually (which is still highly unlikely under the current regulations), the applied premium would become $4,820 in 2023. Yet, during this 13-year period there have been significant increases in wildfires and damaged properties, in addition to rising inflation, necessitating a premium of $7,720 for the policy to be actuarially sound. Under the strict regulations, the insurer is losing $2,900 of the premium, equivalent to over a third of the fair pricing.

Figure 12 – The Impact of Premium Suppression on Insurers

Source: First Street Foundation.

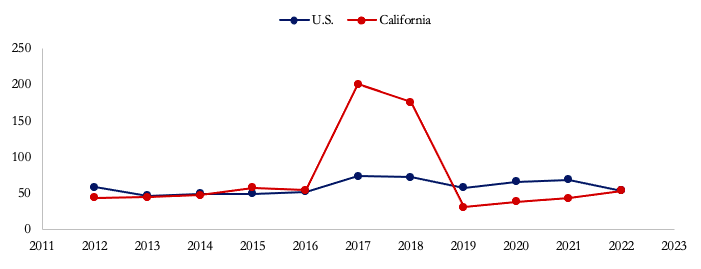

In the wake of the increasing severity and frequency of wildfires, payouts on claims to homeowners in California more than doubled between 2019 and 2022, whereas premiums rose by no more than one-third over the same period. Figure 13 shows the average loss ratio of wildfire claims with respect to premiums for California and the U.S. as a whole. Although the loss ratio was lower in California than the country average in six out of the 10 years leading to 2022, it has been substantially higher in the event of a devastating wildfire. For example, the ratio was as high as 200% in California, compared to a 74% U.S. average, during the 2017 wildfire. Moreover, since 2017, seven out of the eight wildfires with the highest insured losses were in California.

Figure 13 – Loss Ratio for Homeowners Insurance Due to Wildfires

Source: Wall Street Journal.

In the first quarter of 2023 alone, State Farm company recorded $312 million in underwriting loss on property insurance, a remarkable 30% increase over the $241 million losses for the whole year of 2022. Exacerbating the situation has been the inflated reconstruction costs, which increased by 25% in California since 2020, in addition to the increase in reinsurance premiums that property-insurance companies rely on to mitigate their policy risks, which increased by 33% in June 2023.

Future Trends and Projections

Climate change is an ongoing global challenge that continues to evolve and impact various aspects of society, including property values and insurance premiums in the United States, therefore, it is imperative to peer into the future to anticipate trends and projections that will shape the landscape of real estate and insurance in the United States. The coming years are poised to bring forth a multitude of challenges and opportunities, each intricately woven into the fabric of our changing climate.

Climate change is only expected to get worse. It is estimated that the U.S. gross domestic product (GDP) will fall by 7% if global temperatures increase by 2°C above industrial levels by 2050. Moreover, under the existing policy pathways, climate change could drop GDP by as much as 10% by the end of the century.

A recent study published in the Nature Climate Change journal found that the impact of climate risk is not fully captured in the current property values. When accounting for actual flood risk alone, U.S. property prices are estimated to be overvalued by between $121 and $237 billion. Overvaluation tends to be higher in regions where potential buyers are unaware of actual climate risks, due to lack of accurate information. For example, property prices are more overvalued in counties where there are inconsistent state-level flood risk disclosure laws or where the Federal Emergency Management Agency (FEMA)’s flood insurance risk maps are deficient or don’t reflect the true scope of the risk. Florida, California, and Texas are the top three states with the highest overvaluations, of around $50, $20, and $10 million, respectively.

This unrealized flood risk, the authors argue, is creating a bubble that challenges the stability of the U.S. residential property market. If such risks are realized, low-income homeowners would face the highest risk of losing home equity due to price reductions. Moreover, municipalities that rely heavily on property taxes for revenue are at greater risk of facing budgetary distress. It is estimated that around 15 million residential properties in the U.S. face at least a 1% annual probability of flooding, with annual projected damages of more than $30 billion. By 2050, the number of properties exposed to flooding risk is expected to increase by 11% with increased annual losses by 26%, as the severity and frequency of flood risks continue to trend upwards. “As we’ve seen in California the last few weeks, these aren’t hypotheticals, and the risk is more extensive than expected,” argues Jesse Gourevitch, a lead author in the study, “and that risk carries an enormous cost.”

So, although home values in risky coastal areas might still be increasing due to their favorable amenities, this trend will eventually reverse. As homeowners start to realize the true extent of climate risks, demand will certainly fall for properties in risky zones, and the market will start to adequately price the cost of climate into its valuation.

Directly linked to the increasing risk of properties is the insurance industry. As climate risk increases and the market becomes more aware of its extent, insurance companies would correct for higher perceived risks through higher premiums. Moreover, higher insurance costs and the inability of some homeowners to afford protection, would feed again into property values as demand drops for the costly houses, leading to an overall state of lower property values and higher insurance costs.

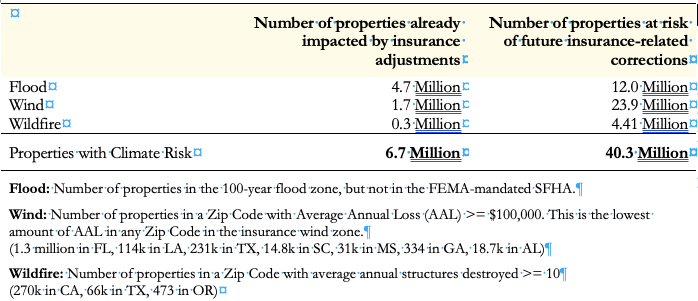

A recent study by the First Street Foundation finds that property insurance is underpriced, due to strict regulations and increasing climate risks. It is estimated that around 40 million properties in the U.S. (one-quarter of all properties in the country) are at high risk of a climate event, such as flooding, hurricanes, or wildfires, and are accordingly at high risk of future insurance corrections. This is currently not reflected in home insurance premiums.

Out of those properties (Figure 14), around 12 million face major flood risk (and are not in the FEMA flood zones), 24 million face significant risks of destructive winds, and 4 million face extremely high risk of wildfire. In addition, around 7 million out of the 40 million properties are extremely risky and no insurance company would provide them coverage.

Figure 14 – Properties at Risk of Insurance Increases/Non-Renewals in the U.S.

Source: First Street Foundation.

Policy Recommendations

In the face of the growing nexus between climate change, property values, and insurance premiums in the United States, it is imperative to develop proactive policies to mitigate the associated risks and challenges.

The current overvaluation in the property market can potentially lead to a housing crash if not adequately managed, which could cause high equity losses to lower-income and vulnerable communities. According to Dr. Carolyn Kousky, Associate Vice President at the Environmental Defense Fund, “We need policy approaches that improve the transparency of climate risk in markets while also providing increased support and protection for frontline communities.” Several short-term and long-term measures can be adopted by policymakers to address the issue at hand and reduce its impact moving forward.

Investing in High-Quality Data on Climate Risk

The first reason that policymakers are not equipped to adequately tackle the climate-induced property crisis is the lack of necessary data. Investing in high-quality asset-level data that capture the actual future risks posed by climate hazards is critical. (There are plenty of AI driven websites which can already give approximations of the impact on property values by climate change.) Not only would that allow homeowners and market participants to make informed decisions, but it would also enable the development of sound evidence-based policy to mitigate and prepare for losses. Without fully understanding the scale and scope of the problem, it would be impossible to sufficiently address it. Cooperation between FEMA, the Federal Housing Finance Agency (FHFA), and the National Oceanic and Atmospheric Administration (NOAA) is necessary to purchase or develop such data, which can then be used to update flood and wildfire risk maps to reflect the likelihood of future, not merely historical, risks.

Good communication of data and risks is also essential. First, data should be translated into risk disclosure laws to increase transparency and facilitate investments in adaptation. Second, high-quality data should be widely available and open to homeowners, investors, and companies across the U.S., to make informed decisions on their house choices, adaptation, investments, and product design.

Incentivizing Lower-Risk Exposure through Regulatory Reform and Cooperation

Evidence shows that despite the increasing threats, higher-risk locations are experiencing faster population growth rates, as Americans are moving to areas with higher climate risk. It is essential that regulators use incentives to encourage homeowners to lower their physical and financial exposure to climate risk, through investing in adaptation, purchasing disaster insurance, and moving to lower-risk areas.

First, by requiring lenders, insurers and government to transparently disclose actual climate risks and coverage limitations, regulators could discourage citizens from moving to risky locations and encourage them to invest in climate adaptation to protect their houses and reduce losses. This would require dependence on high-quality data to capture the probabilities of damage in different areas.

Second, offering conditional insurance discounts for landlords and homeowners who invest in the reduction of physical climate risk could improve affordability and incentivize take-up.

Third, working with lenders to implement climate-risk-based pricing for mortgages could provide incentives to reduce exposure. By penalizing higher-risk locations through higher mortgage interest rates or larger down payments, lenders could nudge homeowners to seek safer locations. Under the current National Flood Insurance Program, taxpayers living in low-risk areas continue to subsidize those in higher-risk locations. Accordingly, climate-risk-based pricing could offer advantages in leveling the playing field.

Fourth, by consistently sharing information on actual climate risks, regulators could discourage property developments in high-risk locations. For example, local governments can develop consistent rules on climate-risk disclosures across different areas or create schedules of climate-related property taxes and impact fees.

Finally, through zoning, developing strict land use regulations and having federal government flood insurance reflect the risks of flooding, the government can completely prohibit new property developments in extremely risky locations.

While all such policies are ambitious and might require several regulatory reforms, they can promise great potential if applied. To start with, such policy interventions would require close cooperation between multiple parties to develop and implement regulations, including: (1) the federal government, which regulates mortgage markets and provides infrastructure finance; (2) the state governments, which regulate property insurance markets; (3) the local governments, which oversee land use; and (4) the private sector, which develops, contracts, and manages property based on regulations.

Conclusion

The relationship between climate change, property values, and insurance premiums in the United States is a complex, challenging and correlated. As our climate continues to evolve, the impact on the real estate market and insurance industry are profound. This demands action or risk further reductions in private insurance coverage with homeowners and businesses exposed to all the potential costs of extreme weather events. If no action is taken, we can expect an acceleration of insurance companies withdrawing coverage from areas that are prone to extreme weather events. This will leave either the US government to foot the bill or the homeowner to potentially lose all the value of the home. It should lead to better decisions on where to locate, build and insure.