How It Could Reshape Your Wallet and Business

Executive Summary: Tax Policy Outlook for Trump 2.0

Key Takeaways:

- Tax Cuts and Jobs Act (TCJA) Extensions: The Trump administration aims to make individual and business tax cuts permanent.

- Winners: Capital-intensive industries, high-income earners, and pass-through businesses.

- Losers: Green energy sector, healthcare, and real estate investors facing policy shifts.

- Budget Deficit Impact: Extending TCJA would reduce federal revenue by an estimated $5.3 trillion over 10 years.

- Democratic Counterproposals: Focus on expanding the Child Tax Credit and increasing taxes on high-income individuals.

- Trade & Tariffs: Increased tariffs may offset tax cuts but could hurt economic growth.

Introduction

When Benjamin Franklin quipped that only death and taxes were certain, he left out an important caveat. Taxation may be inevitable, but the details vary immensely. At the time of our nation’s founding, tariffs on imports and sales taxes on specific consumer products funded the government entirely. Payroll taxes, income taxes, and corporate taxes were non-existent. Yet in the nearly 250 years since, the American tax code has grown into a complex behemoth of exclusions, deductions, credits, and preferential tax rates. Armies of lawyers and accountants work full-time to help American consumers and businesses navigate the web.

Despite Republican dreams of making tax filing as simple as writing a postcard, the path forward in 2025 and beyond seems anything but straightforward. Several major provisions of the Tax Cuts and Jobs Act of 2017 (TCJA) – a generational piece of legislation that dramatically altered the U.S. tax landscape – are set to expire by the year’s end. If they do, Americans will feel the pinch in their pockets immediately. The standard deduction for individuals and households will shrink, tax rates will increase, and the Child Tax Credit would be slashed in half. All told, according to the Tax Foundation, 62 percent of households would see a tax increase if the TCJA is allowed to expire. And that outcome is highly unlikely as neither party wants to be blamed for it.

With an emboldened President Trump in the White House and Republicans in control of both chambers of Congress, the tax relief implemented by the TCJA will almost certainly continue. President Trump is eager to craft a tax framework that keeps taxes low for households (particularly those at the top income levels) and supercharges domestic consumer spending. In keeping with his “America First” agenda, the President and his advisers also remain intent on using the tax code to lure manufacturing, research, and development back onto American shores. Firms with high R&D budgets and major capital outlays are likely to benefit, provided they undertake their production activities in the United States.

The Democratic Party, still largely reeling from the drubbing they received at the polls last November, have failed to articulate a concrete alternative vision for tax policy. They will put up ceremonial resistance but offer no real impediments to the Trump agenda. The biggest risk to America’s next round of fiscal largesse comes from within the Republican Party. Just this week, House Republicans advanced a budget and tax policy proposal promising $1.5 trillion in spending cuts – alongside $4.5 trillion worth of tax cuts. Simple math indicates that this will only increase the federal budget deficit, much to the chagrin of deficit hawks in the Republican Party.

The national debt, already surpassing $34 trillion, remains a looming concern. While proponents argue that lower taxes can spur economic expansion and, in turn, generate higher revenues, skeptics warn of potential long-term fiscal instability. The balancing act between tax cuts and responsible governance will be a defining challenge in shaping America’s financial future.

Our research will investigate the themes and dynamics at play in the coming tax policy debate. Let us begin…

Tax Policy Context: Background on the TCJA

When the TCJA passed in 2017, both supporters and critics hailed the legislation as the most consequential overhaul of the American tax code in over 30 years. (See our research here on Trump’s previous economic policies.) Lawmakers ushered in changes to both personal and business taxes designed to lower the tax bills for American households and enhance the competitiveness of the US business environment. A few major provisions, such as the reduction in the corporate tax rate, were authorized permanently. However, many impactful provisions were only authorized temporarily, with most slated to expire by the end of 2025.

On the personal side, major changes included a reduction in the tax rates for each income bracket, as well as modifications to the income brackets themselves. Overall, these changes lowered the tax basis for most American households. Another important change occurred for the Child Tax Credit (CTC). The baseline CTC, which lowers taxable income for parents with children, doubled from $1,000 to $2,000 per child. The income limits where the credit phases out also increased substantially.

Finally, the TCJA modified various components of standard and itemized deductions. The standard deduction doubled, providing an incentive for fewer taxpayers to itemize deductions. One of the most controversial changes related to itemized deductions pertains to a provision called the State and Local Tax deduction (SALT). Prior to the TCJA, the SALT deduction allowed taxpayers to deduct the amount paid to their state and local governments from their federal tax basis. The TCJA capped this deduction at $10,000, limiting the benefits for taxpayers in high-tax jurisdictions.

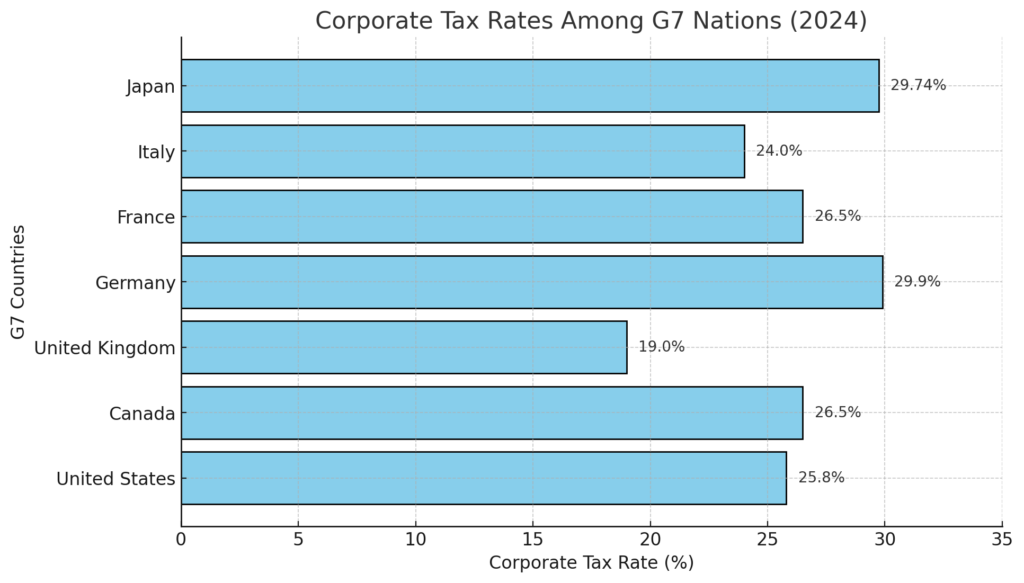

For businesses and corporations, the TCJA also made several important changes. These include a reduction of the corporate tax rate from 35 percent to 21 percent – a steep change that aligned the US corporate with other advanced economies.

Figure 1: Corporate Tax Rates Among the G7

Source: Tax Foundation

The TCJA also authorized a provision known as “bonus depreciation” for five years. This provision allowed companies to deduct the full expense of new capital and research investments in the year they were made. Prior to the TCJA, companies were obligated to amortize their capital expenditures and research costs over several years. Bonus depreciation for capital investments began to phase out in 2023 and, barring action from Congress will be fully eliminated by the end of 2026. For research and development, full, immediate expensing halted in 2022. American companies must now amortize any research and development expenses over five years for domestic expenditures or over 15 years for expenses incurred overseas.

Two additional business tax provisions deserve mention. First and foremost, a major deduction allowed pass-through business entities to deduct 20% of their “qualified business income” from their taxable income. Often referred to as the QBI deduction, this 20% reduction impacted most US businesses. While corporations tend to attract much of the public attention, at the time of the TCJA’s authorization, around 95% of all US businesses were structured as pass-through entities. These businesses encompass a wide cross-section of the American economy, including sole proprietorships and small businesses in sectors as diverse as farming, healthcare, law, accounting, real estate, construction, finance, and technology. The QBI deduction is therefore one of the business tax provisions touching the widest range of American businesses.

Second, the TCJA dramatically changed how the US tax system covers the international activities of American companies. The law shifted the US tax approach from a worldwide to a territorial system. President Trump’s follow up on the international stage could have serious tax implications for American companies operating globally.

Impact of the TCJA and Biden Administration Actions

Just how well the TCJA worked or did not work is the subject of intense debate. Evaluating the impact of tax policies can be notoriously difficult given the variables impacting economic and investment decision-making. Nevertheless, the consensus from analysts tends to be that the TCJA led to increased business investment, a stronger labor market, and modest increases in economic growth.

Figure 2: Estimated Increase in Average Annual Earnings for Americans After the TCJA

Source: Heritage Foundation

The Heritage Foundation, a conservative think-tank that generally supports reduced taxes, estimated that the TCJA increased average annual wages for Americans by about $1,400 above trend. Heritage researchers also found that economic growth after the TCJA outpaced previous estimates. A working paper from economists at the University of Chicago estimated wage gains of less than $1,000 per worker and tepid increases in gross domestic product (GDP).

The economic gains of the TCJA were more muted due to the turbulent international trade and tariff landscape, a direct result of President Trump’s maneuvers on the global stage. Furthermore, the outbreak of COVID-19 wreaked havoc on the global economy, creating further headwinds on US economic growth.

Between President Trump’s first term and now, the Biden Administration and allies in Congress did not seek to overhaul the TCJA provisions. Instead, the previous Administration focused efforts on providing government stimulus to support economic recovery. As part of the stimulus package, the Inflation Reduction Act authorized a slew of tax credits and other incentives for the adoption of clean energy technologies. In addition, the Biden Administration invested time and resources into the global tax reform efforts led by the OECD. Former Treasury Secretary Janet Yellen served as a major proponent of OECD efforts and threw US support behind the new framework.

The enduring impact of the TCJA and the incremental changes of the Biden era form the backdrop for the tax policy debate happening inside the Beltway today. Both political parties understand what is at stake as key provisions of the TCJA phase out and expire. The end of 2025 is a critical juncture.

In the absence of Congressional action, all the individual tax provisions found in the TCJA will expire at the end of the year. That would mean a higher tax bill in the 2026 tax year for most American households. Most tax brackets would see an increase in the marginal tax rate of between one to three percentage points. In addition, the tax brackets would become much narrower, throwing more American households into brackets that require higher payments.

Deductions claimed by many households and businesses are also scheduled to decrease at the end of 2025. Both the standard deduction and the Child Tax Credit will be slashed by about half. In addition, the QBI deduction for pass-through business entities would completely expire. The one exception is the SALT deduction, which will see the $10,000 cap lifted when the TCJA expires.

Corporations and businesses would also face major changes if the TCJA is allowed to expire. Bonus depreciation would sunset completely by the end of 2026. Additional limits would be placed on the deduction of interest payments. Real estate investors would no longer receive special tax treatment for investing in targeted economic development areas (a program known as Opportunity Zones).

Under the scenario of full TCJA expiration, federal government revenue would increase in 2027. According to the Congressional Budget Office (CBO), federal revenues are projected to reach 17.1 percent of GDP in 2025 but rise to 18.2 percent of GDP in 2027. Increased revenue collection spurred by the expiration of the TCJA would temporarily narrow the budget deficit in 2027 and 2028. However, the increased federal revenues would also likely come with a political cost. Americans would feel the tax increases much more acutely than a growing budget deficit, even if over the long-run high deficits increase interest rates and debt servicing costs for all. Interestingly, the CBO also notes that projected increases in Social Security and Medicare would outpace the additional revenues as soon as 2029, leading to growing budget deficits as the nation approaches 2035.

The Path Forward: Republican Plans for TCJA Extension

With the political and economic realities of the TCJA sunset in mind, Republican tax wonks are working feverishly to bring President Trump’s tax agenda to life. Flush with a renewed mandate and control of Congress, President Trump is keen to deliver on his campaign promises. Chief among them is making the TCJA provisions permanent. The one exception is the SALT deduction. President Trump is in favor of lifting the $10,000 cap or removing the limit altogether.

Cementing the individual and business tax code as it stands today would come with budgetary consequences. According to estimates from the Tax Foundation, permanence for expiring TCJA provisions, plus the removal of the SALT cap, would reduce revenue by $5.3 trillion over the next ten years.

However, proponents argue that the economic growth spurred by these tax policies would offset at least a portion of the revenue shortfall. Lower taxes, they claim, will stimulate investment, job creation, and overall economic expansion, leading to higher taxable incomes across the board. While traditional Keynesian economic models suggest that revenue losses from tax cuts are rarely fully recouped through growth, supply-side economists within the Trump Administration believe that a combination of business-friendly tax policies and regulatory rollbacks could produce stronger-than-expected fiscal outcomes. The Congressional Budget Office (CBO), however, offers a more tempered projection, estimating that even under optimistic economic scenarios, less than half of the revenue lost from TCJA extensions would be recovered through increased economic activity.

President Trump does not want to stop there. In addition to extending TCJA provisions and removing the SALT deduction cap, President Trump expressed a desire to further reduce the corporate tax rate, fully eliminate the estate tax, and exempt overtime pay, tips, auto loans and Social Security benefits from income tax. During the campaign, Vice President JD Vance also promised to pursue a “pro-family” tax policy which would further expand the Child Tax Credit to $5,000 per child, plus provide an additional credit of $5,000 for family caregivers. President Trump’s stance on these items remains unclear, but in any event, the current administration is intent on providing relief for families.

If enacted, Trump Administration tax plans would result in major revenue losses for the federal government. They would also put President Trump squarely at odds with fiscal conservatives in his own party, unless the tax cuts are tied to spending cuts that help reduce the size of the federal budget deficit.

Republicans in Congress are eager to support the Trump agenda, but they must carefully navigate any divergence within their own camp. The House of Representatives cleared an initial hurdle recently, passing a comprehensive budget and tax measure that aligns with President Trump’s wish list. The $4.5 trillion price tag initially spooked fiscal conservatives, who sought much more strident spending cuts to complement the fiscal policy changes.

In the end, a flurry of direct lobbying by House Republican leadership and President Trump helped sway reluctant members to get on board. Only one lone Republican, Rep. Thomas Massie (KY) voted against the budget and tax measure. Tax policy debates in the Republican Party tend to pit the federal deficit hawks against Republicans who are more liberal with fiscal policy choices. The momentum for fiscal largesse appears to be winning for now.

In the Senate, Republicans are focusing instead on a two-part approach with first narrow budget package focused on initially funding immigration enforcement and border security. Then a second package dealing with TCJA extensions. The House and Senate dueling approaches could pose a problem for achieving the legislative goals of President Trump. Without alignment between the House and Senate, Republicans will not be able to use a legislative process known as “reconciliation” to pass any tax changes along strict party lines.

Reconciliation remains a critical legislative tool for Republicans, allowing them to bypass the traditional 60-vote filibuster threshold in the Senate and pass budget-related measures with a simple majority. Both bills must match and then they can pass the legislation without a filibuster in the Senate. However, the procedural constraints of reconciliation mean that any tax legislation must be carefully structured to adhere to Senate rules, limiting the scope of changes that can be made. The Byrd Rule prohibits provisions that increase the deficit beyond a 10-year window unless offset by corresponding spending cuts or revenue increases. This reality may force Republicans to make difficult choices regarding the permanence of certain tax breaks and the scale of tax reductions they can realistically pursue.

One way to grease the wheels of a comprehensive tax reform package is to identify offsetting government programs or tax breaks that could be eliminated. The various clean energy incentives found in the Inflation Reduction Act represent the lowest-hanging fruit. President Trump and fellow Republicans see little need to maintain incentives for electric vehicles, renewable fuels, or other items supported by Democrats. Cost estimates for the clean energy incentives in the legislation vary but typically range from $750 billion to $1 trillion over the course of 10 years. Eliminating them could therefore yield substantial savings for Republicans looking to pay for permanent extensions of the TCJA.

Another prime target for fiscal deficit hawks could be federally funded healthcare programs like Medicare or Medicaid. President Trump has shown little political appetite for touching entitlement programs, but the budget outline asks for over $800 billion in savings from the Energy and Commerce Committee’s budget portfolio. Achieving savings of that magnitude without cutting Medicare or Medicaid would prove virtually impossible.

Finally, President Trump has also promised that revenue from import tariffs would help pay for tax cuts. Higher duties on a range of imported goods would certainly bolster federal government coffers, but the exact amounts depend on the precise implementation of tariff changes and how economic actors adjust their behavior. According to analysts at the Tax Foundation, at the end of 2024, tariffs implemented during President Trump’s first term netted Uncle Sam an additional $264 billion in tariff revenue (this figure includes customs duties collected during the time President Biden was in office).

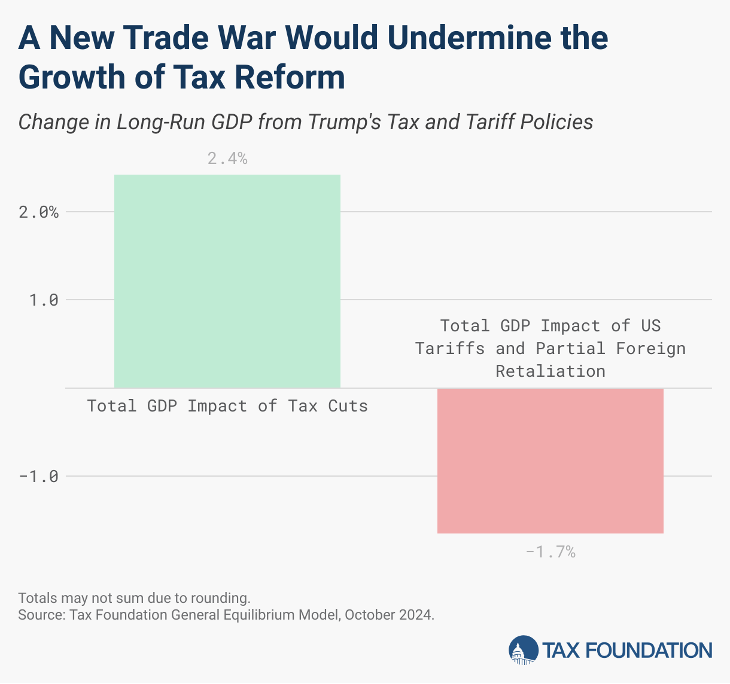

At the same time, the federal government spent nearly $30 billion to compensate American farmers who experienced retaliation from foreign trading partners during the trade war. A universal tariff of 10% on all imported goods could raise as much as $2 trillion over 10 years, but these estimates fail to account for the potential drag on the American economy and the subsequent reduction in spending on these goods due to higher prices. Tariffs may help generate modest revenue to fund tax cuts, but the tariffs themselves could undermine the economic benefits tax cuts were meant to create.

Figure 3: Tariffs Could Counteract Economic Gains of Tax Cuts

Source: Tax Foundation

Democrat Counterproposals

While Republicans work towards a unified position, Democrats have failed to articulate a comprehensive tax policy proposal of their own. Lacking any control in Congress, they have focused instead on pointing out inconsistencies with the Republican position and highlighting the benefits Republican policies would provide for high income households and those with substantial net worth.

The first broad category on the Democratic wish list relates to tax breaks and deductions aimed at the lower end of the tax bracket. This includes expanding the Child Tax Credit to $6,000 for newborn children, providing larger tax credits for start-up businesses, and subsidizing healthcare premiums for low-income Americans. Interestingly, the Democrats also share a desire to exempt tips from income tax with President Trump.

Democrats also seek to use the tax code to target high-net-worth individuals as a source of government revenue generation. To achieve these ends, they propose a return to the pre-TCJA tax rate of 39.6 percent for the top income bracket. They would also seek to raise the net investment income tax by about a percentage point. The tax kicks in for high earners with income earned from investments. Finally, some Democrats have floated a proposal that would tax unrealized capital gains on ultra-high-net-worth taxpayers.

Potential Economic Impact:

- Tax Foundation: A projected 1.1% boost to long-run GDP if tax cuts remain permanent.

- Tax Policy Center: Economic growth would boost taxable incomes and offset about $220 billion (6 percent) of the $4 trillion cost of extension from 2025 to 2034. (Figure 4)

- Higher disposable income for taxpayers but at the cost of rising deficits.

- Small businesses continue benefiting from pass-through tax deductions.

Figure 4: Impact on Revenues of Extending TCJA

Source: Tax Policy Center

Given the political landscape, the most likely tax policy outcome remains a legislative package that aligns with President Trump’s vision. The budget deficit hawks in the Republican Party will need a few ceremonial wins, but overall, the approach is likely to lead toward fiscal expansion. On an aggregate level, most analysts agree this would lead to (at least) a moderate growth in economic output. Like the TCJA before it, fiscal expansion and lower taxes tend to encourage additional investment and economic growth – even if the benefits are not as dramatic as tax cut proponents may advertise.

The Tax Foundation estimates that a tax policy package in-line with President Trump’s vision – permanent extensions of the individual and business tax provisions of the TCJA – would increase long-run economic output by a combined 1.1 percent. Incomes would see a similar boost. When accounting for the secondary economic impacts of tax cuts, the Tax Foundation model predicted an increase of 2.8 percent in average incomes across the U.S.

Figure 5: Revenue Loss of SALT Cap Scenarios

Source: CRFB

A few specific economic sectors also stand to benefit from the Trump tax approach. One early winner is likely to be consumer discretionary spending, including retail, travel, and luxury goods. The permanent extension of personal tax cuts, including lower marginal tax rates and enhanced credits and deductions, will leave more disposable income available for American households. Higher-income households enjoyed much of the tax savings benefits of the TCJA. A permanent extension would solidify these advantages, with higher discretionary spending available to many. Trade uncertainty and increased tariffs may weigh on consumer essentials, hitting low-income Americans hard. But the higher-income households who can withstand the pressure on consumer staples are still likely to spend.

Another category standing to benefit are capital intensive industries, particularly in the manufacturing and life sciences sectors. Many manufacturers and life science companies must operate large production and research facilities. In addition, they must fund extensive R&D and product development pipelines through significant capital expenditure investments. The likely tax outcome will reinstate bonus depreciation and immediate expensing for R&D, providing a boon to firms where these categories eat up a higher-than-average share of the annual budget. Large technology companies, currently on a data center construction binge driven by enthusiasm for artificial intelligence, will also stand to benefit from these same provisions.

Within capital intensive firms, those who choose to conduct their activities on American soil will enjoy special privileges. Fully reviving the manufacturing sector in the U.S. represents one of President Trump’s central economic aims. Tax policy will seek to further accelerate the “onshoring” and “nearshoring” trends. Companies operating in the US will enjoy potentially lower tax rates, combined with more aggressive tax treatment on foreign earnings and activities. Whether the tax benefits of investing in domestic manufacturing will outweigh the costs of building new supply networks will depend on several factors. And these changes take time. But Trump Administration policymakers and Republicans in Congress will try to use every incentive possible through the tax code to cajole manufacturers in the domestic direction.

However, the transition to domestic production may not be as seamless as envisioned. The cost of building new supply chains, particularly in industries dependent on specialized labor and raw materials sourced from abroad, could significantly impact the short-term competitiveness of American manufacturing. Furthermore, while incentives may attract businesses to reshore, the effectiveness of these policies will depend on broader economic conditions, such as workforce availability, infrastructure investments, and global trade relationships.

Finally, small businesses in every sector of America will continue to enjoy favorable tax treatment under the Trump plan. If the 20 percent qualified business deduction remains in place, it will continue to shield a sizable portion of income allocated to pass-through business entities from income tax. Small businesses continue to make up over 90% of businesses in the U.S., with pass-through entities serving as a common, enduring structure. Retail trade, professional services, and construction are examples of sectors where pass-through entities are the norm.

In addition to the opportunities, investors should be cautious about any industry relying on green energy subsidies to drive business value. As noted above, repealing green energy incentives passed under the Biden years will serve as an easy opportunity to pay for tax cuts in alternative areas. Electric vehicles and renewable fuels are two examples of green energy segments that were key beneficiaries of programs implemented via the Inflation Reduction Act.

Healthcare could also prove to be a tricky sector. While the aging Baby Boomer population continues to provide sustained pressure on demand for healthcare services, the potential reductions in federally funded programs might reduce total spend in the market. At the same time, large pharmaceutical companies, who have plenty of facilities in the U.S., may benefit from bonus depreciation and R&D expensing. Furthermore, many medical practices and healthcare clinics are structured as pass-through entities, meaning they will enjoy the permanent qualified business income reduction.

Few Republicans apart from extreme deficit hawks are likely to have the stomach for drastic cuts to federal healthcare spending. Programs like Medicaid remain hugely popular with voters. In fact, public opinion polling from January 2025 found that “three-fourths of the public say they have an either “very favorable” or “somewhat favorable” view of [Medicaid].” Perhaps unsurprisingly, over 80 percent of self-identified Democrats and Independents respond favorably. But President Trump and his allies surely understand that nearly two-thirds of Republicans also view Medicaid in a favorable light.

Finally, real estate is a market that will see benefits and drawbacks from the likely tax policy approach. Many construction and real estate companies enjoy pass-through entity status, with immediate benefits for the QBI deduction. However, two tailwinds could provide a drag on the sector’s performance. First, in the short-term, the Opportunity Zones program authorized in the TCJA will expire at the end of 2026. Opportunity Zones attempts to funnel real estate investment to designated areas in all fifty states, with the goal of spurring local economic development. President Trump’s exact position on the program is unclear, which raises questions about continued viability. Second, over the long-term, the continued expansion of the federal budget deficit is likely to put pressure on interest rate levels. Real estate is extremely sensitive to changes in interest rates, and the increased debt servicing costs of the national debt only add to the interest rate levels in the real economy.

The Global Tax Landscape

The TCJA shifted the US toward a modified, territorial tax system. Instead of taxing worldwide earnings, the US attempted to make the US a more attractive jurisdiction for companies to locate in, maintain profits, and invest in hard assets. At the same time, the TCJA left several key implementation details unresolved.

During the Biden years, Treasury Secretary Janet Yellen nudged the US toward the global tax policy approach pursued under the umbrella of the Organization for Economic Co-operation and Development (OECD). The primary goal of the deal was to reduce profit-shifting by global companies through the implementation of a 15 percent global minimum corporate tax. In one of President Trump’s first executive orders, he rescinded US commitments to the OECD’s global tax deal. According to Trump, the previous US policy posture limited the nation’s ability to enact tax policies favoring US businesses and workers.

The shift in direction introduces significant uncertainty into the international tax landscape, particularly affecting U.S. businesses operating globally. By withdrawing from the OECD agreement, American multinational corporations could face increased taxation from other countries implementing the global minimum tax. In addition, uncertainty over how the US taxes foreign-earned income could result in US companies being ineligible to offset foreign-paid taxes from their US tax bill.

The executive order’s implications extend across various U.S. economic sectors, especially those with substantial international operations, such as technology and pharmaceuticals. These industries, which often utilize global tax planning strategies, may need to reassess their financial structures to navigate the evolving tax environment. The potential for increased foreign taxation and the possibility of retaliatory U.S. tax measures could disrupt existing supply chains and investment plans. Moreover, the move may strain diplomatic relations with key trading partners, as countries adhering to the OECD framework might view the U.S. withdrawal as undermining collective efforts to establish a fair international tax system.

What Businesses Should Consider:

- Plan for potential capital investment incentives (bonus depreciation & R&D expensing).

- Monitor tariff policy changes that may affect supply chains.

- Evaluate pass-through tax benefits and structure accordingly.

The trajectory of U.S. tax policy remains deeply intertwined with the political dynamics of President Trump and the Republican Party. As the expiration of key provisions of the TCJA looms, Congress appears poised to push for a permanent extension of key TCJA provisions, along with additional tax reductions aimed at bolstering domestic production and consumer spending. However, the potential impact on the federal deficit, coupled with intra-party debates over fiscal responsibility, introduces significant uncertainty into the legislative process. The ongoing tug-of-war between tax cuts and deficit reduction will shape the final contours of any tax policy reform, with implications for businesses, households, and the broader economy.

At the same time, the Trump Administration’s decision to withdraw from the OECD Global Tax Deal signals a shift in the U.S. approach to international tax coordination, creating new challenges for multinational corporations and trade relations. While this move aligns with the administration’s broader goal of incentivizing domestic production and limiting foreign influence over U.S. tax policy, it may also lead to increased tax burdens for American companies operating abroad. Ultimately, the evolving tax landscape presents both opportunities and risks, and its long-term effects will depend on the administration’s ability to navigate economic realities, political pressures, and international responses.

Looking Ahead: Congressional debates will determine whether tax cuts can be funded through spending reductions or other fiscal measures. Businesses and investors should prepare for legislative uncertainty and potential shifts in fiscal priorities.