As the final days of the Illinois general assembly came to a close, state representatives resolved to fund state programs through the end of the calendar year. The budget will allow Illinois schools to open on time, will partially fund (with big strings attached) Chicago teacher pensions and will provide funding for humans services, which received little or no funding in FY2016 and, in addition, carries a backlog of over $130 million for services not paid for since July 1, 2015. In this article, we review the agreement from three angles: major parts impacting business; the top tax items; and what still needs to be done.

Top Business Aspects

For Illinois business, few positives come from this agreement and many negatives remain. On the positive side, the fact that an agreement has been reached is a step in the right direction toward getting the state fiscally stable. There are many rivers to cross before the state can rise up from the bottom of the credit pile, but having a budget, even a short-term one, gets the process moving. While Gov. Rauner didn’t get any of his “Turnaround” agenda passed, there will still be opportunities to compromise and to address key components of his agenda, like pension and workers compensation reform.

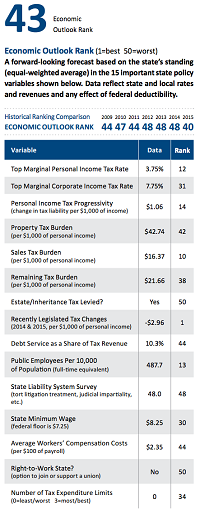

On the negative side, Illinois businesses don’t get the fiscal stability and certainty they need. The agreement covers FY2016 (which ended July 1) and the first half of FY2017 (7/2016 and 12/2016). In previous proposed budgets, there was a $5-5.5 billion gap between revenues and spending. To eliminate this deficit, of course, the assembly needs to either reduce spending, increase tax receipts or both. In general, states with higher taxes economically underperform states with lower taxes. The chart below shows Illinois’ ranking against the other states in the union on 15 key economic outlook indicators, according to the American Legislative Exchange Council.

Clearly, there is more work that needs to be done to rehabilitate the state’s fiscal structure and business environment.

Taxes

In the budget agreement, there were tax provisions hitting hospitals and property owners. According to the Civic Federation, the General Fund’s resources were increased for FY2017 by approximately $150 million through a new assessment on hospitals. This assessment will pay for Medicaid costs that would have otherwise relied on the State’s operating resources. Sadly, the agreement provided no general funds for group health insurance in FY2016, nor were any allocated for FY2017. This means the $3.3 billion in unpaid health insurance claims will not be addressed.

The City of Chicago had two tax provisions granted. For Chicago Public Schools, the city was given the authority to levy a special property tax to pay for pension costs. This could generate $250 million per year if the full 0.383% tax rate is implemented. The City of Chicago was granted a new development authority to apply tax increment financing (TIF) to areas linked to the four major Chicago Transit Authority rail projects in order to fund expansion and improvements to the system.

According to the Chicago Tribune, “… the measure also grants the mayor and City Council wide discretion to create the so-called tax-increment finance districts within a one-mile-wide swath of land along 46 miles of Chicago Transit Authority rail lines throughout the city. The districts, which could remain in place for up to 35 years, would siphon off 80 percent of property tax revenue within their boundaries (with the exception of taxes for Chicago Public Schools) and dedicate the money toward four major transit projects.”

Future Needs

Putting all this into perspective, this is a state that has operated without a budget agreement for the last year, has $7.5 billion in overdue bills, and has over $110 billion in unfunded pension liabilities. It is the lowest credit rated state in the country and Chicago’s bonds are rated junk (Ba1 Moody’s).

Obviously, Illinois has a long road as it struggles to rebuild a sustainable fiscal structure. To do so, the state needs to balance raising taxes with cutting spending to reduce the overall budget gap. It needs to balance discouraging job creation by raising taxes on companies already experiencing a high burden, with spending cuts that would hurt the state’s ability to provide human services, education and infrastructure improvements.

As this budget agreement process has shown, this will not be easy and it will be politically noisy. Yet, this might be seen as an important first step.

https://www.ilga.gov/legislation/publicacts/99/PDF/099-0516.pdf

https://www.civicfed.org/iifs/blog/break-illinois-budget-impasse-allows-partial-spending-plan

https://www.alec.org/app/uploads/2016/04/2016-ALEC-Rich-States-Poor-States-Rankings.pdf