Today, the US BLS releases its monthly employment data. The expectations were for 950k NFP with some predicting as high as 1.4m new jobs created. The unemployment rate was expected to fall from 6.0% in March to 5.8% in April. Prior to the release, the US 10yr yield was 1.57% and the S&P futures were +9.

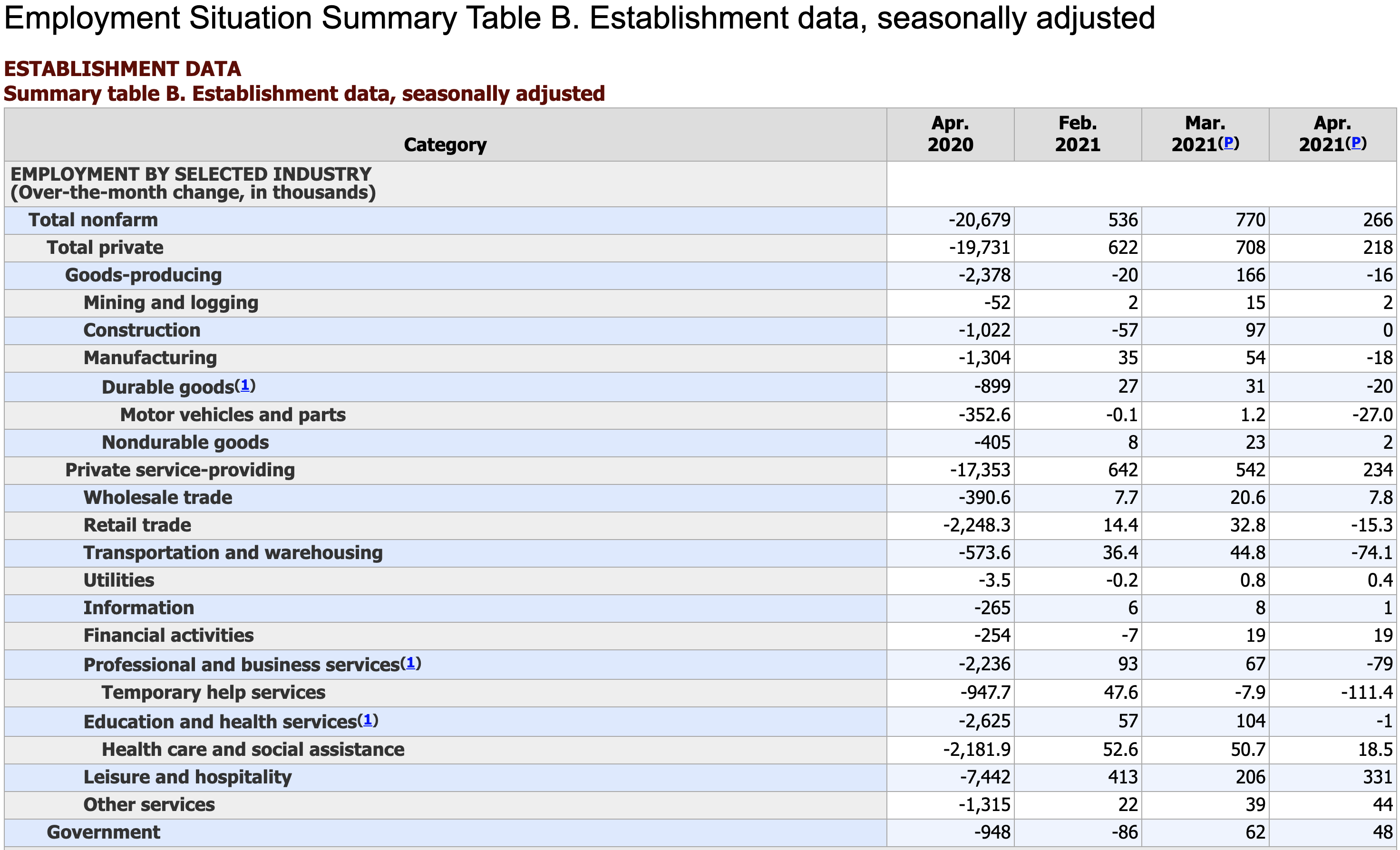

BLS said the NFP was 266k and UE was 6.1%. These are massive misses. Stocks bounced around from negative to positive, but bond yields dropped 8bps immediately. But it gets worse, March NFP was revised down from 916K to 770k. The table below shows Leisure & Hospitality grew 331k, but retail dropped 15.3k plus transportation & warehousing fell 74.1k. Construction was zero.

This was not great news and not as expected with the vaccinations rising, US COVID infections rapidly declining and states gradually lifting their restrictions since the start of the year. But these have led to a boom in the economy along with the massive federal stimulus. Q1 GDP was 6.4% and Q2 could be as high as 12% (NY Fed Weekly Economic Index). Many analysts and CEOs have mentioned the $2T in US excess savings and expect strong spending to occur as shoppers return to stores, fueling additional growth in retail sales throughout the year. Maybe now, we begin to reprice this exuberance.

Over the last year, markets priced in this reopening recovery with an expectation of strong economic and earnings growth.

But let’s face it, the bottle neck strains are showing via dramatic increases in home prices, construction costs and used cars. Market participants are beginning to question the Federal Reserve’s insistence of keeping interest rates lower for longer and expectations for rate hikes are beginning to increase. I can’t recall any time when the Fed was stimulating aggressively and not concerned about inflation, US politicians were massively deficit spending and wanted to spend more, and the US economy was growing at 6%+ GDP growth. The strains will get worse if this continues and then consumers will change their behavior. And so will investors.

Remember, stock market rallies or bubbles don’t end with an event. They end when there are less people wildly enthusiastic about putting their money into equities and begin to hold off buying or take money out. They end when expectations shift. To me, we are in peak economic growth right now and this could start the shift.

To this point, the Federal Reserve raised this risk in the recently released Financial Stability report. Here’s the key text with my bold: “Prices of risky assets have generally increased since November with improving fundamentals, and, in some markets, prices are high compared with expected cash flows. Long-term Treasury yields have risen over the past few months but remain low by historical standards. High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields. In this setting, asset prices may be vulnerable to significant declines should risk appetite fall.”

Does the Fed have a great track record on predicting stocks? No. Greenspan’s famous “irrational exuberance” comment about stocks in 1996 was 4 years early. I don’t expect them their timing to be great this time, either.

But I do take notice of their point.