The Global Shockwave of Trump’s 2025 Tariff Strategy

Plus 5 Strategies to Overcome

The “Liberation Day” announcement of tariffs for 180 countries was the capstone to a Trump promise to American voters to bring jobs and prosperity back to the US. The disruptive force unleashed on global trade is immense and economically destructive. There are many reasons to address massive imbalances by China and Germany, but the broad cloak of raising tariffs significantly by a method that is illogical is beyond troubling. This is not Trump 1.0 where he enacted tariffs to renegotiate NAFTA and wring concessions out of China. This is Trump 2.0 where he is unbridled by either seasoned economic advice or a split Congress.

In this research, we’ll quickly cover the following:

- Context for the tariffs

- What tariffs were presented and what methodology was adopted

- Current country reactions

- Early domestic pushback

- Strategies to overcome US tariffs

As we say in politics and finance, this is a fluid situation and may change significantly by the time you read this. Early indication: S&P 500 did drop over 20% since “Liberation Day” and has remained volatile subject to rumors of a 90-day pause and countries planning to meet with President Trump.

As with all our research, this is not meant to be exhaustive, but informative.

Situation is fluid.

Tariff Context

Before we get to the tariffs, a quick reminder. The US has had extraordinary economic growth over the last 50 years with global trade rising from 11% in 1975 to over 25% in 2024. Global trade has boosted US productivity by promoting specialization and scale. Sectors in the US economy open to global trade competition have outperformed more insulated sectors. Access to imported intermediate goods has lowered costs and spurred innovation in areas like semiconductors, pharmaceuticals, and electronics.

Let’s jump in.

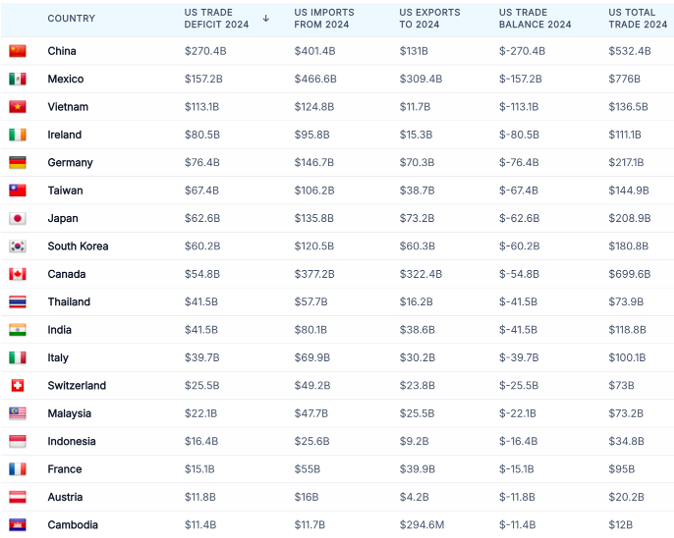

Utilizing 2024 data, the table below provides the picture of a country running trade deficits with many nations.

Figure 1: 2024 US Trade Deficits

Three items jump out immediately. First, China is running a massive trade surplus with the US. Two, Canada is #9 on this list. Three, Germany is number #4. But let’s put this in a broader context. The graphic below shows the massive surplus China and Germany both run with the rest of the world.

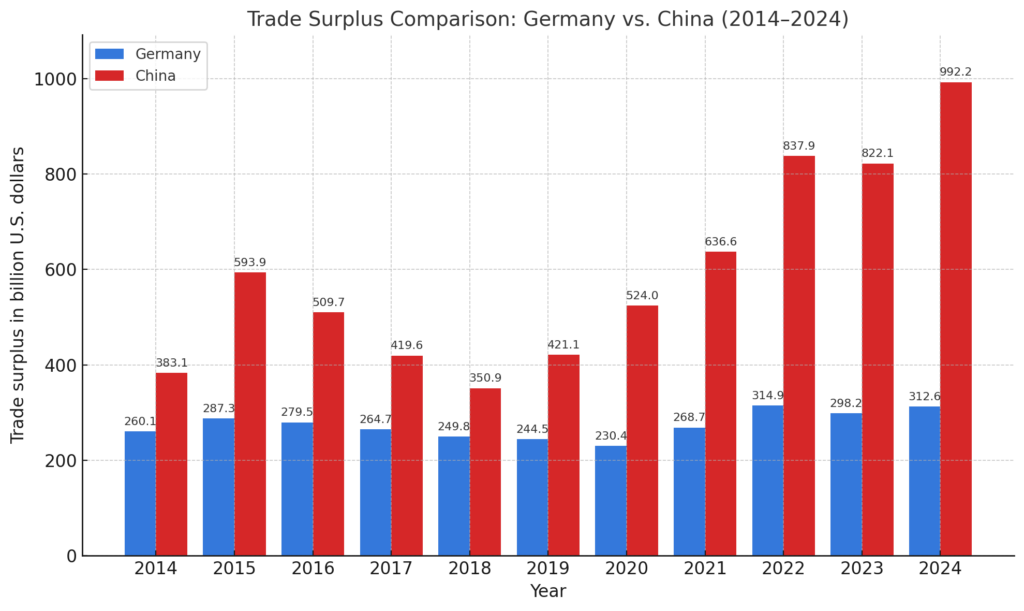

Figure 2: Chinese and German Trade Surplus (2024)

The surplus is a staggering $992B for China and $312.6B for Germany. A combined trade surplus of $1.2T! This surplus is destabilizing to the global economy and financial markets. It could only occur if there was a country large enough to run massive government deficits to fund massive consumer spending above normal levels.

These trade imbalances are not purely the result of comparative advantage or productivity dynamics; rather, they are also shaped by deliberate policy choices, structural economic models, and long-standing geopolitical strategies. For example, the global dominance of the US dollar as the reserve currency allows the United States to maintain persistent trade deficits without facing the same currency pressures that developing economies would. This privilege, however, comes with the burden of effectively acting as the consumer of last resort for the global economy, absorbing exports from surplus nations and maintaining liquidity in global financial markets. At the same time, this dynamic contributes to domestic political dissatisfaction, as offshoring and import competition are often blamed for job losses in key sectors such as manufacturing and steel production.

In Germany, they have run very tight government fiscal policies and have generated little domestic private investment with the economy barely growing as they focus on manufacturing and exports. Germany is the most creditworthy country in the EU and would be able to generate much higher domestic demand if they would borrow more to spend on areas like defense. (See our research on AI & Defense) [GS1] Lastly, the gross savings (savings/GDP) in Germany is relatively high for a developed country at 25-27%.

China has run a massive trade surplus via capital controls that have artificially kept their currency very weak compared to the capital inflows they have received. In turn, this has led them to accumulate large financial assets in US dollars with which they have bought US Treasury securities. In turn, this has led to a policy of keeping domestic savings high (40%) via weaker purchasing power. Also, the Chinese have not created a strong social safety net for retirement or health. This further drives Chinese citizens to save. Over the last twenty years, China could have easily run a lower savings rate while aiding their citizens by providing welfare and increasing consumer spending. As a comparison, the US GDP has around 67% consumer spending, Germany 52% and China has about 39%.

Another important dimension of China’s trade surplus lies in the structural overcapacity embedded in its manufacturing sector. Decades of state-led investment, subsidized inputs, and directed credit have led to a glut in industries such as steel, solar panels, and electric vehicles. These industries, shielded from market discipline, have been incentivized to overproduce, dumping excess capacity into global markets at prices often below cost. This has triggered multiple trade disputes and anti-dumping investigations worldwide. Additionally, Beijing’s strategy of moving up the value chain—seen in its “Made in China 2025” plan—has raised alarms in advanced economies about long-term competitive threats, particularly in high-tech industries like robotics, aerospace, and biotechnology.

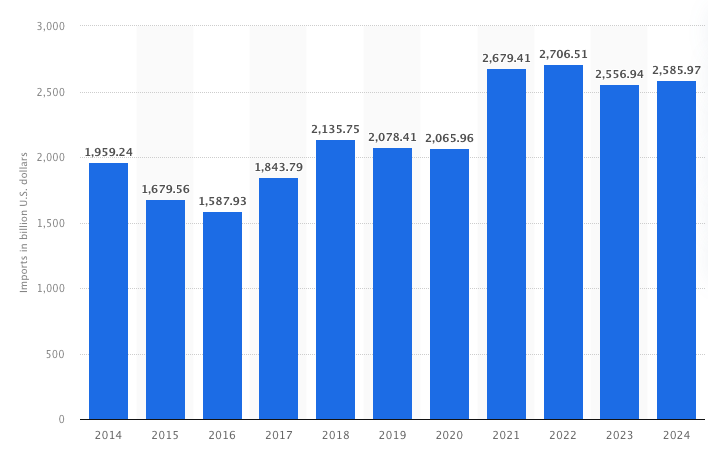

Two numbers underscore this issue. Over the last 5-6 years, Chinese manufacturing imports have declined from approximately $2.7T to $2.6T.

Figure 3: Chinese Imports

Source: Statista

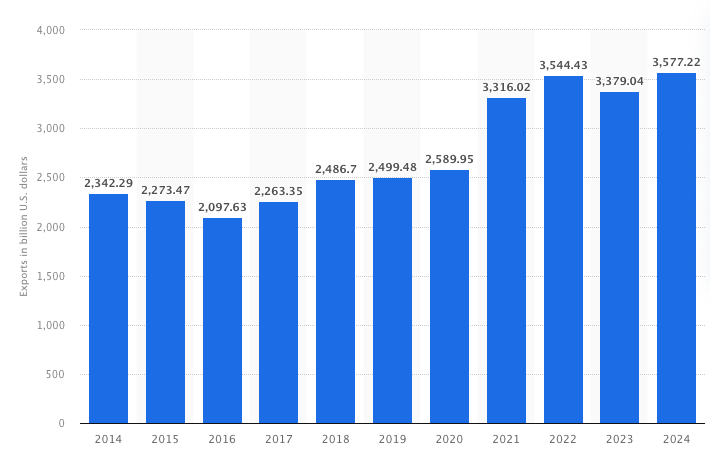

Figure 4: Chinese Exports

Source: Statista

Over the same period, Chinese manufacturing exports have grown around $3.3T to $3.6T. This has led to a massive, massive trade imbalance of about $1T a year and is a destabilizing force in global trade.

Clearly, these surpluses are by choice and part of an economic strategy favoring/subsidizing/encouraging exports while doing the opposite for imports. Like Trump’s tariffs, these choices have consequences. For Europe, the Eurozone debt crisis was partly caused by Germany’s insistence of fiscal austerity and the inability to help smaller nations in the union by expanding EU debt issuance to generate growth. In China, the lack of a social safety net and wasted government resources on state-owned enterprises (SOEs) have made the Chinese people poorer and ballooned their trade surplus making their exports a target for tariffs. As the US puts tariffs on China, China will seek out other markets and likely flood them with cheap goods exacerbating their trade surplus with rest of the world.

Liberation Day Tariffs

On April 2nd in the Rose Garden, President Trump announced sweeping tariffs on 180 countries. These are expected to go into effect on 4/9. Below is the list. There are 2 components. First, a universal 10% tariff on all imports. Second, a “reciprocal” tariff on countries with trade surpluses with the United States.

Figure 5: Trump 4/2 Trade Reciprocal Tariffs

Putting aside the smaller countries, the graphic below breaks down the major countries.

Figure 6 Major US Trading Partners

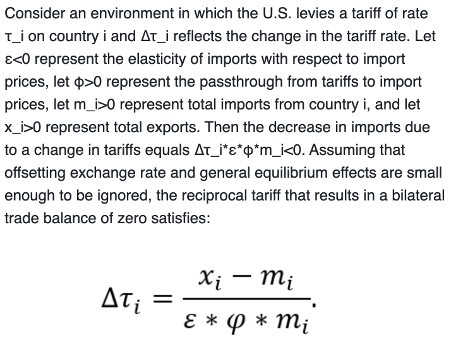

According to the White House, this is the methodology for the tariffs.

From CSIS:

Where:

- ε = –4, the assumed elasticity of U.S. import demand

- φ = 0.25, the assumed pass-through rate of tariffs to prices

This simplifies mathematically to:

“Reciprocal” Tariff (Percent) = U.S. Trade Deficit with Country ÷ U.S. Imports from Country

To soften the impact, the result is then halved—producing what officials have called a “discounted reciprocal tariff.”

Examples:

- European Union: $235.6 billion deficit ÷ $605.8 billion imports = 39 percent, halved to 20 percent

- Indonesia: $17.9 billion ÷ $28.1 billion = 64 percent, halved to 32 percent

Stating the obvious, this is a non-normative methodology and strains credulity. It’s the equivalent of a customer asking a supplier to buy the same amount of goods back from them. The Economist has this analysis, “And Mr Trump’s grasp of the technicalities was pathetic. He suggested that the new tariffs were based on an assessment of a country’s tariffs against America, plus currency manipulation and other supposed distortions, such as value-added tax. But it looks as if officials set the tariffs using a formula that takes America’s bilateral trade deficit as a share of goods imported from each country and halves it—which is almost as random as taxing you on the number of vowels in your name.”

To put it bluntly, the methodology lacks coherence and deviates sharply from established international trade norms under the WTO framework. Typically, tariffs are deployed with careful legal and economic justification, often following investigations under statutes like Section 301 or 232 in U.S. law. In this case, however, the blanket approach suggests an intent less about addressing specific grievances and more about reshaping the global trade landscape through shock and leverage.

Referring to our research on Trump 2.0, one should understand Trump’s methods are often at odds with how the world currently works. However, his unorthodox and highly disruptive methods have already brought about changes like Germany breaking their debt brake and China attempting to stimulate domestic demand. We’re early days on the new trade tariff environment and things will change.

Remember, President Trump wants balanced trade not free trade. This is the lens to view all the negotiations and policy choices.

Country Reax (As of Monday 4.7.25)

The reactions to the Liberation Day tariffs have been quick.

China:

- Retaliatory Tariffs: China imposed a 34% tariff on all U.S. imports, effective April 10, 2025, mirroring the U.S. tariffs imposed on Chinese goods.

- Export Controls: Beijing announced enhanced export controls on rare earth elements critical to high-tech industries, including samarium and gadolinium, which are vital for aerospace and medical applications.

European Union (EU):

- Proposed Counter-Tariffs: The EU plans to implement a 25% tariff on a range of U.S. goods, including beauty and personal care products, as a direct countermeasure to the U.S. tariffs.

- Strategic Targeting: EU officials are considering additional measures that may target U.S. tech firms and service industries, aiming to exert pressure on sectors where the U.S. has a trade surplus.

Japan:

- Diplomatic Objections: Japan’s Trade and Industry Minister Yoji Muto labeled the U.S. tariffs as “extremely regrettable” and has been actively urging the U.S. administration to exempt Japan from these measures.

- Consultations: Japanese officials are engaging in high-level discussions with their U.S. counterparts to seek relief from the imposed tariffs.

Canada:

- Reciprocal Tariffs: Prime Minister Mark Carney announced a 25% tariff on U.S. vehicles not compliant with the United States-Mexico-Canada Agreement (USMCA), as well as on the non-Canadian components of compliant vehicles.

- Alliance Building: Canada is seeking to form alliances with like-minded countries, including Germany, Mexico, France, the UK, and Australia, to collectively address the challenges posed by the U.S. tariffs.

Mexico:

- Exemption from Tariffs: Mexico was notably exempted from the latest U.S. tariffs, a development attributed to the existing USMCA.

- Economic Initiatives: President Claudia Sheinbaum introduced “Plan Mexico,” aimed at stimulating domestic industrial growth and reducing reliance on imports, exemplified by the development of the locally produced electric bus, the Taruk.

Strategies to Overcome

This is the difficult part as we must make assumptions about how long the tariffs will last and at what magnitude. We’ll approach this from an assumption these tariffs will stay on for an extended period. Again, balanced trade vs. free trade.

First, the impact. From an economic standpoint, the tariffs will decrease global economic and US growth. The graph below shows the impact on US real GDP over time.

Figure 7: Decline in US Real GDP

Clearly, a negative hit to growth which hits hard at over 1.2% of GDP by 2026 and then stabilizes around 0.6%.

If we’re assuming the tariffs stay on longer at their current levels, then we can expect a gradually growing economy. Businesses should then prepare by doing the normal downturn playbook: reduce investments, reduce risk and reduce staff. This is not how to grow after tariffs are reduced, but it is a way to survive if you weren’t prepared.

Beyond this, there are 5 major steps countries can take, and businesses should anticipate.

Strategy 1 – Deepen Trade Integration

- Description: Prioritize intra-regional trade deals, especially among the EU, CPTPP, South Korea, and smaller open economies

- Key Sectors: Services, digital trade, and high-value manufacturing

- Supporting Data: These regions represent 34% of global import demand

- Benefit: Diversifies risk, reduces dependency on U.S. markets

Strategy 2 – Avoid Retaliation

- Description: Refrain from tit-for-tat tariffs; pursue diplomatic engagement through global institutions like WTO

- Rationale: Retaliation often leads to escalation (e.g., Smoot-Hawley 1930s)

- Policy Recommendation: Strengthen global coalitions to isolate protectionism

- Benefit: Maintains global trade stability, preserves market confidence

Strategy 3 – Rebalance Trade with China

- Description: Develop conditional trade partnerships with China focused on domestic consumption and fair competition

- Incentives: Lower tariffs in exchange for tech transfer, foreign direct investment, and SOE reform

- Mechanisms: Centralize EU investment rules, expand CPTPP membership

- Benefit: Reduces export dumping, fosters balanced and rules-based trade

Strategy 4: Reorient Supply Chain

- Description: Move supply chain through countries with low trade imbalance with the United States

- Rationale: Since the reciprocal tariffs are based on a country’s trade surplus with the US, one can take parts from China and move them through Brazil to avoid tariffs

- Downside: This structure could change once a country sustains a large trade surplus with the US.

Strategy 5: Become USMCA compliant

- Description: Move supply chain into Canada and Mexico to avoid reciprocal tariffs.

- Rationale: Outside of autos, steel and aluminium, Canada and Mexico avoided the major tariffs

- The Upside: When the USMCA gets renegotiated over the next year, Canada and Mexico will remain large US trade partners with likely restrictions on Chinese products for final assembly

We haven’t discussed Canada much in this research and to remedy this, here’s a strategic response framework for them.

Target #1: Double Down on Diversification Beyond the U.S.

Challenge: While Canada has been spared the latest tariffs, it remains highly dependent on the U.S., with over 70% of its exports going south. This makes the country vulnerable to future political shifts and trade policy volatility.

Strategy:

- Accelerate trade expansion through existing agreements like CPTPP and CETA (EU-Canada).

- Negotiate new trade deals with emerging markets (e.g., ASEAN, India, Africa).

- Invest in infrastructure at Pacific and Atlantic ports to facilitate non-U.S. exports.

- Expand Export Development Canada (EDC) programs to support market entry for Canadian firms.

Impact:

- Reduces overreliance on the U.S. market.

- Opens access to fast-growing consumer bases in Asia and Europe.

- Positions Canada as a stable global trading partner.

Target #2: Build Leadership in Multilateral Trade Alliances

Challenge: Unilateral U.S. protectionism weakens the rules-based international order, where Canada thrives.

Strategy:

- Take a leadership role in reviving and expanding the CPTPP, advocating for the inclusion of new members (e.g., the UK, South Korea).

- Push for WTO reform with like-minded countries (EU, Japan, Australia).

- Host summits on economic cooperation among middle powers to coordinate responses to U.S. protectionism.

Impact:

- Strengthens Canada’s diplomatic clout.

- Helps sustain global trade norms.

- Provides a platform to influence economic rules in a multipolar world.

Target #3: Bolster Domestic Competitiveness and Innovation

Challenge: U.S. tariffs may drive up costs and reduce supply chain efficiency for Canadian firms tied to American markets.

Strategy:

- Incentivize reshoring and nearshoring of critical industries (e.g., semiconductors, EV batteries).

- Increase funding for innovation, clean tech, and digital trade sectors.

- Expand workforce upskilling programs in logistics, AI, and advanced manufacturing.

- Reduce regulatory burdens across provinces and harmonize standards to promote large infrastructure, plant expansions and power generation.

Impact:

- Increases economic resilience and flexibility.

- Enhances long-term growth capacity.

- Drives efficiency and encourages long-term projects to meet internal and external energy demands.

Lastly…

The markets’ reactions to “Liberation Day” tariffs have been overwhelmingly negative and swift. World leaders have stated clearly that they will retaliate quickly and with force. The big question is time. How long will the tariffs stay on? How high will the tariffs remain? How soon will countries attempt to negotiate? How soon will the US and global economy sink?

And beneath these tactical concerns lies a deeper, strategic rupture: the erosion of trust in the United States as a predictable economic partner. For decades, the global trading system relied on America not merely for scale, but for stability—for rule of law, contractual reliability, and institutional memory. The current trade regime signals to allies and adversaries alike that U.S. policy may be increasingly driven by domestic politics rather than international commitments. This reopens a conversation many thought closed: What replaces American economic hegemony when it becomes erratic? Remember, the current international trade system developed over eighty years with the US leading the way towards reducing trade barriers and increasing free flow of trade.

The bigger question is what happens after some of this settles down. Global market economies and global investments need certainty and confidence in policy not this week or even this year. They need it over the next 5 to 10 years. This is what is at risk today.