The Trump administration era starts and begins the process towards shaping government policy as it relates to US business. Without question, this will be a major shift in priorities and policies away from the path set by the Obama presidency. During the campaign and after, Trump and his Cabinet nominees have vowed to reduce business taxes, reduce regulatory burdens and increase economic growth.

Here are the key business takeaways:

- Congress is already in the process of creating a tax reform bill to reduce and simplify business taxes.

- President Trump can immediately notify trade partners of his intent to renegotiate NAFTA, pull-out of the Transpacific Partnership trade deal and end negotiations for the Transatlantic Trade and Investment Partnership (TTIP).

- President Trump can act quickly to reduce regulatory burdens or red tape via executive order and by changing the leadership in the major regulatory agencies, but major regulations like Dodd-Frank and Affordable Care Act will need Congressional action.

Below is an overview of the specific targeted areas and key players involved. There is a potential for some of the Trump nominees to be delayed over necessary paperwork. This could translate into a slower deregulatory environment, but the change in direction is clear. However, I believe this will usher in a new, friendly business environment overall and lead to reduced compliance costs, increased profits and a stronger economic environment. Given the US economy is expected to grow in a 2.0-2.5% rate for 2017, these changes can have a significant impact on growth and interest rates over the next year.

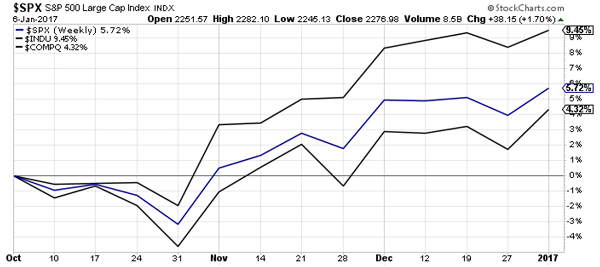

The chart below reflects the market optimism to the Trump victory as stocks have rallied significantly since November 8th.

Key government leaders for business

What follows is a list of some key positions in the Trump administration, regulatory agencies and Congressional committees involved in setting policy that could impact business.

US Treasury Secretary nominee Steve Mnuchin

US Commerce Secretary nominee Wilbur Ross

National Trade Council nominee Peter Navarro

Office of the US Trade Representative nominee Robert Lighthizer

US Department of Labor nominee Andrew Puzder

Environmental Protection Agency (EPA) nominee Scott Pruitt

Health and Human Services (HHS) nominee Tom Price

House Ways and Means (central House tax writing committee) chair Kevin Brady (R-TX)

Senate Finance Committee (central Senate tax writing committee) chair Orin Hatch (R-UT)

Securities and Exchange Commission (SEC)

Commodity Futures and Trading Commission (CFTC)

Federal Reserve Janet Yellen (term ends 2018)

Key Issues

Tax reform. During the campaign, Trump outlined a plan to cut the nominal corporate tax rate from 35% to 15%. For pass through entities like subchapter S corps or LLCs, his plan limits the tax rate to 15% from 39.6% (top tax rate). On international taxes and to eliminate incentives for inversions, he has a one-time 10 percent tax on all foreign profits currently held overseas, which are estimated to be over $2.3 trillion. Lastly, he wanted to eliminate all other corporation tax expenditures or breaks, he wants to eliminate the corporate Alternative Minimum Tax, and he wants to substantially reduce the deductibility of interest expenses from debt. These items synch closely with US Speaker of the House Paul Ryan’s plans (A Better Way) to simplify the US tax code and reduce the overall business tax burden.

Why does this matter for business? There will be winners and losers from tax reform. Overall, the tax burden on businesses large and small will be reduced and streamlined. This is a major shift from the Obama administration and a major positive for economic growth. Yet, there will likely be losses of tax breaks for things like deductibility of debt costs and potentially added burdens for importers (border/destination adjustments). Similar to 1980s tax reform under President Reagan, we can expect lots of political horse trading to be done prior to producing a final bill. For the economy, this has the potential to significantly increase economic growth and profitability for US business. In turn, this may cause the Federal Reserve to raise interest rates faster and raise the value of the US dollar.

Trade. Again, during the campaign, Trump repeatedly criticized US free trade agreements like NAFTA and TPP. Trump has threatened to impose 35% tariffs on goods coming in from Mexico and has continued to Tweet out criticism to Ford, GM and Toyota over moving plants south of the border. Trump has threatened to put 45% tariffs on China and send Tweets out over the unbalanced nature of the Chinese-US trade relationship. Lastly, he has mentioned a willingness to pull out of the World Trade Organization (WTO) and 20 current free trade agreements. Via the US Constitution and Congress, the office of the US President has tremendous leeway to negotiate trade agreements and to place tariffs on goods. To leave NAFTA, Trump can simply provide 60-day notice to Canada and Mexico of his intent to withdrawal.

Why does this matter for business? International trade is a cornerstone for the US economy. Since the recovery began, US real GDP is up 2.3% at an annual rate, and exports have contributed one-third (o.7%) to this growth (USTR). As well, approximately three quarters of the world’s purchasing power and over 95% of world consumers are outside of America’s borders. If Trump were to follow through on his threats over free trade and tariffs, the US could be involved in a trade war. Per the Peterson Institute for International Economics, this would plunge the US economy into recession and cost more than 4 million private sector American jobs. “…export-dependent US industries that manufacture machinery used to create capital goods in the information technology, aerospace, and engineering sectors would be the most severely affected. But the shock resulting from Trump’s proposed trade sanctions would also damage sectors not engaged directly in trade, such as wholesale and retail distribution, restaurants, and temporary employment agencies, particularly in regions where the most heavily affected goods are produced.” While Trump’s Tweets are disconcerting for the specific companies involved and for overall international trade, the 140 character announcements could be simply part of his opening negotiations with both multinational corporations and foreign nations over plant locations and trade.

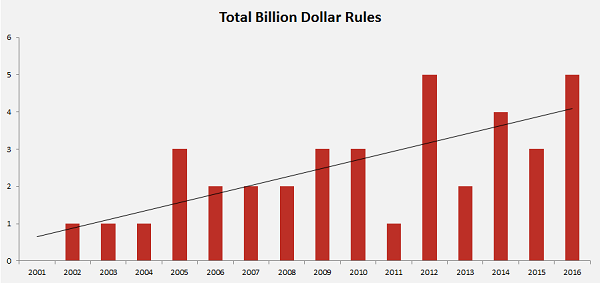

Regulations. During the Obama administration, regulations are estimated to have cost $743 billion and required 11.5 billion in work hours. To put the last number into perspective, homo sapiens have been in existence less time. Below is a chart of mega rules (costing greater than $100M) since 2001.

Source: AAF

During the campaign and after, Trump pledged to reduce the regulatory burden on US business. During his acceptance speech for the Republican nomination for president, he said, “

“We are going to deal with the issue of regulation, one of the greatest job-killers of them all. Excessive regulation is costing our country as much as $2 trillion a year, and we will end it very, very quickly. He vowed to replace the Affordable Care Act, to dismantle Dodd-Frank regulations and to lift restrictions on the production of American energy. On his first day in office, Trump can declare a moratorium on all new regulations like what President George HW Bush (41) and President George W Bush (43) did.

Why does this matter for business? Over the last eight years, the regulatory burden has increased significantly for US business, increased costs of compliance and reduced profitability. The shift in policy will help begin the process to stop or reverse the current regulatory course. This will not likely be accomplished as quickly as many hope given the complexity of regulations and how many regulations have been already adopted by major agencies. Also, there will likely be uncertainty created over removing the current regulations and transitioning into new or reduced regulations (Ex: ACA repeal and replace?). Make no mistake, this is a radical shift in relations between government and business. It has the potential to increase economic activity, increase job growth and increase profitability.