Getting you ready for the 1st 2024 US presidential debates, we release our first 2024 presidential election rimer: Republican Candidates’ Economic Policies. The upcoming U.S. presidential election has captivated both domestic and global attention for good reason. The rival legal issues for former President Trump and Hunter Biden are daily news items covered extensively by CNN and NYPost. Given the media noise, it’s easy to miss the critical issues beneath the chaos. This is why we are creating a new series on the 2024 US Presidential Election. We begin with topic #1 in the minds of most voters: the economy.

While issues like foreign relations, social matters, and leadership qualities all contribute to the voter choice, it is the economic stance and vision of each candidate that holds the power to sway voter sentiment and ultimately shape the nation’s growth trajectory. Given the post-pandemic recovery, inflation, and Ukraine War, the focus on economic policy choices has grown red hot.

Within the Republican Party, five prominent figures have risen as frontrunners for the party’s nomination. These contenders offer a spectrum of experiences, ideologies, and visions. The roster includes former President Donald Trump, current Florida Governor Ron DeSantis, former Vice President Mike Pence, Senator Tim Scott of South Carolina, and former New Jersey Governor Chris Christie. We didn’t include all of the candidates making the stage (tech entrepreneur Vivek Ramaswamy, former U.N. ambassador and South Carolina Gov. Nikki Haley, North Dakota Gov. Doug Burgum and former Arkansas Gov. Asa Hutchinson) due to length limitations. However, this group represents a diversity of Republican thought and present distinct economic policy platforms that mirror their individual stances on fiscal matters. This article evaluates the economic policy platforms of these candidates.

President Joe Biden assumed office with the Coronavirus pandemic in full swing. Ultra-low interest rates and massive deficit spending marked the first half of his term. Despite the aftermath of COVID lockdowns and supply chain chaos, the American economy demonstrated surprising resilience. But the world will likely look far different for the winner of the 2024 Presidential cycle.

Several Republicans are vying for the post, hoping to ride high inflation and American economic anxieties to the pinnacle of American politics. Yet the economic cards they inherit are exceedingly difficult to predict. The profound impacts of monetary policy tightening on the U.S. (and global) economy will take years to fully play out. Just 18 months ago, the effective benchmark interest rate at the U.S. Federal Reserve (the Fed) was close to 0%. Today it hovers above 5% and US mortgage rates are north of 7%. The consequences of rising rates combined with a confusing macroeconomic backdrop make for a volatile mix and an uncertain path forward. Massive government stimulus in the U.S., deflationary concerns in China, and food supply risk stemming from the war in Ukraine are merely the highlights of a long list of powerful economic forces.

The ability of the U.S. president to direct and shape a complex global economy worth upwards of $25 trillion is often exaggerated in the minds of the voting public. Nonetheless, the U.S. president plays an outsized role in business and financial markets through economic, trade and regulatory policy choices.

The five candidates share a remarkable degree of similarity in their policy platforms, demonstrating just how ingrained the “America First” economic priorities of former President Trump have become in the Republican mainstream. Still, the candidates exhibit key differences on philosophical and practical issues. The most palpable fault lines concern the proper role of the federal government and the most effective response to competition with China, but more subtle disagreements are also visible.

The analysis of this article is intended to serve as a general primer on the key features of each candidate’s economic policy stance. Of course, economic policy brings together a wide range of issue areas, from taxes to trade. Future articles will a provide more in-depth analysis of these specific aspects of economic policy. For now, we will focus on the core tenets of each candidate’s stated platform, with a special eye on fiscal policy (taxing and spending) and monetary policy (interest rates and money supply). Trade policy is often cited as the third aspect of economic policy, but given the monumental shifts implemented by former President Trump, trade policy is deserving of a separate article to be published in the future.

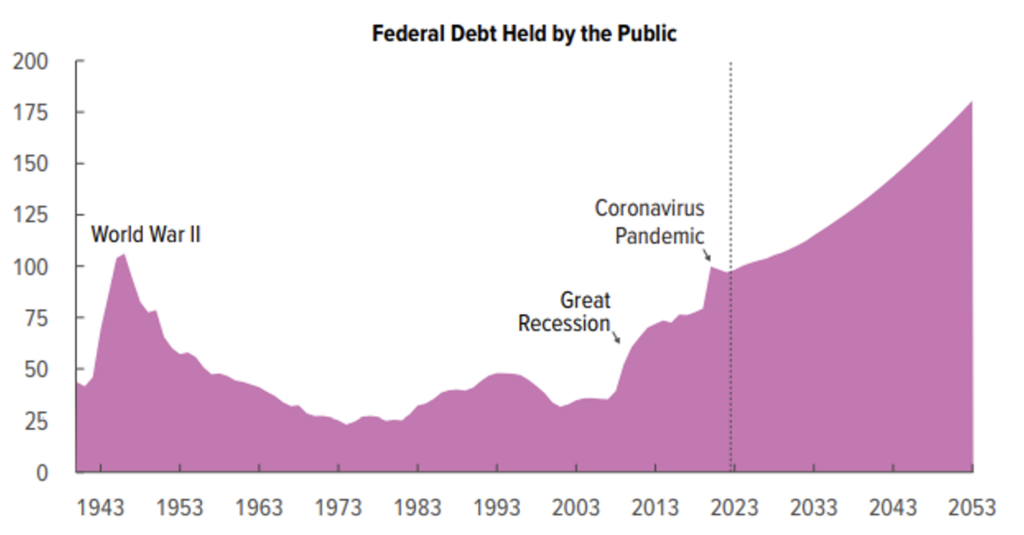

The dynamics of fiscal and monetary policy alone provide plenty of fodder for consideration. Having just survived another game of chicken over the U.S. federal government’s borrowing limit, Congress appears no closer to seriously dealing with the national debt. Lawmakers are facing a $1.5 trillion deficit for this fiscal year – a number only projected to keep growing on the heels of massive government stimulus packages like the Inflation Reduction Act.

The Republican candidates roundly condemn “reckless spending” from President Biden, yet they offer few specific solutions or identified areas to cut. Only Chris Christie has vowed to address Medicare and Social Security – by far the largest sources of non-military spending by the U.S. federal government each year.

Monetary policy also finds itself in the candidates’ crosshairs. Typically, the sole remit of technocratic central bankers, the Fed’s role in fighting inflation is bringing the decisions of the Federal Open Markets Committee to center stage. Whether or not Jerome Powell can pull off a “soft landing,” the Republican candidates in the race have demonstrated a willingness to wade into monetary issues. The Fed maintains a reasonable degree of independence, but the president still influences the institution through monetary “jawboning” (dot plots) and key appointments.

Now, let’s dig into the candidates for a look at the fiscal and monetary policy flashpoints likely to arise at the first Republican primary debate on August 23.

Donald Trump’s Economic Policies

Former President Donald Trump’s tenure in the White House was characterized by a unique economic strategy that aimed to bolster growth, advance American interests, and reshape international trade dynamics. As he competes for the Republican nomination in the upcoming U.S. presidential election, comprehending the economic policies he championed during his presidency, as well as his current proposals, is crucial.

At present, the former President holds a commanding lead in the polls and presents a distinct vision centered around an “America First” economic policy. His campaign’s central objectives are succinctly outlined as follows: “Lower taxes, bigger paychecks, and more jobs for American workers.” The crux of his economic philosophy is built upon the premise that past political leaders sacrificed the interests of American workers in pursuit of a “globalist” agenda. Notably, durable goods manufacturing, particularly steel, occupies a central position in President Trump’s conceptualization of an ideal U.S. economy. He has demonstrated a willingness to leverage the full power of the U.S. federal government, including taxes and assertive tariff policies, to support the country’s industrial foundation.

While a comprehensive economic campaign platform for 2024 is yet to be released by the former President, his track record during his presidency, continued public statements, and policy recommendations from closely associated think tanks, such as the America First Policy Institute, all provide insights into specific economic policies he is likely to prioritize. Among these are the reduction of taxes and the reconfiguration of America’s international trade relationships, which are intrinsic components of Trump’s overarching approach. This approach can be distilled into three main objectives:

Reducing the Tax and Regulatory Burden: Trump boasts of his achievement in enacting the Tax Cuts and Jobs Act, an extensive tax reform law. This sweeping legislation included measures such as lower corporate income tax rates, immediate business expensing provisions, and the introduction of various favorable tax programs. Notable accomplishments include doubling the Child Tax Credit and establishing Opportunity Zones. The former allows American families to decrease their taxable income by up to $2,000 per child, while the latter offers real estate investors the opportunity to defer certain capital gains taxes if their developments are situated within economically distressed communities. While specific tax objectives for a potential second term remain uncertain, his past initiatives underscore his emphasis on tax reform. Also, Trump’s regulatory reform helped reduce to cost to US businesses from expensive new rules. Under Trump, the policy of 1 new regulation for every 2 regulations eliminated was key for reducing costs. The graphic below underscores the differences between the Trump, Biden and Obama administrations.

Supporting U.S. Manufacturers in Competition with China: Trump’s economic worldview is rooted in skepticism toward “globalist” economic policies and dissatisfaction with past leaders who, in his view, compromised American interests in favor of China. To rectify this, Trump disrupted existing trade relationships and actively encouraged manufacturing investment within the U.S. In addition to tax incentives, he utilized media platforms to directly appeal to corporations to establish operations in the United States and hire American workers. Employing tariffs on imported goods, particularly in sectors such as steel and aluminum, became a favored approach to address competition concerns with China.

Also, in his previous term, Trump sought to reduce government healthcare costs directly by announcing an intention to lower prescription drug prices. The movement largely faltered but could experience a revival under a second term. Furthermore, Trump views energy production as a pocketbook issue. He wants the U.S. to become “the number one producer of oil and natural gas on earth, achieving American energy independence and delivering historically low costs for oil, gas, diesel, and electricity to consumers and businesses.”

Trump’s stance on monetary policy is also discernible. During his time in office, he criticized Federal Reserve Chair Jerome Powell for what he perceived as insufficient support for the U.S. economy. This year, he publicly expressed his belief that Powell was “too interest rate happy.” Although Trump lacks a clearly defined monetary policy approach, he remains unafraid to comment on how central bank actions intersect with his preferred economic strategies. A second term for Trump would likely result in a new Federal Reserve chair.

Throughout his presidency, Donald Trump’s economic policies centered on tax reductions, deregulation, and a focus on domestic industries. These policies garnered praise from his supporters for their contribution to pre-pandemic economic expansion. Nonetheless, they faced criticism for their potential to exacerbate income inequality and prioritize immediate gains over long-term stability. As Trump seeks reelection, his economic propositions continue to spark debate, with their potential ramifications on job creation, taxation, trade dynamics, and economic growth serving as ongoing points of contention.

Ron DeSantis’ Economic Policies

Few figures have garnered as much attention and speculation as Ron DeSantis, the current Governor of Florida and a leading contender for the Republican nomination to the U.S. presidency. His economic track record in Florida, combined with his proposed policy initiatives, presents a comprehensive lens through which to examine his potential impact on the nation’s economic landscape.

DeSantis assumed the role of Florida’s Governor in 2019, stepping into a challenging economic environment shaped by the COVID-19 pandemic. His response to the economic challenges presented by the pandemic has offered valuable insights into his approach to economic governance. Notably, DeSantis chose to keep Florida’s economy operational, refraining from imposing widespread lockdowns. This decision, rooted in the belief that maintaining economic activity was crucial for the welfare of Floridians, garnered both praise and criticism. The state’s relatively lower unemployment rate in comparison to national averages was seen as a testament to the effectiveness of this strategy. Additionally, DeSantis prioritized supporting the state’s tourism industry while implementing health and safety protocols. This demonstrated his aim to strike a balance between economic recovery and public health considerations.

Echoing the America First, populist tone of Trump, Ron DeSantis recently unveiled his Declaration of American Economic Independence. The catchy tagline seems picked straight out of Trump’s playbook: “We Win, They Lose.” Like Trump, DeSantis approaches global economic competition with a zero-sum mindset. China attracts the most criticism and DeSantis promises to “end our abusive relationship with the [Chinese Communist Party].” China looms large throughout the policy platform. In addition to barring land purchases from Chinese actors, he would seek to “repatriate” U.S. capital from China through tax measures without providing specifics.

The pillars of the DeSantis plan on fiscal policy can be broken down into a few general categories.

First, he targets policies designed to impact the macroeconomic environment. In addition to competition with China, DeSantis homes in on a 3% annual economic growth target and American energy independence. He plans to pursue a mixture of economic competitiveness actions to support the 3% growth target, including lowering taxes and cutting red tape. He proposes several permanent changes to the U.S. tax code while also highlighting President Biden’s alleged mismanagement of inflation.

Energy independence is also viewed as a critical enabling sector for economic success. DeSantis aims to “unleash our domestic energy sector” and “modernize and protect our grid”. His heavy emphasis on regulation and other obstacles to increased energy production mirrors other Republican candidates in the race. As governor, he vetoed a bipartisan bill aimed at encouraging people to buy more EVs and promised to reverse Biden administration policies on EVs.

As governor in Florida, DeSantis presided over steady increases in state GDP. While he was not the first to institute low taxes and other competitive business environment measures in Florida, he was a strong supporter of reducing bureaucracy and regulation that stifles growth.

Second, DeSantis includes pillars targeting individual corporations. He is especially critical of corporations pursuing environmental, social, and governance goals instead of shareholder returns. He claims to want to avoid damaging American companies by “strengthening rules governing fiduciary responsibilities, transparency requirements, and scrutiny of firms that manage public pension funds.” DeSantis reserves similar ire for “bad economic actors.” He would oppose federal bailouts for banks that fail, likely a reference to the collapse of Silicon Valley Bank and the role the Fed played in backstopping defaults. DeSantis even targets corporate executives in financial crisis situations, saying he would “strip those accountable of all golden parachutes and prevent the further accumulation of wealth to those already deemed too big to fail.”

As governor, DeSantis has shown a willingness to target corporations over their social stances. He could use the same tactic on an even bigger stage as president.

A third category of pillars targets American workers. He places the individual as the “central criteria for economic advancement.” In addition, he would use federal government authority to help increase educational access for working-class Americans and restrict immigration to protect the domestic labor market. His record on job creation in Florida was noteworthy. His time in the executive office has witnessed a lower unemployment rate than the national average. He also attracted domestic immigration to the state during the Coronavirus pandemic, with an aggressive “open for business” stance.

Finally, an entire pillar of the Declaration of Economic Independence is devoted to the Federal Reserve. DeSantis does not offer specific monetary policy prescriptions, but he vows to “rein in” the Fed by appointing officials who will focus exclusively on dollar and price stability. He criticizes “political pressure” at the Fed and clearly views the Fed as exceeding its mandate. In addition, DeSantis opposes the implementation of a possible central bank digital currency. The Federal Reserve initiated studies related to digital currency, but DeSantis warns of privacy risks and similarities to China’s social credit system.

Ron DeSantis’s economic track record in Florida and his proposed policy initiatives paint a detailed picture of his economic vision. Through his resilience in the face of adversity, his commitment to business incentives, and his alignment with traditional Republican economic principles, it is clear that DeSantis aims to position himself as a champion of economic growth, limited government, and individual empowerment.

Mike Pence’s Economic Policies

Former Vice President Mike Pence’s tenure in the Trump administration was marked by his influential role in shaping economic policies that aimed to stimulate growth, enhance business environments, and promote fiscal responsibility. As Vice President, Mike Pence was a key figure in driving economic policies that aligned with the Trump administration’s overarching goal of boosting economic growth and job creation. Pence’s background as a former governor of Indiana, where he implemented pro-business policies, provided him with valuable insights into effective economic governance.

The top lieutenant in the Trump administration launched a campaign of his own. Economic policy features prominently in Pence’s pitch to American voters. Unsurprisingly, he draws on similar themes as Trump and DeSantis. However, the simplicity of the Pence plan stands in stark contrast to the wide-ranging policy menu proposed by his peers.

The full platform consists of twin economic goals: Ending Inflation and Energy Expansion. In a recent appearance at the Iowa State Fair, Pence described his economic philosophy as one of “fiscal responsibility, low taxes, and economic growth.” His two policy objectives are geared toward achieving these goals and promoting “the American family.”

For Ending Inflation, Pence leads with a familiar tone that sharply criticizes Joe Biden. His fact sheet places the blame for rising prices solely on the current president’s shoulders. Pence says that “families are being crushed by prices that have skyrocketed since Joe Biden became president” and that “inflation has reached a 40-year high.” Instead of the Biden approach, Pence outlines four specific actions that he would take.

First, he would stop government deficit spending by freezing non-defense spending and repealing over $3 trillion in deficit spending seen under President Biden. Second, he would seek to reshore American manufacturing and spur additional production of durable goods on American soil. Pence suggests a mixture of measures to encourage more domestic manufacturing, from taxes to reducing red tape.

Third, cheap, abundant energy is seen as a critical component of domestic manufacturing. Pence made restoring American energy independence a key action step under Ending Inflation, but he also devotes an entire economic policy pillar to the topic as well. Both Trump and DeSantis include similar positions in their platforms. Restarting oil and gas leasing on federal lands, investing in pipeline infrastructure, and other industry-friendly measures are suggested as key actions to achieve the policy goal.

Fourth and finally, Pence suggests a change in monetary policy as an avenue to tackle inflation. He goes further than DeSantis in calling for an actual change to the Federal Reserve’s congressional mandate. Currently, the Fed is responsible for promoting maximum employment and ensuring price stability (i.e., maintaining consistent, low levels of inflation). Pence suggests that the mandate be updated to focus only on the latter. He characterizes the dual mandate as “contradictory” and says that current Fed policy has devalued the strength of the U.S. dollar.

For Energy Expansion, Pence lays out a future world in 2020 where “the United States can meet the energy demands of our own country while becoming the world’s top supplier of energy.” Pence views American energy potential as a vast untapped resource. Through a policy approach that aggressively promotes expanded energy production and services, Pence says he will reduce costs for consumers and businesses. He explicitly highlights the value of conventional fossil fuel production, saying we must meet the increasing demand for oil, gas, and goal. In Pence’s view, “if [the U.S.] does not answer the call, China will.”

Former Vice President Mike Pence’s economic legacy within the Trump administration was characterized by his dedication to fiscal conservatism, deregulation, and his instrumental role in shaping significant economic policies. His experience as a governor and his leadership in the realm of tax reform and regulatory relief left an indelible mark on the administration’s economic agenda. While sharing broad economic goals with President Trump, Pence’s approach often differed in terms of style, trade policies, and public messaging, and this is expected to shape his economic policies.

Tim Scott’s Economic Policies

As the race for the Republican presidential nomination gains momentum, Senator Tim Scott of South Carolina has emerged as a standout candidate for his distinctive economic policy vision. Known for his pragmatic approach and commitment to addressing key economic challenges, Scott’s economic policy record and proposed initiatives reflect his focus on tackling income inequality and fostering workforce development.

The core of Tim Scott’s economic plan is outlined in his Opportunity Agenda. In his words, “the Opportunity Agenda was founded on the principle that all Americans should have the opportunity to succeed.” In the Senate, Scott has earned a reputation as an economic and tax policy wonk with bipartisan credentials. The Opportunity Agenda reflects Scott’s reputation, with serious, thoughtful proposals that target the nuts and bolts of economic empowerment.

Scott authored many key components of the Tax Cuts and Jobs Act, including the Opportunity Zone concept that Trump promotes in his policy platform. Scott is also chair of the bipartisan Financial Literacy Caucus and has focused attention on credit and banking issues for underserved and underbanked communities. Pragmatic policy proposals such as the Credit Score Competition Act and Credit Access and Inclusion Act target real challenges that often fly under the radar of economic policymakers. Scott’s emphasis on financial inclusion is unique in the field.

At the same time, Senator Scott echoes other Republican candidates on the risks of China. In a recent congressional hearing, Scott used his opening remarks to comment that “China has grown in force and strength, persistently engaging in coercive economic policies to further its interests and undermine those of the United States and our allies.”

Scott clearly agrees China poses an existential threat to U.S. economic leadership. However, unlike many of his counterparts, he does not advocate for explicit industrial policy efforts by the U.S. government. Instead, he believes that America can beat China on the world stage by returning to free-market principles and global economic leadership. He stated that the U.S. “must boost economic growth and competitiveness through a renewed commitment to free enterprise, free trade, rule of law, and international U.S. leadership.”

The rhetoric hearkens back to the George W. Bush era, when America sought to aggressively open markets, reduce trade barriers, and encourage the adoption of free-market policies around the world. While not explicitly stated, it is fair to assume that Scott would like to see renewed leadership in multilateral economic institutions. By contrast, Trump and DeSantis advocate for a more inward, nationalist economic posture for the U.S. economy.

Scott also echoes Republican concerns about high inflation. He blames the Inflation Reduction Act and other “reckless spending” for causing a 40-year high in domestic prices. It is also interesting to note that, despite some variations in economic policy emphasis, Scott voted along with the president’s position 96.7 percent of the time during the years that Trump held office.

Senator Tim Scott’s economic policy journey showcases his dedication to crafting solutions that address income inequality and nurture workforce development. Through a combination of fiscal responsibility, education reform, and targeted initiatives, Scott’s economic vision aligns with key Republican values while offering pragmatic pathways to a more equitable and prosperous future.

Chris Christie’s Economic Policies

Former New Jersey Governor Chris Christie’s tenure was marked by a mix of economic policies that garnered both praise and criticism. As he sets his sights on the presidential race, his economic proposals, particularly those centered around fiscal responsibility and infrastructure investment, have the potential to shape the national conversation. During his time as New Jersey’s governor from 2010 to 2018, Chris Christie faced a range of economic challenges, including a struggling job market, budget deficits, and high property taxes. His approach to addressing these issues leaned towards fiscal conservatism and a focus on reducing government spending.

The colorful former mayor of New Jersey has yet to release a comprehensive economic policy platform for his 2024 run. However, his public appearances and messages largely seem to mirror his experience as a state executive. The economy, job creation, and tax reform lie at the core of Christie’s economic approach. In addition, he frequently promotes his ability to advance economic policies on a bipartisan basis.

In recent media appearances, Christie focused on bringing government spending “under control,” reforming entitlement programs, and maintaining a hard line on China. He joined other Republicans in the field in blaming President Biden for current inflationary pressures. However, he has also kept the focus on addressing Medicare and Social Security – two programs that other candidates seem hesitant to highlight.

His focus on these programs is consistent with his time as governor. As much as ten years ago, Christie was warning that the biggest risk at state and federal levels” is ballooning entitlement costs. At the federal level, Medicare and Social Security gobble up about a third of spending each year. In New Jersey, Christie addressed fiscal entitlement programs by implementing more penalties for early retirement and requiring new contributions from government employees to healthcare and pension schemes. Christie claims to have withstood vigorous opposition to these plans at the state level and seems willing to take on federal spending with the same enthusiasm.

Christie also passed three balanced budgets in a row in New Jersey. Balancing the books of a relatively small state like New Jersey pales in comparison to the U.S. federal government, which supplies the world’s undisputed reserve currency. Nevertheless, Christie’s record of paying down government debt and stewarding public funds is impressive. As governor, he vetoed $360 million in special interest spending and tried to attract job creators to the state.

Christie joins all other Republican candidates in highlighting the economic threat from China. On monetary policy, Christie has vocally supported the independence of the Federal Reserve. Beyond that, he has offered limited public comments.

Chris Christie’s economic policies as New Jersey’s governor and his proposals for the presidential race underline his commitment to fiscal responsibility, tax reform, and infrastructure investment. His track record in addressing economic challenges and his pragmatic approach could make his policies appealing to a broad spectrum of voters, extending beyond his home state.

Comparative Analysis of The Economic Policies of The Leading Republican Presidential Nomination Contenders

Analyzing the economic policies put forth by the entire field of Republican candidates reveals several prevailing themes. To begin with, all five of these candidates share a common commitment to prioritizing American families, particularly those within the working class.

Their economic policy prescriptions are intricately designed to serve this overarching objective.

Additionally, a unanimous consensus emerges among all five contenders when it comes to criticizing President Biden’s fiscal policy, specifically his approach to government spending. Most of the policy proposals put forth by these candidates are formulated in direct response to Biden’s economic agenda, rather than being in direct contrast to those of their fellow Republican contenders. While this dynamic is likely to shift as the primary process unfolds, especially during debates, the current references to other Republican candidates remain subtle and indirect. Notably, Mike Pence has taken a more direct stance by asserting himself as the “only candidate” equipped with a comprehensive strategy to combat inflation.

Another prominent shared theme among these Republican candidates is their stance on energy production. They collectively view the energy sector as an indispensable driving force behind the American economy. Their reasoning is rooted in the acknowledgment that the cost of oil and the broader energy market significantly contribute to inflationary pressures. Furthermore, the candidates highlight the crucial role of a cost-effective and abundant energy supply as a pivotal input for the production of durable goods, a sector they highly value. While these candidates often frame their energy policies as a response to counter Democratic priorities, the reality remains that various forms of energy production, spanning from fossil fuels to green technologies, are expected to be essential in meeting the nation’s demand well into the foreseeable future.

However, areas of divergence in economic policies offer intriguing insights for analysis. A prevailing thread uniting Republican economic policies is grounded in the “America First” mindset. This perspective, although not always overtly labeled as such, is palpable within the platforms of candidates like DeSantis and Pence, reflecting economic nationalism and populism. This subset of Republicans believes in a more direct intervention by the U.S. federal government in industrial policy matters. Their viewpoint tends to perceive economic competition as a zero-sum game, often placing a stronger emphasis on durable goods manufacturing over other sectors.

In contrast, Tim Scott and Chris Christie orient their platforms more towards classical liberal economics. In this context, “liberal” denotes a desire to maintain a small and non-intrusive government. Government interference is met with skepticism, as these candidates envision the federal government’s primary role as establishing a fundamental business framework and enforcing contracts through the justice system. They advocate for minimal regulation and government intervention, with the belief that less explicit direction leads to better outcomes. This approach, sometimes termed neo-liberalism, had been the norm in Republican economic thought for a considerable period. However, Donald Trump’s ascent to the presidency in 2016 shifted this perspective for many Republican politicians. Trump’s focus on internal economic matters, challenging established trade norms, and critiquing “globalist” international institutions reshaped the landscape. Yet, platforms like those of Scott and Christie signify that classical liberal economic notions have not entirely faded within the Republican sphere. Nevertheless, the momentum predominantly aligns with the principles of Trump’s “America First” ideology and his policy successors.

The viewpoint on the appropriate government role in the economy greatly influences the response to competitive pressures from China. While all candidates concur on the need to counter Chinese businesses and practices globally, the populist and classical liberal camps diverge in their strategies. Populists advocate for an approach that mirrors China’s statist policies, leveraging the full extent of American governmental influence. On the other hand, the classical liberals favor a return to core American economic principles and global leadership. Their preferred approach could be termed “leading by example,” standing in contrast to the populists who opt for a confrontational strategy. While a complete decoupling from China seems improbable, recent years have witnessed greater diversification of business investments in other economies due to events such as stringent lockdowns in China. This shift has favored economies like India and Vietnam, even though it may not align directly with the future envisioned by Republican candidates.

Lastly, the candidates’ emphasis on wage growth appears to overshadow discussions of asset ownership. While real wages serve as a pivotal economic metric and play a critical role in stimulating overall demand, recent trends have demonstrated the potency of asset ownership in elevating economic fortunes. Particularly in the era of historically low-interest rates, asset prices surged, making significant milestones like homeownership inaccessible for many Americans. A similar narrative applies to publicly-traded equities, where 40% of Americans do not own any stock, effectively locking them out of capital appreciation while inflation eats away at their purchasing power. Among the candidates, only Tim Scott offers well-thought-out ideas on how to broaden economic benefits more inclusively. Nonetheless, a detailed focus on financial inclusion alone may not be sufficient to propel Scott to the forefront of the Republican race.

In essence, the economic policy platforms of these prominent Republican presidential contenders encapsulate a range of approaches to taxation, regulation, job creation, and economic stability. While commonalities exist in their support for tax reduction and deregulation, each candidate brings unique subtleties and priorities to these crucial economic domains.

Top of Form

The Implications and Challenges for the Republican Presidential Candidates

Let’s take a look at the potential implications and challenges associated with the proposed economic policies of the five prominent contenders for the Republican nomination: Donald Trump, Ron DeSantis, Mike Pence, Tim Scott, and Chris Christie.

Potential Impact on the National Economy

The economic legacy of the Trump administration, characterized by tax cuts, deregulation, and trade renegotiations, remains a significant point of reference. Trump’s proposed policies, including further tax reductions and maintaining a strong trade stance, could yield short-term economic growth. However, concerns about long-term fiscal sustainability due to increased deficits need careful consideration. Additionally, the effect of these policies on income inequality and job creation demands thorough analysis.

Ron DeSantis’ focus on tax reduction and fostering business growth has the potential to stimulate economic activity. His track record as Florida’s governor showcases a commitment to attracting businesses and boosting tourism. The question arises whether his state-level strategies can be effectively adapted on a national scale, as the dynamics between these contexts may differ considerably.

Mike Pence’s dedication to fiscal conservatism and streamlined regulations might resonate with traditional Republican voters. His policies could lead to reduced government involvement in the economy and potential improvements in the budgetary situation. However, critics argue that such an approach could neglect vital social safety net programs and necessary infrastructure investments for long-term economic stability.

Tim Scott’s policies targeting workforce development and income equality could contribute to a more inclusive economic growth trajectory. By bolstering vocational training and education, he aims to enhance the productivity of the labor force. Challenges lie in securing adequate funding and implementing these programs effectively, particularly amidst ideological divisions regarding the government’s role in education and social welfare.

Chris Christie’s emphasis on fiscal responsibility and infrastructure investment aligns with his experience as a governor. His proposed policies have the potential to address longstanding infrastructure issues and generate employment opportunities. The crux of the matter is whether his plans can garner bipartisan support for substantial budget allocations.

Challenges and Criticisms

Donald Trump’s tax cuts have been criticized for disproportionately benefiting the wealthy and failing to deliver the promised widespread advantages. Skeptics also express concerns about his trade policies impacting global relations and supply chains, potentially leading to market uncertainty. His deregulation agenda would reverse the current Biden administration’s attempt to reduce global warming and grow the EV industry.

Ron DeSantis faces challenges in adapting his state-level policies for national implementation and reconciling potential trade-offs between tax cuts and funding essential programs like healthcare and education. Skeptics question the sustainability of economies heavily reliant on tourism.

Critics of Mike Pence argue that his deregulation approach might overlook environmental and consumer protections. Furthermore, his emphasis on reducing government intervention could hamper necessary responses to economic crises or inequality.

Tim Scott’s policies may be deemed insufficient to tackle deeply rooted systemic issues by some critics. Striking a balance between fiscal responsibility and investments in education and social programs is challenging, particularly in a polarized political landscape.

Chris Christie’s emphasis on fiscal responsibility might encounter resistance from lawmakers hesitant to allocate significant funds for infrastructure projects. Critics may question the feasibility of bipartisan cooperation within a politically divided environment.

Evaluating the Economic Policy Platforms of Leading Republican Presidential Candidates

The ongoing race for the Republican nomination to the U.S. presidency has brought to the forefront five prominent contenders, each presenting distinct economic policy platforms. In this comprehensive analysis, we delved into the economic policy stances of Former President Donald Trump, current Florida Governor Ron DeSantis, former Vice President Mike Pence, Senator Tim Scott of South Carolina, and former New Jersey Governor Chris Christie. As we conclude our exploration, we recap their economic policy positions, underline the pivotal role economic policies play in the nomination race, and reflect on the potential implications of these policies for the future trajectory of the Republican Party.

Donald Trump, drawing from his previous presidency, focuses on pro-business strategies such as reduced regulations, tax cuts, and renegotiation of trade agreements. His platform prioritizes job creation, economic growth, and safeguarding American industries.

Ron DeSantis leans toward pro-growth policies, emphasizing tax reductions, streamlined regulations, and investments in infrastructure. His intent is to create a favorable climate for job opportunities and entrepreneurial ventures.

Mike Pence, a steadfast fiscal conservative, champions restrained spending and minimal government intervention. His proposals include trimming bureaucracy, maintaining low taxes, and advocating for a balanced federal budget.

Tim Scott’s economic vision centers on addressing income inequality and facilitating economic mobility. His strategy involves workforce development, educational reforms, and targeted initiatives to enable marginalized communities to access economic opportunities.

Chris Christie’s policies stem from his tenure as a governor, highlighting fiscal responsibility and strategic infrastructure investment. His approach entails prudent budgeting while focusing on essential public infrastructure enhancements.

Economic policy stands as a linchpin in the political campaigns, particularly within the context of the Republican Party’s nomination race. Candidates address fundamental voter concerns of job security, financial stability, and overall economic health. Their stances on taxation, regulation, and fiscal responsibility serve as crucial indicators of their alignment with traditional conservative values.

Beyond individual campaigns, economic policy speaks to the identity and priorities of the party as a whole. The candidates’ divergent approaches reflect the Republican Party’s ongoing evolution as it navigates maintaining its core principles while adapting to evolving socioeconomic landscapes.

The economic policies proposed by these candidates bear the potential to shape the trajectory of the Republican Party for years to come. The outcome of the nomination race will influence the party’s platform for the general election and beyond. The candidate whose policies resonate most effectively with voters could influence the party’s priorities, governance strategies, and legislative agendas.

In an era characterized by shifting political dynamics, the Republican Party faces the challenge of balancing the demands of its diverse voter base. The economic policies presented by these candidates will play a decisive role in determining the issues and ideologies that take center stage, ultimately steering the party’s direction and shaping its future.

As the Republican nomination race unfolds, the proposed economic policies of these five candidates remain at the heart of the political debate. Rooted in fiscal conservatism and growth-oriented strategies, these policies present varying visions for the nation’s economic future. Beyond electoral preferences, these policies will shape the broader trajectory of the Republican Party itself, highlighting the intricate interplay between political ideology, governance, and the economic welfare of the American people.

All eyes will be on the Republican field on August 23rd in Milwaukee, where the policy debate will kick off in earnest. Look for the key economic themes outlined above to take their rightful place on the debate stage.

Top of Form

Sources:

- https://americafirstpolicy.com/latest/afpi-debt-ceiling-deal-policy-takeaways

- https://www.donaldjtrump.com/issues

- https://rondesantis.com/mission/Declaration-of-economic-independence/

- https://assets.mikepence2024.com/2023/07/pence-plan_ending-inflation.pdf

- https://mikepence2024.com/the-pence-plan/energy-expansion/

- https://www.scott.senate.gov/media-center/press-releases/scott-urges-a-return-to-free-market-principles-economic-freedom-to-counter-chinas-growing-aggression

- https://www.brookings.edu/events/restoring-fiscal-integrity-and-accountability-a-discussion-with-governor-chris-christie-r-nj/

- https://www.scott.senate.gov/issues/bridging-the-wealth-gap

- https://www.scott.senate.gov/about/opportunity-agenda

- https://www.politico.com/newsletters/morning-money/2022/11/04/tim-scotts-banking-agenda-what-we-know-00065089

- https://rollcall.com/2023/05/22/five-things-to-know-about-tim-scotts-record-in-congress/

- https://www.cnbc.com/2023/06/20/chris-christie-floats-social-security-cuts-slams-trump.html

- https://www.c-span.org/video/?529715-101/mike-pence-speaks-iowa-state-fair

- https://www.bloomberg.com/news/newsletters/2023-07-19/gop-presidential-candidate-chris-christie-says-he-can-do-what-donald-trump-can-t

- https://www.cbo.gov/system/files/2023-06/59014-LTBO.pdf

- https://thehill.com/business/3921112-trump-says-he-was-not-a-big-fan-of-fed-chair-jerome-powell-and-beat-the-hell-out-of-him/

- https://www.tampabay.com/news/florida-politics/2023/05/25/desantis-florida-president-economy-unemployment-wages-politifact/

- https://www.washingtonpost.com/business/2023/06/06/american-stock-ownership/