We’ve been writing on Environmental, Social and Governance (ESG) over the last year, with ESG Supercharged by government spending, Why ESG Now?, EU Carbon Plan and Fastest Growing Investment Theme. All of the work we do follows a “where we’ve been, where we are and where we’re going approach.” Today, we’re going to provide some additional context for understanding environmental, social and governance with a very brief history of this investing theme and where we are today. As Bob Marley once sang, “In this bright future, you can’t forget your past.” (No Woman, No Cry.)

Check out my ESG and Climate Change: Growth Opportunities video

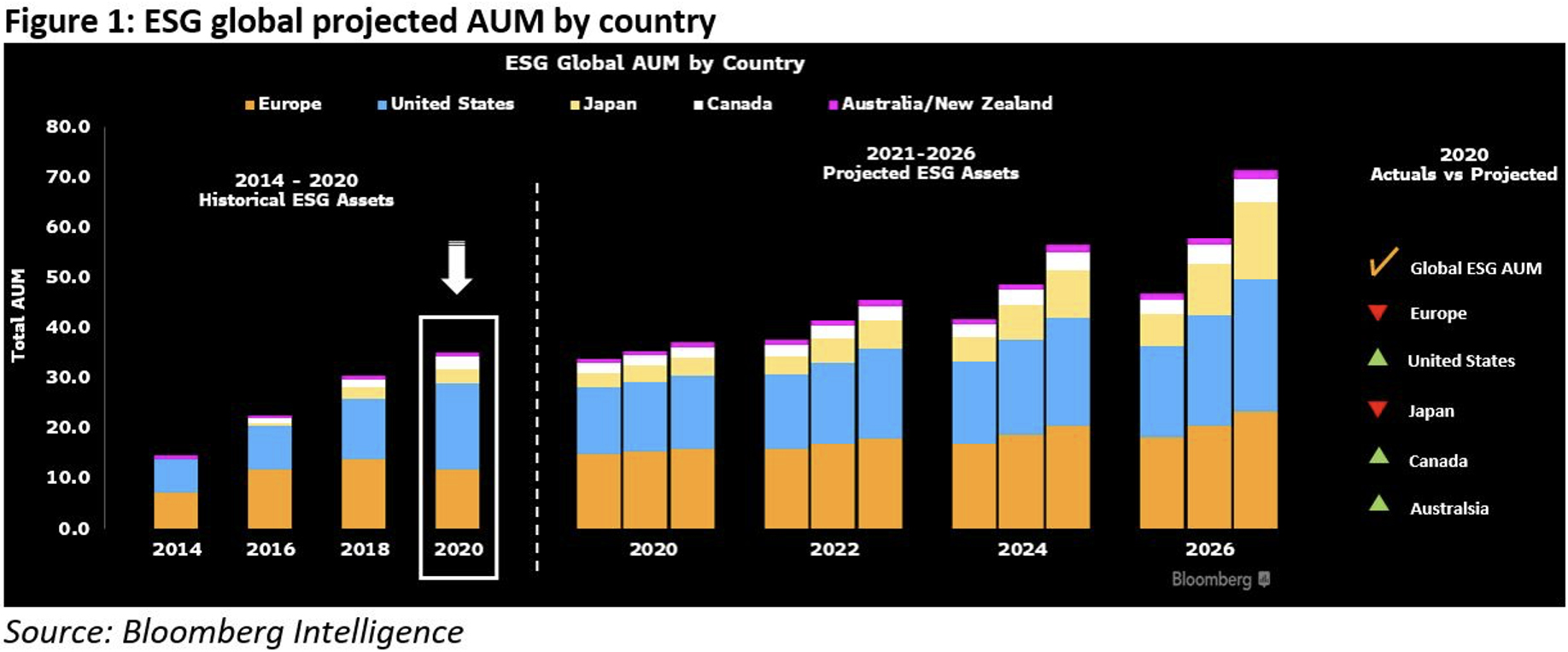

The path to ESG began well before the term ESG was coined in 2004 when the UN Global Compact initiated a series of publications to support the growth of sustainable investments, titled “Who Cares Wins.” The initiative was officially launched in a 2005 conference to bring together investors, regulators, researchers, and global consultants, and later led to a series of influential publications over 2004-08. Yet, the momentum from 2005 has been building rapidly and will likely be accelerated further over the coming decade as both public and private sectors drive towards addressing climate and social change. As an example, today almost every major investment firm has a product with this designation or has some component of sustainability imbedded into its investment products. ESG assets are on track to exceed $50 trillion by 2025, representing more than a third of the projected $140.5 trillion in total global assets under management, according to Bloomberg Intelligence.

When Did All This Begin?

The concept of doing well by doing good has had a long tradition stemming from religion and can be traced back to as early as the beginning of Judaism in 1500 BC. The Jewish concept ‘Tzedek’, which stands for justice and equity, prevents the ownership of and income generation through any holdings that could cause harm. The roots of responsible investing can also be traced back to the origins of Christianity. Whether it was financial restrictions based on the Old Testament or prohibiting usury or avoiding ‘sinful’ trade and profit maximizing for exploitation, Catholics, Methodists and Quakers have had some component of socially responsible investing or fund allocation in their beliefs. As well, Islam has similar aspects prohibiting exploitative-lending through ‘Riba’ and today, Islamic banking restricts adult entertainment and gambling (Renneboog, 2007; Puaschunder, 2016).

Here are a few key milestones on the timeline of SRI

1898 Quaker Friends Fiduciary corporation is created with a no weapons, alcohol, or tobacco investment strategy.

1928 Ecclesiastical group in Boston founded the Pioneer Fund with the first public offering of a socially screened investment fund, which avoids sin industries. The Pioneer Fund is still active today.

1960s U.S. students protest the Vietnam war and demand that universities divest military contractors from their portfolios, which helped build up SRI trends.

1971 Pax World launches the first socially responsible investing mutual fund.

1977 Congress passes the “Community Reinvestment Act” to meet the credit needs of low-income neighborhoods

1984 The U.S. forum for Sustainable and Responsible Investment (US SIF) was founded.

1985 U.S. students at Columbia University protest and demand that the university stop investing in any companies doing business with South Africa, refusing its policy of apartheid.

1986 U.S. enacts the “Comprehensive Anti-Apartheid Act” imposing sanctions on South Africa and prohibiting U.S. nationals from making any new investments there.

1990 The Domini Social Index (now MSCI KLD 400 Social Index), was composed of 400 U.S. publicly traded companies that met certain social and environmental standards.

2006 UN launches “Principles for Responsible Investment” or PRI.

Socially Responsible Investing or SRI is an allocation style, in which socially conscientious investors select securities not only for their expected yield and volatility, but foremost for social, environmental, and institutional ethicality aspects (Mohr, Webb & Harris, 2001; Beltratti, 2003; Williams, 2005; Puaschunder, 2016). Most often, this has been done via portfolio exclusion to pursue profit maximization with social endeavors. This double bottom line approach screens investments to evaluate options on a wide range of economic fundamentals and qualitative internal/external organizational aspects.

ESG can but doesn’t mandate exclusionary portfolios. Generally, this investment theme views selection through the lens of risk management to each of the areas under consideration. It is not, nor should it be, a standalone investment strategy. It is an overlay consideration for upside and downside risk. ESG should measure the sustainability or societal impact of an investment in a company. The goal is to assess non financial risks to the future financial performance of a company. From a legal and regulatory standpoint, this is an attempt to assess and integrate the “materiality” of environment, social and governance on the future performance of a stock.

Here are a few recent global developments in this space.

12/12/2015: The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties and entered into force on 11/4/2016. Its goal is to limit global warming to well below 2, preferably to 1.5 degrees Celsius, compared to pre-industrial levels. To reach this goal, countries have pledged to achieve a climate neutral world by mid-century.

01/01/2016: The UN Sustainable Development Goals (SDGs) adopted by 193 countries following the influential 2015 UN Summit. The SDGs comprise 17 goals that aim to reach the 2030 Agenda of Sustainable Development, building on the success of the previous Millennium Development Goals (MDGs). Those goals range from eradicating poverty and hunger to combating climate change and global warming.

11/03/2017 The U.S. Global Change Research Program released the first volume of the “Fourth National Climate Assessment” report, entitled “Climate Science Special Report.”

11/23/2018 The second volume of the “Fourth National Climate Assessment” is released on the “Impacts, Risks, and Adaptation in the United States.” The report highlights that there will be “substantial damages on the U.S. economy, human health, and the environment. Under scenarios with high emissions and limited or no adaptation, annual losses in some sectors are estimated to grow to hundreds of billions of dollars by the end of the century.”

09/22/2020: Chinese President Xi Jinping made major commitments at the UN general assembly to lower carbon dioxide emissions and achieve carbon neutrality by 2060.

7/14/2021: The European Union adopted a package of proposals designed to reduce CO2 output by almost half in 2030 and reach carbon neutrality in 2050.

04/22/2021 The U.S. President Joe Biden pledged to cut greenhouse gas emissions by half from 2005 levels in 2030

8/9/2021 The Intergovernmental Panel on Climate Change (IPCC) released its “Sixth Assessment Report,” stressing on how human influence has exacerbated global warming.

The next event on this timeline will be the UN’s COP26 conference, scheduled in Glasgow on October 31st – November 12th. We’ll be discussing what to expect and the outcomes as we approach this date.

As we always tell our clients, it doesn’t matter if you believe in ESG investing or climate change. What matters is that policy makers believe in it, and they are enacting regulations and legislation to address environmental, social and governance issues. Moreover, investors believe in it and are pouring trillions of dollars into these themes.