There is a lot of market discussion about an upcoming recession caused by the Federal Reserve tightening monetary policy as they attempt to combat the scourge of a dual supply chain and commodity-driven inflation spike. Even Cardi B Tweeted, “When y’all think they going to announce that we going into a recession?” Keep in mind, the US economy has strength via strong household and business balance sheets; US banks holding significantly higher loss-absorbing equity from 2008 (8% to 13%); and a credible central bank (see LT inflation expectations). To be clear, the US already has a slowing economy from 2021 and will likely see growth below 1.5% (see Federal Reserve of Atlanta GDPNow).

In this article, we will be looking at a few key data points to see what’s happening when it comes to inflation and a recession.

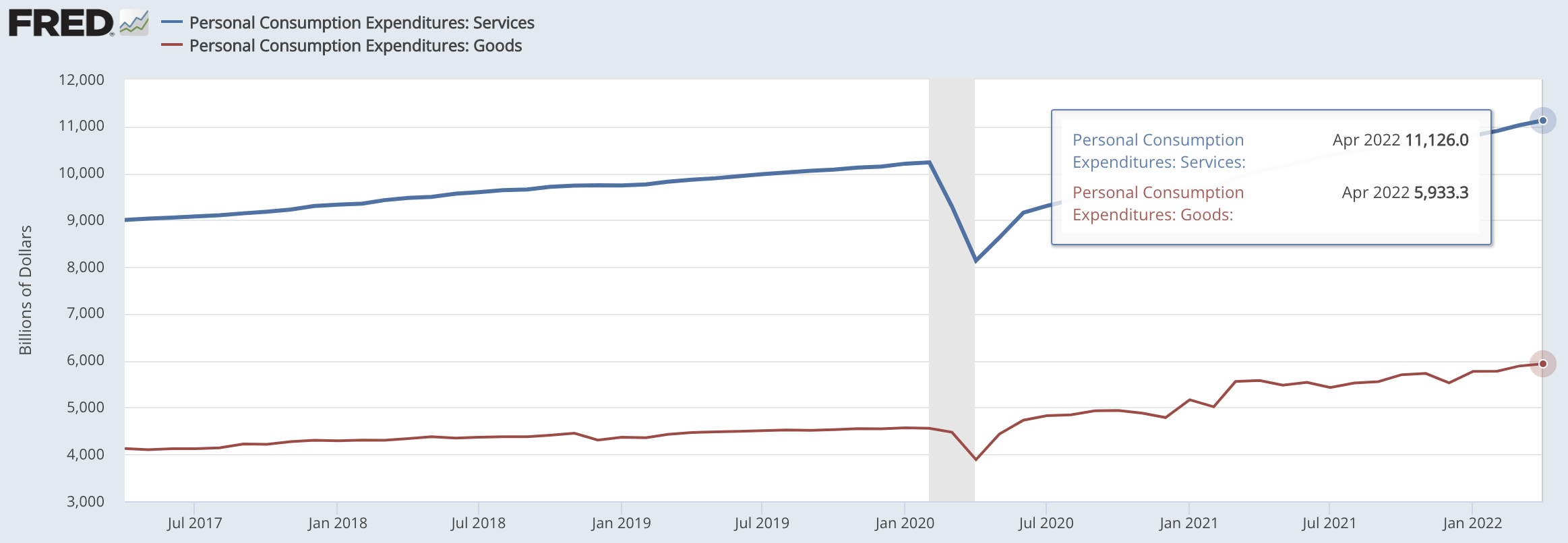

Personal consumption expenditures (PCE) for goods have risen as a share of consumer spending and have not reverted to pre-COVID levels. In February 2020, PCE for goods was 31% of total consumer spending. In April 2022, it was about 35%. This may not seem like a large increase, but it has created major changes and pressures across the supply chains that produce the goods.

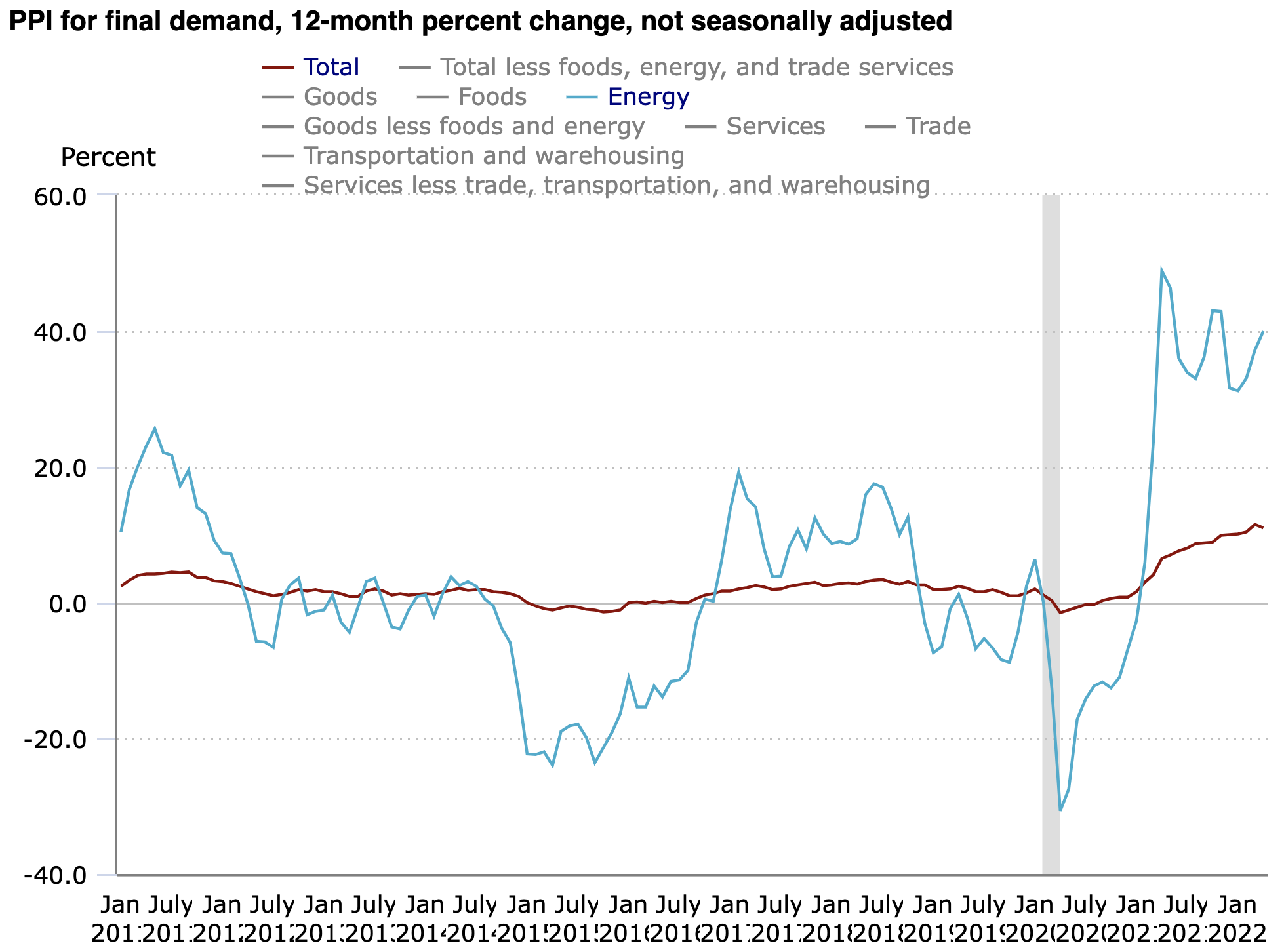

Due to this, there are continued and persistent strains in the producer price index (PPI) for final demand. This is mainly driven by the change in the spending mix along with major supply chain disruptions like China COVID shutdowns, the Ukraine war and volatile weather patterns.

As the US GDP returns to near pre-COVID output levels, it is pertinent to remember that the change in the balance of spending between services and goods has led to an increase in inflation. Overall, we would expect this spending balance to shift back towards the pre-COVID levels over time. In turn, this would reduce the strain on the supply chains and ease price pressures in the goods sector. To some extent, the recent announcements by Target and other retail stores stating that they overbought and as a result must reduce inventories are part of the process of easing supply chain problems and PPI.

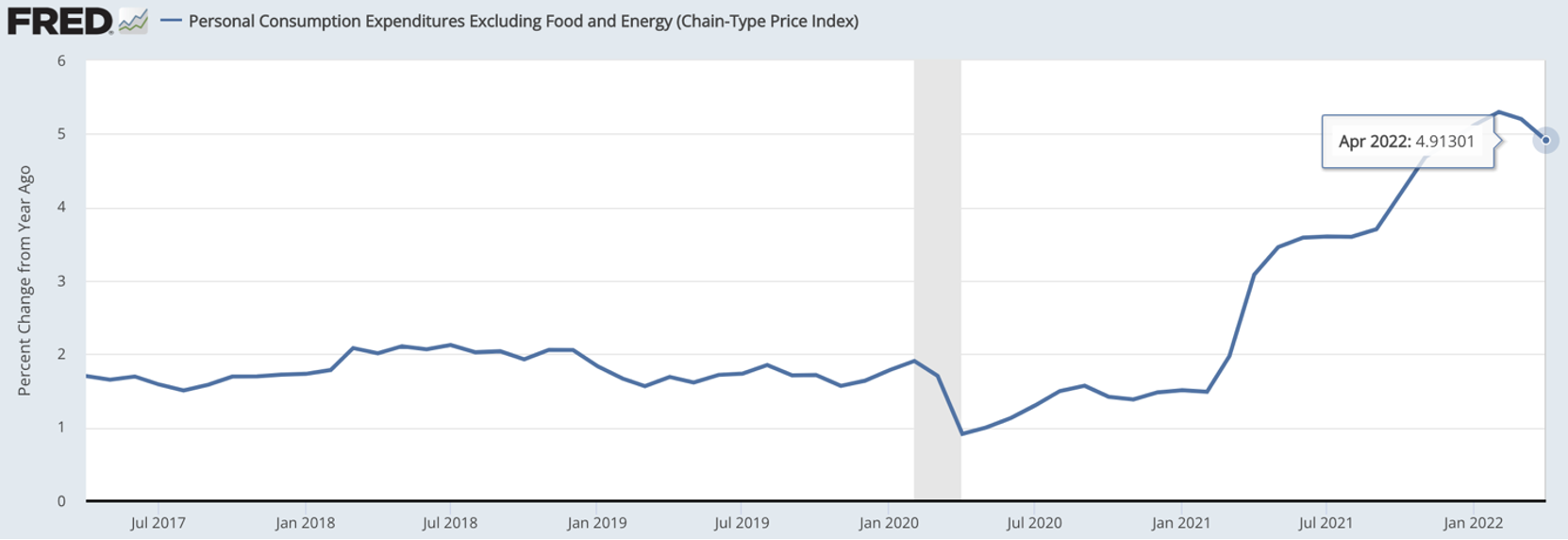

Consumer prices have only recently begun to show some signs of easing, but not much. Tomorrow, we will get the latest reading. Personal consumption expenditures excluding food and energy have fallen from a +5.2% pace in March to a +4.9% rate in April.

Whether we use PCE or CPI, the story is the same with some pressures easing, but energy costs and housing remaining high.

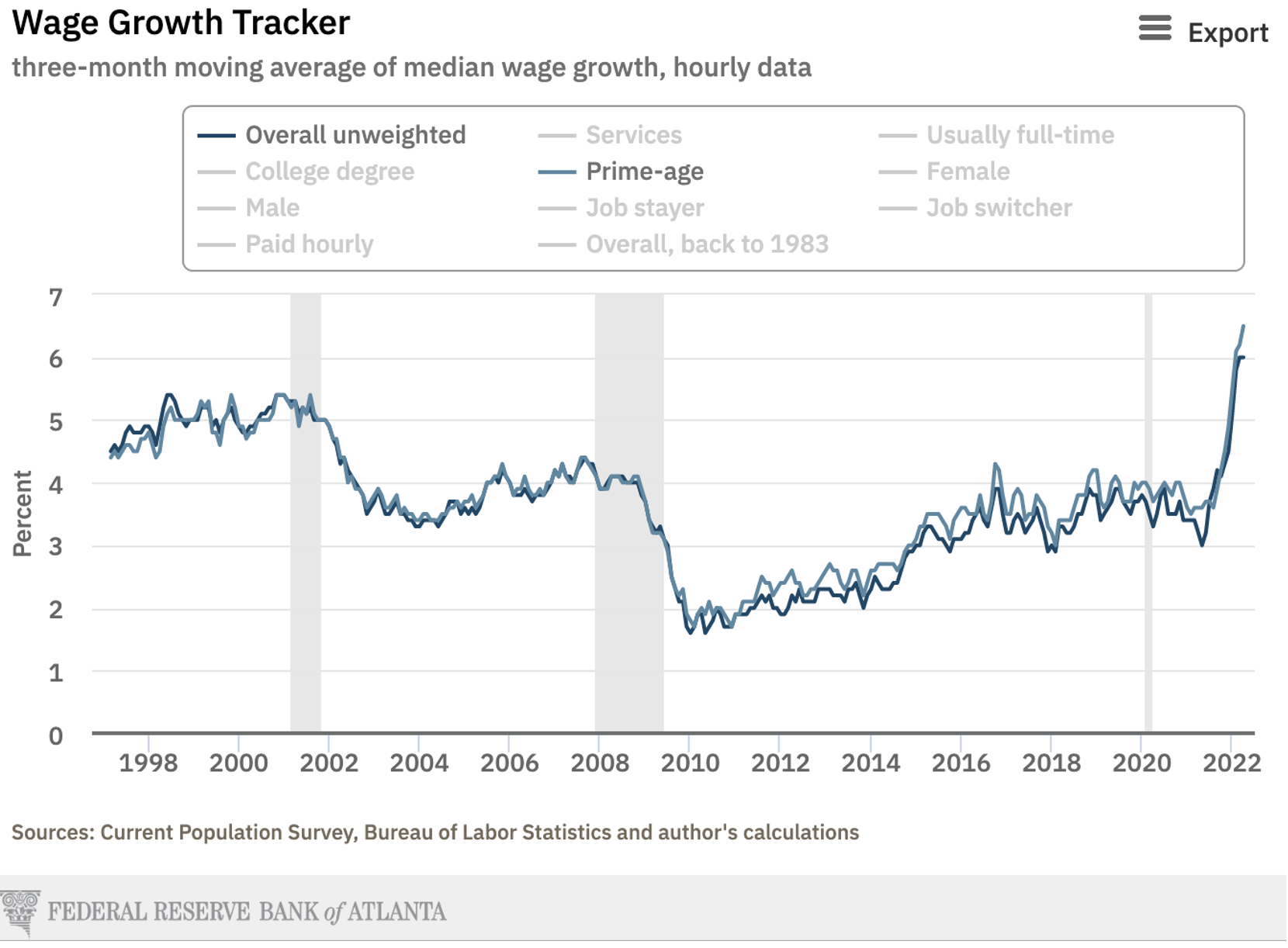

The more concerning aspect of inflation is that wages are not very flexible. Wages are sticky and once they move up, they rarely come off unless there’s a recession. The Federal Reserve Bank of Atlanta’s wage growth tracker shows the spike in wage growth occurring in the country as businesses try to fill the 11.4 million jobs available.

Building on further inflation-induced spending pressures, Social Security recently bumped up monthly outlays in 2022 to retirees by 5.9% and could increase them by 8% in 2023. Unions have been negotiating and winning large pay increases (John Deere) which fuel consumers’ ability to spend. This comes as an addition to five rounds of US government stimulus near $7 trillion.

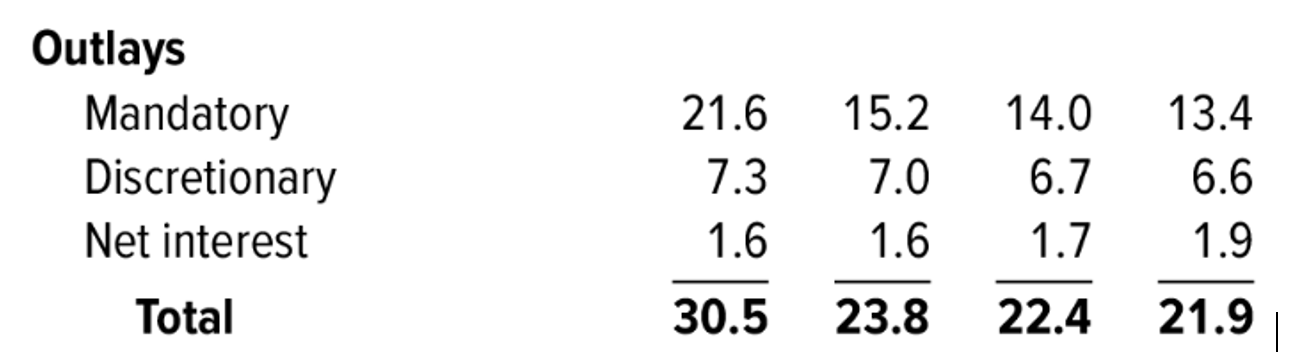

Also reducing inflation pressure is that fiscal spending is dropping rapidly from 2021. The CBO data below shows outlays for 2021 with projected outlays for 2022, 2023 and 2024. The 22% drop from 2021 to 2022 can be viewed as fiscal tightening, even though the level remains elevated. After the US midterm elections, we should not expect any additional fiscal stimulus from a likely split or Republican unified Congress.

Finally, the Federal Reserve has noted the persistent inflation and has begun a dual tightening of its own via raising rates and reducing its balance sheet. The Fed has raised rates by 75 basis points and indicated it will raise rates by 50 basis points at each of its next 3 meetings. It has also begun the process of reducing its swollen $9 trillion balance sheet by ramping up to $95 billion per month by the fall. The interest rate markets raced ahead of the Fed by pricing in a total of 325 basis points of rate hikes into April 2023, and the stock markets fell as this adjustment was being priced in.

The goal of the central bank is to reduce inflationary pressures while not causing the economy to sink into a recession. Yet if today’s inflationary problems are mainly caused by a shift in consumer spending patterns between goods and services, it’s unlikely the raising of interest rates will address the higher prices in the short term. If consumer spending rebalances, then the supply chain pressures will ease, and the goods component of inflation will ease on its own.

As well, the Fed has no control over geopolitical issues like the Ukraine war or the shutting down of ports by the Chinese government due to COVID. Neither does it have control over their impact on supply chains.

A combination of tighter monetary policy (225bps not needed), tighter fiscal policy and a rebalancing of consumer spending towards services will likely bring down inflation over the next 6 months. The big questions are “to what level will inflation fall, and will it remain elevated if wage gains persist?”

Given this, it’s difficult to believe the Fed will over tighten to cause a recession. There are many potential causes of a recession, but the central bank using too strong a hand to raise rates or being unwilling to adjust to slower conditions is difficult to envision as being the main driver of one.