By now, everyone has seen a daily deterioration of the global stock markets. The US has been driving the movement with declines between 1-4%+ and only a smattering of mini rallies of 1-3%+. The S&P 500 peaked near the end of last year but has since seen an 18.5% drop. How far down the equity markets go is difficult to gauge as the further they sink the more pressure builds on the Federal Reserve and federal government to change policy.

Why is this sell-off occurring?

The answer is simpler than most analysts will provide. The drop hinges upon two basic items: the level of fiscal and monetary stimulus.

Stating the obvious, it’s far easier to make money investing in stocks when there is a provision of both monetary and fiscal stimulus.

Stating the flipside, it’s far more difficult to make money investing in stocks when there is a withdrawal of monetary and fiscal stimulus.

It’s this latter scenario we are experiencing today.

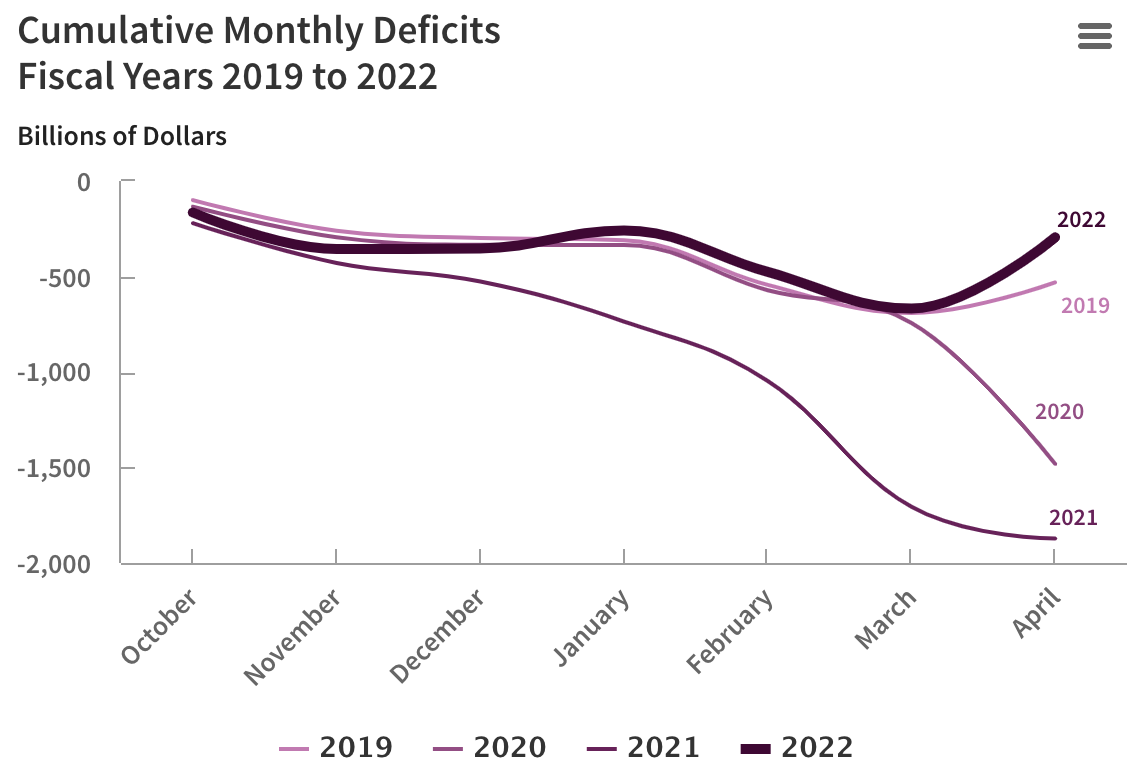

On the fiscal side, US spending has dropped dramatically from 2020 and 2021. The reduction in the fiscal deficit is even sharper than what was occurring in 2019. The CBO graph below provides the visuals.

Here’s the key text from CBO with bold for my emphasis: “The federal budget deficit was $360 billion in the first seven months of fiscal year 2022 (that is, from October 2021 through April 2022), the Congressional Budget Office estimates. That amount is about one-fifth of the $1.9 trillion shortfall recorded during the same period in 2021.” Or put differently, an 80% reduction in stimulus from 2021. This is simply massive.

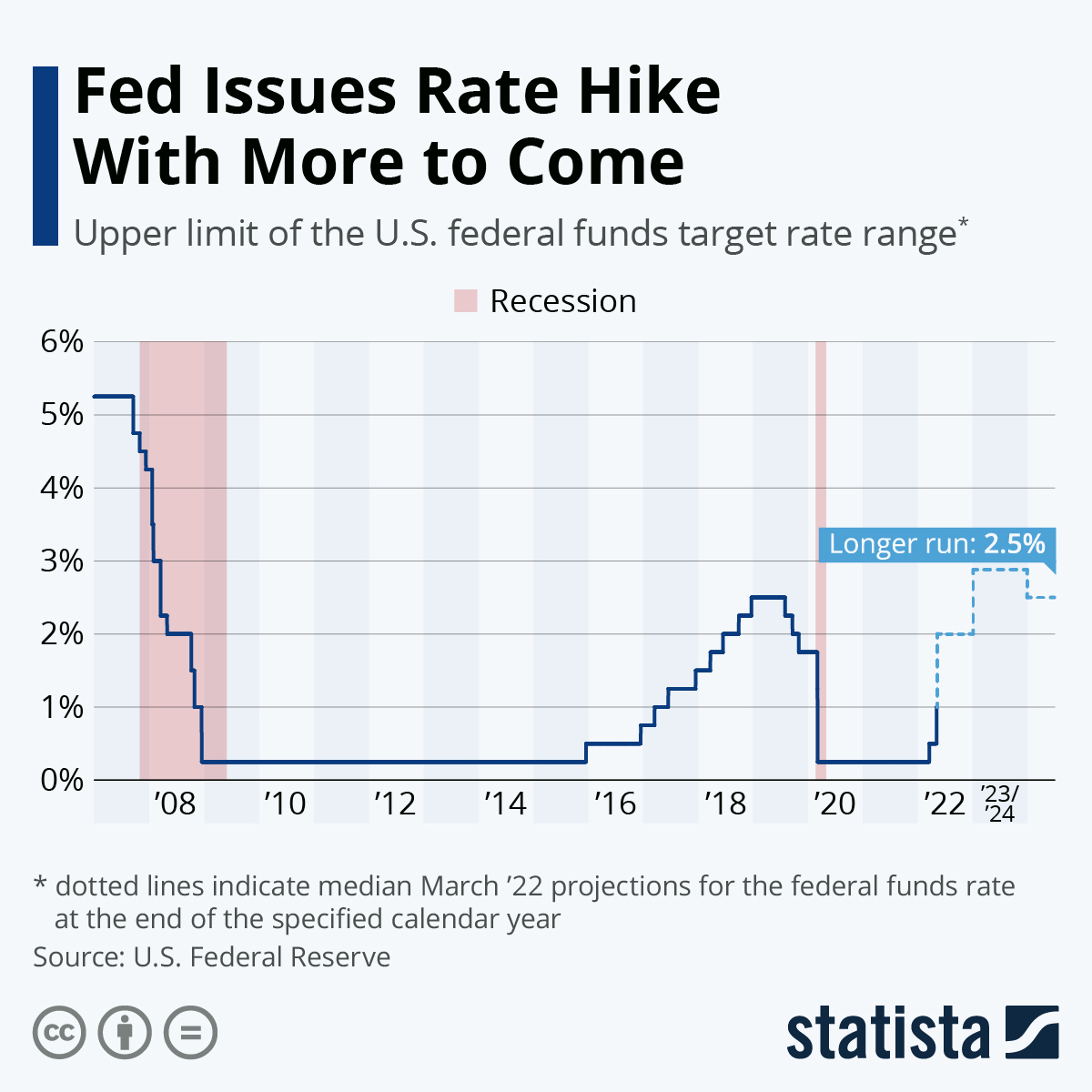

On the monetary side, the Federal Reserve is reducing stimulus at a pace not seen since in 22 years with a 50 basis point rate hike at last meeting and telling the markets they will continue to raise rates at that pace for the next couple of meetings. (WSJ) The graphic below indicates the Federal Reserve dot plots anticipating a Fed Funds rate at 2.75% indicating 200 basis points more of increases by EOY.

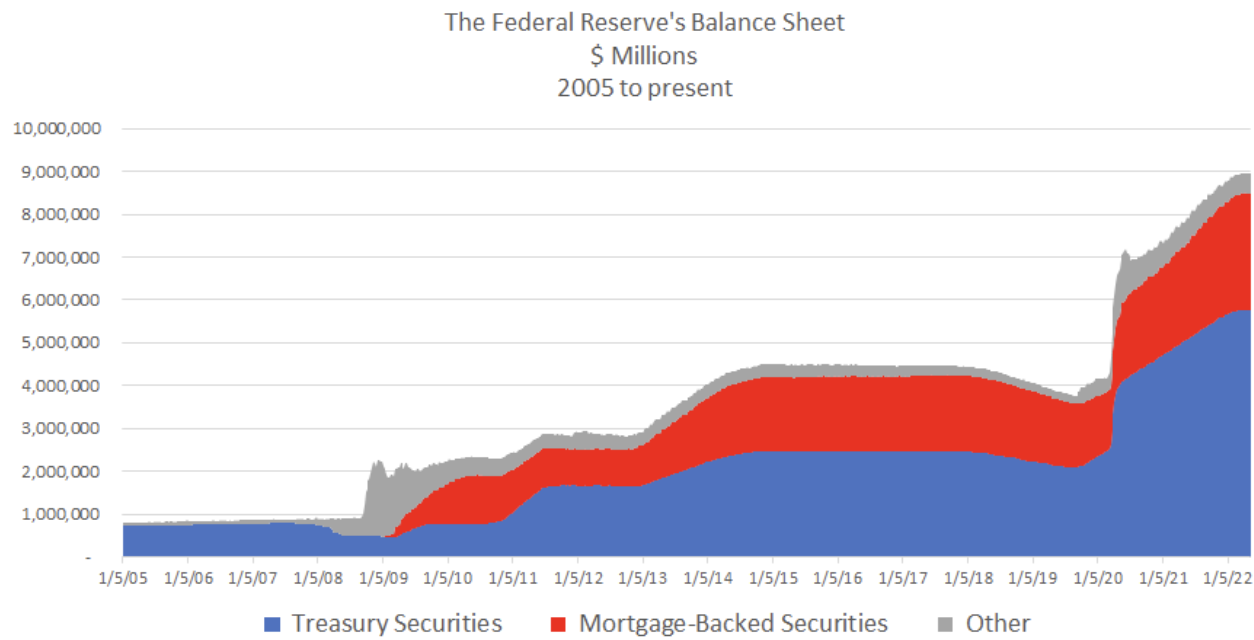

Also, the central bank is going to reverse its purchases of US Treasury, mortgage-backed and agency debt securities. The Fed had increased its balance sheet from around $4T to almost $9T to support the economy during COVID.

It now plans to reduce the balance sheet over the next 3 months starting in June by $30B per month for Treasury securities and $17.5T a month for agency debt and agency mortgage-backed securities. After this occurs, the plan is to increase the reduction to $60B and $35B a month. When I was in the US government as CMIO, the Fed engaged in similar balance sheet reduction and caused tremendous volatility in the financial markets.

Yes, return to pre-COVID trend GDP growth and return to 1980s style inflation levels are driving the central bank to act aggressively to raise interest rates and tighten monetary policy. Yet, the Fed has never navigated a combined fiscal tightening of this magnitude with an attempted monetary policy tightening (both rate hikes and balance sheet) with this level of inflation.

It’s highly unlikely they will be successful to create a soft landing. The equity (and risky assets) markets are responding to the reality of two, maybe even three, punchbowls being taken away at the same time after one of the biggest financial parties we’ve seen in our lifetimes.