Iowa Outcome:

Former President Trump won the Iowa caucuses with a historic 30-point victory and had 51% of the vote. FL Gov. DeSantis was second with 21.2% and former SC Gov. Nikki Haley was third with 19.1%. Iowa Republicans historically support strong conservative views and clearly supported the former president. The cold weather hurt turnout and likely hurt Nikki Haley.

The race to the nomination now goes to New Hampshire on January 23rd. In this state, the polls show a closer race with Trump at 44.5%, Haley at 31.3%, Christie at 11%, Ramaswamy at 6% and DeSantis at 5.8%. Both Christie and Ramaswamy have dropped out of the race with their supporters likely to go to Haley and Trump respectively. Should this occur, the outcome will be very close between Trump and Haley, perhaps signaling an opportunity for her to build momentum into Super Tuesday.

Overall, my view remains for Trump to be the Republican nominee. This sets up a rematch of 2020 with President Biden. According to RealClearPolitics, Trump leads Biden by a very narrow margin of 1.3%. With this margin essentially a rounding error, the race to the 2024 presidency will be in doubt all the way to November 5th…and likely well beyond it as there will be court challenges and recounts.

Executive Summary

- Iowa focus: The Republican candidates display a striking similarity on agriculture and rural issues, largely reflecting the concerns of Iowa’s first-in-the-nation caucus-goers. Ramaswamy’s unorthodox policy ideas stand out as an exception.

- Skepticism of the EPA and foreign investors: Every Republican candidate would seek a lighter touch from the US Environmental Protection Agency (EPA) and other federal regulatory agencies. The candidates also share a heavy dose of skepticism regarding foreign investment in the agriculture and food supply chain. Chinese investors draw particular ire, but any foreign-owned agribusiness firm could face increased regulatory scrutiny from the Republican candidates.

- Beware of policy wildcards: The lack of a comprehensive agriculture and rural aid policy from the Republican candidates amplifies the risk of collateral damage from other policy actions. Under any of the Republican candidates, farmers and agribusiness firms could face negative consequences stemming from trade policy, changes in government spending, or increased immigration enforcement.

Intro and Context

The Iowa caucuses are upon us, marking the official beginning of the US presidential primaries. As the eyes of the nation turned to Hawkeye State, it is fitting to focus our next article on the state’s leading economic sector: agriculture.

The US food and agriculture sector is a global juggernaut. Although less than 2% of Americans are directly employed in farming, the broader food and agriculture value chain contributes over $1 trillion to US gross domestic product annually and provides about 10% of American jobs. Extremely efficient production, high-quality goods, and consistent commodity surpluses prime the industry’s export dominance. The US Department of Agriculture (USDA) expects US food and agriculture exports to reach nearly $170 billion in 2024. This economic contribution is vital not only domestically but also on the global stage, as the United States plays a pivotal role in shaping international agricultural trade policies.

This article reviews the remaining Republican presidential candidates’ policy stances related to agriculture and rural aid. As Chris Christie departs from the field, leaving just four candidates in the race, it’s crucial to analyze how their proposed policies could impact the agricultural landscape.

Despite the diversity of the candidates, all four have staked their immediate agriculture policy aims on issues that primarily impact corn-producing states in the Midwest. This is no mere coincidence. Every presidential election cycle, Iowa’s advantageous position as the first barometer for primary candidates skews agriculture policy pronouncements towards Iowa’s interests – at least in the short term. That is why you will see heavy emphasis on ethanol and biofuels topics, in addition to concern over regulatory burdens and foreign control of agricultural assets.

There is no denying the influence of King Corn on the Republican candidates. But there is also no guarantee these interests will have durable staying power as the primary election gets farther in the rearview mirror. None of the candidates have outlined a comprehensive vision for America’s food and agriculture sector, which could leave farmers and agribusiness at the mercy of competing policy interests. Trade policy is one perilous example. Farmers felt the sting of Chinese retaliation against Donald Trump’s tariffs in 2018, a situation only rectified by generous government aid to the tune of $12 billion. Decisions to rein in government spending or crackdown on immigration could pose similar threats if any one of the Republican contenders eventually takes office. It is therefore imperative for stakeholders to scrutinize the potential long-term ramifications of these policies on the stability and growth of the agriculture sector.

Let’s dive in.

Candidate Overview

Donald Trump, Nikki Haley, and Ron DeSantis

Previous articles in the series on Republican presidential candidates outlined separate policy overviews for each candidate. For agriculture and rural aid, such distinctions are hardly necessary. The policy proposals from Trump, Haley and DeSantis bear a striking similarity. None of the candidates have released a comprehensive vision for food, agriculture, or rural economies. Instead, they have outlined their proposals through media appearances, stump speeches in Iowa, and minor references to agriculture in their broader economic policy plans.

The first policy priority shared by the candidates revolves around ethanol and biofuels. Looking at the numbers, it is easy to understand why. Advocacy group Biofuels Vision notes Iowa produced 4.5 billion gallons of ethanol in 2022. Ethanol is derived from corn, and the massive demand created by ethanol production is a major boon to farmers in Iowa and other corn-producing states. Iowa also produced nearly 350 million gallons of biodiesel in the same year, using conventional crops as a feedstock. All told, the biofuels industry in Iowa contributed over $7 billion to the state’s GDP and supported nearly 60,000 jobs across the state.

The economic clout of that magnitude has the candidates scrambling to one-up each other in support of the industry. Trump’s claim that he “fought for Iowa ethanol like no president in history” by approving a requirement for US automotive fuel producers to blend 15% ethanol into their products on a year-round basis has drawn attention. Haley vocally supports the ethanol industry’s preferred policy positions on everything from carbon intensity scoring to carbon capture and storage infrastructure. And DeSantis even mused about increasing the percentage of ethanol in automotive fuel to 30%.

The candidates’ vigorous support for ethanol dovetails nicely with their shared antipathy toward electric vehicle (EV) mandates and regulations. All three candidates’ rail against President Joe Biden and Democratic lawmakers for trying to incentivize EV adoption through government action.

Their unanimous criticism is rooted in their belief that such measures unfairly tip the scales of the market against ethanol, a sentiment strongly echoed by corn farmers and ethanol firms.

The second area of policy consensus surrounds the actions of US government regulators, particularly the EPA. Trump, Haley and DeSantis seek a light-touch regulatory environment for farmers, calling out a Biden administration rule seeking expanded federal jurisdiction over US waterways as an egregious example of government overreach. Investors can expect any of the candidates to push for reduced regulations at the EPA on issues that impact agriculture. This includes less emphasis on enforcing environmental laws that increase compliance costs for farmers and ranchers, such as the Endangered Species Act.

The third and final area of policy agreement for Trump, Haley and DeSantis comes on the subject of foreign investment in US farmland and agribusinesses. All the candidates are intent on preventing Chinese investors from acquiring food and agricultural assets. Each candidate echoes harsh rhetoric against China and other foreign nations, vowing to protect America’s food supply from “infiltration” or “dependence on adversaries.” Haley emphasizes that “food security is national security,” underlining the gravity of the issue. As president, every candidate promises to use their considerable regulatory powers and the bully pulpit to discourage sales of strategic US assets to Chinese investors.

How to prepare: Account for longer timelines of EV adoption, particularly in Midwestern corn-producing states. Expect more acres of corn production, supported by increased ethanol demand. Increase risk-weighting in your portfolio for agribusiness companies with ties to China or other US adversaries. Additionally, stay vigilant for potential positive shifts in regulatory policies that may impact the agricultural sector, particularly those related to environmental regulations and foreign investment restrictions.

Vivek Ramaswamy (dropped out after Iowa)

On agriculture and rural aid issues, Ramaswamy is the lone wolf away from the pack. Instead of toeing the line of conventional agricultural policy, Ramaswamy has proposed unorthodox ideas designed to appeal to Iowa farmers.

Ramaswamy largely shares the concerns of the other three candidates on regulations and China. He often criticizes the regulatory apparatus of the US government and seeks to downsize enforcement agencies. He is also adamant about preventing Chinese investors from benefiting from US food and agricultural assets and technology, advocating for near-total decoupling of the US and Chinese economies. Ramaswamy’s commitment to these shared concerns aligns him with his Republican counterparts on key policy fronts.

At the same time, Ramaswamy has made clear breaks from Trump, Haley and DeSantis. In the biofuels arena, Ramaswamy has referred to the requirement to blend ethanol into automotive fuel as a “government mandate” and the “second best option” to pure consumer choice. He also vocally opposed the ethanol industry’s plan to build carbon capture and storage technology. Both positions run counter to the preferred view of many Iowa corn farmers and their industry allies in the corn refining industry. His dissenting stance highlights a shift away from the usual Republican stance on biofuels, introducing a more nuanced perspective within the party.

In addition, Ramaswamy has suggested a radical concept of returning the value of the US dollar to an underlying commodity peg. Rather than a return to the gold standard, Ramaswamy wants to tie the dollar to a basket of commodities, including precious metals and grains. He claims the set-up would ensure more price stability for the US dollar. The idea may garner interest in Iowa, a state that plants about 12 million acres of corn and 10 million acres of soybeans each year. His proposal for an alternative monetary policy introduces a fresh economic outlook which might appeal to individuals in the agricultural sector seeking stability in commodity prices.

How to prepare: Increase risk-weighting in your portfolio for agribusiness companies with ties to China or other US adversaries. Estimate steady or slightly lower ethanol demand and corn production. Develop potential responses to alternative monetary policy scenarios. Diversify investments to hedge against fluctuations in commodity prices that may arise from Ramaswamy’s proposed approach to tying the US dollar to a basket of commodities.

Analysis

The areas of agreement for the Republican candidates are crystal clear. No matter the candidate, a lighter touch from US regulatory agencies and increased scrutiny on foreign investment in US agriculture seem destined to materialize if a Republican takes office. In the near-term, the reduced regulatory burden could lower costs of production for farmers and increase planted acres in the US.

On foreign investment restrictions, the Republican candidates are targeting China above all else. However, the heightened emphasis on the subject also presents real risks for any foreign investor with current or future interests in US farmland and agribusiness. The candidates have been quick to pounce on Smithfield Foods, a major pork producer that was acquired by a Chinese company in 2013. Another major agribusiness player, Syngenta, was bought by a Chinese company in 2017. A leading provider of crop seeds and pesticides, Syngenta was ordered to sell US farmland owned by the company in Arkansas. The order came from the state government, not federal authorities. These highlight the potential challenges and risks associated with foreign ownership of US agribusiness, signaling that, at the federal level, actions in this direction are likely under a future Republican president.

It is worth noting that the foreign nation with the largest holdings in US farmland is Canada, by a wide margin. Canadian investors own nearly 13 million acres, with the Netherlands a distant second at nearly 5 million. Chinese investors own a relatively small 384,000 acres, but these realities are unlikely to stem the tide of scrutiny. Close allies like Canada may be immune, but concern over foreign involvement in US agribusiness could extend to global competitors like Brazil under certain circumstances.

Aside from these explicit policy choices, investors would be wise to evaluate a few scenarios we will call “policy wildcards.” With all Republican candidates lacking a comprehensive plan on agriculture and rural aid, it is difficult to know how much the candidates would prioritize these areas over competing policy priorities. The absence of a detailed plan highlights the uncertainty surrounding the candidates’ commitment to agricultural and rural issues, urging investors to consider a range of potential outcomes.

Long after the glow of Iowa has faded, the future president will be forced to reckon with how decisions on trade, government spending, and immigration will impact agriculture and rural communities. The fortunes of US farmers and agribusiness firms may hinge on how the Republican candidates ultimately choose to resolve policy decisions. This long-term perspective emphasizes the need for investors to consider the broader implications of policy decisions on the agricultural sector. It highlights the interconnected nature of trade, government spending, and immigration in rural economies.

On trade policy, Trump’s proposal to impose 10% tariffs on all US imports poses the biggest risk. America’s agricultural export prowess makes the sector ripe for retaliation in trade disputes. DeSantis and Haley do not support the unilateral 10% tariff idea, but they have voiced their support for using tariffs in a more targeted fashion to pressure China and other foreign adversaries. Even without Trump’s drastic action, the risk of retaliation against US farm exports is real.

Another unknown relates to government spending. Fiscal hawks have often pointed to food and agriculture spending by the US government as a major source of potential savings. Consider that nutrition assistance (commonly referred to as “food stamps”) costs the US government over $100 billion annually. Meanwhile, crop insurance subsidies require outlays of anywhere from $10-$17 billion each year. Republican candidates like Haley and DeSantis, who emphasize fiscal discipline and seek balanced federal budgets, may ultimately decide to push for spending cuts in these areas. Reductions in nutrition assistance would dent demand at grocery stores and other food retailers, while cuts to crop insurance would increase premium costs borne by farmers. It is far from clear if Haley, DeSantis or Ramaswamy would protect these or other areas of government spending on agriculture and rural aid.

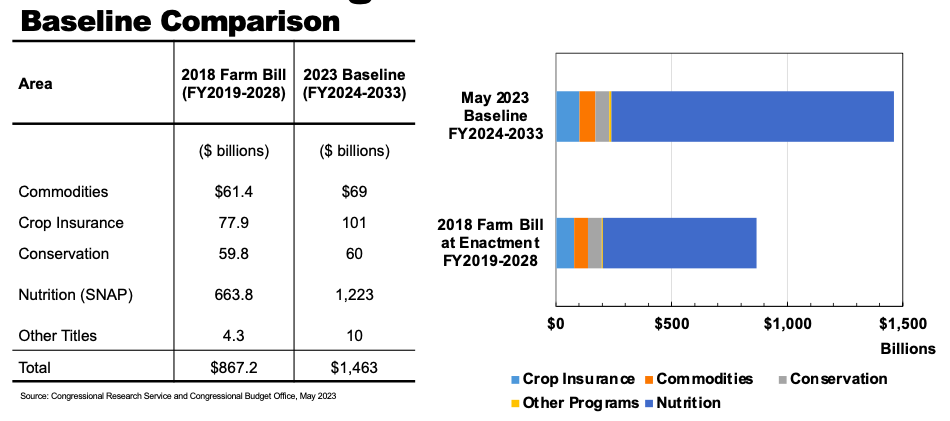

The chart below shows the major problem with getting the 2024 Farm Bill completed. The doubling of the Nutrition (SNAP) component of the bill has led Republican spending hawks to push back on the bill. In its current form, it would be difficult for any of the Republican candidates to support it.

Source: Dr. Bradley D. Lubben, University of Nebraska

Finally, a Republican candidate intent on restricting immigration for political gain could harm a source of reliable labor for the agricultural sector. Many farm workers come to the US through legal means, but plenty of illegal immigrants help harvest US crops or manufacture US food. Temporary farm worker visa programs managed by the federal government are already under strain. Further tightening of border security measures or increased restrictions on legal immigration could inadvertently undermine the agricultural workforce, inflicting economic pain on farmers, processors, and food manufacturers.

Final Thoughts

As the Republican candidates campaigned in Iowa, their attention to agriculture and rural issues has emerged as the focal point. Despite a shared commitment to lighter regulations and cautious foreign investment, nuances within their policies reveal distinct perspectives.

The common ground on ethanol and biofuels, crucial for Iowa’s economy, unites Trump, Haley, and DeSantis. Their collective resistance to electric vehicle mandates showcases a shared determination to safeguard the biofuels industry. However, Ramaswamy’s dissenting stance introduces an element of unpredictability, challenging the conventional Republican position.

Skepticism towards the Environmental Protection Agency (EPA) and concerns about foreign investment, notably from China, surface as additional policy consequences. The candidates’ shared dedication to ensuring national food security underscores a unified priority.

Vivek Ramaswamy’s departure on biofuels and his proposal for an alternative monetary policy bring variability to the Republican narrative, challenging traditional viewpoints. His distinctive ideas add layers of complexity to the party’s agricultural approach.

Investors are dealing with a situation where there is clarity in terms of reducing regulations and examining foreign investment. However, there are significant uncertainties surrounding trade, government spending, and immigration policies. The potential impact on neglected areas, such as rural healthcare, remains a wildcard in this complex political environment.

After the Iowa caucuses, the decisions of Republican candidates will have a lasting impact on agriculture and rural communities. The interaction between policies on trade, spending, and immigration introduces variables requiring continuous scrutiny. While certain elements of the Republican agricultural policy are evident, the path forward is uncertain. This calls for investors to remain flexible and adept in navigating the ever-changing political terrain that is shaping the future of the agricultural sector. The likelihood of enduring features, including reduced regulations and minimized foreign involvement, stands out if the Republicans secure the White House. Additionally, investors can anticipate measures to boost ethanol demand, contingent on Ramaswamy not emerging as the ultimate victor.

However, uncertainties persist, particularly in addressing areas like rural healthcare, as the candidates’ Iowa-centric focus adds complexity to predicting policy trajectories. In the near- and medium-term, the Republican candidates’ emphasis on trade, government spending, and immigration is poised to significantly impact the food and agriculture sector.

References

- https://www.ers.usda.gov/topics/international-markets-u-s-trade/u-s-agricultural-trade/outlook-for-u-s-agricultural-trade/

- https://www.donaldjtrump.com/issues

- https://trumpwhitehouse.archives.gov/presidential-actions/presidential-executive-order-promoting-agriculture-rural-prosperity-america/

- https://eu.desmoinesregister.com/story/opinion/columnists/caucus/2023/09/26/nikki-haley-farmers-freedom-washington-china/70968301007/

- https://nikkihaley.com/2023/11/07/nikki-haley-launches-new-coalition-aimed-at-supporting-iowas-farmers-rural-communities/

- https://www.iowacorn.org/about/news/biofuels-vision-solidified-for-nikki-haley

- https://www.biofuelsvision.com

- https://www.thegazette.com/campaigns-elections/where-do-republican-presidential-candidates-stand-on-agriculture/

- https://www.desmoinesregister.com/story/news/elections/presidential/caucus/2023/09/21/nikki-haley-returns-to-iowa-with-growing-crowds-after-gop-debate/70863378007/

- https://www.porkbusiness.com/news/ag-policy/exclusive-presidential-candidate-nikki-haley-shares-her-vision-us-agriculture

- https://www.agweb.com/news/business/taxes-and-finance/exclusive-qa-presidential-hopeful-ron-desantis

- https://iowacapitaldispatch.com/2023/08/16/tie-value-of-dollar-to-corn-beans-ag-commodities-presidential-candidate-vivek-ramaswamy-says/

- https://www.nbcnews.com/news/amp/rcna127839

- https://crsreports.congress.gov/product/pdf/R/R47893

- https://www.gao.gov/products/gao-24-106086

- https://www.ers.usda.gov/data-products/ag-and-food-statistics-charting-the-essentials/ag-and-food-sectors-and-the-economy/

- https://www.usda.gov/media/press-releases/2018/08/27/usda-announces-details-assistance-farmers-impacted-unjustified

- https://www.nass.usda.gov/Quick_Stats/Ag_Overview/stateOverview.php?state=IOWA

- https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/EPAS/PDF/2022_afida_annual_report_12_20_23.pdf