Autonomous warfare is now a business opportunity

Artificial intelligence and robotics are fundamentally changing how nations wage war, protect borders, and project military power. The development of experimental unmanned systems has become a major technological shift that touches every aspect of defense operations, from logistics to the use of lethal force. This transformation is occurring at unprecedented speed, compressing what historically took decades of military innovation into just a few years of rapid technological advancement.

Multiple pressures are driving this evolution: recent recruiting challenges across Western militaries, prohibitive training costs for soldiers, and adversaries deploying robotic systems that demand technological responses. Ukraine’s battlefield innovations with commercial drones, China’s investments in autonomous swarms, and the Pentagon’s push toward unmanned systems such as the Replicator initiative also reflect the fact that traditional military approaches are no longer sufficient in the world of modern warfare.

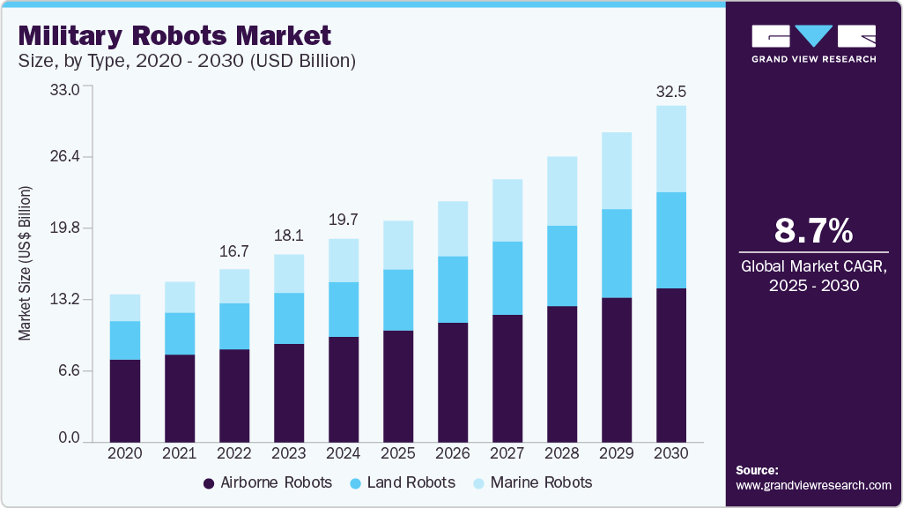

Defense spending patterns show this shift in hard numbers: the global military robots market is projected to expand from USD 19.68 billion in 2024 to USD 32.50 billion by 2030, growing at 8.7% annually. These shifts are also reflected in government spending: the United States Department of Defense (DoD) requested $10.1 billion for uncrewed vehicle acquisition and development in FY 2025, and $13.4 billion for autonomous systems in FY 2026. You can see these trends in Figure 1 below:

Figure 1. Grand View Research. Military Robots Market.

These investments in military technology cover both air, land, sea, space, and cyber domains as military planners seek technological advancements that could give them an edge.

This analysis covers robotics’ impact across the following issues:

- Categories of Defense Robotics: From humanoid logistics support to drone swarms, weaponized platforms, and space-based systems, robots are transforming every area of warfare.

- Integration of Robotics with Human Soldiers: How man-machine teams create force multipliers and reshape tactical coordination on battlefields.

- AI, Autonomy, and Ethical Dilemmas: The regulatory challenges of lethal autonomous weapons and the cybersecurity risks of AI-enabled military systems.

- Global Defense Robotics Investment & Policy: How the U.S., China, Russia, and other nations are racing to gain capabilities that provide strategic advantages.

- Venture Capital & Private Investment: The details of the surge in funding for dual-use robotics companies, as well as strategic acquisitions.

- Economic & Industrial Impact: The process of new defense-industrial subsectors emerging, while supply chains adapt to this transformation.

- Supply Chains: The Industrial Front Line of Autonomous Warfare

- Outlook: How military robot deployments will evolve over the next 3, 5, and 10 years.

Military robotics has crossed the threshold from prototype to operational reality. Countries that successfully integrate human intelligence with robotic capabilities will secure decisive advantages. They can sustain operations in hostile environments without the logistical burden of personnel, conduct sustained operations without personnel rotation constraints, and accept operational risks that would be politically untenable with human forces. Those that resist or delay adoption will face ever-more equipped and fearsome adversaries.

Categories of Defense Robotics

Humanoid and Quadrupedal Robots

A major category of defense robots includes humanoid and quadrupedal robots, which excel at tasks requiring human-like and versatile mobility in complex terrain. These systems handle logistics support, reconnaissance, and hazardous assignments that traditionally expose soldiers to significant risk. The fundamental advantage of these platforms lies in their ability to navigate infrastructure designed for human or animal locomotion, including stairs, ladders, narrow passages, and uneven surfaces that wheeled or tracked vehicles cannot traverse.

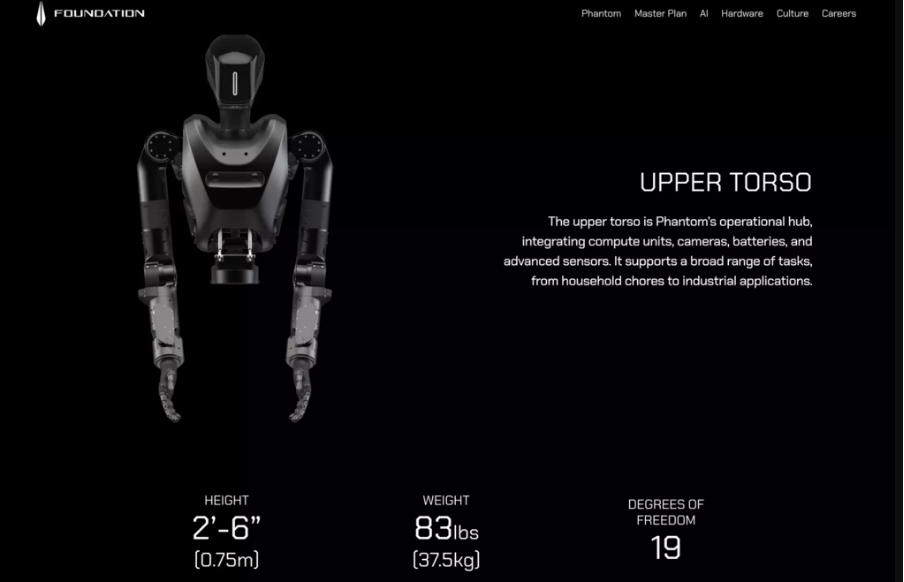

One humanoid called Phantom has been produced by the startup company Foundation. The San Francisco Standard reported that the Phantom “can be used for menial factory work — or, if desired, defense purposes — for $100,000 per year. Unlike its competitors … Foundation is open to attaching guns or other weapons to its robots.” Other startups like Figure AI do not design their humanoid robots specifically for defense, although they could be repurposed. You can see the Phantom robot in Figure 2 below.

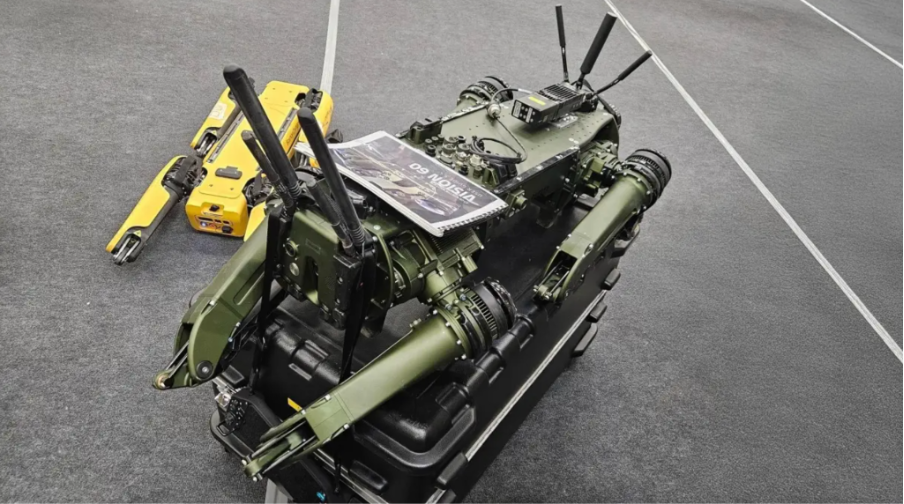

A more common design for military robots is the quadruped approach, which uses four legs and dog-like structure. One example of these types of robots is the well-known Boston Dynamics Spot robot, which was shown at SOF Week 2024 in Tampa. SOF week is a conference for the Special Operations Forces (SOF) community.

Figure 2. SF Standard. Foundation robot Phantom.

Another example of this type of quadruped robot is Ghost Robotics’ Vision 60. This robot is already in use by the German Bundeswehr for surveillance missions. You can see Spot compared to the Vision 60 quadrupedal robots in Figure 3 below. Ghost Robotics also delivered a number of Vision 60 units to the Japanese Self-Defense Forces, which illustrates their widespread adoption and geographical reach.

Figure 3. Heise Online. In contrast to Spot, the Ghost Vision 60 appears somewhat more menacing (from left to right).

These quadruped platforms excel in logistics support, carrying equipment across terrain where wheeled vehicles cannot operate. Their mobility enables navigation through buildings, tunnels, and urban environments while maintaining communication with human operators.

Spot robots already took part successfully in the DARPA Subterranean Challenge, or SubT, which is an underground challenge to search for 20 objects in a complex underground course. Combat applications, however, remain limited to reconnaissance and surveillance, though their role is becoming ever-more complex and sophisticated. The US Army has already sent a robot dog, armed with an AI-enabled gun, to the Middle East for testing.

Autonomous Reconnaissance & Surveillance

One task robots are particularly suited to is reconnaissance and surveillance. AI-enabled surveillance systems use a combination of computer vision, sensor fusion, and machine learning to provide continuous intelligence gathering. These platforms can also operate independently in contested airspace where human-piloted aircrafts could face unacceptable risks.

Drone swarms are a particularly significant development in Intelligence, Surveillance, and Reconnaissance (ISR) capabilities. Multiple small drones or platforms coordinate autonomously to saturate enemy air defenses, while maintaining surveillance coverage.

Ukrainian forces have pioneered many of these drone warfare tactics using commercial platforms modified for military purposes. Ukraine became capable of producing 4 million drones per year in February 2025. Their power is immense: in Ukraine, drones have been responsible for 60-70% of the damage to Russian equipment in the war.

Advanced computer vision algorithms that drones can be equipped with allow threat detection and classification without human intervention. They can process visual data faster than human operators while maintaining consistent accuracy across extended operations. Where human analysts experience fatigue-related performance degradation after several hours of continuous surveillance monitoring, AI systems maintain consistent detection capabilities across 24-hour operations, though they currently lack human judgment for contextual assessment and remain vulnerable to adversarial examples or spoofing techniques designed to deceive machine learning algorithms. AI navigation systems are also able to adapt to countermeasures and maintain mission effectiveness despite radar or other communication disruptions, such as “last mile” modules that allow the drone to continue flying even after it has lost contact with operators.

Disaster Response & Battlefield Support Robots

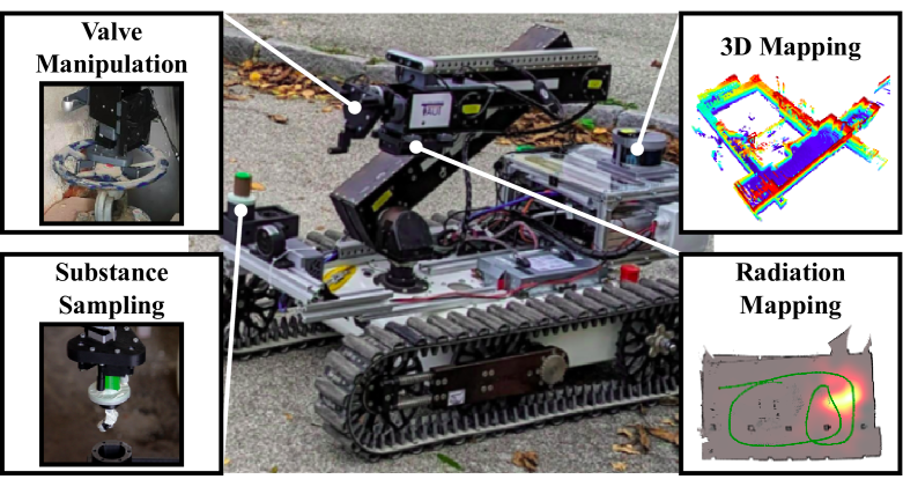

Another key role for robotics in the defense sector is specialized robotic platforms for handling dangerous battlefield support missions, such as bomb disposal, chemical detection, and casualty evacuation from hostile areas.

For example, firefighting capabilities allow robotic systems to operate in burning buildings or chemical facilities where human firefighters cannot survive. Advanced manipulation systems allow these platforms to operate valves, carry equipment, and perform rescue operations while maintaining communication with human supervisors who provide strategic oversight.

An example of a firefighting robot is shown in Figure 4 below, with some of its capabilities including valve manipulation, 3D mapping, substance sampling, and radiation mapping:

Figure 4. Arxiv. The robot system solves four tasks on one platform to assist first responders in disaster scenarios: Autonomous navigation and mapping, radiation mapping, semi-autonomous substance sampling and valve manipulation.

DARPA’s Robotics Challenge specifically addresses humanitarian and disaster relief operations where grave risks to rescue workers prove too great for timely human response. The challenge is intended to promote innovation in human-supervised robotic technology for disaster-response operations and hopes to establish frameworks that transfer directly to military applications.

Weaponized and Non-Lethal Platforms

Armed unmanned ground vehicles are the most controversial category of defense robotics, as they can deliver lethal force either under human supervision or autonomous control. These platforms range from remote-controlled systems to fully autonomous weapons that can engage targets based on pre-programmed parameters.

Ghost Robotics’ Vision 60 has been equipped with a “Special Purpose Unmanned Rifle” system, which demonstrated how it can be used for tasks from surveillance to combat roles. While this robot could only engage with permission from humans, the gap between controlled and autonomous robots is decreasing (such as with the last-mile drones mentioned above).

Importantly, ethical considerations and international pressure have so far limited widespread deployment of lethal autonomous weapons systems (LAWS). Over 30 countries have called for prohibitions or restrictions on LAWS development, while organizations including Human Rights Watch and the Campaign to Stop Killer Robots advocate for pre-emptive bans, though major military powers including the United States, China, Russia, Israel, and South Korea have resisted binding international treaties that would restrict their autonomy in developing these capabilities, arguing that human oversight requirements and rules of engagement provide sufficient safeguards.

Other, non-lethal, non-humanoid systems are also being developed alongside these vehicles and quadruped robots. Non-lethal platforms focus on crowd control, perimeter security, and area denial missions. Directed energy systems, acoustic weapons, and automated barriers are some of the tools used to provide protection without causing permanent harm, though their psychological impact remains significant.

Drones and Autonomous Aerial Vehicles

Unmanned aerial systems and drones are well-known as a major robotic development in warfare, as mentioned above. They have evolved from experimental platforms into the backbone of modern military operations. This transformation occurred with remarkable speed. The first armed Predator drone strike took place in 2001, yet just two decades later, unmanned systems conduct the majority of reconnaissance missions and an increasing share of strike operations across multiple theaters, fundamentally displacing crewed aircraft from missions previously considered their exclusive domain. Commercial quadcopters modified for military use dominate Ukraine’s battlefield, where both sides deploy thousands daily.

The Pentagon’s Replicator initiative, operating since 2023, is one initiative that aims to develop these technologies at speed. It is intended to develop “an accelerated process that identifies key capabilities with significant operational impact and delivers them to the warfighter at speed and scale,” through partnerships with commercial entities. The focus is on unmanned robots such as drones and unmanned surface vehicles. The program planned approximately $1 billion in investment for FY2024-2025.

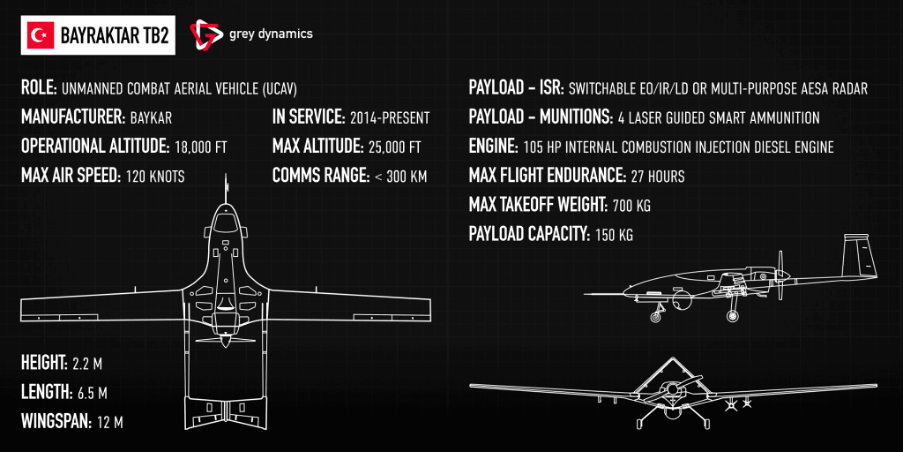

One example of a widespread drone in active combat use is Turkey’s Bayraktar TB2. It demonstrated combat effectiveness across multiple conflicts, and provided affordable precision strikes to nations without advanced fighter fleets. In Figure 5 below, you can see an illustration of the Bayraktar drone. China also showcased its Jetank heavy UAV “swarm carrier” at Airshow China 2024. This carrier can carry missiles, bombs, and smaller drones, and can release or deploy them above battlefields in swarms. China’s largest drone mothership, designed to launch up to 100 drones in coordination, was prepared for deployment in June 2025. This capability is of great importance. A single high-value asset can deliver swarm effects previously requiring coordination across dozens of launch platforms, though the mothership itself becomes a lucrative target whose destruction eliminates entire swarm capabilities, creating tactical dilemmas about acceptable operational risk for such concentration of capability.

Figure 5. Grey Dynamics. Bayraktar TB2 drone.

In response to technologies such as these that are in use across Ukraine, with increasing incursions into Europe, the European Union is also planning a “drone wall” along its border with Russia.

Exoskeletons & Wearable Robotics

Another use of robotics in military sectors is the use of exoskeletons. Powered exoskeletons augment soldier capabilities by enhancing endurance, strength, and load-carrying capacity while reducing injury rates. These systems highlight how robotics can integrate with human physiology rather than replacing human decision-making.

One example of an experimental program for these suits is DARPA’s Warrior Web program. It developed soft exosuits which reduced metabolic costs during loaded marching. Military systems prioritize lightweight designs that don’t restrict movement or create vulnerabilities. Soldiers routinely carry 80-100 pounds (or more) over difficult terrain, which leads to musculoskeletal injuries accounting for significant medical costs and reduced readiness. Exoskeletons or suits need to mitigate these issues.

China’s PLA has also tested exoskeletons so that soldiers can carry heavy weapons that previously required vehicle transport. Battery limitations currently constrain deployment to specific missions rather than continuous wear, though if actuator and battery advances continue on current trajectories, limited operational exoskeleton systems could be used in selective missions within 3-5 years.

Naval & Underwater Robotics

Naval and underwater robots are also increasingly in use. Maritime robotics operate for long periods of time with minimal oversight and can carry out missions from mine countermeasures to strategic surveillance across vast ocean areas. The importance of maritime autonomy stems from simple geography. Oceans cover 71% of Earth’s surface, yet naval forces remain expensive to maintain and limited in numbers, with major surface combatants costing billions of dollars and requiring crews of hundreds, creating coverage gaps that adversaries can exploit, while unmanned systems offer persistent presence at fractions of conventional costs. Unmanned surface vehicles can carry out patrol, reconnaissance, and offensive missions. The U.S. Navy’s Sea Hunter prototype demonstrated its capability in trans-Pacific autonomous navigation, while Israel’s Protector USV is already in use, providing harbor security and coastal patrol. These platforms extend naval presence without the logistical and human burden of crewed vessels.

Autonomous underwater vehicles can carry out tasks such as hunting mines, mapping seafloors, and conducting covert surveillance in contested waters, such as the US Navy robot “Knifefish.” Modern AUVs are able to operate for months underwater, gathering intelligence on submarine activities and undersea infrastructure. China’s underwater uncrewed surface vessel development focuses on South China Sea operations, where territorial claims need continuous surveillance without escalation.

Cyber & Virtual Robotics

A lesser-known sector is that of cyber and virtual robotics. AI-driven systems can defend networks by performing autonomous threat detection and response at a scale and speed faster than human operators can process. Modern cyberattacks can compromise networks in milliseconds, creating an operational necessity for automated defensive responses that can match attack timelines. One DARPA challenge, the AI Cyber Challenge, was created “in an effort to put AI to good use amid escalating cyberattacks that leveraged newly discovered vulnerabilities in popular software.”

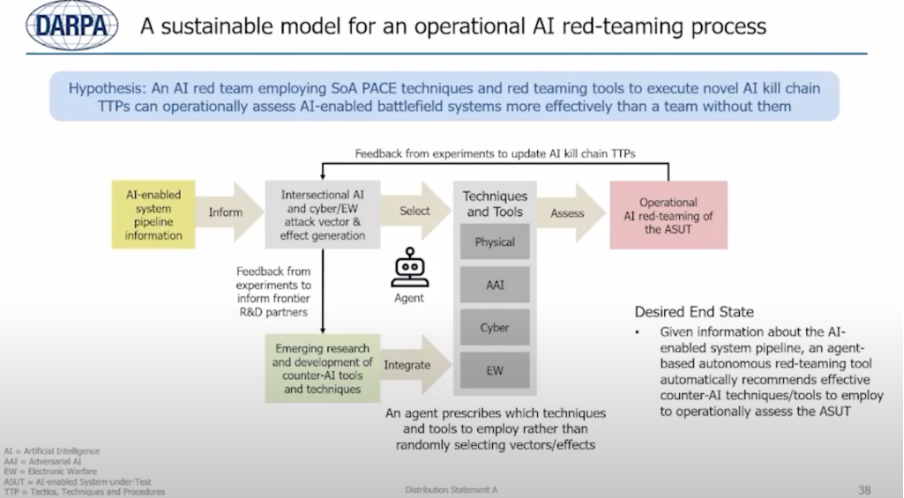

Another US military program, “Securing Artificial Intelligence for Battlefield Effective Robustness (SABER)”, is intended to build an AI team “equipped with the necessary counter-AI techniques, tools, and technical competency to operationally assess AI-enabled battlefield systems”. These “virtual robots” patrol digital infrastructure, identifying intrusions and deploying countermeasures, while military operations increasingly depend on networked systems vulnerable to cyber-attack. In Figure 6 below, you can see DARPA’s proposed sustainable model for an operational AI red-teaming process. Red-teaming is where ethical hackers conduct a training or non-destructive attack, for learning purposes.

Figure 6. DARPA. A sustainable model for an operational AI red-teaming process

Digital twins are also able to create virtual replicas of physical systems, so that commanders can test tactics and train forces in simulated environments before real-world deployment. These virtual robotics platforms reduce training costs while improving readiness through unlimited repetition of complex scenarios.

Space Robotics

Space robotics is also in development, although not necessarily with military use in mind. Orbital systems are already carrying out satellite servicing, debris removal, and monitoring potential anti-satellite operations in an increasingly contested domain. Space robotics enables the maintenance of critical communication and surveillance assets without expensive manned missions.

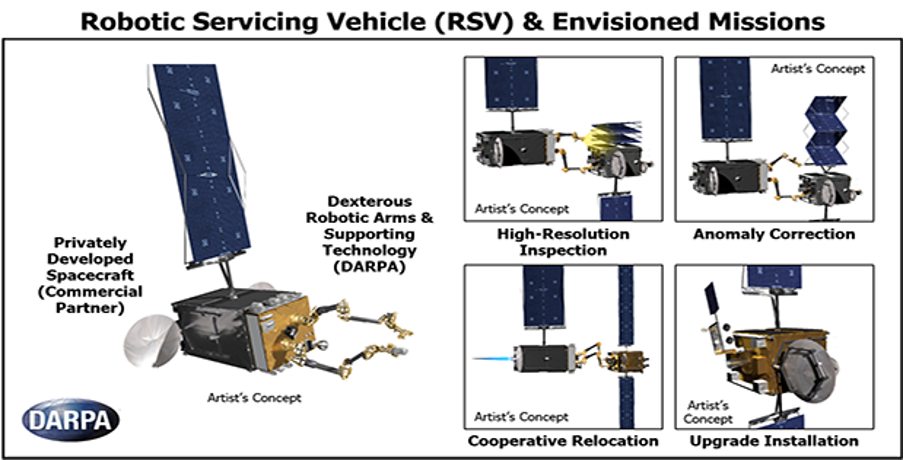

DARPA’s Robotic Servicing of Geosynchronous Satellites program demonstrated autonomous orbital repairs, extending satellite lifespans and reducing replacement costs. You can see below in Figure 7 the ways in which the robotic servicing vehicle could improve maintenance and repairs:

Figure 7. DARPA. Robotic Servicing Vehicle (RSV) & Envisioned Missions

However, dual-use concerns arise, as systems capable of servicing friendly satellites can also disable adversary platforms. This creates strategic ambiguity about intentions in space operations when robots are used in this way.

Integration of Robotics with Human Soldiers

Robots do not always have to be used in isolation, either. Man-machine teaming is the most significant tactical evolution in modern warfare, creating multipliers that extend human capabilities while preserving critical judgment in complex environments.

Modern military doctrine increasingly emphasizes hybrid formations where human soldiers coordinate with autonomous platforms rather than the platforms operating independently. A single infantry squad equipped with reconnaissance drones, robotic logistics support, and AI-enabled targeting can carry out missions that previously required company-sized units. This force multiplication addresses recruiting shortfalls while maintaining operational tempo across dispersed battlefields.

The U.S. Army’s Project Convergence experiments test these concepts through live exercises where autonomous systems provide targeting data, logistics support, and perimeter security while human commanders maintain authority over lethal engagement decisions.

Future battlefields will feature mixed formations where ground forces advance with robotic scouts providing reconnaissance, aerial drones delivering intelligence, and unmanned logistics vehicles sustaining operations without exposing supply personnel. This transforms warfare from human-centric operations into collaborative human-machine systems.

The transition creates significant challenges in trust, communication protocols, and fail-safe mechanisms. DARPA notes that “due to the rapid advancement and breadth of generative AI technologies, evaluation paradigms for human-AI teams need to be revised to accommodate the range of human-AI team behaviors that might emerge.” Soldiers must trust robotic systems enough to act on their intelligence while maintaining healthy skepticism about AI limitations. Communication systems must also continue to function despite electronic warfare attempts to disrupt coordination between human and machine elements.

AI, Autonomy, and Ethical Dilemmas

Artificial intelligence enables autonomous systems to process battlefield data, identify threats, and execute tactical maneuvers faster than human operators can respond. However, autonomous decision-making in lethal scenarios raises serious ethical and legal questions. Lethal Autonomous Weapons Systems (LAWS) that select and engage targets without human intervention are incompatible with traditional frameworks of accountability and proportionality in warfare. When an autonomous weapon makes an erroneous targeting decision, who bears responsibility becomes unclear: the commanding officer who deployed it, the software developer who created it, the military service that authorized its use, or the nation that established the policy? International humanitarian law also requires human judgment about legitimate military objectives and proportional use of force, yet LAWS operate without this essential human element, leaving the accountability gap unresolved.

The United Nations continues discussions on LAWS regulation, with some nations advocating for comprehensive bans while military powers resist restrictions they view as unilateral disarmament.

Cybersecurity risks increase these ethical concerns, as adversaries develop capabilities to hack or manipulate AI-driven military systems. Compromised autonomous platforms could engage friendly forces, target civilians, or provide false intelligence, leading to catastrophic decisions. The ethical trade-off is complex: autonomous systems reduce casualties among friendly forces while potentially lowering barriers to conflict escalation. Removing human soldiers from immediate danger saves lives and reduces the political costs of military operations. However, delegating lethal decisions to machines may make warfare more frequent.

Global Defense Robotics Investment & Policy

United States

Global defense robotics investment and policy vary around the world, with some nations more focused on these developments than others. In the US, the Pentagon is aiming for comprehensive robotics integration across all military services. Autonomous systems are viewed as essential to maintaining technological advantage against peer competitors. The Replicator initiative mentioned above is one of the most ambitious programs.

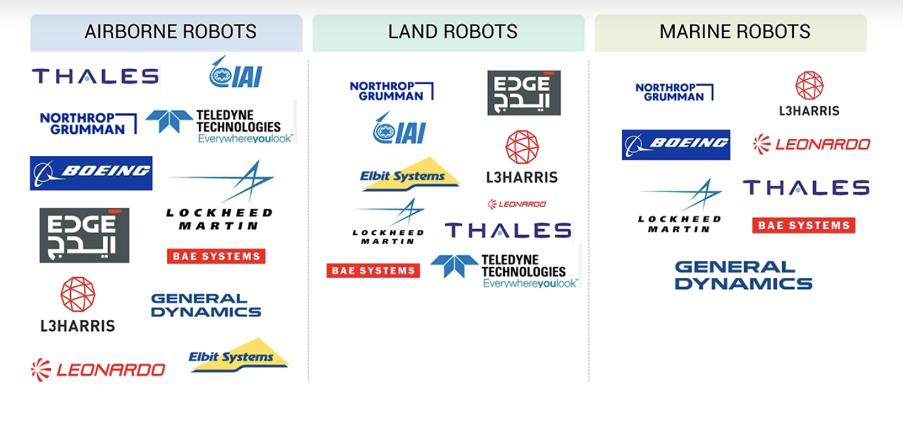

Many of the key technology development players are also in the US, including Northrop Grumman, Boeing, Lockheed Martin, and Teledyne. Markets and Markets reports that the airborne robots sector captures the largest share of the military robots’ market, because of the need for reconnaissance and fighting abilities. They also note that the US dominates the military robots market due to the high military budget of the US, and the high level of investment into all categories of robotic defense systems. You can see some of the main companies involved in producing airborne, land, and marine robots in Figure 8 below:

Figure 8. Markets and Markets. Global Military Robots Ecosystem.

DARPA continues research in humanoid robotics, exoskeletons, and AI systems that push technological boundaries before military services adopt proven capabilities. Programs like Squad X experiment with man-machine teaming, while the Robotics Challenge (as mentioned before) established frameworks for disaster response that could transfer directly to combat support missions.

China

The People’s Liberation Army (PLA) is also pursuing comprehensive robotics integration as central to its military modernization strategy. Chinese doctrine emphasizes “intelligentized warfare” where AI-enabled systems will provide decisive advantages and coordinated autonomous operations.

For example, China’s drone swarm development has produced systems that coordinate hundreds of small platforms in synchronized attacks designed to saturate enemy air defenses. In 2024, PLA specialists from the Academy of Military Sciences published articles describing autonomous uncrewed platforms as “the preferred type of battlefield equipment” in the evolution toward intelligent warfare. These swarm systems make use of China’s commercial drone manufacturing base, where companies like DJI dominate global civilian markets while maintaining relationships with military developers.

Nonetheless, China has also advocated for a ban on fully autonomous weapons.

Russia

Russia’s military robotics development accelerated dramatically following experiences in Ukraine, where both sides employ thousands of commercial and military drones daily.

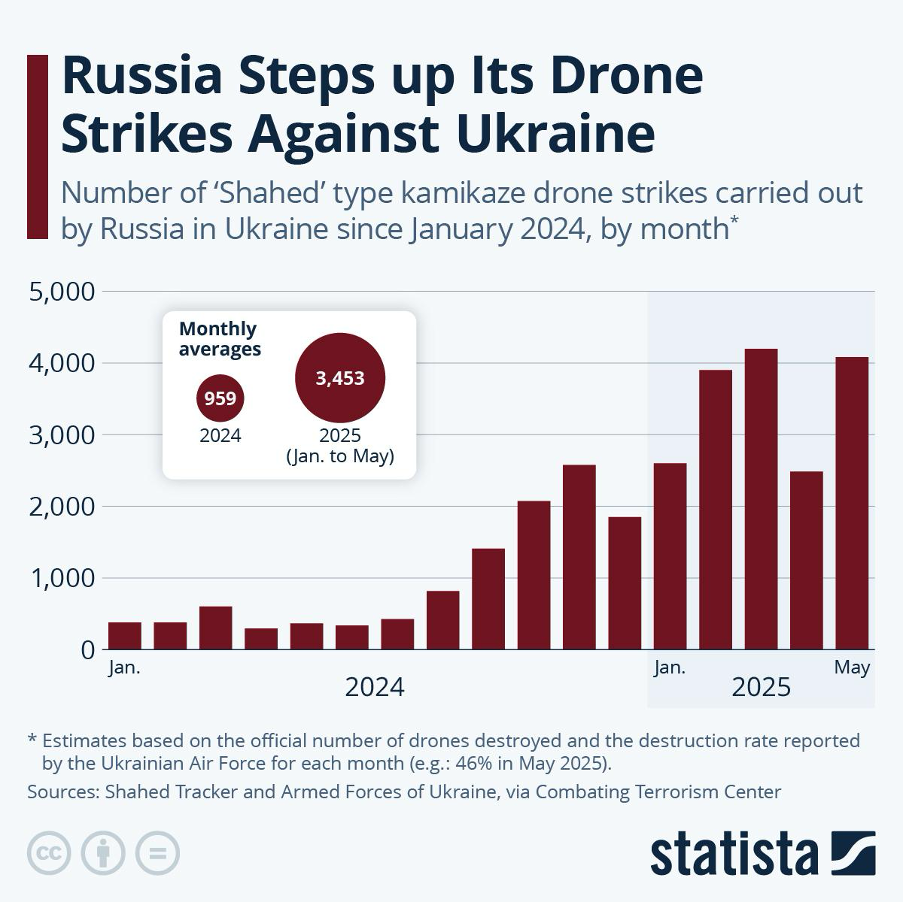

Figure 9. Statista. Russia Steps up Its Drone Strikes Against Ukraine.

Russian forces have deployed Uran-9 unmanned ground vehicles and various UAV platforms, though performance has proven inconsistent and reliability remains problematic compared to Western and Chinese systems.

Heavy investment focuses on counter-drone systems as much as autonomous platforms themselves. This highlights the ways in which small, cheap drones pose asymmetric threats to expensive conventional forces. Electronic warfare capabilities target drone control links while directed energy weapons offer potential solutions to swarm attacks that conventional anti-aircraft systems cannot economically engage.

Europe, Israel, and Others

Israel maintains leadership in military UAV technology, having pioneered operational concepts and export markets for unmanned systems decades before other nations recognized their strategic importance. Israeli defense companies like Elbit Systems and Israel Aerospace Industries supply drones to militaries worldwide, while domestic forces use autonomous systems extensively for border security and targeted strike missions.

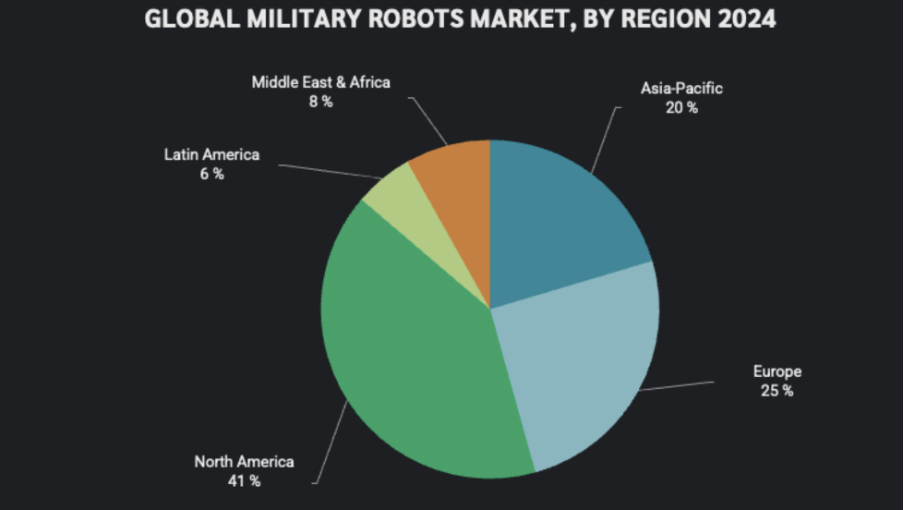

NATO collaborative programs pool European resources to develop autonomous capabilities that individual nations cannot afford independently. The European Union’s drone wall initiative along the Russian border (mentioned above) is a significant commitment to robotic security systems, combining surveillance platforms with integrated air defense and anti-drone capabilities. You can see in Figure 10 below that Europe was only second to North America in 2024 in terms of the military robots’ market, according to Stazon:

Figure 10. Statzon. Global Military Robots Market, by Region 2024

Turkey’s success with Bayraktar drones also demonstrated that second-tier military powers can develop competitive systems through focused investment and operational innovation rather than attempting to match larger nations across all capabilities.

Venture Capital & Private Investment

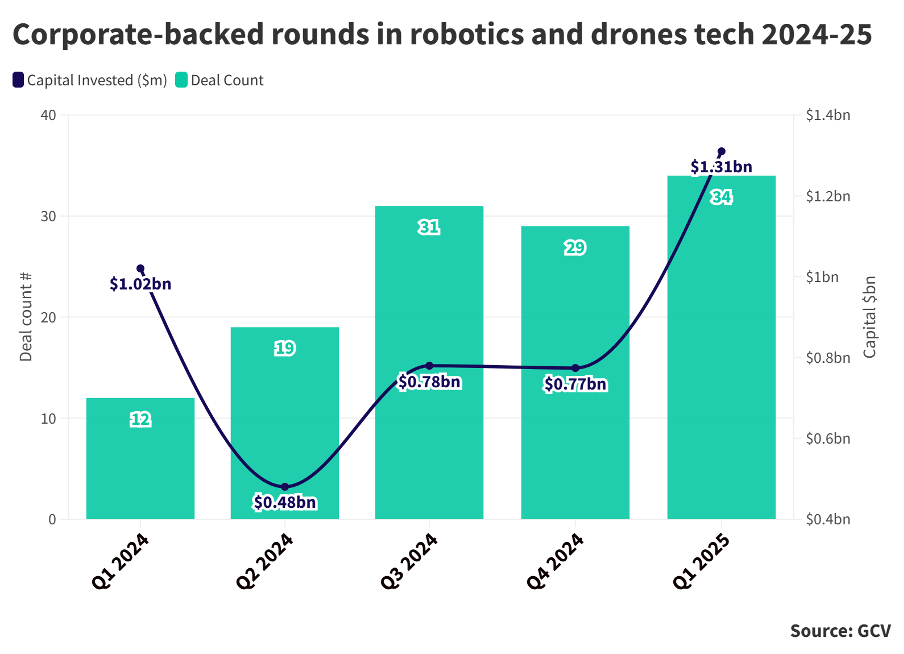

Venture capital funding has surged into dual-use robotics companies that serve both defense and commercial markets, attracting billions in investment. You can see in Figure 11 below that both deal count and capital investment into robotics and drones increased towards the last half of 2024 and into the first quarter of 2025, showing increasing interest in these technologies:

Figure 11. Global Venturing. Corporate-backed rounds in robotics and drone tech 2024-25.

Anduril Industries exemplifies this new defense-tech paradigm, raising $2.5 billion at a $30.5 billion valuation in June 2025 through rapid development cycles and commercial technology stacks. Anduril produces autonomous systems like the Ghost drone platform and Lattice software that coordinates multiple platforms through unified interfaces. The company’s approach emphasizes software capabilities that can be updated rapidly rather than hardware platforms requiring years-long development cycles.

Shield AI has also raised over $500 million to develop AI pilots for autonomous aircraft. In April 2024, DARPA and the Air Force conducted flight tests demonstrating safe autonomous fighter jet employment, including nose-to-nose dogfighting against a human F-16 pilot, with Shield AI participating. Air Force Secretary Frank Kendall also flew in the AI-controlled X-62 VISTA aircraft in May 2024. In August 2024, Shield AI’s Hivemind AI successfully controlled two Kratos MQM-178 Firejet target drones. The company’s Hivemind enables drones to operate in GPS-denied and communications-disrupted environments, which are critical capabilities for battlefields with electronic warfare.

Skydio is another company that has attracted significant financial attention, with over $700 million in funding. The U.S. Army awarded Skydio a five-year contract worth up to $99.8 million for its Short Range Reconnaissance program, with a base year value of $20.2 million. In February 2025, Skydio also secured a major Spanish military contract, with its systems adopted by 25 allied nations.

Ghost Robotics operates at smaller funding scales but maintains strong relationships with DARPA, NATO members, and U.S. military branches through proven operational deployments. The company’s quadrupedal platforms fill niche requirements, demonstrating how specialized capabilities can succeed in markets dominated by diversified defense primes. LIG Nex1, a South Korean aerospace and defense manufacturer, acquired Ghost Robotics in 2024 in a $240 million deal.

The humanoid robot startup Foundation raised $11 million in a pre-seed round in August 2024, with an additional raise in Q1 2025. Their total funding is now approximately $21 million. While Foundation’s funding is significantly smaller than that of its competitors, they are explicitly open to military applications and weaponization, while others are not.

Traditional defense contractors increasingly acquire robotics startups to accelerate capability development and access talent they cannot recruit through conventional hiring. Lockheed Martin, Northrop Grumman, and BAE Systems have purchased smaller firms with autonomous systems expertise, integrating their technologies into established platforms.

Crossover from logistics, agriculture, and manufacturing robotics into defense applications expands the investor base beyond traditional defense-focused venture capital. Firms developing autonomous vehicles for warehouse operations or agricultural harvesting discover that their core technologies transfer directly to military logistics and reconnaissance missions.

Economic & Industrial Impact

Defense robotics creates entirely new industrial subsectors where AI integration with mechanical systems demands capabilities that traditional defense manufacturers and software companies cannot independently provide.

As a result of growth in this area, supply chains for semiconductors, sensors, and actuators face unprecedented demand as autonomous systems proliferate across military and commercial markets. Specialized components like LIDAR sensors, computer vision processors, and lightweight actuators create bottlenecks where limited production capacity cannot satisfy increased requirements. These constraints favor nations with advanced semiconductor manufacturing and established supply relationships.

China’s dominance in rare earth elements and battery production provides strategic advantages in robotics manufacturing that parallel its position in commercial electronics. Attempts by the U.S. and European nations to reshore critical component production also face significant cost and capacity challenges given decades of industrial offshoring.

Dual-use spinoffs transform commercial markets as military-developed robotics technologies can be applied in construction, mining, and logistics (or the other way around). This technology transfer accelerates civilian robotics adoption while providing defense contractors with commercial revenue streams that reduce dependence on government procurement cycles.

Workforce implications transform defense industry employment patterns as militaries require fewer traditional soldiers but more roboticists, AI engineers, and autonomous systems operators. In addition, many of the deadliest jobs can be replaced. In Figure 12 below, you can see robots developed by an Australian company called Marathon Targets. They were created because “the Australian military observed that the first-time new recruits shoot live ammunition at actual hostile individuals is in combat, which is not exactly a good time to learn from mistakes.”

Figure 12. Strategy Business. Military training robots.

This transition creates friction as existing personnel lack skills, while recruitment targets younger workers comfortable with AI systems and remote warfare concepts. Training costs rise dramatically as soldiers must master both traditional combat skills and complex robotic systems operation, further increasing the desire for more autonomous systems.

The defense-industrial base is likely to contract in traditional manufacturing while expanding in software and AI development. Metal fabrication and mechanical assembly may decline in importance while cloud infrastructure, machine learning, and cybersecurity become strategic priorities. This shift will fundamentally alter where defense innovation happens. Established manufacturing regions that have dominated defense contracting will lose ground, while technology hubs in coastal cities will gain strategic importance as centers of AI talent and commercial software expertise.

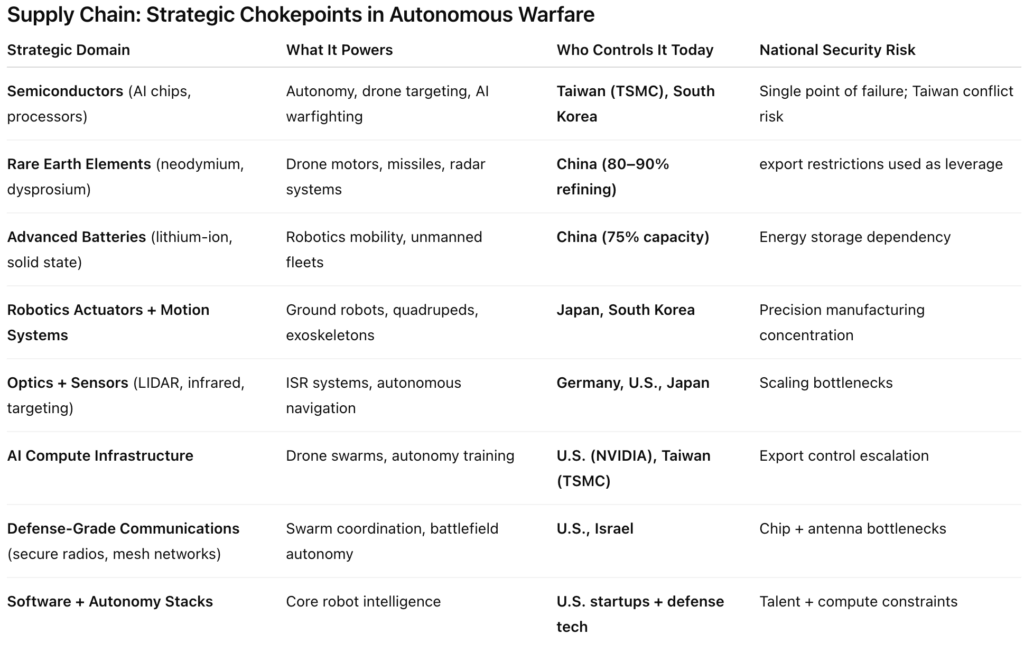

Supply Chains: The Industrial Front Line of Autonomous Warfare

The rise of AI-enabled robotics has revealed a strategic vulnerability that is now impossible for military planners and national governments to ignore: autonomous systems depend entirely on access to secure, resilient, and scalable supply chains. Unlike traditional weapon systems, which relied heavily on steel production and energy logistics, the next generation of defense capability depends on semiconductors, rare earth minerals, advanced optics, lithium batteries, and precision actuators. These specialized inputs are sourced from a highly concentrated global manufacturing base, creating new dependencies and leverage points that adversaries can exploit.

Autonomous drones, robotic ground vehicles, AI surveillance networks, and uncrewed naval systems cannot be produced or sustained without these components. This reality has shifted supply chains from an economic matter to a national security concern. The result is an emerging form of geo-industrial competition in which control over manufacturing capacity, raw materials, and critical technologies has become as strategically important as troop readiness or missile defense.

Global Chokepoints and Strategic Dependency

Modern defense systems are constrained by their supply chains. Taiwan Semiconductor Manufacturing Company (TSMC) produces over 60% of the world’s advanced logic chips and nearly 90% of the most sophisticated AI processors. China controls more than 80% of global rare earth mineral refining, a necessary process for producing permanent magnets used in missile guidance, drone motors, and satellite hardware. Japan and South Korea dominate the production of precision gears, actuators, and motion systems essential for robotics.

These bottlenecks represent single points of failure that hostile nations can weaponize. The economic tensions between the United States and China have already demonstrated the use of supply restrictions as strategic tools. U.S. export controls on high-performance AI chips were followed by China’s countermeasures limiting exports of gallium and germanium—materials essential for semiconductor production, radar systems, and military-grade electronics.

Supply Chain Militarization

As access to critical components becomes a dimension of strategic conflict, supply chains are undergoing militarization. National governments and defense ministries are taking direct action to secure industrial capacity. This includes stockpiling essential materials, nationalizing or co-investing in strategic production facilities, restricting foreign ownership of sensitive technologies, and accelerating reshoring of critical manufacturing.

The U.S. Department of Defense has invoked the Defense Production Act (DPA) to expand domestic production of rare earth magnets, missile components, and hypersonic systems. The CHIPS and Science Act allocates $280 billion to restore semiconductor fabrication inside U.S. borders. Meanwhile, Japan, South Korea, India, and the European Union are executing similar strategies under national security frameworks designed to reduce dependence on Chinese-controlled supply chains.

Industrial Realignment and Dual-Use Acceleration

Defense procurement patterns are also being reshaped by this supply chain competition. Long lead times and geopolitical risk have made governments favor partners capable of rapid production using dual-use commercial manufacturing—companies that serve both defense and industrial markets. Robotics firms like Anduril, Skydio, Ghost Robotics, and Shield AI have leveraged commercial supply chains to deliver autonomous platforms faster than legacy defense contractors.

This has triggered a broader industrial realignment:

- Reshoring and friend-shoring of semiconductor, robotics, and AI hardware production.

- Localizing battery and energy storage capacity to sustain electric and autonomous platforms.

- Vertical integration as defense programs secure end-to-end component control.

- Supply redundancy strategies, replacing cost efficiency with resilience as the primary priority.

Robotics firms are now designing platforms that reduce dependence on Chinese supply chains to qualify for NATO and U.S. defense contracts. As a result, supply chain positioning is now a competitive advantage in securing government procurement.

Outlook

Within three years, drone swarms will achieve operational status across multiple services as production scales. Small tactical drones will become standard platoon equipment throughout Western and Chinese forces. In Figure 13 below you can see a Statista forecast on the countries that are most likely to dominate drone warfare by 2028:

Figure 13. Statista. The Countries Set to Dominate Drone Warfare.

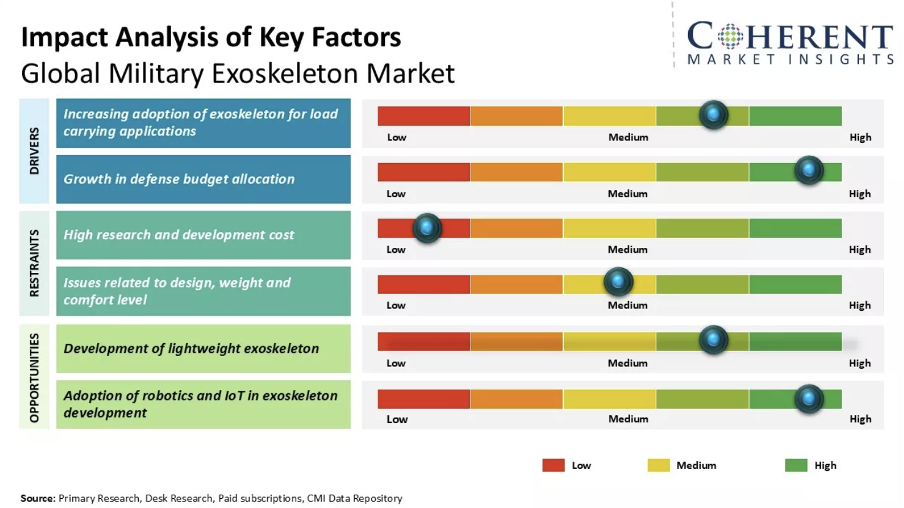

Exoskeletons will transition to limited deployments for specialized logistics units, with battery technology enabling 4–6-hour mission durations. Autonomous aerial vehicles will also increasingly handle logistics resupply in contested environments. Below in Figure 14 you can also see that defense budget allocations for exoskeletons are highly likely to increase, as well as the use of robotics and IoT in exoskeleton development:

Figure 14. Coherent Market Insights. Impact Analysis of Key Factors. Global Military Exoskeleton Market.

By five years, humanoid and quadrupedal robots will be integrated into battlefield support roles, including casualty evacuation and perimeter security. Ethical frameworks will have evolved with more operational experience.

Naval unmanned systems will also achieve decisive capabilities in mine countermeasures and undersea surveillance, with crewed vessels serving as command platforms coordinating swarms of autonomous vehicles. Counter-robotics systems will have matured, as nations increasingly develop capabilities to disrupt, deceive, and destroy adversary autonomous platforms through electronic warfare and directed energy weapons.

Within ten years, fully autonomous combat units will conduct independent operations in scenarios where communication proves impossible or cyber capabilities compromise control links. Space-based robotic defense will have achieved operational maturity with autonomous systems conducting satellite servicing and potential anti-satellite missions. Cyber-AI fusion operations will carry out digital and physical warfare simultaneously. The distinction between commercial and military robotics will have eroded, as dual-use technologies proliferate.

Conclusion

The use of defense robotics is the next wave of military revolution, fundamentally transforming warfare as mechanization did in the early 20th century. Robotics will reshape the economics of war through cost asymmetries where $400 drones destroy million-dollar tanks, enabling rapid development cycles that favor software innovation over traditional manufacturing. Second-tier powers will be able to field credible capabilities at a fraction of historical costs.

Strategic competition among the United States, China, and Russia is already accelerating deployment and will continue to do so, as each nation fears technological surprises that could prove decisive. This competition will continue to drive investment, talent acquisition, and doctrinal innovation at unprecedented speeds, with the global market expanding significantly.

For businesses, defense procurement will increasingly favor agile technology firms over traditional contractors, creating openings for new entrants. Supply chain positions in semiconductors, sensors, and specialized components will become increasingly strategically valuable. Companies controlling critical components like advanced processors, specialized sensors, or battery technologies will exercise disproportionate influence over military capability development. Commercialization of military-developed technologies also offers significant revenue opportunities for firms.

he convergence of artificial intelligence, autonomous systems, and distributed manufacturing will accelerate this shift, rewarding companies that can rapidly iterate and scale novel solutions. Organizations that secure early partnerships with defense establishments and build robust intellectual property portfolios will establish durable competitive advantages in this nascent but rapidly maturing sector. The next decade will determine which companies and nations position themselves advantageously as autonomous systems reshape defense industries and the global security landscape.