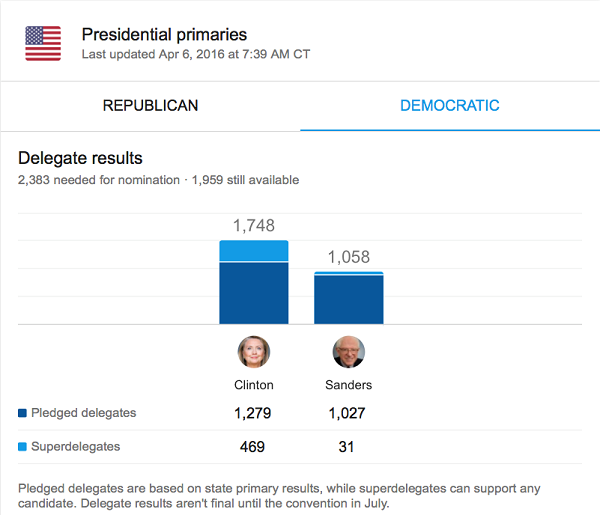

The race to the Democratic 2016 presidential nomination continues to grow more interesting with each passing primary, Wisconsin providing the latest intrigue. While once considered a “fringe” candidate, Sen. Bernie Sanders has now reeled off victories in 6 out of the last 7 primaries and is not likely to drop out of the race any time soon. Sanders’ 13-point margin of victory in the Badger state provides strong momentum heading into the April 19th New York state primary. Below is the current delegate count:

Source AP

Amid the media coverage of this particularly acrimonious primary season, substantive differences between the respective economic policies of the candidates are often blurred. In this article, we’ll review the top economic policies of Clinton and Sanders, and show how they are likely to impact growth and business.

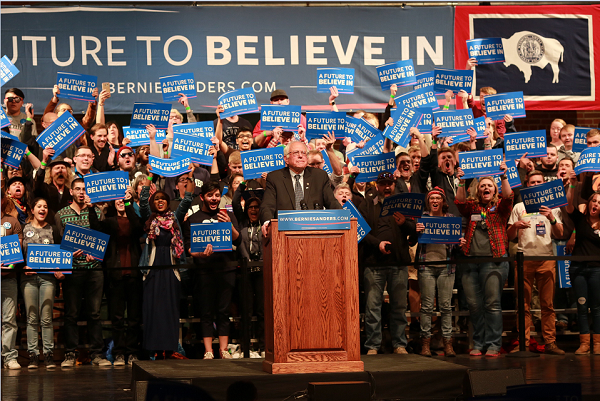

Sanders Economic Policies

(Source BernieSanders.com)

Under his current strategy, Sen. Sanders has large social spending plans that need to be funded as a precondition to economic growth. Unlike Republicans, Democrats generally focus on direct government spending to stimulate growth in GDP and jobs. Single-payer health care structure, free tuition for college and university students, expanding Social Security, and universal childcare and prekindergarten programs are all part of the Sanders’ plan. To accomplish these goals, he needs to make similarly large changes to the current corporate and business tax code, as well as to the current regulatory structure. Here are the major components of his revenue generating plans:

- Eliminate several business tax provisions involving oil, gas, and coal companies.

- End the deferral of income from controlled foreign subsidiaries and repatriate back to the U.S.

- Change several international tax rules to curb corporate inversions and limit use of the foreign tax credit. (Might be unnecessary now after US Treasury actions)

- Create a financial transactions tax on the value of stocks, bonds, derivatives, and other financial assets traded by U.S. persons. The rate of the tax would range from 0.005 percent to 0.5 percent, depending on the type of asset.

- Create a new 6.2 percent employer-side payroll tax on all wages and salaries.

- Create a 0.2 percent employer-side payroll tax to fund a new family and medical leave trust fund.

(Source Sander’s Tax and Economic Plans: a challenge for Texas)

Furthermore, Sanders has a five-year plan to spend $1 trillion on infrastructure, which he estimates would create 13 million jobs. On energy, he wants to move toward 100% clean sources for electricity, heating, and transportation; he claims this also would create millions of jobs while reducing the US dependence on foreign oil. Lastly, Sanders wants to end current free trade pacts like NAFTA, CAFTA and PNTR and is against the Trans Pacific Partnership pact currently under negotiation by the Obama administration.

Clinton Economic Policies

(Source HillaryClinton.com)

Like Sanders, Clinton has spending programs geared toward creating economic growth that need to be funded through changes in the current corporate and business tax code and regulatory structure. Unlike Sanders, Clinton is not as ambitious on her social spending plans and therefore doesn’t have the need to create as much new tax revenue as Sanders. Like Sanders, Clinton has an infrastructure-spending plan intended to create jobs and improve efficiency in the economy by upgrading the nation’s transportation networks. However, her plans are on a vastly smaller scale than Sanders’: she’s calling for a $275 billion plan coupled with a $25 billion infrastructure bank that has a reauthorization of the Build America Bond program. Clinton wants to fund additional research on clean energy and on various scientific and medical projects. . She provides new corporate tax credits to incentivize companies to provide employees with apprenticeships and profit sharing. On health care, Clinton supports extension of current ACA or Obamacare health insurance programs.

To pay for these programs, she makes these changes:

- A cap on itemized deductions, the Buffet Rule, and a 4 percent surtax on taxpayers with incomes over $5 million.

- Capital gains tax rate changes to incentivize longer holding periods by raising taxes on short-term cap gains and then reducing them with longer holding periods. Tax rate starts at 43.4% in year one and declines to 23.8% by year six.

- Raises taxes on high-income taxpayers, modifies taxation of multinational corporations, repeals fossil fuel tax incentives, and increases estate and gift taxes.

Finally on trade, Clinton differs from Sanders on tearing up current free trade agreements. She would keep them intact. However, she is against the current pending TPP.

What is likely outcome for policy?

Both candidates have appeal to Democratic voters on their key policy plans. Both candidates will likely face a Congress that is dominated by Republicans in one or both of the chambers. Therefore, both candidates will likely see challenges when and if they try to bring these ideas to fruition. This will translate into a need for compromise. Of the two candidates, the Clinton plans have the better likelihood of being enacted given the more incremental nature of the plans and the total lower costs of her plans versus the higher total costs of the Sanders’ plans.

The race is far from over, of course. It heads towards the New York primary and then on to additional primaries where Clinton leads in the polls. Therefore, it is also likely she will be the ultimate winner when the primary season ends in June. And despite the current acrimony between the two camps, Sanders will likely endorse Clinton after she wins the nomination. Like House of Cards, however, many surprises may remain before the race is finished that could upend this scenario.