By Andrew Busch and Leah Hamilton

In this paper, we’ll review what ESG is, why demand is rising and what some of the problems are for this type of investment.

Key Takeaway: ESG investing is growing rapidly and could be super-charged by a Biden administration and the new EU stimulus program.

Data Point: $48 trillion in wealth will be transferred from Baby Boomers to Millennials (heirs) over next 25 years according to Cerulli. Millennials care about ESG. (ThinkAdvisor)

One of the biggest investment surprises of 2020 is the flow of funds into ESG investments (environmental, social and governance). Last year, mutual funds and exchange-traded funds with a focus on sustainability raked in $20.6 billion of total new assets in 2019, according to Morningstar. (CNBC) In the first half of 2020, money continued to flow into ESG at a record pace of $15 billion, while $240 billion flowed out of equity mutual funds. (Barron’s) Financial Times notes that “while dedicated ESG funds remain a tiny part of the global stock market, the broader trend is towards all asset managers becoming more focused on these issues, whether their funds are explicitly ESG-oriented or not.” (Financial Times)

Morningstar research also explains that “the universe of sustainable funds continues to grow,” with the number of funds in their 2018 report increasing by almost 50% compared to 2017, a record number of new funds being launched, and an increasing number of existing funds adding ESG criteria to their prospectuses. (Morningstar) In 2019, these US funds grew to 303 from 270 in 2018 and only 111 in 2014. (Morningstar)

In addition, environmental and social issues have become increasing risk factors to particular industries. With regard to the environment, climate change can create increased risk for businesses from both regulatory (energy with potential carbon tax) and event (RE and CRE with flooding) standpoints. On social issues, the impact from the killing of George Floyd and the rise of BLM has challenged consumer product companies to rapidly adapt to address racism and clarify their policies on a wide range of topics from police reform to gender equality. Lastly, societal shifts are raising the value companies derive from intangible assets, such as brand value, employee engagement and employee satisfaction.

On ESG matters, the global investing environment is much further ahead than the US, but the US is also starting to catch on and shift towards ESG-focused investment models. One large blocker is that US regulators remain skeptical of ESG approaches, and the SEC has come out with numerous criticisms of ESG and how it is rated and measured. (SEC) On the other hand, the recent US Department of Labor proposed rule for ERISA appears to specifically target including ESG considerations in investments for pension funds.

What is ESG?

Let’s begin with an explanation of what ESG is. ESG stands for “Environmental, Social, and Governance.” It is a type of investing also known as Socially Responsible Investing, or “SRI.” ESG is sometimes classified as a type of SRI, and other times is viewed as adjacent to SRI in terms of investing approaches. The best SRI example is the divestment strategy used in South Africa to force the nation to end apartheid. The general idea behind ESG is that when an investment is being evaluated for success, it creates a framework to assess the investment’s impacts in a non-financial sphere. (Sustainable Finance) Namely, it assesses an investment’s performance on sustainable and ethical measures, as well as the environmental and social impact that the investment would have. (ADEC Innovations)

A related concept is that of the “triple bottom line,” which is a framework that suggests companies should focus on not just profits, but also social and environmental issues. The three bottom lines are: people, profits, and the planet. (Investopedia) By re-thinking the business proposition to include environmental, social and governance policies, this can help a company to be more sustainable in the long term, and therefore more financially stable and productive. (Bloomberg)

What is Behind the Demand for ESG?

There are a number of factors behind the demand and increase in ESG funds today. The concept of corporate social responsibility has grown over the past fifty years, and ESG began to take more of a front seat with the increasing awareness of SRI from the 1970s onwards. From the 1962 UN resolution 1761 to the publication of Cannibals with Forks: The Triple Bottom Line of 21st Century Business in 1997, the walls between typical finance and environmentally focused investing were beginning to shift. As GS puts it, “…ESG investing clearly meets a deeper need within the system. There is a clear and almost unquestioned assessment that something is missing within the regular investment process that represents a critical failure of modern finance and perhaps of capitalism itself.”

Internationally, milestones such as the Who Cares Wins report in 2005 continued to lay the foundations for ESG, focusing on the idea that integrating ESG issues “in investment is inevitably becoming an obligation for mainstream analysts and decisions makers” and that “the way that [ESG] issues are managed is part of companies’ overall management quality needed to compete successfully.” It also clearly noted that “companies that perform better with regard to these issues can increase shareholder value by, for example, properly managing risks, anticipating regulatory action or accessing new markets.” (IFC) This then resulted in the creation of the Principles for Responsible Investment, which propelled ESG approaches forward. (PRI)

In the US setting, ESG remained a bolt-on for many years. Companies looked at their carbon footprints and looked at the social contract and interactions with their customers and employees. However, they didn’t directly incorporate the concepts. In the last 20 years, ESG has begun to play a more central role in businesses in the US, and ESG frameworks are now viewed as a necessary or appropriate way to create a sustainable and profitable company. (Bloomberg)

While each ESG driver can cost a company something in terms of time, effort, or policy implementation, they also carry risks for the business if they are not carried out effectively. If businesses do not move with societal shifts, and work alongside issues that society is facing, they may fall behind or be severely impacted by events such as protests. Consumer brands have a higher risk of losing customers if they don’t adapt. (AdAge)

In addition, a number of core changes have happened in the US economic, environmental, and social surroundings that have driven the shift towards investors considering ESG approaches. COVID-19 and the protests over the killing of George Floyd have dramatically highlighted the impact ESG events can have on society and the value of companies. These kinds of events can be turned into profits if they are handled properly and worked with, rather than pushed against. (Bloomberg) In other words, there can be a dual, positive outcome for investors and society.

Environmental

From an environmental perspective, a large number of things are changing in the modern world. Companies are more focused on (and subject to more regulation of) pollution and resource usage, as well as greenhouse gas emissions and their effect on environmental issues such as deforestation. Other environmental issues include renewable energy, green electricity, plastic and water pollution, carbon offset policies, recycling approaches, and green infrastructure or transit. (Fool)

With increasing awareness of climate change issues, companies that are invested in coal power or fracking (for example) may be viewed less positively by investors. Company exposure to the production and use of GHG is becoming an investing theme creating alpha for fund managers. (Entelligent)

Social

There are a number of key issues that are driving a wide range of social changes in the US, including social inequality, race issues and racism, LGBTQ and identity politics, the “Me Too” movement, as well as economic movements such as Occupy Wall Street. The killing of George Floyd and the rise of the Black Lives Matter movement demonstrates the importance of social issues to companies’ values. These social movements impact play a role in which policies and considerations companies take into account in their day-to-day running, including how they treat their employees generally, employee relations, working conditions, and the impact that the business has on the community around them. As an example, studies show employee satisfaction and company performance are closely tied, effectively making the case for stockholders, management and markets to place a premium on higher ranking businesses.

For companies, this means that they may need to implement tougher sexual harassment and anti-discrimination policies, minimum wages, employee professional development and training programs, and take public stances on social justice efforts such as providing funds for lobbying. (Fool)

Governance

As governance drivers, businesses are also focusing on several areas, including increased diversity, better decision-making, and higher employee participation. This can also include tax and remuneration strategies and levels (such as ensuring that CEOs are not paid significantly more than employees), as well as political lobbying groups that are supported, corporate donations (which could also be considered as a social contribution), and issues to do with corporate corruption and bribery, as well as board-level diversity and structure.

What Does This Mean for Investors?

Investors must consider how ESG investments will perform and how to balance ESG approaches with financial gain. ESG considerations have been criticized for potentially negatively impacting the financial performance of an investment, as the investment rating is not solely based on financial considerations. However, according to a guide put forward by the Chartered Financial Analyst Institute this is a “lingering misperception.” Rather, a core idea of the benefit of ESG is that the consideration of ESG issues will ultimately lead to “more complete investment analyses and better-informed investment decisions,” which can lead to better financial outcomes in the long run. (CFA Institute) A recent study by Morningstar on ESG funds showed US large-cap blend equity funds that invest sustainably were the best performers, with more than 80 per cent of funds in this category beating their traditional peers over 10 years.

Investors are increasingly making decisions based on the ESG model or taking ESG factors into account. In terms of the potential growths for companies, the financial services industry has a big opportunity with ESG investing. (Bloomberg) Many large companies are also taking ESG considerations into account, which means that investors in many cases may not even be aware that their portfolios already have ESG built in. For example, Goldman Sachs has now instituted policies such as that it “will refuse to take a company public unless it has at least one woman or non-white board member.” (CBS)

In addition, large asset management groups such as Blackrock have now set ESG as their “new standard” for investing. (Blackrock) Blackrock have stated that their belief is that “sustainability-integrated portfolios can provide better risk-adjusted returns to investors … [and] that sustainable investment will be a critical foundation for client portfolios going forward.” In addition, they “intend to make sustainable funds the standard building blocks in [their] solutions wherever possible.” (Blackrock)

A survey conducted by Harvard Business Review of over “70 senior executives at 43 global institutional investing firms” found that “ESG was almost universally top of mind for these executives.” They noted that “ESG issues have become much more important for us as long-term investors,” and that “more than half of global asset owners are currently implementing or evaluating ESG considerations in their investment strategy.” (Harvard Business Review)

When these large players require ESG considerations as a foundation of their investment strategies, or shift in this direction more generally, investors should be prepared to see this approach becoming widespread in asset management spheres.

What are Examples of ESG Investments?

There are a number of different kinds of ESG investments that investors can participate in. For example, ESG mutual funds and ESG exchange-traded funds (ETFs) are widely available. ESG ETFs can be evaluated in the environmental, social, and governance dimensions using a number of different metrics.

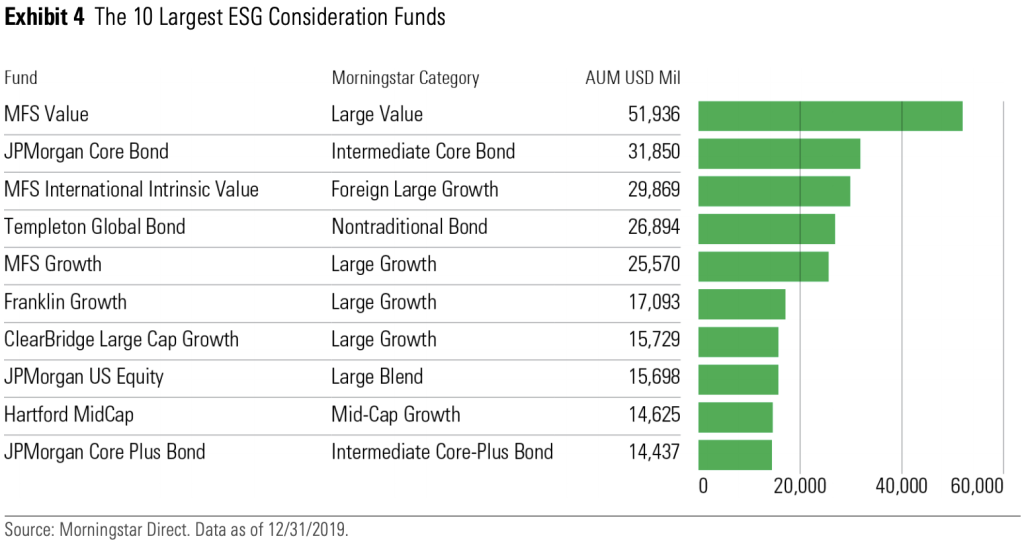

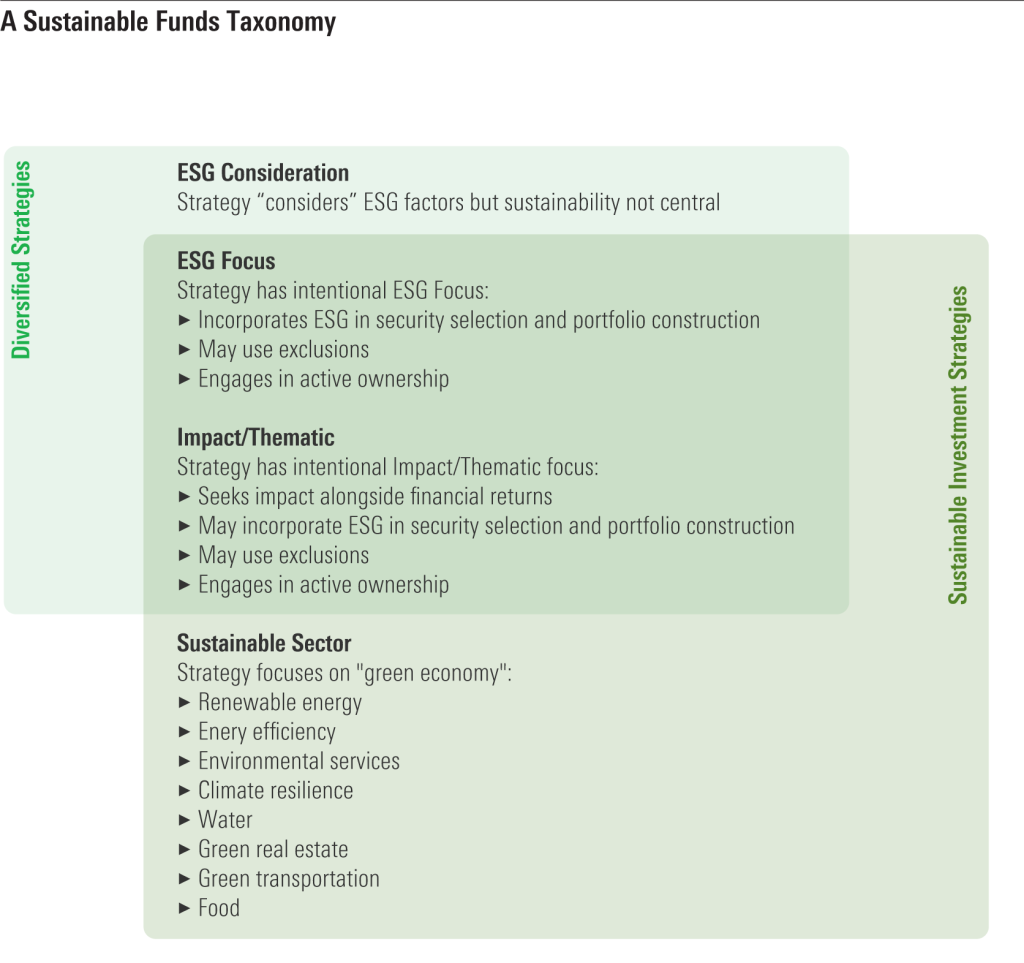

ETF Database notes that investors could consider “revenue exposure to environmental impact, severe environmental controversies, and revenue exposure to sustainable impact solutions.” Exposure to severe environmental controversies could include a metric such as “the percentage of an ETF’s market value exposed to companies facing one or more severe environmental controversies related to Energy and Climate Change, Land Use & Biodiversity, Toxic Spills & Releases, Water Stress or Operational Waste.” (ETF Database) ETFs can be evaluated by investors and experts on these different metrics and dimensions to determine scores for how good these ETFs are in terms of investment decisions. Below is an ESG taxonomy from Morningstar.

Another option for investors to consider is green bonds. Green bonds are a type of investment that is specifically intended to provide a positive impact in relation to environmental issues such as renewable energy, clean water and water management, or sustainable agriculture. (Climate Bonds) They might also focus on energy efficiency projects, sustainable forestry, or clean transport. (Investopedia) Green bonds have become increasingly popular in recent years, with issuance reaching record highs in 2019. (Investopedia) Green bonds can be verified by some external ratings organizations, such as Moody’s Investors Service, the Climate Bonds Initiative, various international firms,[1] and the Climate Bond Standard Board in the US. (Bloomberg) In addition, many issuers follow the Green Bond Principles, which have been endorsed by the International Capital Market Association. (Bloomberg)

Alongside green bonds, sustainable bonds are also available. These offer social incentives in addition to environmental gains, rather than a purely environmental focus. They also face some of the similar issues that green bonds do and are growing in popularity like other ESG investments. (Bloomberg)

What are the Challenges of ESG Investing?

Despite the potential benefits of ESG investing, there are also potential challenges. For instance, despite the fact that ESG has grown rapidly in the last few years, the SEC has noted concerns about how ESG is determined and measured and has “asked ESG providers for more information on how they define exactly what ESG is.” (CNBC)

While (as mentioned above) ETF Database and other organizations attempt to allocate dimensions and metrics to ESG investments, these metrics are widely variable and sometimes more qualitative than quantitative. This is not to say that the underlying qualitative concept or issue is not important, but rather that it is hard to allocate it a fair, accurate, and consistently measurable value that allows companies or investments to be compared with each other on a truly level playing field.

In the research paper “Aggregate Confusion: The Divergence of ESG Ratings”, the authors review six prominent rating agencies—namely, KLD (MSCI Stats), Sustainalytics, Vigeo Eiris (Moody’s), RobecoSAM (S&P Global), Asset4 (Refinitiv), and MSCI. They have three major findings.

- ESG performance is less likely to be reflected in corporate stock and bond prices, as investors face a challenge when trying to identify outperformers and laggards.

- The divergence hampers the ambition of companies to improve their ESG performance, because they receive mixed signals from rating agencies about which actions are expected and will be valued by the market.

- The divergence of ratings poses a challenge for empirical research, as using one rater versus another may alter a study’s results and conclusions.

The authors conclude that the ambiguity around ESG ratings represents a challenge for decision-makers trying to contribute to an environmentally sustainable and socially just economy. In addition, there remains a lack of globally accepted standards and accountability measures. With the increase in companies “greenwashing” their practices, many companies can make problematic decisions under the guise of ESG approaches. For example, Bloomberg notes that some Chinese issuers faced “criticism for using green bonds to finance coal-burning power plants” as they justified it by saying “the new facilities [were] cleaner than predecessors.” (Bloomberg) While these practices are slowly changing, a lack of clarity on what exactly “green” is, remains an issue.

Another issue arises in the decision-making sphere between shareholders and Boards. Boards have fiduciary duties to maximize profits for shareholders, however with an ESG mandate alongside that fiduciary duty, it creates greater discretion for Boards to make decisions that fit within that mandate as well. When the mandate is so broad and amorphous, this can in some cases allow unscrupulous or corrupt retroactive decision-making, such as a director making a decision that ultimately was against the shareholder’s interests, and later justifying it within ESG boundaries as an “ESG” decision (and thus supported by their pre-established mandate). The vagueness of ESG policies can allow these kinds of decisions to slip through, or at least reduce some level of Board accountability.

Regulation in the past for ESG in the US has been light, though with the expansion of ESG in recent years, legal experts have noted that the regulatory environment has now “shifted dramatically.” (IR Magazine) In mid-2019, the first congressional hearing on environmental, social and governance (ESG) issues took place, following “growing demand from investors for improved disclosure.” (Greenbiz)

What is the Regulatory Outlook and Opportunity?

Under the Trump administration, the SEC has raised significant skepticism over ESG investments, with SEC Commissioner Hester Peirce noting several issues in July 2019. First, she explained that the “E” “S” and “G” “tend to travel in a pack,” which can make it hard to determine reliable and accurate metrics for assessing performance, which makes it “difficult to figure out how to measure success or failure.” (SEC)

She also noted that the proliferation of standards organizations trying to rate and measure ESGs has led to a growing group of so-called “experts” on ESG issues. However, the issue is that “there are many different scorecards and standards out there, each of which embodies the maker’s judgments about any issues it chooses to classify as ESG,” and that even “putting aside the analysis that produces the final score, some ESG scores are grounded in inaccurate information.” (SEC) This inaccuracy stems from company surveys, machine-analyzed sustainability reports, and slight wording differences such as companies calling their ESG approach a “practice” rather than a “policy.” In addition, incomplete or weak disclosures can lead to poor ESG ratings, rather than actual poor policy or performance. (SEC)

Another issue that she raised was that “questions about what ESG means for returns are also gaining attention. … While ESG advocates can point to studies that certain ESG policies serve companies well, the amorphous nature of such policies makes it hard to generalize … [and] the ambiguity of ESG makes research inherently difficult.” This can make it hard to determine whether ESG investments are actually supportive of long-term shareholder value and positive returns (on both financial and ESG fronts). (SEC)

Finally, another issue is that the materiality of ESG as an asset class is difficult to prove. For ESG factors to be material, they must either have had an impact on either value gain or reducing costs. Due to difficulties in measuring and assessing ESG, even if a company is successful it is hard to determine how big of a role the ESG factors played in that success. (Robeco) ESG is challenging to investors and investment advisors due to the lack of hard metrics on strategies that include all three. Breaking out each component would likely provide better data and analysis rather than a blend or adding ESG as an overlay.

Underscoring the SEC regulatory skepticism, the US Department of Labor has proposed a new rule intended to provide clear regulatory guideposts for plan fiduciaries in light of recent trends involving environmental, social and governance (ESG) investing. “The proposal is designed, in part, to make clear that ERISA plan fiduciaries may not invest in ESG vehicles when they understand an underlying investment strategy of the vehicle is to subordinate return or increase risk for the purpose of non-financial objectives.”

The opportunity for a significant shift in regulatory policy and spending occurs under a Biden administration. As we’ve written before (Trump vs. Biden: Energy and Environment), Biden’s environmental policies will shift towards stronger actions to prevent climate change. The Biden-Sanders Unity Task Force Recommendations state that “climate change is a global emergency. We have no time to waste in taking action to protect Americans’ lives and futures.” The list of recommendations is extensive, but the major tenets are:

- Rejoin the Paris Climate Agreement.

- Commit to eliminating carbon pollution from power plants by 2035.

- Must achieve net-zero greenhouse gas emissions as soon as possible, and no later than 2050.

- Net-zero greenhouse gas emissions for all new buildings by 2030.

- Make investments to create millions of family-supporting and union jobs in clean energy generation, energy efficiency, clean transportation, advanced manufacturing, and sustainable agriculture across America.

A Biden administration is likely to result in greater regulatory support for ESG investment. However, the extent to which policy and frameworks will be put in place to alleviate the issues with ESG, is unclear.

Summary

Investors with over $80 trillion in combined assets have signed a commitment to integrate ESG information into their investment decisions under the UN PRI (Principles for Responsible Investment. PRI “works to understand the investment implications of environmental, social and governance (ESG) factors and to support its international network of investor signatories in incorporating these factors into their investment and ownership decisions.”

The focus on ESG has the potential to address large environmental and social problems facing citizens both within the US and globally while earning investors returns. Social equity and climate change mitigation are large shifts that many countries are trying to work towards, and the US is no exception (although a little slower off the mark). However, while ESG has potential, there are numerous problems with measuring these kinds of investments, as well as problems with oversight, buy-in from regulators and performing due diligence on all ESG investments. Yet, the prospect of a Biden administration coupled with the EU stimulus program would bring significant, positive momentum to the ESG investing outlook. This makes ESG one of the top themes to consider for investors.