The purpose of this article is to provide a comprehensive analysis of how the NCRF, in addition to the associated actions and announcements, could impact businesses across different sectors. Through a mix of theoretical frameworks and case studies, the article will offer nuanced insights into the challenges and opportunities presented by climate policies. The objective is to contribute to a deeper understanding that can guide both policy formulation and corporate strategy in the context of changing climate resilience.

The next sections will provide an overview of the NCRF and the benefits that a national framework can offer over existing independent resilience strategies. The paper will then delve into why it is important to study the framework’s impact on U.S. businesses through the opportunities and challenges that it can offer, how businesses in various sectors can potentially be impacted, followed by specific case studies of companies that benefited from or were challenged by the direction towards greater climate resilience.

Here are sector-specific sectors impacts:

– Real Estate: The NCRF will likely result in stronger building codes and more disclosures, affecting property demand and market valuations.

– Clean Energy: The framework is expected to provide business opportunities through the push for energy-efficient buildings and stronger power grids.

– Heavy Industries and Fossil-Fuel Sectors: These sectors might face challenges due to stricter disclosure requirements and transition to lower carbon footprints.

– Agricultural and Water Sectors: Expected to benefit from dedicated funding for climate resilience and conservation projects.

– Science and Technology: Opportunities for research and development, especially in climate data and risk models.

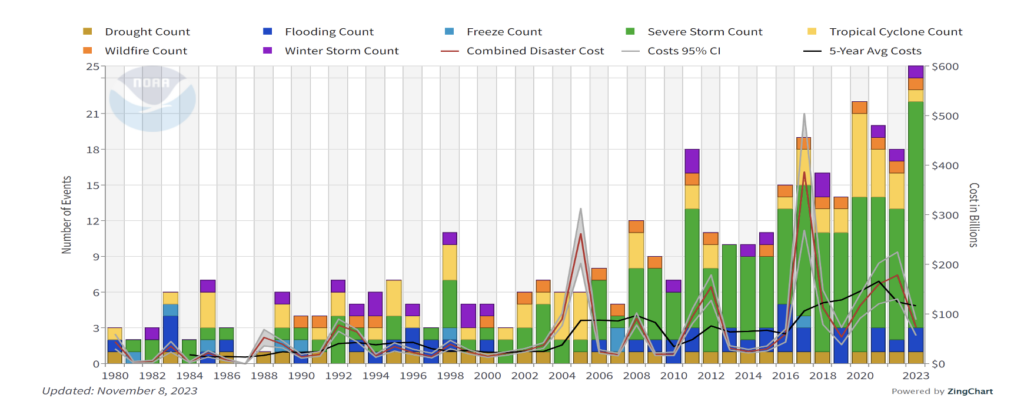

Top of FormAccording to the National Centers for Environmental Information, the annual number of climate disasters causing the U.S. at least $1 billion worth of damages has been increasing rapidly since 1980, totaling 373 events over the four decades. In 2023 alone, as of November 8, the country suffered from 25 billion-dollar climate disasters, including 19 severe storms, 2 flooding events, in addition to single events of droughts, cyclones, wildfires, and winter storms (Figure 1).

Figure 1 – U.S. Annual One-Billion Climate Events, 1980-2023

Source: National Centers for Environmental Information.

These disasters don’t just affect nature—they hurt businesses too. Studies show that when countries face big climate problems, companies there tend to make less money and have trouble borrowing money. Small businesses in high-risk sectors suffer the most.

Further reinforcing this concern, a paper by the International Monetary Fund, which studied a large panel dataset of more than 3.3 million companies across 24 countries from 1997 to 2019, found that companies operating in countries with higher climate change vulnerability or countries with lower capacity to adapt to climate change tended to suffer from relatively lower profitability and productivity, as well as face more obstacles in accessing debt financing. Those negative effects were particularly higher for smaller firms, especially those operating in high-risk sectors. Another study published in the Sustainability Journal, which investigated how climate risk (as measured by the Global Climate Risk Index) affected the financial performance and financial policy of corporates across 37 countries during 2017-2021, found that businesses in countries with higher climate risk tended to have lower return on tier assets and retained more long-term debt.

Surprisingly, despite the increasing challenges and losses, businesses, especially smaller ones, are still generally underprepared to the impact from climate change. According to the International Federation of Red Cross and Red Crescent Societies (IFRC) Framework for Climate Action Towards 2020, communities across the world need to be more resilient and better prepared for the current and future impacts of climate change, including through mobilizing and building the capacity of the private sector to lead on climate resilience action.

On 28 September 2023, the White House hosted the first-ever Summit on Building Climate Resilient Communities, with representatives from over 25 states, territories, and Tribal Nations, to emphasize the government’s commitment to accelerating and integrating solutions that both reduce greenhouse gas emissions and better manage climate risks. The Summit announced the release of the U.S. National Climate Resilience Framework (NCRF), in addition to several actions and dedicated funding resources to align and accelerate climate resilience action.

Although the U.S. already has existing resources and tools in place to build climate resilience across communities, the aim of the framework is to develop a more holistic, whole-government, and multi-agency program that would coordinate resources across agencies and guide climate resilience action across all stakeholders, including businesses.

Overview of U.S. National Climate Resilience Framework

In June 2023, President Biden pledged to organize the first White House Summit on Building Climate Resilient Communities. On September 28, the summit took place with representatives from more than 25 states, territories, and Tribal Nations. The goal was to highlight the government’s dedication and speed up actions to improve how we handle climate risks.

The summit witnessed the release of theU.S. National Climate Resilience Framework, providing guidance, direction, and proposed actions to accelerate and align climate resilience nationwide.

In parallel, the summit announced several new government actions and over $500 million worth of funding, through the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA),to support resilience efforts. Those included:

- $167.7 million from the Department of Energy (DOE) to strengthen the power grid.

- $12.7 million from the National Oceanic and Atmospheric Administration (NOAA) to help communities protect themselves, their infrastructure, and their economies against climate risks.

- $16 million from the Department of Labor (DOL) to improve job quality and increase the availability of good jobs in the critical sectors of climate resilience, care, and hospitality.

- $328 million from the Department of the Interior (DOI) to help make Western communities more resilient to drought.

- $3.9 million from NOAA to reduce drought and wildfire risks of frontline communities.

The NCRF supplements previous climate resilience efforts, aiming to expand and align climate resilience efforts and investments. The goal is to help with more work that expands and speeds up specific solutions driven by communities to improve resilience to climate change. This involves finding out the country’s main priorities, important values, and goals. The framework aims to both strengthen the leadership role of all stakeholders nationwide, including the private sector, as well as integrate the joint efforts of more than 15 federal departments and agencies to strengthen climate resilience. This includes solutions to maximize the impact of the more than $50 billion climate resilience and adaptation investments provided by the BIL and IRA.

In particular, the framework identifies common principles and specific actions to expand and accelerate progress towards six objectives:

- Embed climate resilience into planning and management.

- Increase the resilience of the built environment to both acute climate shocks and chronic stressors.

- Mobilize capital, investment, and innovation to advance climate resilience at scale.

- Equip communities with the information and resources needed to assess their climate risks and develop the climate resilience solutions most appropriate for them.

- Protect and sustainably manage lands and waters to enhance resilience, while providing numerous other benefits.

- Help communities become not only more resilient, but also more safe, healthy, equitable, and economically strong.

In essence, the U.S. National Climate Resilience Framework consolidates efforts for a unified response to climate challenges, aiding businesses and communities to combat climate risks effectively.

Why Does the U.S. Need a National Climate Resilience Framework?

We need a National Climate Resilience Framework to bring together and streamline the different climate tools spread across federal agencies. Before the NCFR, there were some resources and tools did exist for stakeholders and communities to assess their climate vulnerabilities and develop plans to increase resilience.

While these tools were helpful, they were spread out and complicated, making it hard for businesses and communities to use them effectively.

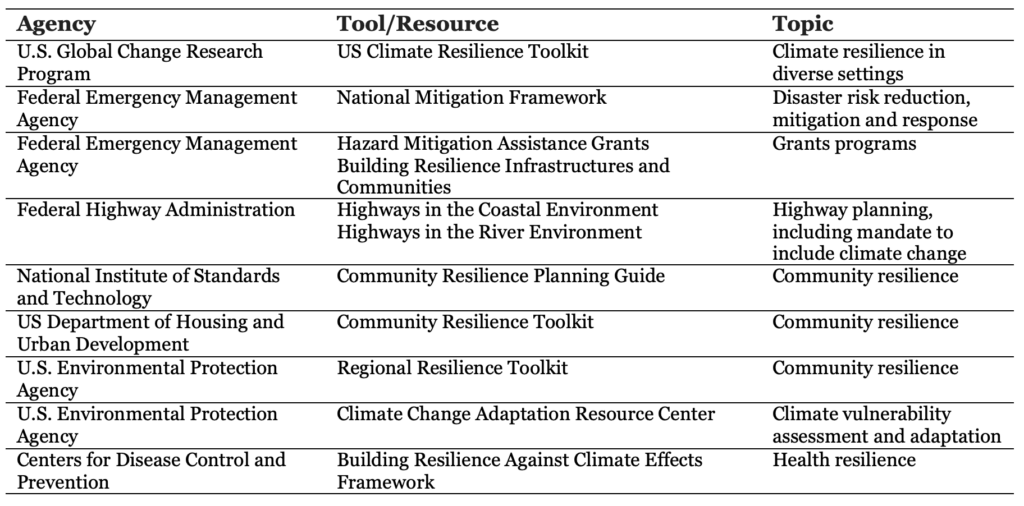

Take, for instance, Figure 2 below. It shows various tools on federal websites tackling specific aspects of climate resilience, but it’s all over the place and not helpful to create a coherent approach to help businesses or communities.

Figure 2 – Climate Resilience Tools on Federal Agencies’ Websites

Source: Deitchman et al. (2021).

Nevertheless, such tools have not been developed in the context of a whole-government or multi-agency program, but rather independently by the different agencies. According to a recent study in the Journal of Health Security, there is currently a lack of resource coordination across agencies, leaving it up to community planners to determine which tools will be most useful for their individual needs.

This scattered approach doesn’t work well for businesses. For example, the U.S. Climate Resilience Toolkit has around 500 tools from several government agencies, nongovernmental organizations (NGOs), and universities, making it overwhelming and confusing for planners trying to deal with climate risks. It gives them too many options and doesn’t help them pick what’s best for their needs.

Experts have thus increasingly called for a well-coordinated federal resilience policy that would (1) strategically and effectively align federal resources, including through the provision of information, services, incentives, funding, policies, and regulations, (2) provide leadership to address gaps and guide climate resilience action, (3) address inequalities among marginalized groups, and (3) catalyze climate resilience across all stakeholders, including local, tribal, and state governments, as well as the private sector.

It is crucial to note that prior to the release of the NCRF, positive steps towards resilience frameworks have been achieved at smaller scales, at the city (e.g., Charleston), region (e.g., Chicago area), and state (e.g., California and North Carolina) levels. Nonetheless, a White-House-led national strategy, such as the NCRF is important to rationalize the overall approach.

The NCRF becomes a one-stop solution. It offers a comprehensive government perspective, leveraging expertise from various stakeholders. It aligns climate resilience planning and efforts across federal, state, local, and tribal governments, NGOs, and businesses. Moreso, it streamlines funding, accurately measures community resilience through set metrics, prioritizes projects, and monitors progress towards nationwide resilience goals.

Side note: this doesn’t mean it’ll be perfect or have implementation issues. As most know, the federal government can make a mess of policy and regulations especially if they don’t understand the costs and secondary/tertiary impacts on communities, businesses and the economy.

Understanding the implications of the U.S. National Climate Resilience Framework (NCRF) on businesses is crucial due to the diverse array of opportunities and challenges it presents.

The private sector is a major stakeholder in national climate resilience action, and the NCRF is expected to provide various opportunities and challenges for its businesses. Businesses play a vital role in dealing with climate challenges. They can use available funds, explore new markets, and manage risks while safeguarding their workers and resources. Leading in climate action, they must also follow rules and meet investors’ interests.

Compliance with Policies, Regulations, and Investor Interest

The NCRF brings changes to how businesses follow rules, emphasizing handling climate issues. When businesses abide by these rules, they can adapt better to changing regulations. It’s not just about obeying the law; it can also positively impress investors concerned about sustainability and drive demand for the stock…if not too cost prohibitive.

Following the release of the NCRF, there will likely be more policies and regulations to protect communities, consumers, and investors. These might involve stricter building codes, worker rights, and requirements for disclosing climate risks.

For instance, on September 28, in conjunction with the release of the NCRF, the U.S. Environmental Protection Agency (EPA) announced its new Climate Enforcement and Compliance Strategy. This strategy aims at “directing all enforcement and compliance programs to address climate change, wherever appropriate, in every matter within their jurisdiction.” According to David M. Uhlmann, Assistant Administrator at EPA’s Office of Enforcement and Compliance Assurance, the strategy “reflects the urgency of holding polluters accountable for unlawful emissions that contribute to climate change, as well as the importance of incorporating climate resilience and adaptation requirements in our cases. These efforts are particularly necessary in overburdened and marginalized communities that are on the frontlines of the climate crisis.” This strategy builds on and expands EPA’s National Enforcement and Compliance Initiative, by requiring its enforcement and compliance programs to fairly and vigorously enforce the full array of current and future climate rules, while embracing, whenever possible, climate-related solutions for all entities, including businesses, to factor climate mitigation, adaptation, and resilience into their operations.

Moreover, in March 2022, the Securities and Exchange Commission released a proposal for new rule amendments. These rules would require publicly listed businesses to disclose, in periodic reports and registration statements, their climate-related risks, greenhouse gas emissions (as a commonly used metric for climate-risk exposure), in addition to certain climate-related financial statement metrics in their audited financial statements. The move came as an attempt to standardize climate disclosure among industries, to track, validate, and report risks, while providing more transparency for stakeholders, including investors and customers.

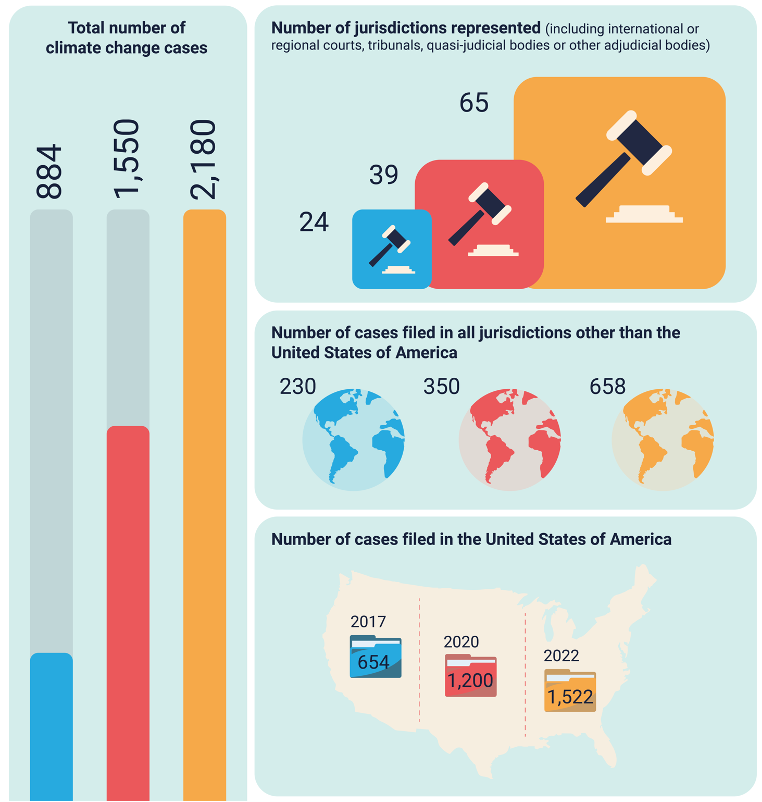

Evidence indeed shows that climate lawsuits are on the rise. The number of climate change litigations has more than doubled since 2017, reaching 2,180 cases by the end of 2022, of which 1,522 were in the U.S. Moving forward, the number of climate change lawsuits is expected to increase even further and more rapidly (Figure 3).

Figure 3 – Cumulative Number of Global Climate Change Litigation Cases, 2017-2022

Source: Sabin Center for Climate Change Law.

Such policies can provide both challenges and opportunities for different companies. Low-carbon-emitting companies, clean energy producers, insurance companies, software and data providers, and compliance and auditing service companies would all stand to gain from stricter disclosure rules. The same cannot be said, however, for companies with higher carbon footprints or real estate developers operating in high-risk zones. Fossil fuel and heavy manufacturing companies need a long time to reduce their carbon footprint. So, stricter rules about disclosure and compliance might impose losses for such businesses, at least in the short to medium run. Similarly, real estate developers owning properties in high-climate-risk zones might face property value losses or be left with stranded assets, especially as more transparent disclosures might drive buyers away and reduce the demand for their assets.

More Incentives and Awareness for Managing Climate Risks

The framework encourages businesses to handle climate risks better. When companies follow the NCRF’s resilient practices, they defend against problems from severe climate events. This readiness can mean lower insurance costs, fewer risks in operations, and stronger supply chains. By focusing on managing risks, the framework pushes businesses to take proactive steps, making their operations more resilient.

There are two types of climate risks, physical and transition risks. Physical risks represent the direct vulnerabilities associated resulting from climate events, including physical damages to capital, property, and assets, disruptions of supply chains, or hazards to workforce safety. Transition risks include the needed transition to other economic activities to mitigate or adapt to climate change.

Businesses are becoming more and more concerned about the safety risks to their physical assets, infrastructure, supply chains, and employees that are brought about by the increasing frequency of extreme weather events. Companies of different sizes and sectors are increasingly suffering from the impacts of climate change. This makes it critical for them to think about how climate issues might affect them now and in the future. To deal with this, they are putting more money into plans that help them adapt to and reduce these risks. This includes things like adding climate risks into their business plans, preparing for climate-related events when buying things, making their supply chains stronger against climate issues, teaching their workers how to manage risks better, investing in better data and ways to understand climate risks, and building stronger infrastructure to handle climate challenges.

The NCRF and its associated national announcements promise to provide dedicated financing for leaders, including businesses, who decide to improve their own resilience as well as provide solutions to improve that of their communities. Moreover, with a more coordinated national effort and the resilience framework in place, companies would have more incentives and pressures to raise both their adaptation and mitigation ambitions and efforts, as their failure to do so might also increase their reputation risks.

Catalyzing Opportunities for New markets and Innovations

Adopting the NCRF can help businesses discover new markets and innovations. Businesses that adjust their products, services, or methods for climate resilience can gain an edge. The framework pushes for innovation, creating new sustainable technologies, services, and business models. New markets for green energy, eco-friendly goods, and climate-ready solutions offer profitable chances for forward-looking businesses.

Climate change and the associated adaptation and resilience needs, especially when aligned at a national level, could provide opportunities and new market possibilities for businesses that lead sustainability efforts across different sectors. For example, developing and distributing innovative goods and services that can help the government, communities, and other businesses build resilience against climate risks might offer profitable opportunities, especially for market leaders.

Businesses can create better ways to predict climate risks, like using satellite technology or advanced modeling. They might also develop water-saving farming systems, strong seeds that can handle climate change, and alert systems for early warnings. Additionally, they can make houses that use less energy and create digital health tools to tackle health problems caused by climate change.

As the U.S. improves its plans for dealing with climate issues, it will highly value innovative solutions that both reduce climate problems and help us adapt to them. For example, companies can invest in more renewable energy in places where storms or sea erosion might threaten power from fossil fuels.

How Could the NCRF Affect Businesses in Different Sectors?

The U.S. National Climate Resilience Framework (NCRF) will greatly influence various industries, reshaping how they work to deal with climate risks and become more resilient. Here’s how this framework could affect different sectors:

The Real Estate Sector: Tax Credits, Building Codes, Zero Emissions, and More Disclosures

The government wants to make buildings stronger against climate problems. On 27 September 2023, one day before the release of the NCRF, the Department of Treasury issued a guidance note about expanding the 45L tax credit for energy-efficient homes.

The amendment provides between $500 and $5,000 in tax credit per home, to contractors who construct or substantially reconstruct and rehabilitate qualified new energy-efficient residential buildings, acquired during 2023-2032. To qualify, homes must meet the minimum requirements of the Energy Star or Zero Energy Ready Home programs. The 45L home credit can provide direct and indirect benefits for builders, developers, and contractors. By reducing their federal income tax liability, the home credit can reduce project costs, increase their cash flow, and boost their return on investment. Moreover, investing in more energy-efficient buildings, could help enhance their property attractiveness, rental rate, and resale value, as well as lower their maintenance costs and insurance premiums.

On the other hand, the NCRF might pose some regulatory implications to boost climate resilience in buildings and protect infrastructure, housing, and people. The framework will expand the adoption of the latest building and energy codes and high-performance standards. In 2022, the Administration released the National Initiative to Advance Building Codes to help state and local governments adopt the latest building codes and standards, to boost resilience against climate hazards such as wildfires, flooding, and hurricanes. Through its Building Codes Strategy, the Federal Emergency Management Agency (FEMA), uses mapping tools and works with all relevant federal agencies to track the adoption of the latest current building codes to promote natural hazard risk reduction. To expand this work, FEMA will issue a set of Federal best practices as a guide to incorporate the latest consensus-based codes and standards in federally funded buildings, to boost their climate resilience and reduce their emissions. According to FEMA, as of Q3 2023, only 31% of the natural-hazard-prone jurisdictions nationwide have adopted the latest hazard-resistant building codes. According to the NCRF, federal agencies can further encourage the adoption of such codes and standards across government and private buildings, through prioritizing existing funding and providing technical assistance.

In conjunction with the release of the NCRF, the White House also announced the forthcoming release of a standard national definition for Zero Emissions Buildings, expected in early 2024. While not mandatory for private businesses, but rather a voluntary aspirational guideline for the federal government, a standard definition at the government level would help establish a uniform understanding of what a Zero Emissions Building is and how to realistically achieve it. This could help accelerate the climate agenda towards more energy-efficient, low-emission, and climate-resilient buildings. Moreover, moving forward, homeowners would increasingly expect the real estate sector to play their part in the climate agenda. Greater awareness and understanding of the topic might indeed raise consumer demand for such buildings, driving developers towards such low-emission pathways.

In addition, with the increasing direction towards more transparency in disclosing climate risks, real estate businesses, especially those publicly listed, will most likely be significantly impacted. Such a trend would affect property demand, market valuations, rental rates, and insurance premiums, all of which would be adjusted to reflect climate risks and penalize non-complying assets. Moreover, the NCRF encourages government efforts and collaboration at all levels, to implement zoning reforms that would shift developments away from higher-risk and more into lower-risk areas, which would hold important implications for future real estate markets and their forward-looking planning and strategies.

The Clean Energy Sector: Greater Efficiency and Strengthening of the Power Grid

Clean and renewable energy sectors are probably among the top winners of national climate policies. For example, the market for energy efficiency in residential buildings is expected to grow at a cumulative annual rate of almost 6% up to 2030, leaving multiple business opportunities to be unlocked. The push for more energy-efficient and zero-emissions buildings under the NCRF would certainly provide even more business opportunities to the clean energy sector.

Major business solutions will be increasingly needed to upgrade the outdated grids and infrastructure, incorporate new technologies (e.g., resilient, cost-effective, and reliable rooftop solar panels and energy storage), and keep up with the shifting consumer preferences. All this places clean energy companies at the forefront of the climate agenda.

The NCRF emphasizes the importance of collaboration among federal agencies and state, local, tribal, and territorial governments to promote resilient energy solutions. In the future, this national direction could help energy companies grow and offer new solutions. They might make things more energy-efficient, stronger against climate issues, and provide backup energy for homes during blackouts.

On September 28, the DOE announced that 11 states, 2 territories, and 20 tribal nations would benefit from a combined total of $167.7 million, available through the BIL, as the eighth cohort of the Grid Resilience State and Tribal Formula Grants. The money helps businesses create projects that make the power grid stronger against extreme climate events. They aim to give clean, cheap, and dependable energy while helping the community the most.

Top of Form

Heavy Industries and Fossil-Fuel Sectors: High Costs of More Transparency and Disclosure

The NCRF could provide the highest challenges, through its direction towards stricter disclosure and compliance requirements, to manufacturing companies in high-emissions industries, such as steel, cement and chemical industries, as well as fossil-fuel energy producers. Such companies are not expected to decarbonize overnight, but rather through a slow and gradual process. Companies with high carbon footprints face big losses when their climate risks are clear in their financial statements. High-carbon companies could be penalized in two ways: by their investors and customers. Stricter disclosure rules with clear climate-risk info help investors make better climate-friendly investments, avoiding misleading green practices in ESG funds. This could increase the cost of capital for high-carbon industries as investors could relatively shy away from them. Similarly, as customers become more informed about the high climate risks associated with such companies, business and revenue might be lost.

In addition, greater disclosure and transparency might provide special challenges for manufacturing companies with particularly complicated and international supply chains. Producers might face trouble tracking reliability, carbon footprint, and climate risk across their supply chain. This might be encountered with short-term transition challenges as they are forced to shift to local suppliers, to comply with climate regulations or to reduce their level of climate risk.

Again, this is an area fraught with problems. Cement, fertilizer, plastics and steel are products requiring large amounts of energy and large amounts of fossil fuels to create. It would either mean significant increases in costs or a reduction in supply of these key economic factors. Energy companies may begin to shutdown coal and natural gas power generating plants due to increased costs and thereby destabilize the grid. This would be the exact opposite of what the intended policy would target.

Agricultural and Water Sectors: Investing in Conservation and Drought Resilience

Thanks to the farmwork’s dedicated funding, the agricultural water industries will particularly receive a boost to climate resiliency investments. The Administration will dedicate $328 million in funding opportunities, available through the BIL, for drought and climate resiliency projects.

This will provide opportunities for businesses in those sectors to come up with innovative solutions for water conservation, storage, and diversification of sources. In particular, funding opportunities will be offered for water recycling, desalination, and small water storage projects.

- Water Recycling and Reuse: $239 million for the planning, design and construction of projects to expand water supplies.

- Desalination and Construction: $64 million for the treatment of ocean or brackish water to develop and supplement municipal and irrigation water supplies.

- Small Water Storage: $25 million for small water storage projects (with a 200-30,000 acre-feet capacity), which increase surface water and groundwater storage in the 17 Western states, Hawaii, and Alaska.

In addition, on September 25 – three days before the release of the framework, the Department of Commerce and NOAA announced around $2 million in funding opportunities, to be provided through the IRA, for projects that enhance tribal drought resilience, by addressing current and future risks, across the West. Up to $700,000 will be disseminated in the first year and expended over three years in the form of cooperative agreements, while, depending on the requested budget, a total of 3-5 projects may be funded.

Moreover, the NCRF emphasizes the importance of increasing opportunities for public-private partnerships to enhance climate resilience through better conservation of lands and waters. All this can provide opportunities for private sector businesses operating in the agricultural and water sectors to advance innovative solutions that contribute to the national priorities of building climate resilience.

Science and Technology Sectors: More R&D and Better Climate Risk Data and Models

Companies in the fields of science, technology, and data could be amongst the highest winners of the climate resilience direction, as they are presented with immense opportunities to provide innovative solutions.

Alongside the NCRF, the Department of Energy (DOE) said on September 28 that it will give $5 million to create Climate Resilience Centers (CRCs) in five states: Arizona, California, Maryland, Michigan, and North Carolina. These centers will help local universities use DOE research to make communities stronger against climate challenges. The aim of the CRCs is to help future technicians, scientists, and engineers use DOE climate research and facilities to create practical local climate resilience solutions. A month later, in October, DOE announced further funding opportunities and a call for applications from the science community for more CRCs.

With the rising need to disclose and adapt to climate risks, companies and households will increasingly need better solutions to measure, track, and predict their current and future climate vulnerabilities. Reliable and accurate climate data that enable policymakers, individuals, and businesses to adequately assess their levels of risk is scarce. Investing in the development of high-quality climate-risk data for different sectors and assets is becoming essential for all stakeholders to make informed decisions and build resilience.

Technology companies are thus expected to face increasing demand and profitable opportunities for developing innovative services, such as the provision of innovative data (e.g., satellite data for sea level rise, soil quality, or coastal erosion), climate data analytics, climate modeling and predictions, numerical weather predictions, climate risk assessments, and policy simulations.

Case Studies: Businesses Benefiting from the Climate Resilience Revolution

ConEdison: Innovative Upgrades and Solutions for a More Resilient Energy Grid

Consolidated Edison, or ConEdison, one of the largest energy companies in the U.S., used the National Climate Resilience Framework (NCRF) to strengthen its energy grid against climate challenges.

In 2020, the company developed its Climate Change Implementation Plan, in collaboration with the New York State Public Service Commission, to identify, project, and address climate risks and integrate them into its business operations. The Plan, which provided a roadmap for climate resilience actions, was based on a comprehensive study in collaboration with Columbia University’s Lamont-Doherty Earth Observatory in 2019. The study evaluated the projected impacts of climate change and the needed infrastructure, design specifications, and procedures to prepare for such challenges.

Through its resilience journey, ConEdison has adopted a forward-looking approach to building its energy system resilience, leading for example, to less equipment damage, fewer outages, and faster recovery and repair rates during extreme weather events. Since 2012, the company has invested over $1 billion in storm hardening, which has contributed to avoiding close to 700 thousand customer interruptions.

Moreover, the company has invested $32 million in new technology over the past five years, to help its customers be prepared, stay informed, and report service problems during climate emergencies. For example, during the tropical Storm Isaias, which caused more than 300 thousand power outages, the company’s social media, texting, and email channels enabled the ongoing and efficient communication with customers. Furthermore, through its dedicated mobile application, ConEdison was able to receive close to 20 thousand damage reports from employees and contractors, which largely reduced outage durations and helped improve site safety. In addition, the company’s investment in smart meters helped provide an accurate near-real-time visibility of customer outages during Isais, contributing to a more efficient storm response and better allocation of resources to the most affected areas. This, for instance, resulted in the avoidance of around 4 thousand truck dispatches during the storm.

CoreLogic: Leading Solutions for Climate Risk Data and Analysis

CoreLogic is a leading technology company that provides data, information, analytics, platforms, and business intelligence services to stakeholders in the housing market, such as real estate developers, financial institutions, insurance carriers, government agencies and homeowners.

Climate Risk Analytics are among the solutions that CoreLogic provides to its clients. Through its expert team of field researchers, analysts, and data scientists, insightful intelligence, as well as its comprehensive and detailed prediction models, the company was able to take advantage of the increasing demand for more reliable climate data and foresight, by creating innovative products and leading new markets.

A particularly valuable solution that CoreLogic provides is advanced and evolved Catastrophe Modeling. Through simulating hundreds of thousands of years of possible weather events, CoreLogic is able to address the limitations of limited historical weather data and create adequate information to feed into its models. This enables the company to provide insights into future climate risks, including vulnerabilities and financial risks. Through its innovative models and data tools, CoreLogic is able to offer highly detailed property risk assessments, which combined with future climate risk probabilities, enable market participants to make better and informed decisions.

Case Studies: Businesses Challenged by the Climate Resilience Revolution

Suing Oil Companies for their Climate Change Impact and Deceptive Campaigns

In 2019, Massachusetts Attorney General Maura Healey sued ExxonMobil, on the claims that the oil company had been misleading its investors and consumers by failing to disclose climate change risks, engaging in greenwashing campaigns, and misrepresenting its products’ actual impact on climate change.

According to Healy, the company “is intentionally deceiving investors by hiding the systemic risk of climate change to the economy and to its own business… Exxon claims to investors that the company is prepared for the business consequences of climate change … but internal documents show that Exxon tells Massachusetts investors one thing and does another.”

Furthermore, the lawsuit claimed that Exxon had been tricking people with its ads. They talked about how great they were for the environment and how much they cared. But in reality, they didn’t invest much in those things or take many steps to reduce their pollution.

In response, Exxon has repeatedly attempted to dismiss the lawsuit, with its CEO, Darren Woods, arguing that its public statements on climate “are and have always been truthful” and that the company has always disclosed its actual climate risks and devoted significant resources to tackling them.

While still in trial, the latest twists saw the Massachusetts Supreme Judicial Court declining ExxonMobil’s attempt to dismiss the lawsuit in May 2022, on the claims that a state law shielded it from the allegations.

The Massachusetts-Exxon case is not the sole lawsuit against oil companies for climate damages and deception of consumers and investors. In 2020, Minnesota Attorney General Keith Ellison sued the American Petroleum Institute, ExxonMobil and three other companies owned by the Koch brothers, claiming that the oil giants have caused the climate change crisis through their “campaign of deception” and by downplaying their climate risks. Following a lost appeal to the Eighth U.S. Circuit Court, the oil companies asked to move the case to the federal court, arguing that the matter goes beyond the limits of state law. Now, the case is pending the decision of the U.S. Supreme Court to accept or decline the appeal.

In a most recent case in September 2023, the California Attorney General filed a lawsuit against 13 fossil fuel companies, including ExxonMobil, and the American Petroleum Institute, accusing them of being “substantially responsible” for causing and accelerating climate change, while “knowingly” concealing and misrepresenting the negative impacts of their products’ dangers, engaging in greenwashing activities, and advertising for false climate action, which had all deceived consumers and delayed the necessary societal response to reduce global warming.

Suing Developers for Negligence and Failure to Disclose Flooding Risk

Following the widespread flooding from Hurricane Harvey, many homeowners in the affected areas filed lawsuits against developers and engineers, for claims of negligence and failure to transparently disclose the high flooding risk.

In 2018, almost 500 residents in Houston’s Woodlands area sued the Woodlands Land Development Company, Howards Hughes Corp., and LJA Engineering Inc., some of the largest developers in the area, accusing them of negligence and deceptive trade practices, and requesting more than $1 million in compensation.

The lawsuit claimed that despite the historical decades of flooding from the nearby Spring Creek, the companies allowed inadequate home elevations in the Village of Creekside Park, Timarron and Timarron Lakes areas, and that they knew of the flooding risk but failed to disclose it at sale. According to one of the homeowners filing the lawsuit, “I picked this community out of several others that I considered because it’s supposed to be safe. As far as I know, they told me it wasn’t in a flood zone area… that was the one thing I asked. They said, ‘Oh no, you’re not in a flood zone area. You’re all right.”

In a similar case, the Harris County court witnessed more than 400 residents in Sugar Land pursuing legal action against the Johnson Development Corp., Riverstone Homeowners Association Inc., and Levee Management Services, following Hurricane Harvey, for failing to disclose that their homes in the Riverstone subdivision bore an “extreme risk of flooding.” While the development area was “originally designated as a flood zone and planned for recreational use,” according to the residents, the developer supposedly “removed it from a flood plain despite (its) knowledge of the low elevation and considerable flood risk.”

Although several such cases have been dismissed by the courts for lack of jurisdiction, with the increasing direction for disclosure and its expected acceleration following the NCRF, we expect to see increasingly similar lawsuits being filed in the future.

Despite initial hurdles, the NCRF’s promise of resilience in the face of climate change could provide a beacon of hope for businesses and create more long term certainty. It’s a roadmap leading towards sustainability, urging companies to adapt and innovate. This paper vividly showcases success stories of companies embracing climate resilience, painting a picture of ConEdison and CoreLogic as trailblazers in navigating these challenges.

Ultimately, the success of the NCRF hinges on collective action—a symphony composed by governments, businesses, and stakeholders working towards a common goal of creating a more resilient future as our climate becomes more volatile.