Since June 2015, the state of Illinois has operated without a budget. Illinois is the lowest rated state in the nation and its bonds pay +2.5% interest rate points above the average AAA rated municipal bond. Currently, the government has accumulated $7.5 billion in unpaid bills, a figure that the Illinois Comptroller estimates will soon grow to $10 billion. . What is more daunting, the state has an estimated +$111 billion of unfunded pension liabilities. As a lawyer would say, these are the facts and they are not in dispute.

What is in dispute is how to deal with the budget crisis facing the state. The good news is that progress is being made. The bad news is that the major players in this drama are still far apart. Let’s break down what’s been happening and where I think we’ll end up.

How We Got Here

The Illinois budget crisis and its related pension funding crisis did not start in 2016 or even when Gov. Bruce Rauner was elected in 2014. The problem started in 1974 when the constitution was changed to disallow pensions from being “diminished or impaired.” In 2015, the Illinois Supreme Court ruled against previous Governor Pat Quinn’s pension reform law that would have stopped automatic, compounded yearly cost-of-living increases for retirees, extended retirement ages for current state workers, and limited the amount of salary used to calculate pension benefits. (Chi Trib)

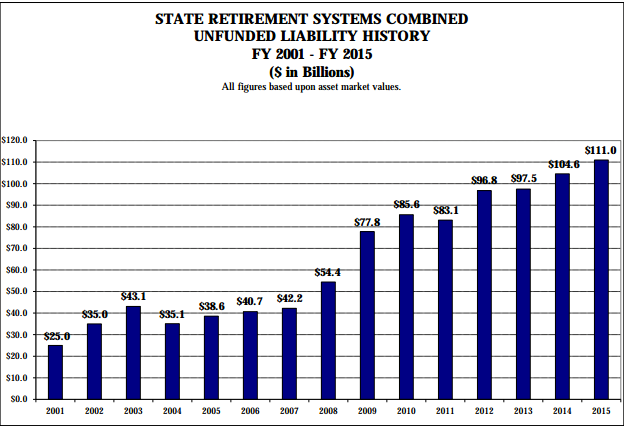

The chart below shows the combined Illinois state unfunded pension liability history. It shows the climb from $25 billion in 2001 to $111 billion in 2015. The 2008 financial crisis substantially accelerated the growth trend. The combined 5 pensions systems are currently funded at an average of only 41.9%.

Source: Illinois Commission on Government Forecasting and Accountability

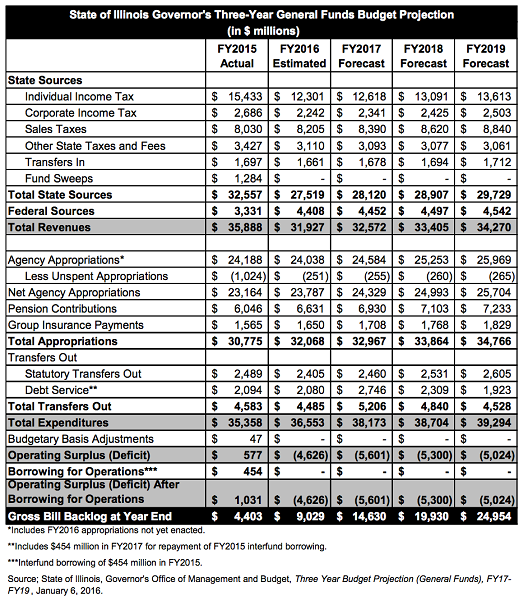

The next graphic is disquieting. First, the operating deficit or budget gap under FY2016 is $4.626 billion. Next, the 2016 combined pension contribution ($6.631billion) and the debt service ($2.080 billion) equal 27.3% of state revenues. Lastly, the unpaid bill backlog grows from $9.029 in 2016 billion to $24.954 billion FY2019. Unlike the federal government, states are prohibited from running fiscal deficits.

Where do the negotiations stand?

There are two sides to this budget standoff. On the Republican side, Gov. Bruce Rauner has stated that he wants his reform plan to be enacted as part of the budget deal. Rauner’s reforms would include workers’ compensation, a property tax freeze and other items. Rauner has indicated that he is willing to raise taxes as part of any deal to assist with balancing the budget. On the Democrat side, House Speaker Mike Madigan has stated that he will not include any part of Rauner’s reform plan in a budget deal. Therefore, the math is pretty simple: no deal.

Yet, there have been recent breakthroughs to provide $600 million to partially fund state colleges and $700 million to partially fund social service programs. There is some hope that this represents the beginning a trust building process that will eventually lead to a larger budget deal. Currently, there is a coalition made up of appropriation leaders from both parties and from both chambers that is focusing on such a compromise. The Budgeteer Group is meeting in private and reportedly making progress. (Politico) The four legislative leaders in both chambers and the governor’s office handpicked the abovementioned coalition, with an eye toward achieving a workable compromise.

Where and when will this end?

The timing of a deal is difficult to predict, but an outline is clearly being formulated. This framework will likely cover both FY2016 and FY2017 for a balanced budget for the fiscal year beginning July 1st.

According the Herald & Review, here are some likely components:

$5.4 billion in new revenue from:

- Raising personal income tax rate from 3.75 percent to 4.85 percent

- Expanding the sales tax to some services

$2.4 billion in savings from:

- $400 million reduction in Medicaid spending

- $450 million from letting the state off the hook for repaying money borrowed from special funds to plug holes in last year’s budget

- $750 million from pension changes Rauner has proposed.

The members of the committee state they are merely providing what the leaders have asked them to present and make no guarantee of passing a compromise.

The most likely scenario for when a deal might be struck would be after the November elections as this would take some of the pressure off both sides to compromise. Sadly, the pressure will not be off from the ratings agencies as they consider future downgrades, or for that matter off vendors expecting to get paid by the state.