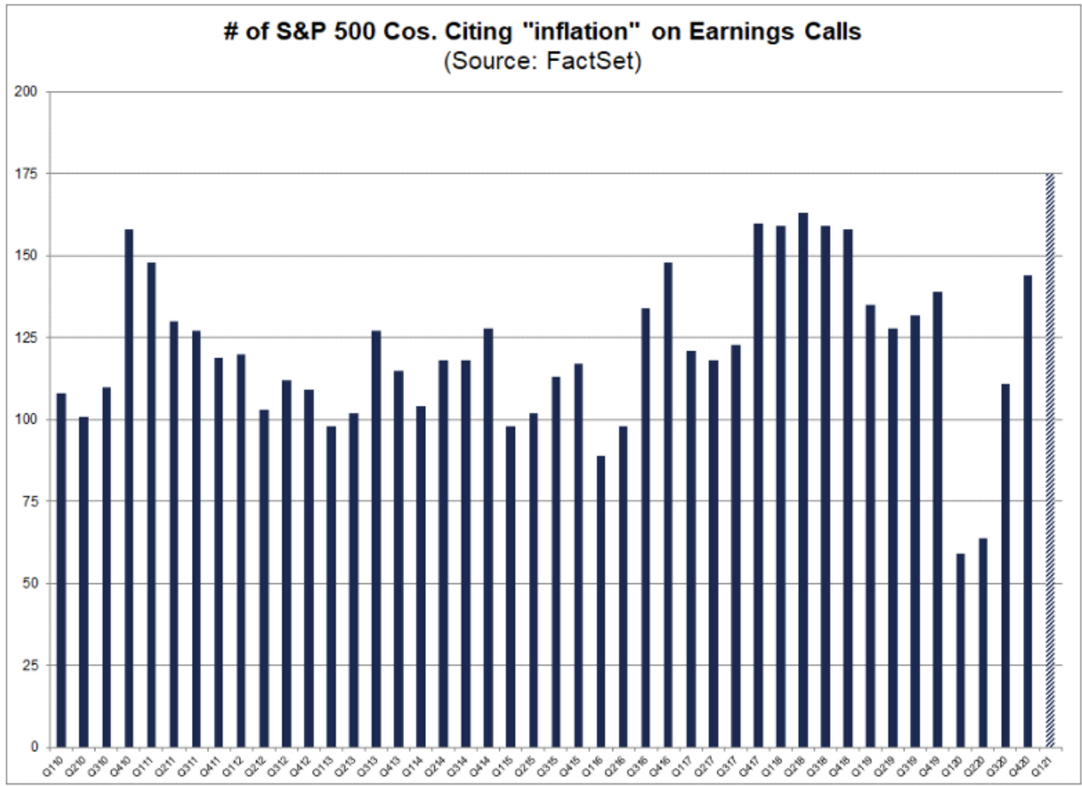

The inflation story keeps getting legs as more and more companies are citing inflation concerns in their investor calls and interviews. As a matter of fact, The word “inflation” is being mentioned in post-earnings conference calls by the most companies in at least 11 years, enough to set a fresh record, according to research provided by FactSet.

As an example, the CFO of retail giant Costco Richard Galanti said this on the company’s latest earnings call:

“Chips shortages are impacting many items from an inflation standpoint, some items more than others. And with regard to containers and shipping, transportation costs have increased as well. This will continue — the feeling is that this will continue for the most part of this calendar year.”

“We’ve had a lot of questions about inflation over the past few months. There have been and are a variety of inflationary pressures that we and others are seeing. Inflationary factors abound. These include higher labor costs, higher freight costs, higher transportation demand, along with the container shortage and port delays, increased demand in various product categories, various shortages of everything from chips to oils and chemical supplies by facilities hit by the Gulf freeze and storms and, in some cases, higher commodity prices.”

Costco is not the only company worried about inflation and some are taking action with Whirlpool, P&G, Reynolds, Hormel and General Mills all stating they would raise prices.

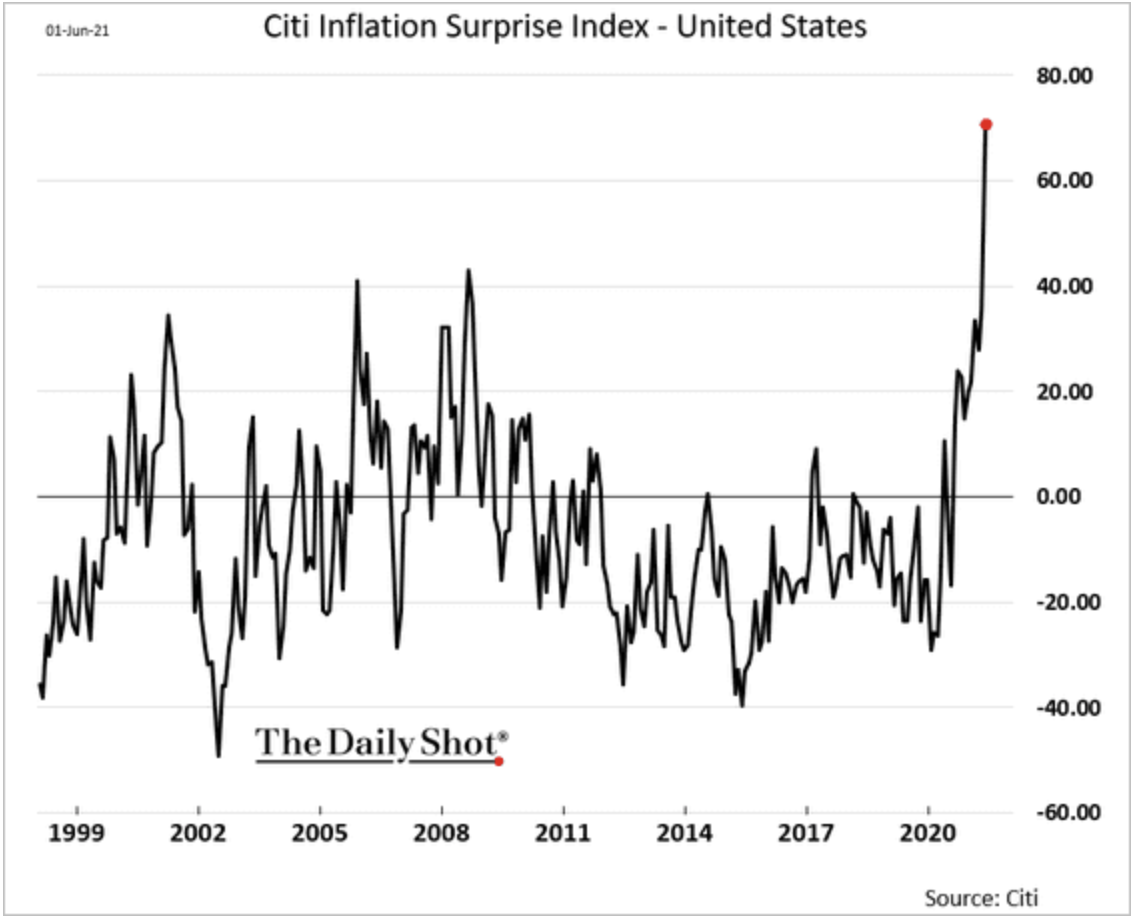

Over the last month, we’ve had significant shocks to the upside for inflation with CPI rising 4.2% and core PCE (Fed’s fav inflation gauge) rising 3.2%. The Citi Inflation Surprise Index shows the dramatic rise in shock inflation announcements. It’s significantly higher than past inflation surprises over the last 20+ years.

Until this week, the Fed has been toeing the company line that inflation will be transitory and no action needs to be taken. Yet, the central bank took its first steps towards a taper. On Wednesday, they announced plans to begin selling the corporate bonds and fixed income ETFs accumulated under the pandemic response program called Secondary Market Corporate Credit Facility (SMCCF), a temporary emergency lending facility that closed on December 31st, 2020. The portfolio is small compared to the $120B a month the Fed is buying of US Treasury securities and MBS. But they have to start the process sometime and now appears to be the time.

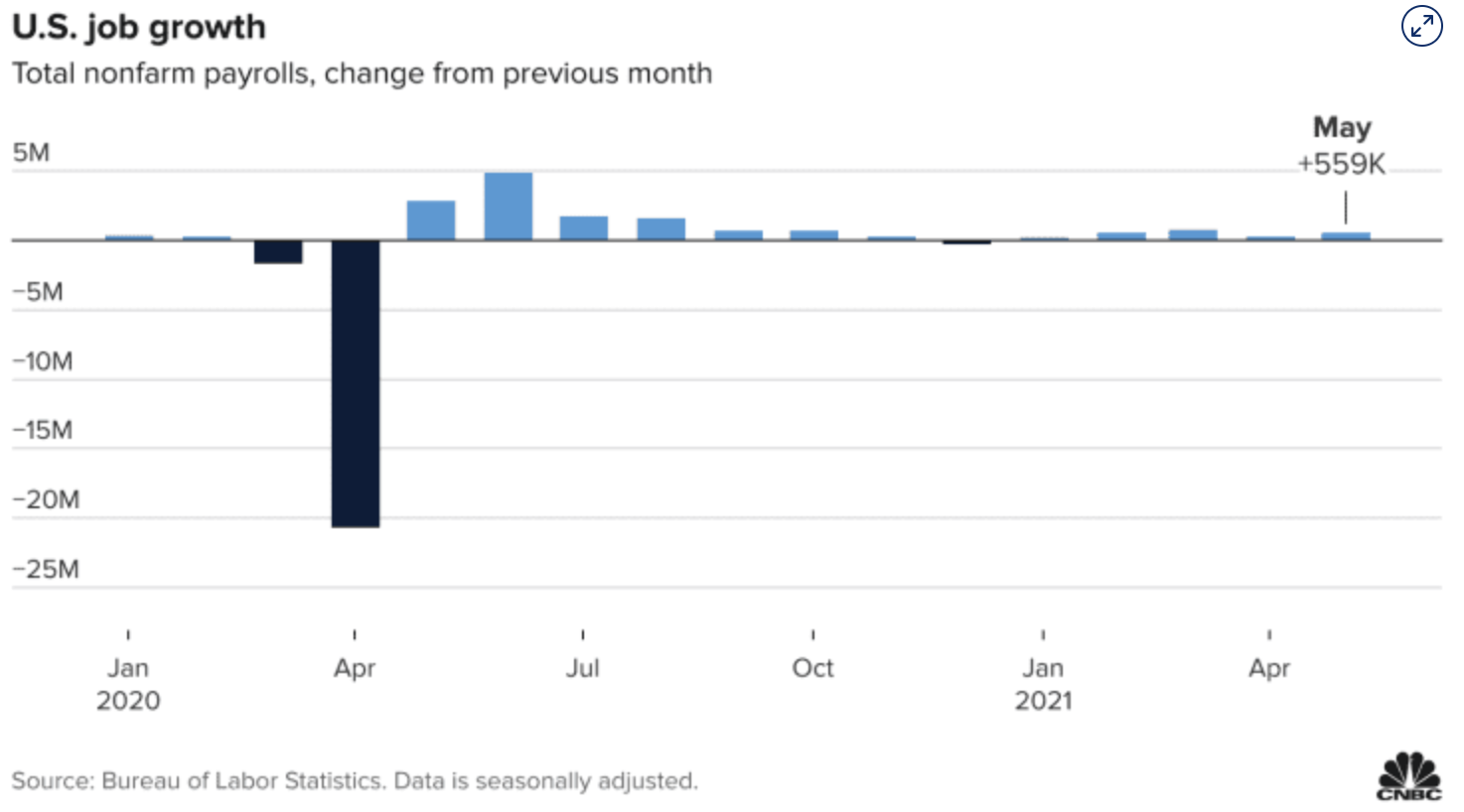

Besides the ultra-easy monetary policy, the other driver of inflation is fiscal policy as the economy reopens. Quick reminder, there has been over $12.4T worth of stimulus provided by the government to stimulate growth. The economy is now just receiving the $1.9T from ARAP enacted earlier this year with $350B flowing out to states and local governments. It has been successful driving unemployment down, GDP up (6.2%) and inflation up. Today’s job numbers show sizable gains emblematic of the success, but maybe a bit below outsized expectations.

And this is beginning to change the conversation on the need for additional stimulus. Cracks are already showing in the Biden administration efforts to pass both the American Jobs Plan (AJP) and the American Family Plan (AFP). It’s not helping that the Senate parliamentarian essentially said Democrats could use only 1 budget reconciliation bill limiting their ability to bring multiple stimulus bills without Republican support.

But a key House Democrat Committee chair wrote a letter to President Biden asking him to drop his proposal on a capital gains step-up basis. This is a critical funding component for AFP and a favorite of progressives.

Both the continuation of the Fed’s ultra-easy monetary policy and the momentum for additional fiscal stimulus appear to be headed for a slowdown. Inflation is clearly stating this stimulus needs to end now before it creates its own momentum.