Quick Intro

The passage of the massive, and erroneously named, Inflation Reduction Act (IRA) is a milestone in the US fight against climate change. The stunning change in policy direction by Sen. (D, WV) Joe Manchin is indicative of the country’s shift in demand for action. Since the 1970s, economists have been calling for action on GHG emissions to raise the cost by taxing it and thereby, reducing the amount produced. This would be the simplest and most effective solution. Sadly, this is not the bill that was passed.

The IRA is chock full of subsidies to incent companies to reduce GHG emissions and to produce new technologies from batteries to carbon capture. In the research below, we detail the provisions.

Background

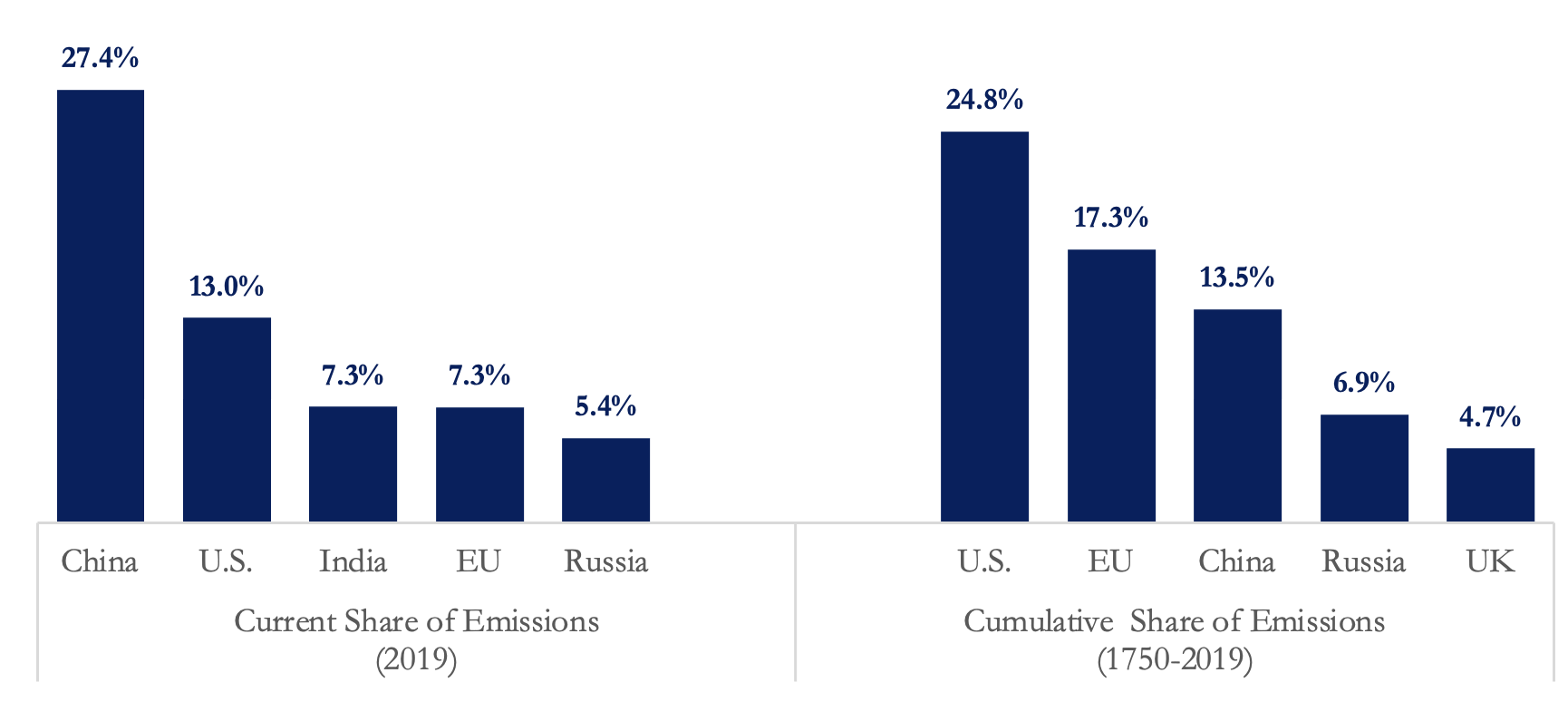

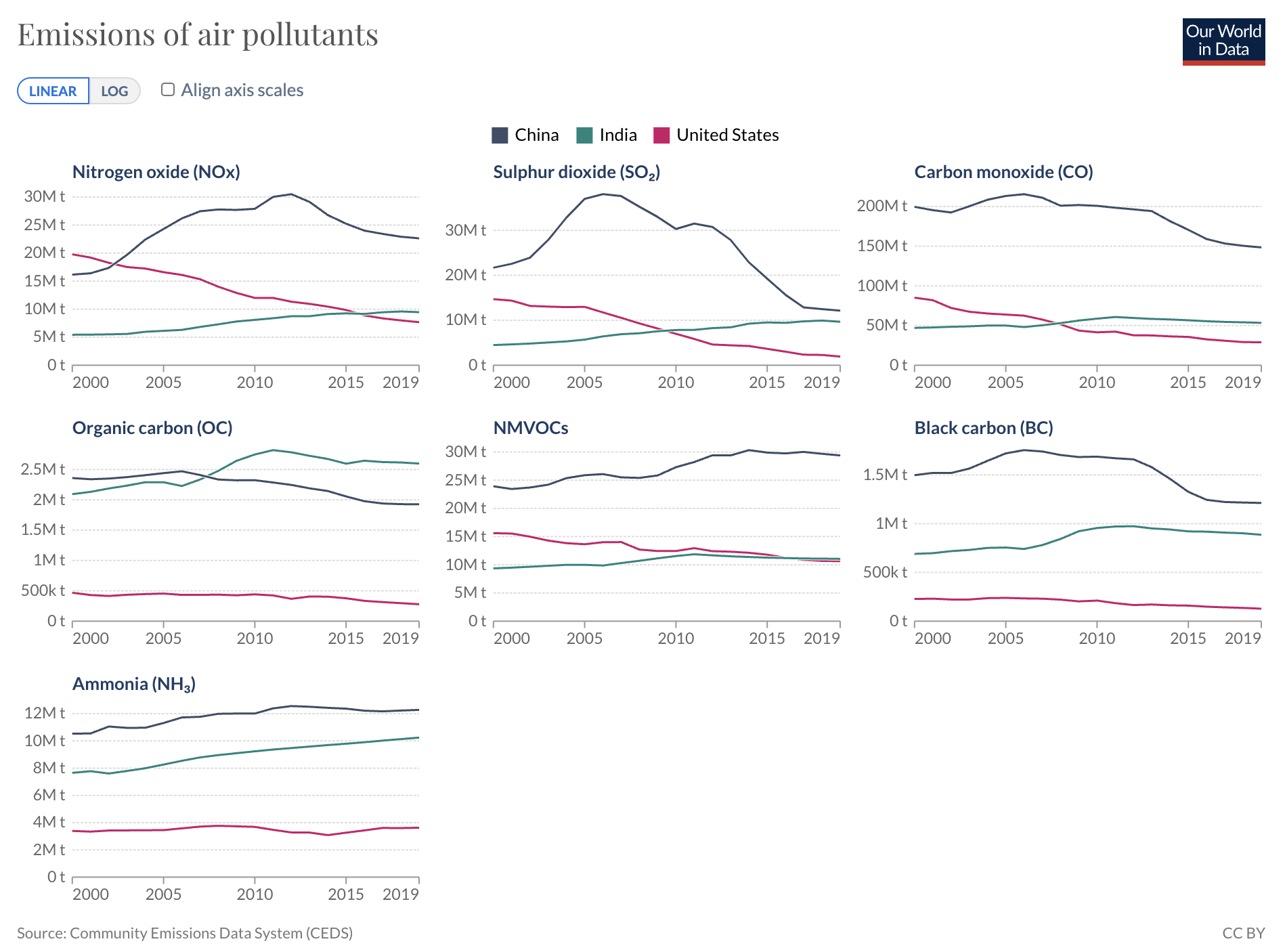

Despite the Glasgow Climate Pact, greenhouse gas (GHG) emissions continue to increase worldwide as the global economy recovers from COVID shutdowns. China is the largest producer of GHG, more than double the next largest. . Figure 1 below shows the Top-5 countries by current emissions in 2019 and cumulative emissions over the last three centuries. While historically the US is the largest contributor, the rise of China and India since 2000 have made the largest impact of rising GHG levels. Figure 2 shows the dramatic increases in a range of air pollutants.

The rise in GHG emissions, and especially in carbon dioxide (CO2) emissions, is deemed to be the main driver of the rise in global temperatures compared to the pre-industrial era, also known as climate change. We have covered in previous articles how climate change is causing weather havoc all over the world, with the increased rates and intensities of wildfires, droughts, storms, and floods. Less than 10 days ago, Pakistan experienced one of the most devastating floods in modern history, leaving more than a third of the country underwater, while damaging houses, roads, and crops, and killing thousands of lives.

Figure 1 – Top-5 Countries by Current and Cumulative GHG Emissions

Source: World Bank’s World Development Indicators and Our World in Data.

Figure 2 Emissions of Air Pollutants Since 2000

The U.S. is not immune either to the negative impacts of climate change. We’ve covered in a previous article how the American Southwest is suffering from a devastating megadrought situation, experiencing its driest weather in at least 1200 years, which is largely impacting agricultural productivity, killing livestock, and hindering industries. Other climate impacts such as unpredictable storms, hurricanes, and floods have also affected industries and households in several U.S. territories. The recent heat wave in California nearly caused rolling blackouts due to soaring electricity demand.

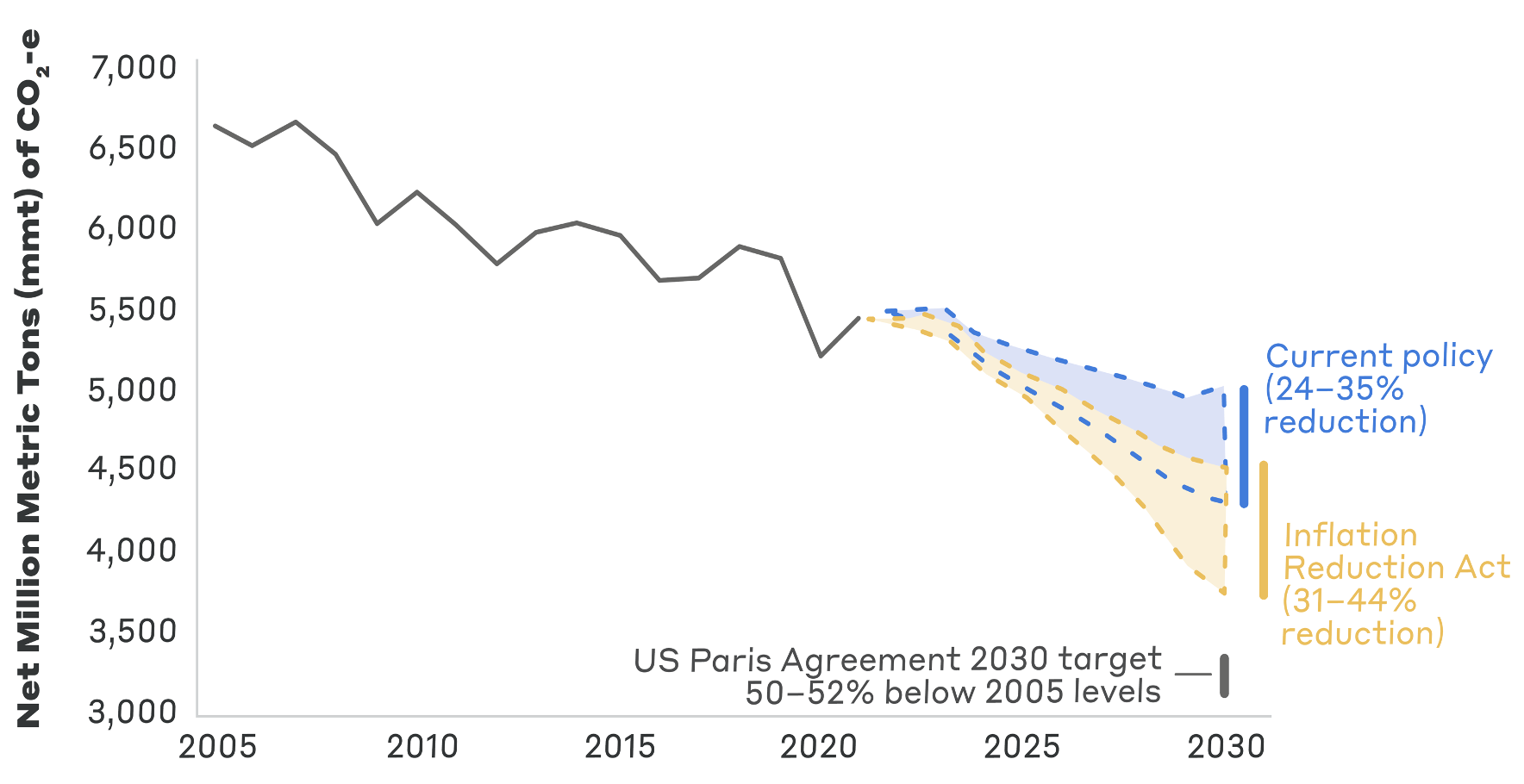

Despite its major role in driving global climate change and sharing the burden of environmental struggles, until the Inflation Reduction Act (IRA) was signed, the U.S. has not taken legislative action to mitigate climate change. In early 2021, President Joe Biden rejoined the Paris agreement, acknowledging the important role of the U.S. in addressing climate action. This move came after the previous exit by the former President, Donald Trump, in late 2020. Later in April 2021, President Biden announced new pledges as the U.S. updated its Nationally Determined Contributions (NDCs), with targets set to cut GHG emissions by 50-52% by 2030, compared to 2005 levels, and reach a net-zero economy by no later than 2050. Prior to passing the IRA, the country would widely miss all these goals.

Inflation Reduction Act=Massive Climate and Energy Policy Provisions

While the IRA is not a “climate bill” per se, almost 50% of its provisions are targeted toward climate and energy policies. The IRA is estimated to raise a total of $737 billion over 10 years, of which $369 will be aimed at climate and energy provisions. This is by far the largest federal investment on climate action in the history of the U.S. It is 4.5 times more than the last comparable law, the American Recovery and Reinvestment Act of 2009, which allocated about $80 billion to investments in renewable energies and green technologies. The provisions of the Inflation Reduction Act have been constructed in such a way as to create a coalition of interests in favor of ecological policies. Several provisions of the Act are aimed at developing the renewable energy and green industries sector in the United States. The Act, now law, includes several tax credits, rebates, grants, and investment provisions, which are expected to increase clean energy production and reduce emissions. According to estimates by Rhodium Group, prior to the IRA, the U.S. was set to reduce GHG emissions by 24-35% by 2030. With the IRA in place, the country is on track to reduce emissions by 31-44% by 2030, positioning it closer to its NDCs target. The graphic below illustrates those two scenarios.

Figure 3 – Reduction of U.S. GHG Scenarios Before and After the IRA

Source: The Bipartisan Policy Center.

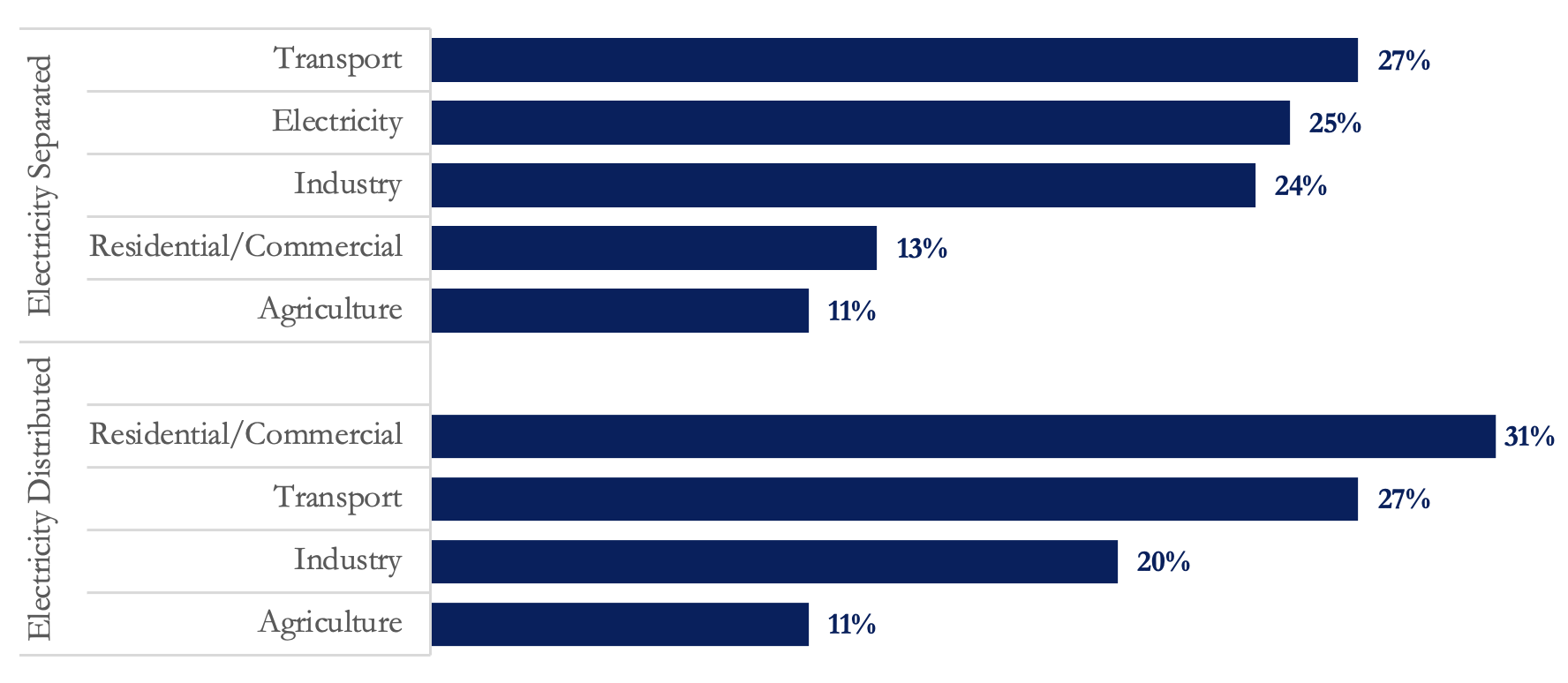

A Climate Bill Targeted at the Highest-Emitting Sectors

According to The United States Environmental Protection Agency, transportation, electricity generation, and industrial activities are the highest contributors to GHG emissions in the U.S., accounting together for a share of 76%. Residential and commercial facilities in addition to agricultural practices are also major contributors, contributing the remaining 13% and 11%, respectively. The chart below shows the U.S. GHG emissions by sector. The electricity generated is used by other economic sectors, such as homes, businesses, and factories. Looking at the demand side of energy, when electricity is distributed to the relevant industrial and residential/commercial sectors, the shares of each increase to account for almost 30% of total emissions.

Figure 4 – U.S. GHG Emissions by Sector

Source: The United States Environmental Protection Agency.

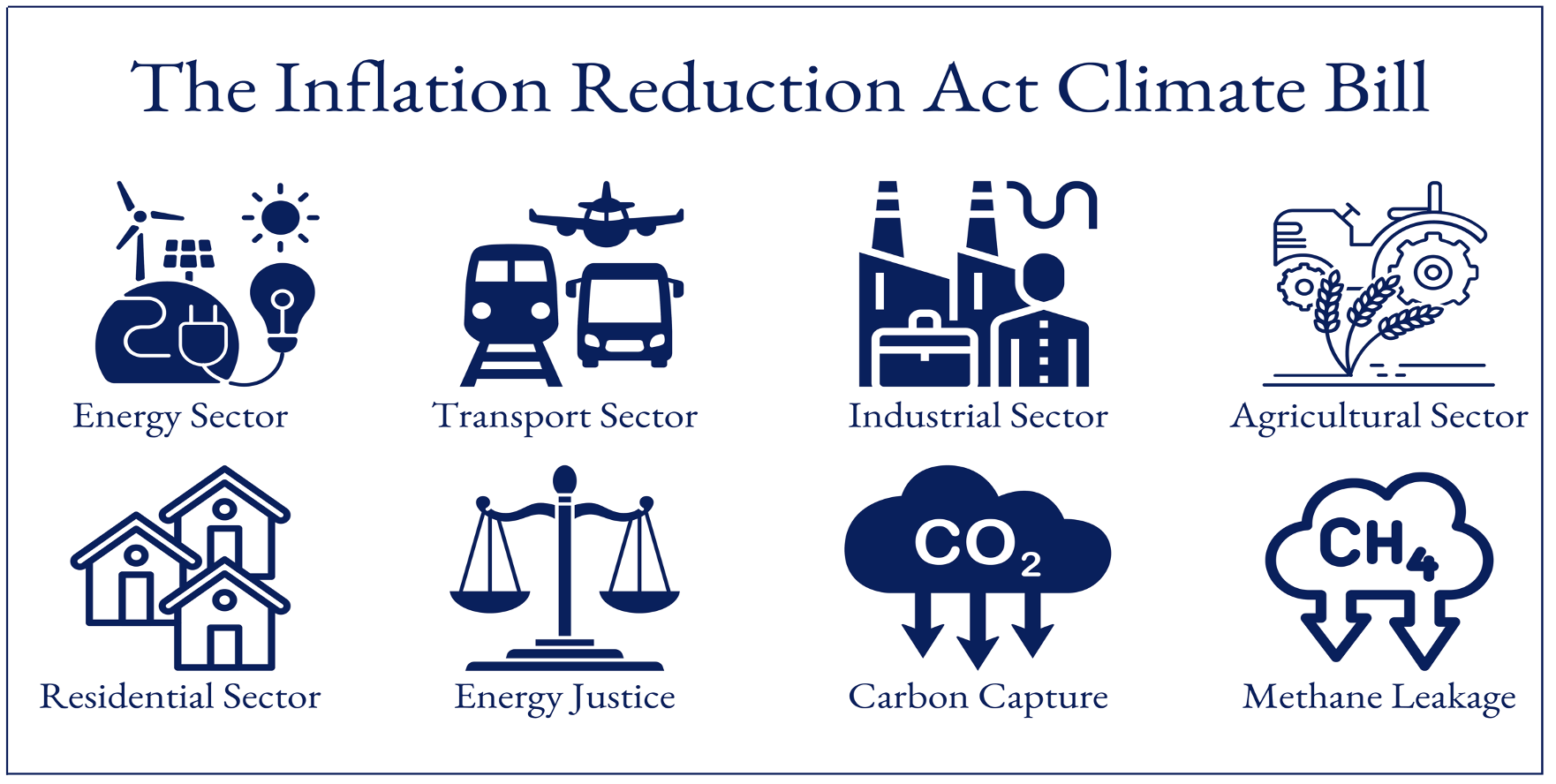

What the climate component of the IRA aims to do is target subsidies and grants towards the most emitting sectors, such as energy, transportation, industry, agriculture, and residential facilities. Energy is addressed from both the supply and demand side, feeding into usage by other sectors. As shown in Figure 5 below and as will be explained further in this article, IRA incentives can be divided into eight segments, those that target the five economic sectors of electricity, transportation, industry, agriculture, and residential facilities, in addition to provisions that enhance energy justice, those that directly target the reduction of fossil fuels and encourage carbon capture, and those that target the reduction of methane leakage.

Figure 5 – The Climate Components of the Inflation Reduction Act

Source: Author’s Diagram.

Cleaner Energy Production and Electricity Generation

The first type of incentive package targets the supply side of energy production, laid out to boost clean energy production, electricity generation, and investment. Tax credits are targeted at energy companies to deploy more clean energy sources such as solar, wind, hydrogen, and batteries. While in the past the congress has offered short-term credits for wind and solar technologies, those usually lasted for a maximum of two years. In the IRA, all zero-carbon technologies are covered with credits that last for at least 10 years, thereby providing companies with more long-term clarity to plan, produce, and invest.

The main incentive package includes a $60 billion sum of tax credits to boost clean energy manufacturing in the U.S. This includes $30 billion of production tax credits to accelerate solar panels, wind turbines, batteries, and critical minerals processing. In addition, $10 billion of investment tax credits are set aside to build clean technology manufacturing facilities, such as renewable energy and electric vehicles. Subsidies are also targeted to increase the production of clean hydrogen and nuclear power.

An additional $500 million package has also been set aside, through the Defense Production Act, for heat pumps and critical minerals processing, to boost the production of energy-efficient technology. Moreover, a total of $2 billion has been dedicated for the Department of Energy National Labs to accelerate breakthrough energy research. This legislation, according to Barbara R. Snyder, the President of the Association of American Universities, “will provide significant new resources for clean energy research and other projects designed to mitigate the effects of climate change, many focusing on communities which will be disproportionately affected…America’s leading research universities will continue developing innovative solutions to climate change and will help the United States and the world meet this unprecedented challenge.”

A Cleaner Transportation Sector

The second type of incentive targets the demand side of energy and fossil fuel usage, by focusing on the highest GHG emitting sector: transportation. On the consumer side, the existing $7,500 rebates for purchasing new clean vehicles have been maintained through the IRA. Clean vehicles include electric, plug-in hybrid, and hydrogen fuel cell vehicles. This credit comes with a per-vehicle ceiling of $80,000 for vans and $55,000 for other types. Only low-income individuals with maximum earnings of $150,000 annually (or $300,000 for joint filers) are eligible to apply. The new-vehicle rebate is conditional on a certain percentage of battery components and its critical minerals, as well as the vehicle’s assembly, being sourced and processed in North America.

In addition to the new-vehicle credit, a consumer credit of $4,000 per vehicle (or 30% of its cost, whichever is less) is provided for the purchase of used vehicles by individuals with a maximum income of $75 thousand a year (or $150 thousand for joint filers). To be eligible, the vehicle must be at least 2 years old with a maximum price of $25 thousand.

Moreover, the IRA targets several incentives at clean vehicle manufacturers to boost their production and investment. A total of $2 billion is set aside for grants to help retool existing automobile manufacturing facilities to produce clean vehicles. Moreover, up to $20 billion of loans will be provided to develop new clean vehicle manufacturing plants across the U.S. A Federal credit of over $9 billion has also been set to purchase U.S. manufactured clean technologies, which includes $3 billion for the U.S. Postal Service to purchase zero-carbon vehicles.

Several tax credits have also been set to reduce emissions by incentivizing the production of low-carbon transportation fuel. For instance, tax credits are provided for sustainable transportation fuel, including aviation fuel, which is calculated proportionally to the rate of CO2 emissions.

Focusing on Residential Emissions

Carrying on the demand side, the IRA targets residential emissions through several subsidies and rebates to accelerate cleaner home energy usage and help reduce consumer energy costs. For example, a total of $9 billion will be provided to boost home energy efficiency through 2031. This includes a $4.3 billion rebate program for whole-house energy-saving retrofits, $4.5 billion for individuals purchasing electric home appliances such as heat pumps and stoves, and $200 million for training contractors to carry out home energy efficiency upgrades. Rebates are especially targeted at low-income and moderate-income individuals, earning below 80% of their area’s median income, who can apply for additional funding.

Tax credits for energy efficiency home improvements will also be provided and extended for 10 years. This includes credits extended for residential solar, wind, biomass fuel, geothermal, and battery storage technologies, of up to 30% of home-improvement project cost. Moreover, an additional budget of $1 billion is set to improve the energy efficiency of eligible affordable housing.

Cleaner Industrial and Agricultural Sectors

The industrial sector is the third largest emitter of GHG after electricity and transportation. Moreover, it is a major user of electric power. When factoring in electricity usage, industrial and residential/commercial sectors become the major two contributors to GHG emissions, as shown in Figure 3 above. Many industries heavily rely on fossil fuels for basic processes, including production, processing, heating, cooling, and cleaning. An advanced industrial facilities deployment program has been set in place, which creates a total of $5.8 billion to invest in decarbonizing energy-intensive industries. These include chemicals, ceramics, glass, paper, pulp, concrete, iron, and steel plants. The funding will be provided in the form of grants, rebates, direct loans, or cooperative agreements to purchase new equipment or upgrade the facilities to be more sustainable. Priority will be given to projects with the highest GHG emissions reduction benefit and the number of people affected in the surrounding area. The program requires a 50% cost sharing by the industrial facilities.

The IRA also acknowledges the important role of agricultural production and forests in the climate agenda, by investing in smart agriculture. Almost $20 billion are budgeted to boost climate-smart agricultural practices, including reducing the emissions generated from soil and crop production as well as livestock. This includes $8.45 billion in grants for practices and improvements that directly improve soil carbon storage and reduce GHG emissions, in addition to close to $10 billion to encourage land conservation. This sum includes technical and financial assistance costs for producers and landowners to adopt sustainable practices, improve conservative systems, and ensure equitable access to tools and information.

Directly Targeting Fossil Fuels and Methane Emissions

When it comes to the oil and natural gas sectors, the IRA has raised the royalty rates by more than 30%. For the next 10 years, offshore oil and gas royalty rates have increased to a minimum of 16.66% from a previous 12.5%. Rental rates have also increased for new onshore oil and gas leases and minimum bids for leasing have been lifted from $2 to $10 per acre, for the coming 10 years. The economic concept is simple: raise the cost to reduce the production. Yet, secondary effects are likely to raise the cost to consumers during a time of high inflation.

The act also comes as the first to set industry-wide restrictions on methane (CH4) leakage. While it is true that methane accounts for only 11% of U.S. GHG emissions, compared to 79% of CO2 emissions, the former is a much leakier gas and is 84-86 times more powerful than CO2 over a 20-year period. While CO2 does stay more in the air, methane has a much higher heat-trapping effect. Through its methane emissions reduction program, the IRA is set to cut down on methane emissions. First, a total of $1.55 billion is set aside to provide grants, incentives, rebates, and loans for facilities and communities that reduce methane leakage. Moreover, a maximum methane waste emissions threshold has been set, restricting facilities to an emission rate of no more than 25 thousand metric tons of CO2 equivalent per year. Penalties of $900 per extra ton will be set starting in 2024, to be raised to $1500 by 2026.

Boosting Community Investment and Energy Justice

A bill of almost $60 billion has been set in the IRA for environmental justice priorities, to increase investment in clean technologies and reduce pollution in disadvantaged communities that bear the greatest burden of climate change. First, a total of $3 billion is set to invest in projects and capacity development in disadvantaged communities that help address the disproportionate public health and environmental impacts of climate change. An additional $3 billion is set to provide grants for better access to clean transportation, reduce air pollution, and adapt to negative climate effects in disadvantaged areas. Moreover, a total of $3 billion is budgeted to procure and install zero-emission technologies at ports, in addition to a $1 billion bill to support clean heavy-duty vehicles such as transit, school, and garbage vehicles.

A total of $27 billion have also been set as a green bank, or the clean energy and sustainability accelerator, with the aim of boosting investments in clean energy, climate-resilient infrastructure, clean transportation, and retrofitting buildings, with a particular focus of almost 60% on disadvantaged and lower-income communities. The funds are allocated into three categories, with $7 billion targeted for the deployment of clean technologies in disadvantaged communities, $8 billion targeted for general investments in reducing GHG emissions in disadvantaged communities, and around $12 billion available for similar objectives but targeted at all U.S. communities.

Carbon Capture and Carbon Sinks

Part of the IRA also focuses on carbon management through incentivizing carbon capture and developing carbon sinks. Tax credits are provided for companies that capture and bury CO2 from power plants and industrial processes prior to escaping into the atmosphere. Such technologies are rarely used due to their high cost of application. The climate bill hence increased the provided subsidies for direct carbon capture and reduced the minimum plant size for eligibility, with support of 5 years available for most entities and 13 years for non-profit organizations.

Another part of the climate bill also focuses on the restoration of forests, which act as natural carbon storage and removal agents. Almost $2.2 billion are targeted for supporting forest restorations, by boosting resilience to wildfires and vegetation management. Moreover, a total of $1.5 billion are provided as grants for tree planting in urban areas, with an additional $700 million provided to protect environmentally important forest areas from degradation.

Around $400 million of funds are also set available to support underserved forest landowners in adopting climate resilient practices to restore their forests and to participate in emerging private markets. In addition to forest restoration, many of the agricultural incentives mentioned above also provide environmental benefits through increasing natural carbon removal.

Wrap Up

The IRA is an unprecedented step towards addressing climate change in the U.S., indicating the seriousness of the situation and setting an example for other countries to follow. The long time frames for the subsidies provide companies with greater certainty to increase their investments, innovations, and production in cleaner technologies. Unfortunately, subsides are expensive and long-lasting, often out-living the goal they were intended to address. Again, the simplest solution would’ve been to create a carbon tax and apply it to all industries.

Jason Walsh, executive director of the environment and labor-focused BlueGreen Alliance, “Those are big investments, and they’re risky investments. And if we expect manufacturers to make them in the United States, they’re going to need to have some long-term policy certainty and support.” The new IRA is expected to boost innovation and investments domestically, reducing the migration of clean-energy production overseas, to countries such as China. Such outcomes are already starting to materialize. For example, the largest solar manufacturer in the U.S., First Solar, has announced in August an investment of $1.2 billion to expand its factory following the bill. While the IRA does not get the U.S. all the way to achieve its NDCs by 2030, without a doubt, it is a meaningful step that could put the country back on track.