Less than 18 days from the election, the markets appear to be on pins and needles over two outcomes. First, another round of stimulus from Congress. Second, a “Blue Wave” with a Biden victory, a Democratic Senate takeover and the elimination of the 60 vote filibuster rule. Both outcomes appear to make investors and traders a bit nervous at the moment.

They shouldn’t be.

On the stimulus package, there continues to be dialogue between the White House representative Treasury Sec. Mnuchin and Democrat Speaker of the House Pelosi. The House bill is lower from its original higher starting point and the White House offer is up from its original lower starting point. What hasn’t changed is the significantly lower Senate bill and it appears unlikely to next week when the body comes back in session. With little time left in the 2020 election, will pressure mount on all three to come together and craft a new bill?

I doubt it. Senate Republicans are watching the polls and seeing they are at risk of losing their majority. They are weighing how much they want to help a sinking President and how much they want to set themselves up for 2022 with a return to fiscal probity. They understand a Democratic majority will do away with the filibuster and will be aggressively spending on a wide range of Biden proposals. They will have no opportunity to stop it nor any other action as it will be majority rule.

But this is the promise of a Biden presidency for the markets. A unified legislature with majority rule coupled with a same party presidency will likely produce a spending bill magnitudes larger than any deal constructed prior to the election. $1.7 trillion on the environment, $1.3 trillion on infrastructure and $640 billion on affordable housing are all in the Biden policy plans. The markets should be more concerned if a stimulus plan was created prior to the election rather than afterwards. For those in need, it would be better to get something now and later.

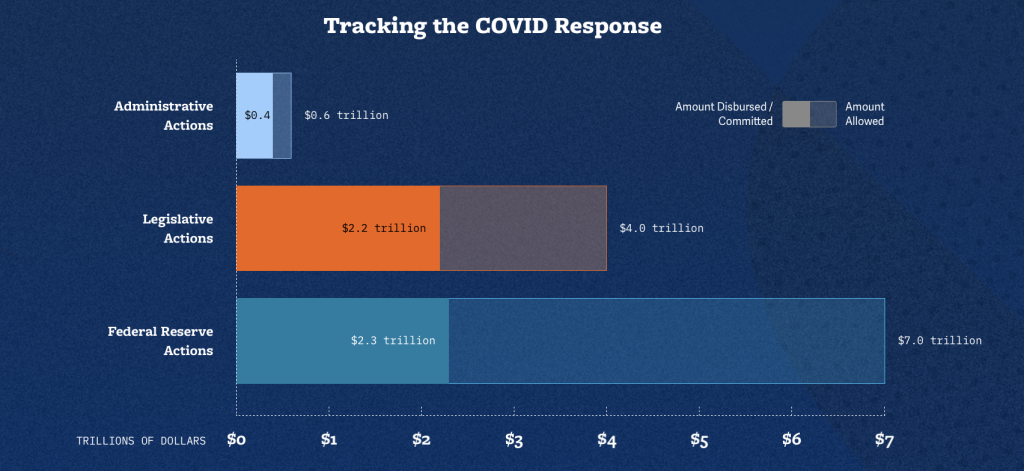

This is not all there is promoting the economic recovery. Remember, we have had the White House, Congress, Treasury and Federal Reserve create $11.6 trillion in stimulus from CARES 1.0 and 2.0. According to the Committee for a Responsible Budget, less fifty percent has been distributed, leaving a whopping $6.7 trillion still in the pipeline to support the economy.

The central bank is also part of the stimulus equation. The Federal Reserve has committed itself to maintaining, until 2023, a monetary policy designed to stimulate the economy, if not embrace MMT. (Comments from Fed Gov. Quarles stated the de facto MMT policy during a virtual appearance this week.)

Finally, there is the strong likelihood of a vaccine. While there have been some setbacks this week amongst key studies, there are many more nearing the finish line and should be available in 2021. To me, the only question here will be convincing people to get it. I don’t believe a vaccine will solve all the problems caused by the virus for the transportation, leisure and hospitality, and entertainment industries. But it will make a significant difference and provide a path forward for economic growth.

A significant fiscal stimulus bill, large Federal Reserve monetary stimulus and a vaccine are all compelling reasons to believe equity markets will remain on an upward trajectory heading into the US election and beyond. Volatility, of course. But the potential for continued economic growth remains strong.