For everyone trying to catch a summer break without watching Washington, I wish you best of luck because they are working hard to hammer out an infrastructure deal. This initial $1.2T bipartisan deal will set in motion more spending as it’s only 1 of 2 bills being worked on to dramatically increase fiscal spending. The other deal is a go-it-alone $3.5T plan to be added after the bipartisan plan is approved. If both passed, they would total 84% of the total of all the stimulus plans passed under both President Trump and President Biden.

Let’s start with the bipartisan deal.

Here are the details from the White House fact sheet:

The major issue with this plan has been what D.C. calls “payfors” or revenue raisers to offset the new spending. So far, the largest of these is a change to a Trump Medicare rule that would save $179B. Note save, not raise taxes. In other words, it’s taking from someone else’s pocket and putting into their pocket. It appears there’s more on the way, but we’ll have to wait to see what happens over the weekend to get the final numbers.

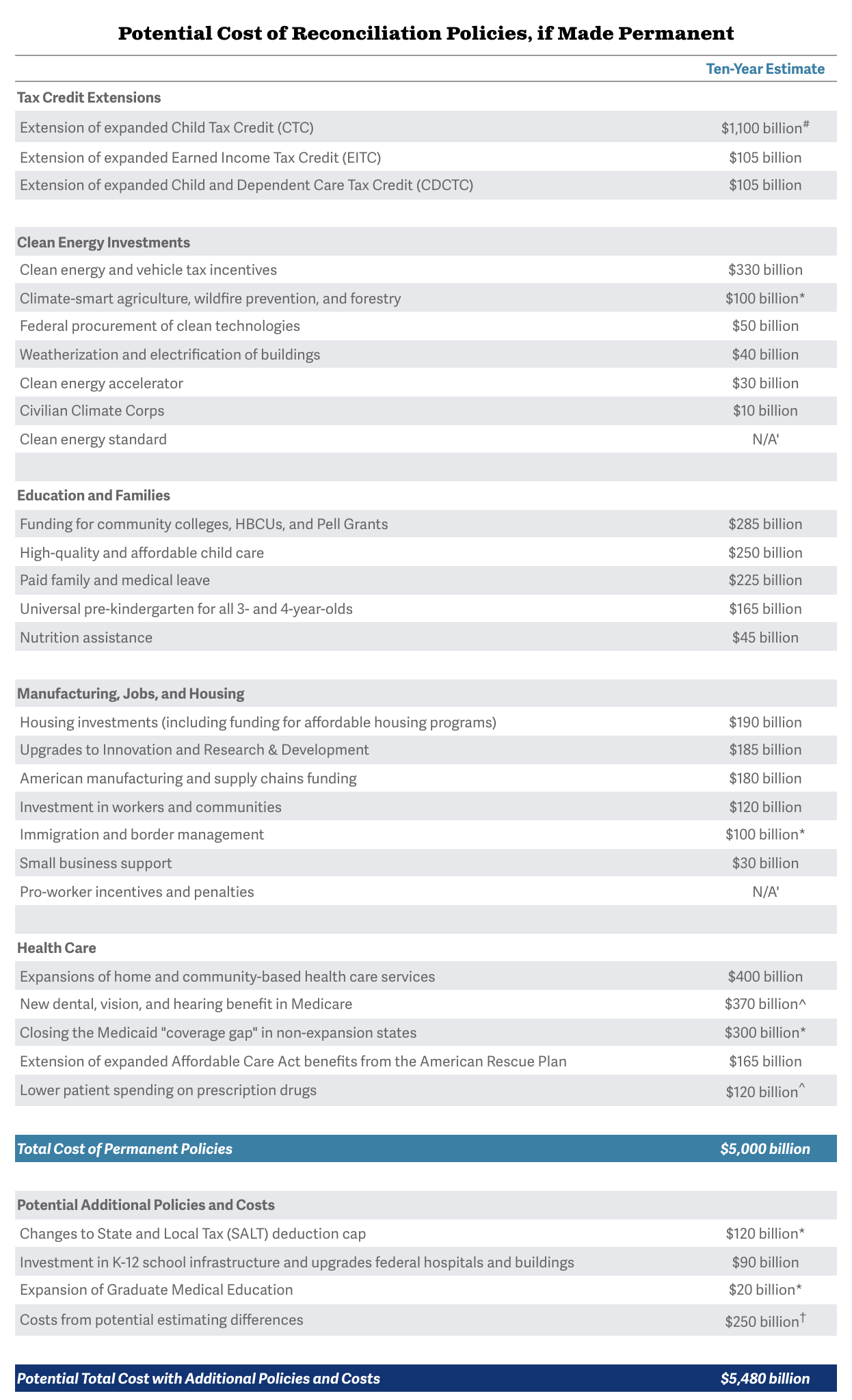

Now to the $3.5T plan. Guess what, it’s not actually $3.5T. It’s really $5.0T!

The Committee for a Responsible Budget has this breakdown:

The major problem with this type of social spending is that once it’s enacted, it’s almost impossible to end the program. Does anyone really believe that if there is “free” community college, a politician would vote to end it?

While most economists are onboard with the physical infrastructure spending need, it’s difficult to believe the ramp up in potential social spending without paying for it would be high on the list. And this brings up the “payfor” question.

Here’s how President Biden breaks down the tax increases:

For corporations:

- 28% corp. tax hike

- Global minimum tax

- 15% corp. min. tax on book income

- Targets: US-based global multinationals, global tech & pharma

For individuals:

- Raise top rate from 37% to 39.6%

- Tax LT cap gains and dividends as ord. income

- Death tax at gains above $1 million

- Elimination of stepped-up basis

- Apply 3.8% NIIT to pass through income >$400k

- Increase IRS funding by $80B

- Targets: upper income earners and pass throughs

Wrapping up these spending bills and tax increases, the thrust is to improve physical and social infrastructure by massively increasing government outlays and reach into the economy. There is a need for some of this spending, but not all of this spending. The potential permanent nature of the $3.5T plan will create both a need for large increases in taxes and likely a large increase in the federal debt.