#1 AOC, Redditt and GameStop. It’s hard not to smile when I see what’s going on with GameStop and Redditt as the once less-powerful retail investor took on bigger hedge funds and won. Turns out, they do know about options and what happens when the underlying price approaches the strike price. It makes the shorts have to buy to delta hedge, driving the price up and creating a short squeeze for the ages and crushed a few hedge funds along the way. It reminds me of the axiom I followed when I was a currency trader: no one trader is bigger than the market. A mass of retail investors is the market, and they are dramatically influencing stock and option prices. They are targeting hedge funds with significant shorts in a stock and then press them to exit. It’ll be interesting if they can replicate this and may cause a market structure change that further pushes up equity prices. Yes, there should be plenty for the CFTC, the SEC, NFA and FINRA to check out, especially on the “Pump and Dump” style of price manipulation within wallstreetbets. All of this highlights big problems of market structure and the ability to manipulate price. While there is a heavy populist vibe to this activity (see AOC above), the market is bigger than the group or person manipulating the market. In other words, the integrity, resilience, and vibrancy of these markets is now being called into question by all investors.

#2 Joe knows EOs. Since he took office, President Biden has been using his Obama “pen and pad” to write new executive orders and attempt to undo previous Trump executive orders. This should surprise no one who’s read our research over the last two years. Yet, the breadth of his reach is large especially on climate. It appears the main criteria for being in the Biden administration is a background in ESG. Brian Deese already appears to be a darling of the White House press corps, especially if they are calling him by his first name. WH Press Secretary Jen Psaki is great, but I do miss SNL Sean Spicer. Back to the EOs, here are the big ones:

-

- Tackling the Climate Crisis at Home and Abroad which puts the climate crisis at the center of US foreign policy and national security and will take a government-wide approach to the climate crisis.

- Organizing and Mobilizing US Government to Combat COVID-19 which creates a Coordinator of the COVID-19 Response to organize the effort to increase the distribution of the vaccines and to prepare for the next outbreak.

- Revocation of EOs Concerning Federal Regulation this order unwinds the Trump 2 out for every 1 in on new regulations.

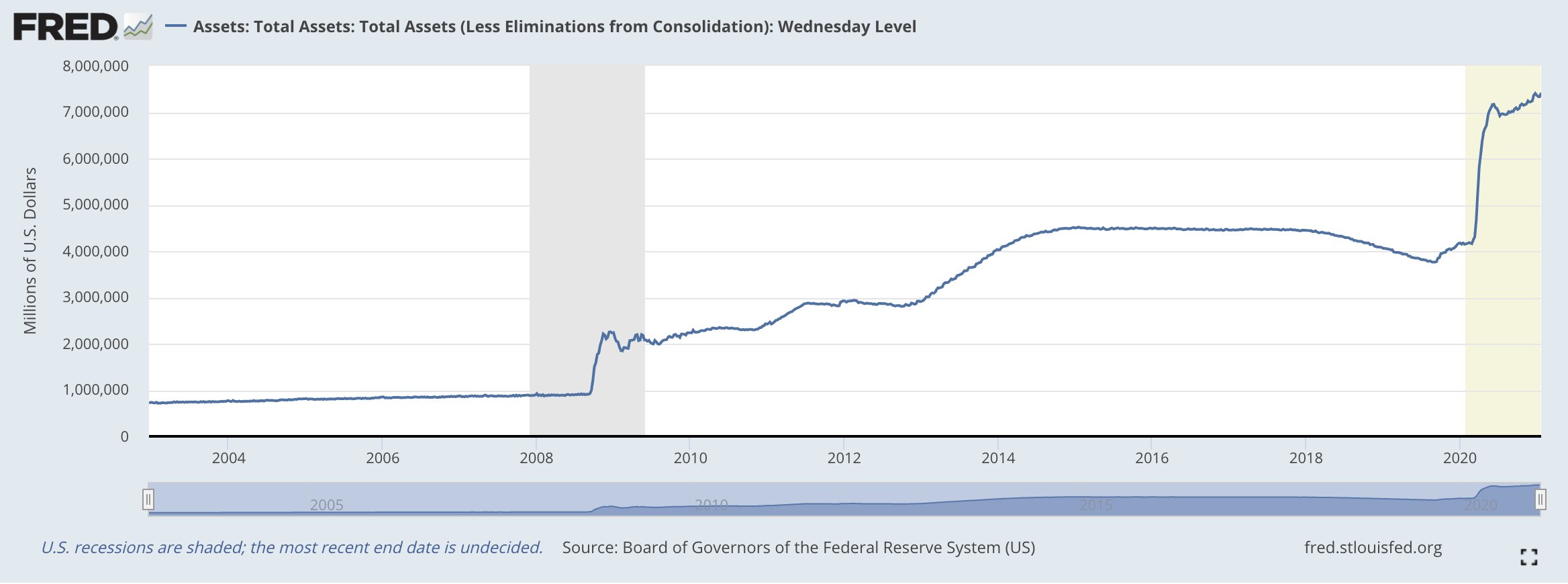

#3 The Federal Reserve remains all-in. Jay Powell and his team at the central bank Fed Funds at 0 and said they would keep buying Treasury and mortgage backed securities until home prices in the Midwest finally went up. Ok, maybe they didn’t go that far, but it seems like they want to let everyone know they are willing to run this economy as hot as possible until the 10 million jobs lost due to COVID-19 come back and as long as inflation remains subdued. To press the point further, Powell reiterated during his press conference that an increase in inflation from the release of (COVID-19) related pent up demand when conditions normalize would likely be transitory. This all points to how the Fed will play good soldier as the Biden administration and Treasury Secretary Yellen ramp up another stimulus package.(Also, see how the Fed is all-in on climate as well.) Yet, a massive package and the Fed’s monetary stimulus are not targeted. Like GameStop, the party is on for the economy and growth. But even people like Larry Summers warns, “If we get covid behind us, we will have an economy on fire.” (January 14th) We should expect the Fed to continue to fuel the stock market, commodities and BTC with their actions. My view is that the Fed will blink sometime in Q4 and begin to reduce their monthly $80 purchases of assets.

#4 Kyrsten and Joe M. know why. Senate Minority Leader Mitch McConnell relented finally on a power sharing agreement with Senate Majority Leader Chuck Schumer after he received promises by Democrats, they would not end the 60 vote filibuster rule. Both Sen. Joe Manchin and Sen. Kyrsten Sinema stated publicly they would not vote to end the rule. Previously, Manchin voted against ending the filibuster for cabinet appointees and judges. Yet, previous Senate Majority Leader Harry Reid went through with the vote and the rest is history. Now, there is a 6-3 conservative SCOTUS and over 187 conservative judges in the system via Trump and McConnell. The lesson here is that Democrats should tread very carefully on this or it will backfire. Something Manchin and Sinema appear to understand. Let’s see how they do when the pressure is ramped up over the next 6 months when Republicans won’t pass progressive House bills like GND and M4A.

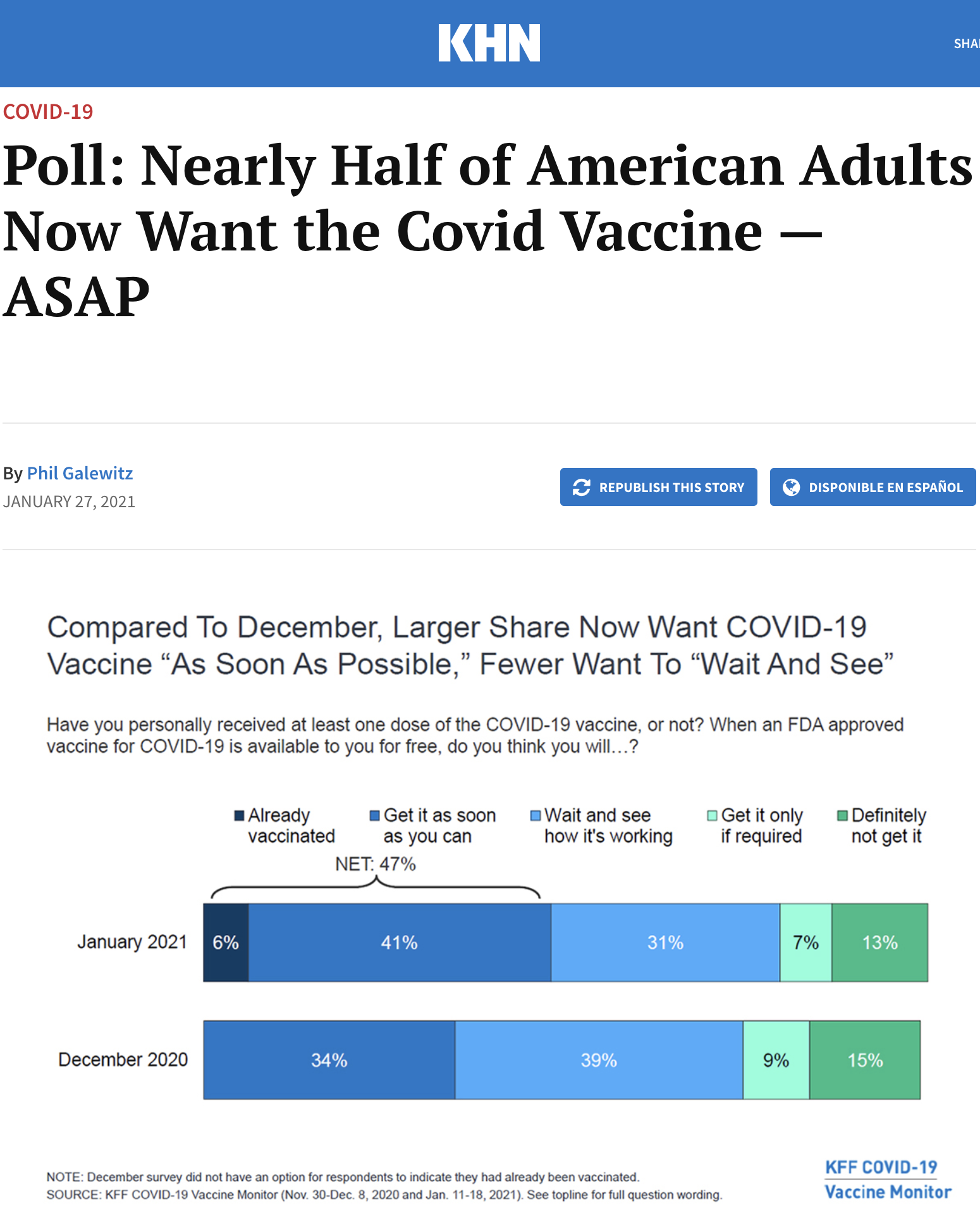

#5 Americans want the jab. A new poll by KHN shows that Americans are starting to shift their views on getting a COVID-19 shot and that’s great news. One of my 2021 biggest economic risks was vaccine hesitancy and it remains a problem. According to KHN, “About half of those who said they want the shot as soon as possible know someone who has already gotten a dose, a much larger share than among those who said they’ll get it only if required (29%) or will refuse to get it (36%).” And just like the chat rooms on Redditt, social media is helping drive the interest as people post their vaccination status on Facebook and Twitter. This is the right direction and the right attitude about the jab. Israel may be a great example of what happens to infections after just one shot. And maybe be the first to show what it’s like when a country can return to an open economy.