- Vaccine Hesitancy

- Virus Mutation

- Cyber War

- Protracted Congressional Fighting

- Credit Crunch

The combination of 1 & 2 will be tragic. But if accompanied by 3,4 or 5, then the optimism for the economy and the enthusiasm for stocks by investors will both shift down significantly.

Vaccine Hesitancy

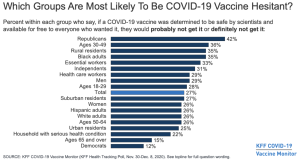

As the first US shipments of vaccines roll-out, the optimism over the positive outcomes should be considered a bit more skeptically. Surveys in the US and abroad show a hesitancy to be fully all-in on a desire to get the vaccine once it becomes widely available. According to a KFF.org survey, about a quarter (27%) of the public remains vaccine hesitant, saying they probably or definitely would not get a COVID-19 vaccine even if it were available for free and deemed safe by scientists.

Here’s how KFF’s hesitancy numbers break down by groups from highest to lowest:

Republicans (42%)

Ages 30-49 (36%)

Rural residents (35%)

35% of Black adults

Essential workers (33%)

Health care delivery workers (29%)

Reasons given for the hesitancy range from worries about possible side effects (59%) to lack of trust in the government to ensure vaccines safety and effectiveness 55%). KFF is more optimistic than a recent Pew Research Center that showed only 60% saying they would get the vaccine and 39% saying they wouldn’t.

Remember, the first vaccines coming out require two shots exactly a month apart. This obstacle will further impede the dual recovery as some percentage of the group initially vaccinated will miss the next round and erode the efficacy rate.

Given conflicting reports during the initial outbreak and ethnic history (Tuskegee Study) /lack of trust (George Floyd), the hesitancy should be considered a potential serious impediment to a return to full economic and physical health for the US.

The Virus Mutates

By definition, an RNA virus is an unstable organism and mistakes in copying the RNA as it moves from host to host are frequent. These viruses aren’t technically living as they need a host to survive. As a pathogen, its job is to evade the immune system, create more copies of itself and then spread to other hosts. This is why the yearly flu virus is so difficult to inoculate against. The FDA/CDC attempt to guess which strain will be the predominate one and then they approve the flu shot for the season. Their guesses are driven by the World Health Organization’s “Global Influenza Surveillance and Response System (GISRS) which puts out recommendations for which strains are most active. (It’s more complicated, but you get the idea.)

Moderna and Pfizer used first-time mRNA approaches to solving the virus and creating a vaccine. Yet, the point to be considered here is that it’s an RNA virus were dealing with. Already, we are seeing reports that British officials have identified COVID-19 mutations with over 1k infections showing a suite of mutations that may drive a surge. This could develop into an outbreak similar to the 1918-19 Spanish Flu where the initial outbreak (1918) was terrible, but the next year was worse (1919) as the virus became both more virulent and spread easier.

A more infectious and deadly strain of COVID-19 is a real possibility and is not being considered by the markets or the economy at this time as an important risk. If it occurs, we’ll see a much slower economic recovery and higher infections with deaths.

A combination of hesitancy and mutation will create the conditions for strongly negative outcomes on health issues, economic growth and job creation.

Cyber War

Cyber espionage is the playing field for spying between countries and businesses. Unlike the novels of John Le Carre, this is a digital world of hide and seek with critical communications and intellectual property at risk. The announced hacking of a leading cybersecurity firm, FireEye, plus major branches of the US government is a chilling, 2X4 to the head of all those involved in security. The break-in apparently came from Russia though a popular piece of server software offered by a company called SolarWinds.

The attack has been compared to a health virus that invades your body, multiplying, and attacking all your internal organs. It appears that the hackers stole the US own hacking capabilities that are used for finding vulnerabilities in foreign networks. This is considered a “very, very serious intrusion.” This comes at a vulnerable time for the US after President Trump recently fired Christopher Krebs, the director of Department of Homeland Security CISA (Cybersecurity and Infrastructure Security Agency).

The question remaining is the response of the US government towards Russia? Will this bring about a declaration of war between the two countries or merely a return to the Cold War? Too small of a response sends the message to other countries, like China, that it is okay to continue acting in this aggressive, digital espionage. Too large of a response would create the conditions for an outbreak of military hostilities.

Whatever president-elect Joe Biden believes will be his focus for the first 100 days, this cyber-attack will disrupt his plans and require a response as the country transitions political leadership. It will be a dangerous time and there is the potential for large mistakes to be made that can disrupt the global economy.

Congressional Fighting

After two years of a Trump administration with a split Congress, this risk is one almost everyone can understand. The impeachment of Trump along with the Mueller investigation has left deep scars on the Republican memory and is likely to drive how a Republican senate will approach a Biden administration.

Remember the role of the US Senate in Article II, section 2: “[The president] shall have Power, by and with the Advice and Consent of the Senate, to make Treaties, provided two thirds of the Senators present concur; and he shall nominate, and by and with the Advice and Consent of the Senate, shall appoint Ambassadors, other public Ministers and Consuls, Judges of the supreme Court, and all other Officers of the United States…” The Senate the exclusive right to provide advice and consent to the president on treaties and nominations.

During the Trump administration, there was difficulty getting many of his new personnel in place due to the 60 vote filibuster rule and Democrats withholding nominees from getting hearings or approvals. (A Democratic senate under Harry Reid did away with the filibuster rule for judicial nominees and allowed Republicans to place over 190 judges and 3 SCOTUS.) One can envision the same treatment to all of Biden’s Cabinet nominees as well as their deputies. This will slow the Biden administration’s plans on a wide range of policy plans from tax changes to spending to the environment.

Where this becomes a problem is what happens when there is a serious need to address and Congress won’t act? The US has critical economic needs, like affordable housing and infrastructure, that must be addressed or risk the continued deterioration of the country. To underscore how difficult this will be, President Trump couldn’t get an infrastructure deal done with a unified Republican Congress during his first two years.

Credit Crunch

The economic fallout from the virus and the rolling shutdowns is not over and will continue to impact the United States in 2021. While the US government lending programs and stimulus measures have helped stave off a longer initial crisis, the medium term outlook remains cloudy for economic growth. Travel & tourism, leisure & hospitality, retail, and any face-to-face businesses will continue to see losses in the new year with or without the vaccine as consumers adjust and make permanent changes to their behavior. This has serious implications on corporate balance sheets.

One of the biggest changes is work from home (WFH) or work from anywhere (WFA). At this time, it’s a bad habit to over-extrapolate into the future the changes occurring under COVID, but this is one trend that was in place prior and has now been supercharged. Employee surveys show workers like the flexibility and a hybrid model of workplace attendance will likely remain in the future. Is it 1 day at home, 4 in the office? Is it 2:3 or 3:2? This one change has critical implications for transportation, office space and apartments.

The US is currently seeing a 13% drop in miles driven. While this doesn’t seem large, it has large implication for gasoline demand and production. Business air travel has collapsed. If continued, this would have a commensurate negative impact on oil companies and energy production in the United States. Granted, oil and gasoline prices have recovered, but what is their upside if this workplace trend has changed?

Along with this, downtown office space and apartment rental prices are cratering in the major US cities like San Francisco and New York. There have been very few CRE deals done in these groups and therefore, price discovery for how far they have fallen is difficult. This translates into questions over funding for city office space and apartments by either the markets or the banks. Banks with loans will likely begin the process of writing down the properties and taking hits to their loan portfolios and balance sheets. On top of this, financial institution with exposure to retail or retail malls is experiencing the “apocalypse” as shoppers stay away due to the virus, accelerating the downtrend in place prior to the outbreak.

As stated above, WFH and WFA are trends impacting demand for travel and transportation. Sales teams have learned you don’t need to travel for 3 hours to attend a 30 minute meeting with a client. It’s likely we’ll see a significant rise in non-performing loans (NPLS) at financial institutions with exposures to businesses like airlines and hotels as they remain significantly impacted by the virus. This will not likely turn-around with the vaccine.

The hope is that with a vaccine, the global economy will return to some normalcy and extended grace periods for loans and evictions will be enough to get everyone through the tough times. Yet in 2021, these grace periods will end, and the adjustment process will begin to rebalance lending and the economy. We should not expect lend & pretend extensions or a Japanese-style zombie approach. There will be limits (see above) to stimulus and government actions to delay the difficult and hard choices needed.

Of course, this potential credit crunch will be exacerbated by a slowing economy and any combinations of the other risks mentioned.

Top 5 Risks for 2021 pdf of this article