The election of Donald Trump, along with a unified Republican Congress, has generated tremendous anticipation for potential changes in the financial services sector. As a candidate, Trump ran on a platform of reforming the Dodd-Frank and the Consumer Financial Protection Bureau. This is consistent with current Republican policy in both the US House of Representatives and the US Senate. As well, Republicans agree that there also needs to be serious regulatory reform in all aspects of government. While there will be differences between the new Congress and president, the thrust of policy change will be in this direction and, therefore, major changes are coming for the wealth management sector.

Here are key wealth management takeaways:

- Reform of the Dodd-Frank law is more likely than a replacement of the entire act due to Senate rules and regulatory agency adoption.

- Regulations like the Department of Labor’s Fiduciary Rule are more likely to be unenforced or slow-walked rather than repealed.

- Rapid changes in investech/fintech will continue to challenge traditional wealth management firms. Government agencies will in turn try to add new layers of regulation as they will be perceived to apply to these new firms.

What follows is an overview of some specific targeted areas and some of the major players involved. Given there will likely be delays in getting critical personnel in place, the Trump administration may find it difficult to have an immediate, substantial impact on the wealth management sector. For the wealthy among the new nominees, the financial disclosure documentation process will be complex, cumbersome, and prolonged. Despite these delays, there will be significant effort to unwind large portions of the current regulatory structure. It’s likely that there will be some immediate impact from the change in agency leadership.

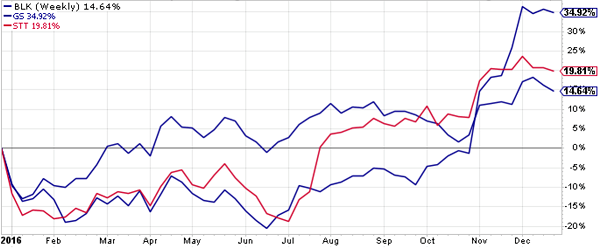

Similar to other areas of the financial services sector, like banking and insurance, wealth management is likely to experience positive momentum, due to reduced compliance costs, increased profits (in part because of higher interest rates and stock prices), and a stronger economic environment. Since the election, the financial services sector has seen strong price appreciation in the stocks of companies in the asset management space. Black Rock (BLK), Goldman Sachs (GS) and State Street Global Advisors (STT) have all seen double digit gains since November 8th.

Source: Stockcharts.com

Key Government Players

Below is a list of some key positions in the Trump administration (and nominees if announced), regulatory agencies, and Congressional Committees involved in the financial services and wealth management sector.

US Treasury Secretary nominee Steve Mnuchin

US Commerce Secretary nominee Wilbur Ross

Federal Reserve Janet Yellen (term ends 2018)

Federal Reserve Vice-Chair Regulation Daniel Tarullo

Office of the Comptroller of the Currency (OCC)

Federal Deposit Insurance Agency (FDIC)

Securities and Exchange Commission (SEC)

Commodity Futures and Trading Commission (CFTC) Christopher Giancarlo, ranking Republican

Consumer Financial Protection Bureau (CFPB)

Department of Labor nominee Andrew Puzder

(DOL fiduciary rule fact sheet)

Financial Stability Oversight Council (FSOC)

Senate Banking Committee chair Sen. Michael Crapo (R-ID)

Senate Banking Committee ranking minority Sen. Sherrod Brown (D-OH)

Senate Banking Committee minority member Sen. Elizabeth Warren (D-MA)

Senate Committee on Health, Education, Labor & Pensions Lamar Alexander (R-TN) chair

Senate Committee on Health, Education, Labor & Pensions Patty Murray (D-WA) ranking minority member

House Financial Services Committee chair Jeb Hensarling (R-TX)

House Financial Services Committee ranking member Maxine Waters (D-CA)

Key Issues

Regulatory Changes. Contrary to campaign rhetoric, the repeal and reform of the Dodd-Frank law will be difficult for two reasons. First, five major federal agencies have adopted the framework and implemented most of the provisions of the law. The Office of the Comptroller of the Currency (OCC), the Board of Governors of the Federal Reserve System, the Securities and Exchange Commission (SEC), the FDIC and the CFTC) will all need to agree to changes for any repeal and reform to apply broadly. Second, due to Senate rules regarding Congressional minorities, the industry should expect strong opposition to major changes from Democrats on the Senate Banking Committee. Unlike ACA, Dodd-Frank will not be part of a budget reconciliation and, therefore, it will not be subject to the 60-vote rule to cut off debate. As well, there are certain Dodd-Frank sections, like the 956 incentives based/clawback rule, that will remain popular amongst consumer advocates, and thereby difficult to remove.

Of specific keen interest for the wealth management sector, the DOL fiduciary rule will be subject to the same hurdles as Dodd-Frank. One possible scenario is that the new heads of the federal agencies in charge of enforcing these regulations may choose not to act on them or to slow-walk their implementation. As an example, the fiduciary rule has been challenged three times in court and the DOL has won each time. The April 10th rule implementation date looms large for insurance companies selling variable annuity products to IRAs. During the confirmation hearing for DOL nominee Andrew Puzder, more information will likely emerge on a Trump administration strategy towards a rule about this. Although cabinet secretaries have broad latitude to issue new rules, and Puzder would have the power to issue an interim rule to delay implementation of the final rule, the DOL would need to show good cause for this to occur. An alternative scenario would be for the SEC to act in this regulatory space and to begin issuing its own rules towards investment advisors and investment products.

Finally, the regulatory initiatives of the SEC will likely endure after the current Chair Mary Jo White leaves. In White’s final testimony to Congress, she weighed in on a uniform fiduciary standard:

Section 913 of the Dodd-Frank Act granted the Commission authority to adopt rules to establish a uniform fiduciary standard of conduct for broker-dealers and investment advisers when providing personalized investment advice about securities to retail customers. As I have stated previously, my evaluation of the differences in the standards that apply to advice under the federal securities laws has led me to conclude that broker-dealers and investment advisers should be subject to a uniform fiduciary standard of conduct when providing personalized investment advice about securities to retail investors. I recognize that this is a complex issue, and that there are significant challenges that will need to be addressed in proposing a uniform fiduciary standard, including how to define the standard, how it would affect current business practices, and the nature of the potential effects on investors, particularly retail investors.

SEC staff has developed a framework for this rulemaking that has been provided to the Commission for its consideration. As part of its analysis in developing its recommendations, the staff is considering, among other things, the SEC staff’s 2011 study under Section 913 of the Dodd-Frank Act,[97] the response to the request for information from March 2013,[98] the additional views of investors and other interested market participants, and the potential economic and market impacts. Ultimately, of course, the Commission as a whole will decide whether to proceed with a rulemaking to implement a uniform fiduciary standard and its parameters.

The following is a list of additional areas of regulatory focus:

- Evolving regulatory tools as the industry evolves (investech)

- Portfolio composition risks and operational risks (liquidity risk management)

- Enhanced data reporting (swing pricing)

- Enhanced controls on risks related to portfolio composition (derivatives)

- Improvement in transition planning and stress testing (continuity planning)

- Assessing systemic risk

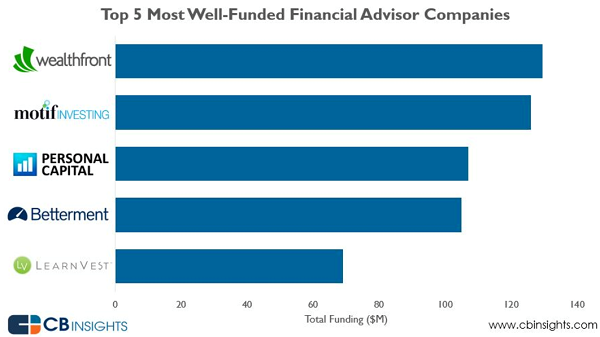

Investech/fintech. The explosion of investment technology in the wealth management space has created challenges for the industry. Millennial consumers have driven demand for a wide range of products from robo wealth advisors (Wealthfront, Betterment, WiseBanayan) to budget management/portfolio tracking/education (Mint, Debitze, Learnvest).

Due to the demand for and extensiveness of fintech, regulatory agencies are turning their focus toward financial technology. The CFPB has put out a request for comment and information regarding consumer access to financial records:

The Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) provides for consumer rights to access financial account and account-related data in usable electronic form. The Bureau of Consumer Financial Protection (Bureau or CFPB) is seeking comments from the public about consumer access to such information, including access by entities acting with consumer permission, in connection with the provision of products or services that make use of that information. Submissions to this Request for Information will assist market participants and policymakers to develop practices and procedures that enable consumers to realize the benefits associated with safe access to their financial records, assess necessary consumer protections and safeguards, and spur innovation.

Take time to read the comments that have been provided as they give insight into the concerns over changes in regulations.

Cyber. On 10/20/16, The Board of Governors of the Federal Reserve System (Board), the Office of the Comptroller of the Currency (OCC), and the Federal Deposit Insurance Corporation (FDIC) asked for comment on an advance notice of proposed rulemaking (ANPR) regarding enhanced cyber risk management standards (enhanced standards) for large and interconnected entities under their supervision and those entities’ service providers. The agencies are considering establishing enhanced standards to increase the operational resilience of these entities and reduce the impact on the financial system in case of a cyber event experienced by one or more of these entities. Given the recent sanctions on Russia for cyber activities and similar such headlines, this is one area where it’s likely the current regulatory regime will remain in place and likely be enhanced.

To discuss further and receive recommendations, please contact Andrew Busch here.