What happens when something goes from infinity to zero?

This is what every portfolio manager is trying to understand after the Federal Reserve indicated it would be raising rates in March and beyond. The Fed Fund Futures contract is pricing in seven 25 basis point rate hikes out to 11/2023. (Ex: 100-98.23-1.77 or 177 basis points.)

Why does this matter for tech?

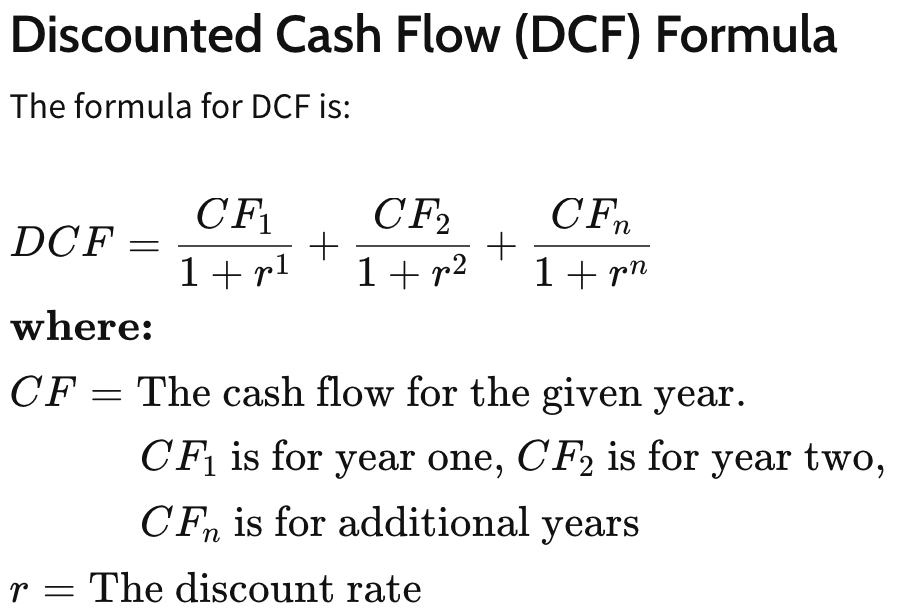

There’s this simple equation most equity models use called discounted cash flow (DCF). It’s one that continues to be taught in most finance classes despite some saying it doesn’t apply to technology companies like Amazon or Tesla. Or when the interest rate/discount rate is zero.

Here’s the formula:

R is the discount rate or interest rate used to discount the flow of future earnings. After the 2020 economic shutdown, the Federal Reserve cut interest rates to zero to stimulate the economy. For companies with earnings, this meant they were worth a lot more as the DCF showed depending on what r one used in the model.

For companies without earnings, DCF with r=0 meant they were essentially worth whatever number (infinity) a model wanted. When you have zero earnings discounted by zero, I think you get infinity or “ERROR.” Either way, a zero-discount rate (or close to zero) allows for fantastical valuations to be placed on SPACs, IPOs and any company with negative earnings. These are usually in the tech sector because no company outside the tech sector would likely dare go public without earnings and get away with it.

This leads us to where we are today. With inflation soaring, the Fed must tell the markets it’s going to raise rates. They will not only raise interest rates, but also reduce the balance sheet to reduce the easy monetary conditions they created causing the inflation. This creates the conditions by which the Fed will not likely bailout the equity markets by changing course. This is game on for higher interest rates and risk off for the market speculation extremes since 2020.

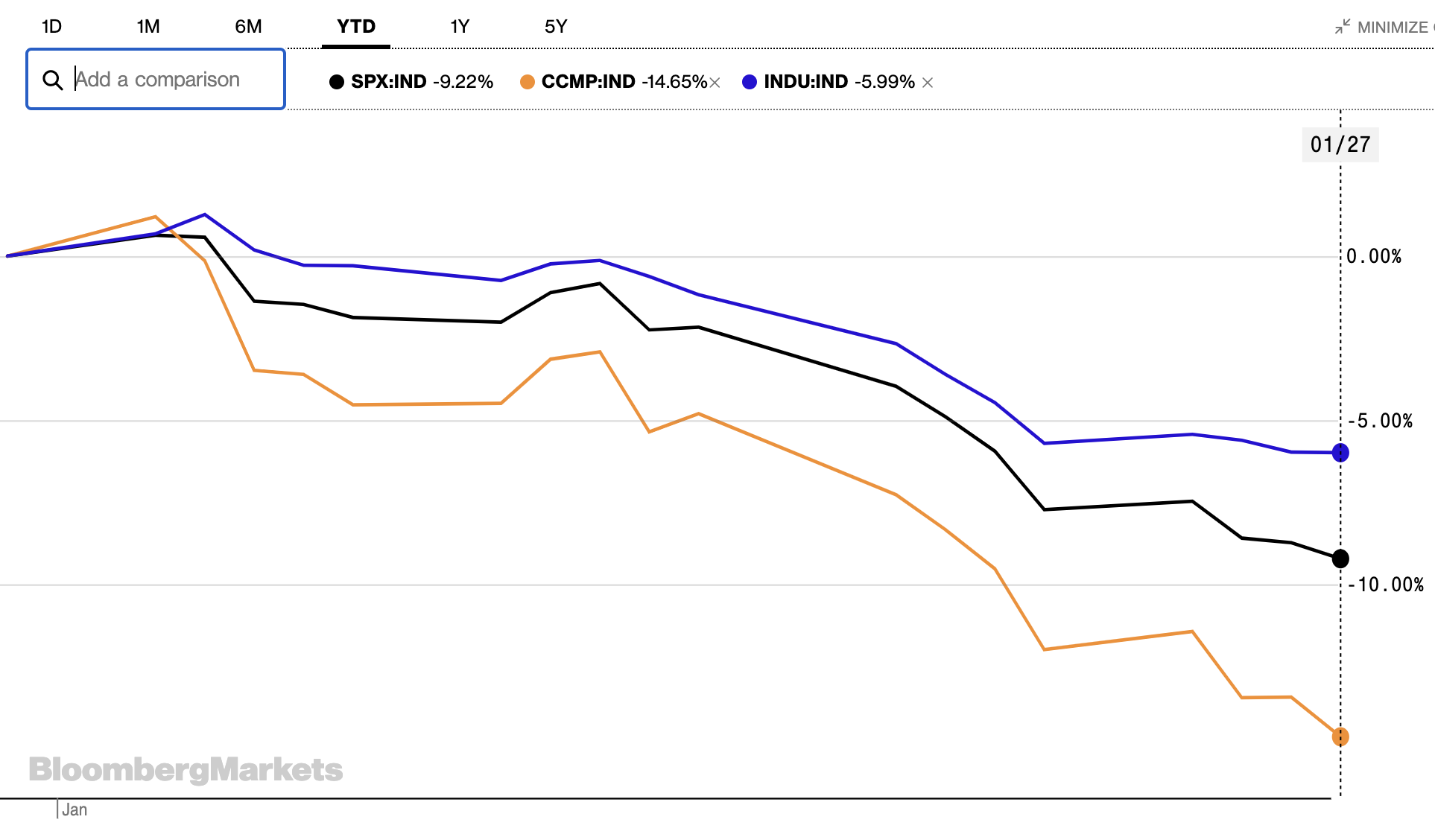

And this risk is mainly targeted at tech stocks. The chart below shows what’s happening.

So where do we go from here?

It’s already tough and it could get worse. There’s tremendous uncertainty over a wide range of topics.

- The US and global economy are slowing rapidly in Q1 due to Omicron, but still have high inflation. The IMF just reduced the 2022 global growth forecast down 0.5% to 4.4% and this is down from 5.9% in 2021. Good thing there’s no such thing as stagflation anymore (sarcasm moment).

- Geo-conflict is rising and where it ends up…Whether it’s China flying into Taiwanese airspace or Russia on the border with Ukraine, the world is on heightened alert. A cyber-attack cascading beyond Ukraine (like Stuxnet or NotPetya) or a nuclear miscalculation would seriously disrupt equity markets as they attempt to adjust risk.

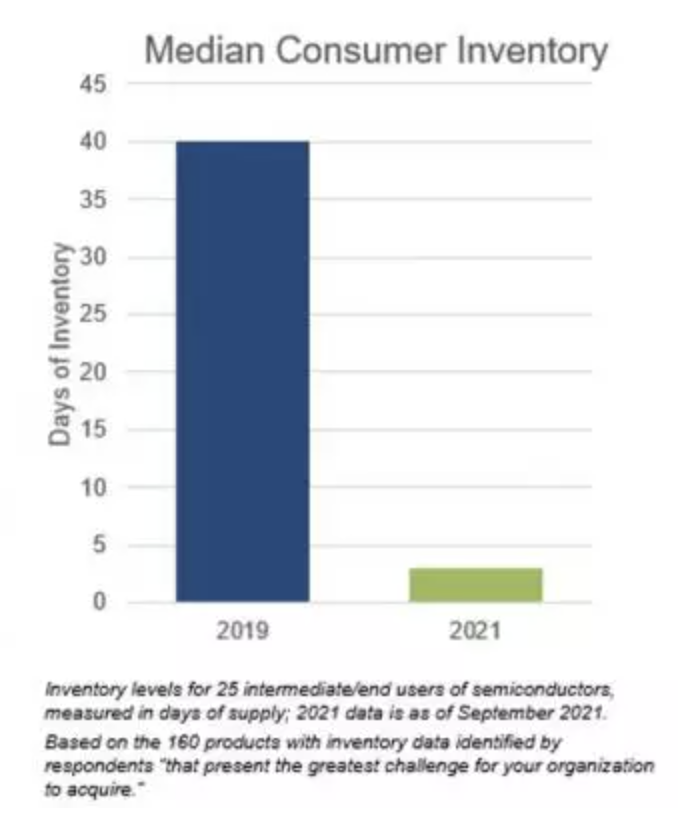

- Supply chain shortage. As an example, the Commerce Department just released a survey of companies and their inventories of chips. “…the median inventory for consumers who responded to the RFI has fallen from 40 days in 2019 to less than 5 days in 2021 (see below). Any disruption to the flow of chips will crush autos.

The good news, a 20% correction is a pretty good start to reducing the over-the-top speculation in tech. The unknown is will we be experiencing 2000 Dotcom 80% NASDAQ drop or will it be a 2020 Economic shutdown 29% drop.

I believe it will be the latter with the caveat of no geo-conflict. I do see tech taking some time to flesh out the change in monetary policy before it can recover. Longer term investors can be patient to add to positions while gaining exposure to companies likely to succeed despite the higher interest rates.