There is strong forward momentum to pass a significantly scaled down version of the Build Back Better Act (BBBA) social spending bill. The White House released details today on the $1.75 trillion bill and President Biden went to Capitol Hill to help push a vote for BBBA and the ) $1.2 trillion bi-partisan infrastructure framework (BIF) bill. BIF has been tied to BBBA by progressives in the House as they wouldn’t allow a vote on BIF until BBBA was agreed upon.

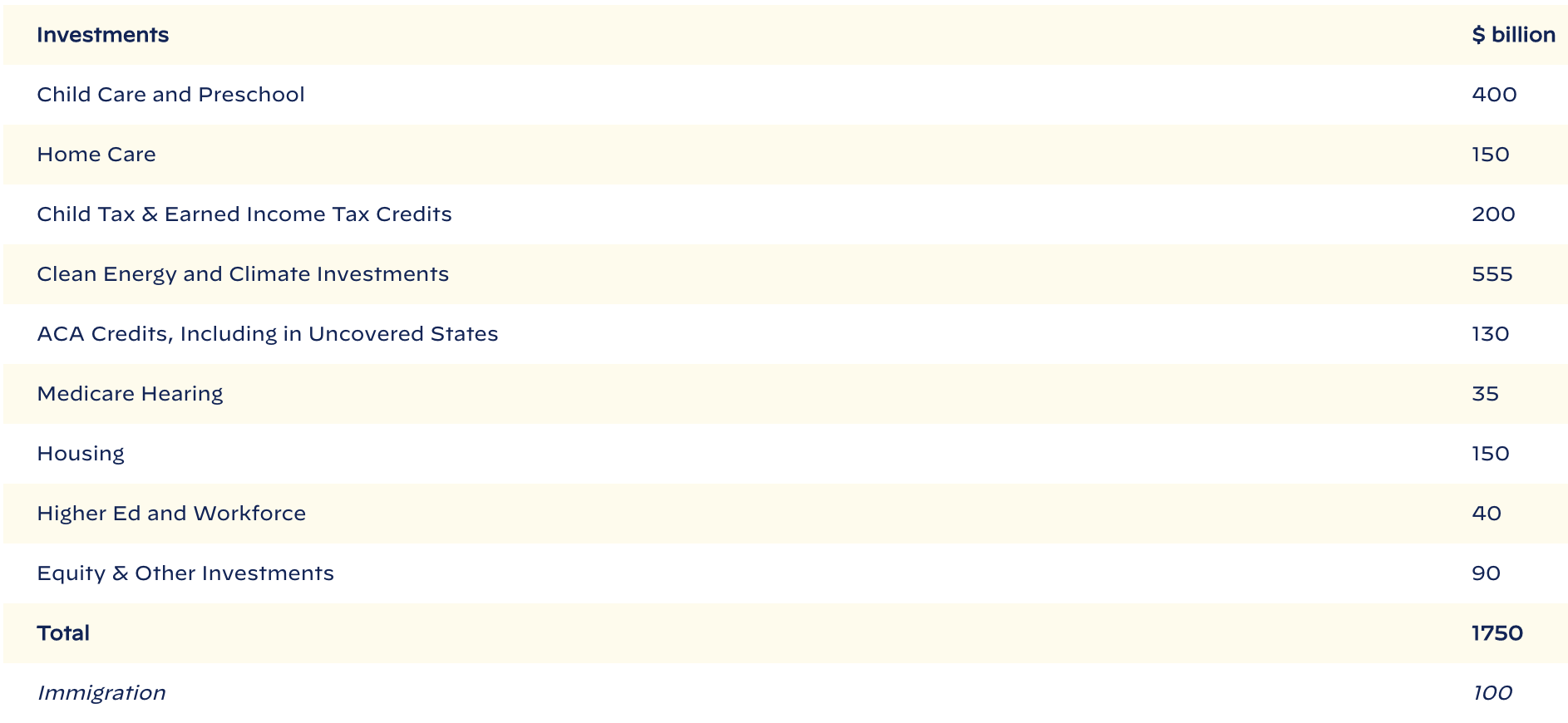

Below are the details on the spending portion or what is called investments by the White House.

As we’ve been warning for some time, these numbers don’t accurately reflect the true cost of key provisions. Why? There are three key spending areas that have sunset provisions. The Child Tax Credit amount and the Earned Income Tax Credit expansion lasts for one year. The increase in spending for the Affordable Care Act lasts only four years. Finally, the funding for Child Care and Pre-school last for only six years. As our friends at the Committee for a Responsible Budget point out, “Extending these policies could end up costing up to $2 trillion over the decade, or perhaps even more.”

In case you think there will be fiscally responsible politicians when these mini-entitlements sunset and need to be renewed, we remind everyone to review the harassment Sen. Sinema is receiving from activists. On October 3rd, these protesters chased the Sinema into a bathroom stall shouting at her questions of what she would cut from the $3.5 trillion BBB is a glimpse into the future of any representative or senator should they choose to oppose renewal of these programs.

On the other provisions consistent with what we’ve been sharing in our research and our conference keynotes, the main spending component of this is $555 billion for clean energy and climate investments. There is no carbon tax or methane tax in the bill at this moment. As well, note the $150 billion on housing. Combine this with the $332 billion housing spend from the BIF and you get a massive amount of money flowing into this area. Given how tight supplies are currently in the housing market, this will exacerbate the price increases for building new homes and likely make them unaffordable for 1st time home buyers. Lastly, there is no SALT provision for upper income earners.

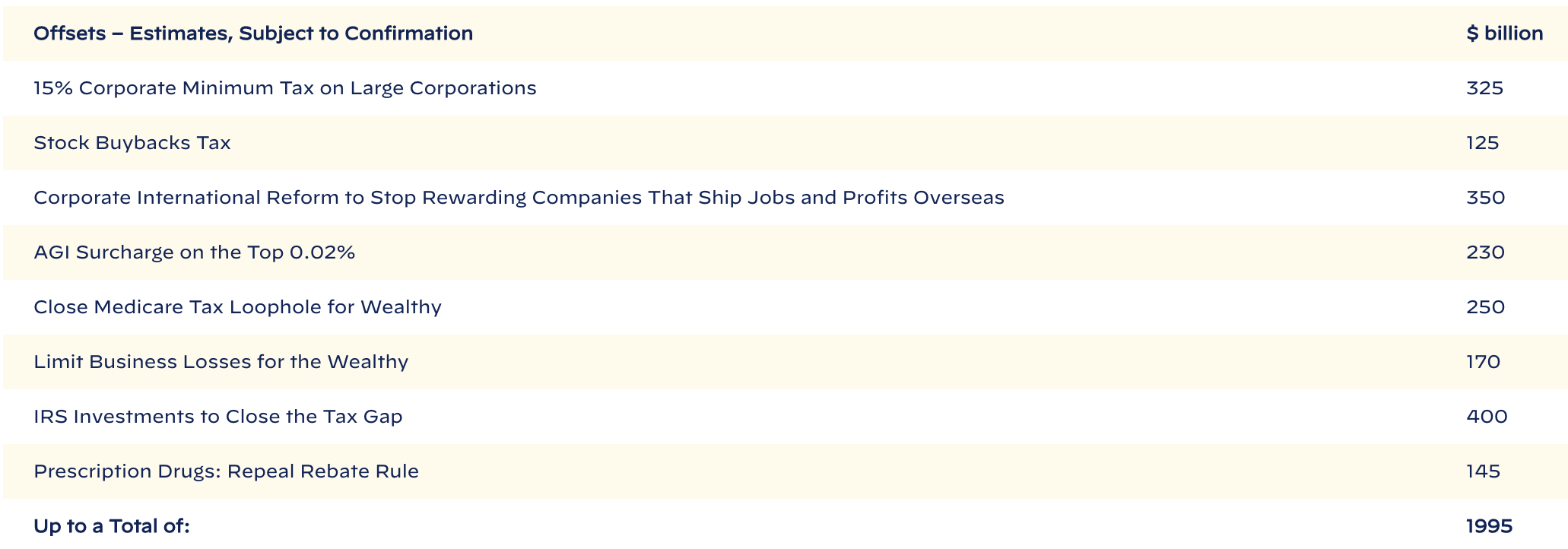

On the revenue component of the $1.75 trillion bill, below are the major raises.

First, the 15% corporate minimum tax on book value is separate from the 15% global minimum tax on foreign profits or what the White House calls, “Corporate International Reform to Stop Rewarding Companies That Ship Jobs and Profits Overseas.” While the former will tax corporations with over $1 billion in profits, the latter doesn’t stipulate any such designation. Second, the massive $400 billion revenue raise from beefing up the IRS and increasing audits on those earning over $400,000 is a bit dream-like and a serious guess. What won’t be a guess is that tax attorneys and accountants will be the major beneficiaries of this provision.

We doubt President Biden would’ve released this new bill structure without already having buy-in from Sen. Sinema and Sen. Manchin. As well, it’s likely House Speaker Pelosi has the votes to get it done despite progressives falling far short of what they wanted. Once the reconciliation process begins, it’s highly likely the two bills will pass. The BIF could be voted on immediately, while the BBBA needs to be converted from a plan into legislative text. This will take until Thanksgiving at the earliest. It remains to be seen if a government funding proposal or a debt ceiling hike will be included in the text. Both need to be done by 12/3.