Overview: Both the U.S. House and Senate passed a combined budget and debt ceiling bill.

Key Points: This action takes away 2 major uncertainties for businesses, as there will be no federal government shutdown and no default on government debt.

After months of work, Congress has passed critical legislation on the federal budget and the U.S. debt ceiling. President Obama stated, “This is a reminder that Washington can still choose to help, rather than hinder, America’s progress, and I look forward to signing it into law as soon as it reaches my desk.” These actions help remove major uncertainties for the markets, for the economy and for businesses. In the words of outgoing Speaker of the House John Boehner, this would “clean the barns” and allow incoming Speaker Paul Ryan to focus on other urgent matters. In this article, we’ll review how the legislation, the Bipartisan Budget Act of 2015 or BBA, impacts the federal budget, the debt ceiling, and who are the winners and losers. We’ll close with a look at how this impacts businesses.

Government shutdown averted

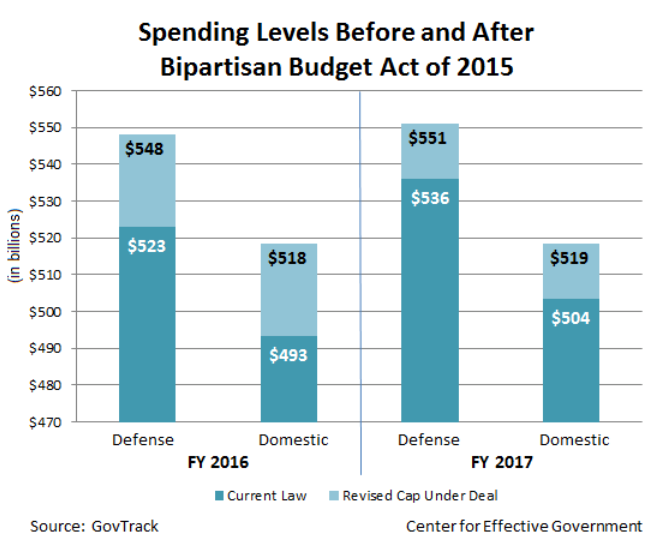

Most importantly, the budget bill takes away a major risk of a U.S. government shutdown in December when the old budget (Continuing Resolution on Budget) would have ended. Congress averted a shutdown by creating a two-year deal that increases appropriated spending and breaks the spending limitations created by the Budget Control Act (BCA) of 2011. Under the current bill, spending levels are raised above the BCA caps by $80 billion through September 2017. The chart below shows the changes in the discretionary spending split between Defense and Domestic buckets.

https://foreffectivegov.org/blog/deal’s-done-what’s-budget-agreement

As well, the legislation increases the debt ceiling, which currently stands at $18.1 trillion. Under the BBA, the debt limit would be suspended until March 16, 2017, allowing unlimited borrowing by the U.S. Treasury. This removes the risk of a U.S. government default on the U.S. debt. Since 1993, there have been twenty measures used to increase the debt limit and eleven were included in broader bills. Therefore, these actions were not without precedent. Clearly, Congress and President Obama wanted to avoid what happened in 2011 when a debt ceiling standoff led to the first ever downgrade of U.S. government debt.

What the deal means for business

With the removal of uncertainty over a default or a government shutdown, businesses can focus on growing their sales and running their companies without worrying over what will happen to their stock value, what federal contractors and industries will get paid, and how borrowing costs may go up or lending dry up.

In 2011, the markets had heightened uncertainty over how a U.S. downgrade would impact credit spreads and lending. If the world’s barometer for risk free debt lost its AAA rating, analysts were unsure how it would cascade through the financial markets.

Yet, the serious problems remain, as the BBA doesn’t address the larger issues of consistent budget deficits that mandate increasing the federal debt to pay for the spending. While the new budget deficit will slightly expand, it will continue to add to the debt. Prior to the deal, the Congressional Budget Office (CBO) estimated that under current spending, the debt would increase over $7 trillion in the next ten years and net interest on the debt would expand to over $800 billion per year. Remember, discretionary spending, defense and domestic, total $1.066 trillion under the new agreement. The translation is that net interest will take away 75% of all discretionary spending by 2025 if nothing changes.

Not to end without hope, the barn has been cleaned to enable the new leadership to focus on important issues like tax reform. As previous chairman of the House Ways and Means Committee, Ryan made it very clear he intended to create legislation to simplify and reform the US tax code. This could include important changes to the international tax component (extra-territoriality), as well as full expensing for capital investments. These would have tremendous, positive impacts for US businesses.

Not raising the debt ceiling can cause interest rates to rise and the stock market to go down along with loss of jobs. I agree that the bigger issue is that the BBA does not account for the budget deficits which will added trillions to the national debt down the road. Spending in Washington has to come under control and budgets needed to be created that allow for a surplus to help pay down the debt instead of adding more to the perpetually increasing national debt.