Typically, a good preacher will understand what is causing concern and angst in their community and more broadly, the world. Then she/he will connect this to faith and show how it can provide strength to overcome the difficult times. COVID, earthquakes in Haiti and forest fires in California all come to mind as examples of things causing concern. Today, I was listening to a preacher and was surprised by what he added to this list: rapidly rising home and rental prices.

Ponder that for a moment. Home and rental prices have increased so intensely that it’s being brought up in church.

With this in mind, let’s take a brief look at what’s driving this concern on housing.

Housing Growth Drivers

Here are my top 8 for what’s creating this rapid growth in housing demand.

- COVID (get me out of the city!)

- Low rates

- Stimulus

- Millennial Demand

- Multi-generation demand

- Pension Funds

- Affordable housing ($45B?)

- Build-to-rent

Given the focus today is on the outcomes of these drivers, we’ll cover these over the coming weeks. There’s a lot going on in the housing space and it’ll be a journey to break these down.

Housing Prices

Let’s begin with the big picture, global affordability. The United States is not the only country stimulating their economy with spending and low interest rates. The graph from the OECD highlights the surge in housing prices globally.

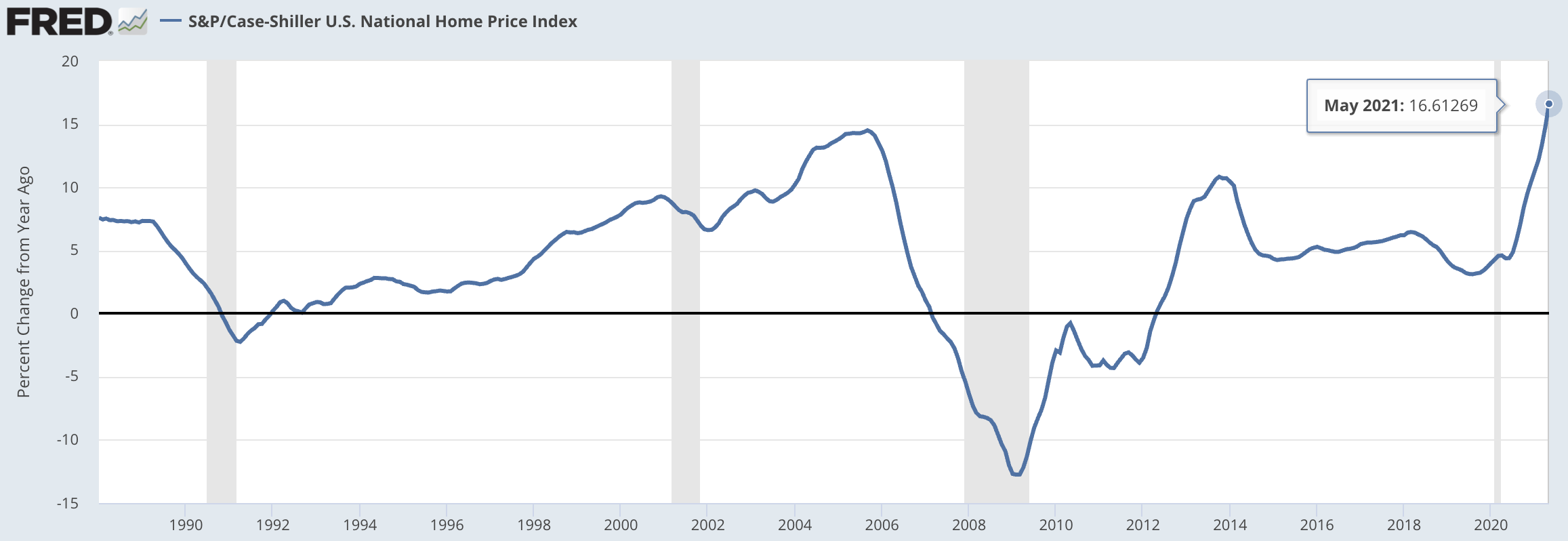

Next up, the Case Shiller national home price index. Since the June 2020 dip, this price index has moved parabolically with the last print up 16.6%.

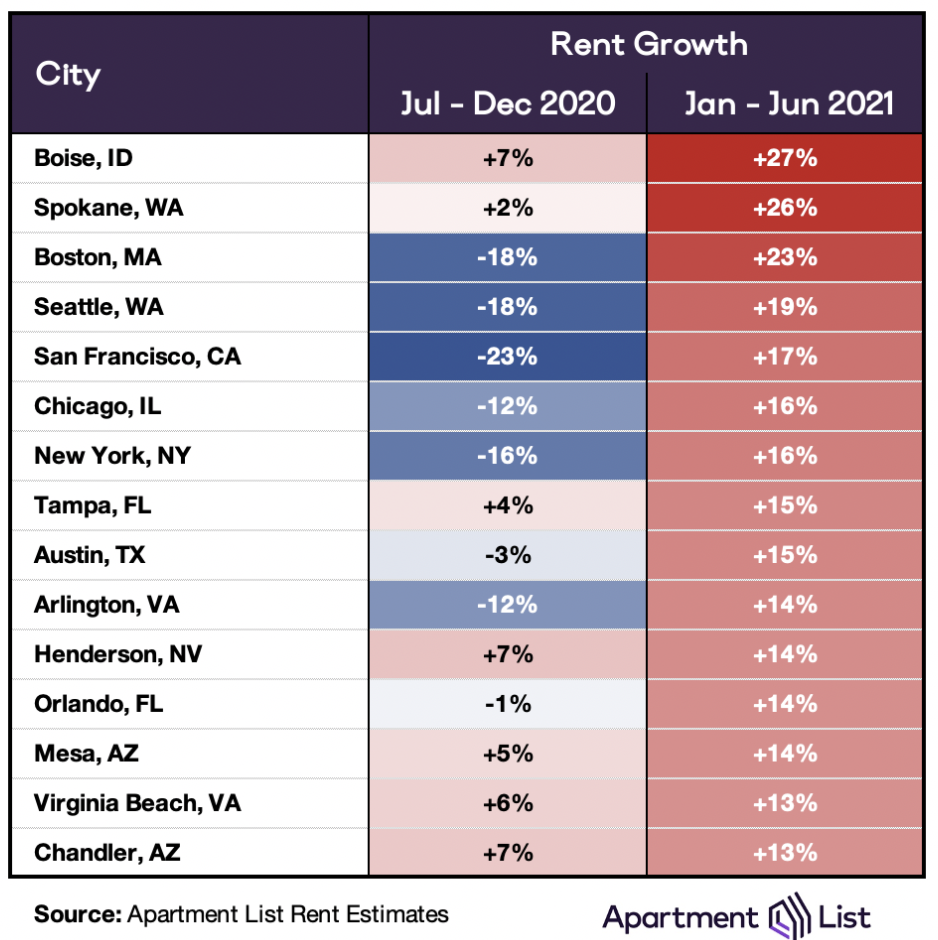

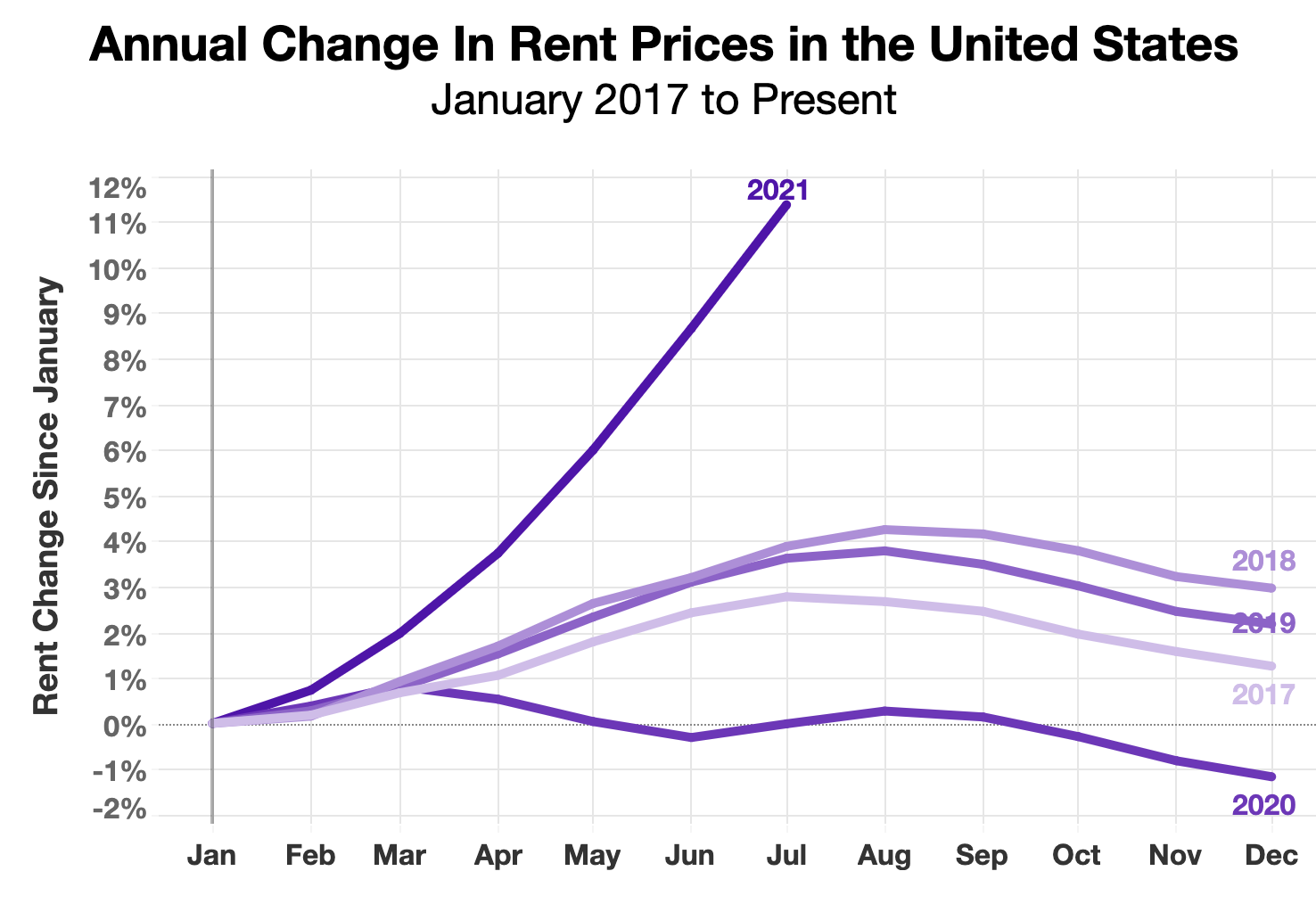

But it’s not just homes going up, the rental market is on fire. The table below is from Apartment List that shows the rent growth in major US cities over the last year and annual change in rents.

Wrapping this up, it’s no surprise that preachers are mentioning the rapid rise in both home prices and rents. The national congregation has every right to be concerned about whether they can afford either buying a house or renting an apartment. The eight factors driving housing demand are not going to meaningfully abate soon. (We’ll review these in the coming weeks.)

For now, expect the house and rental inflation to continue…and the worries.