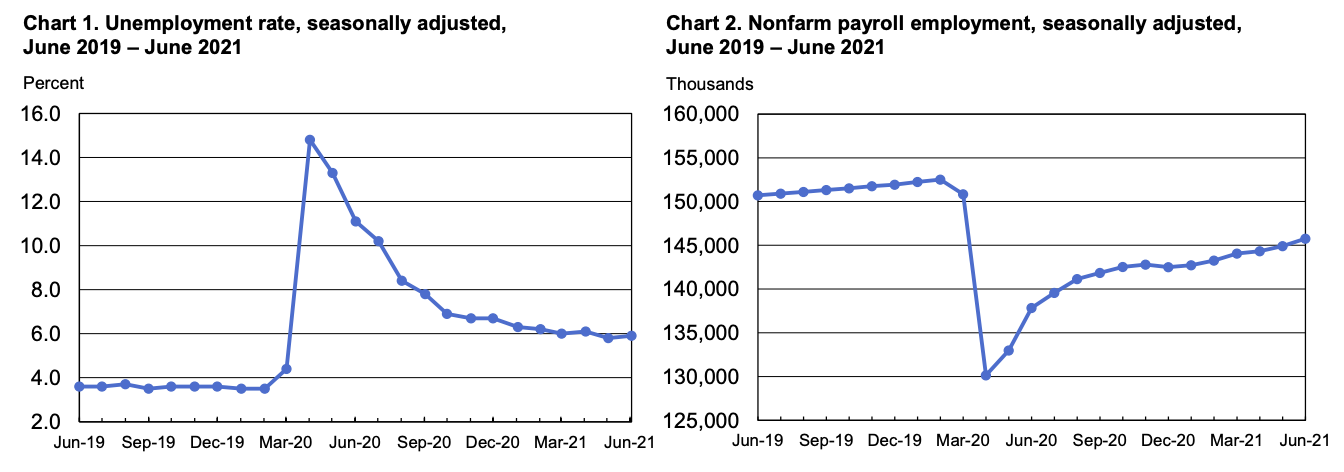

The US releases its monthly unemployment rate and non-farm payroll data on Friday. The charts below show the rapid recovery in jobs since the reopening as over 14.7m jobs have been created. Yet, the country appears to have stalled out with reducing the massive number of jobs lost during the COVID shutdown.

Let’s look at three additional labor statistics to get an understanding of this odd situation.

According to NFIB’s June monthly jobs report, 46% of small business owners reported job openings they could not fill in the current period, down two points from May but still above the 48-year historical average of 22%. “Small business owners continue to struggle to find qualified workers for their open positions while raising compensation at a record high level.” 60% of those surveyed said they have a severe staffing shortage and are experiencing lost sales opportunities.

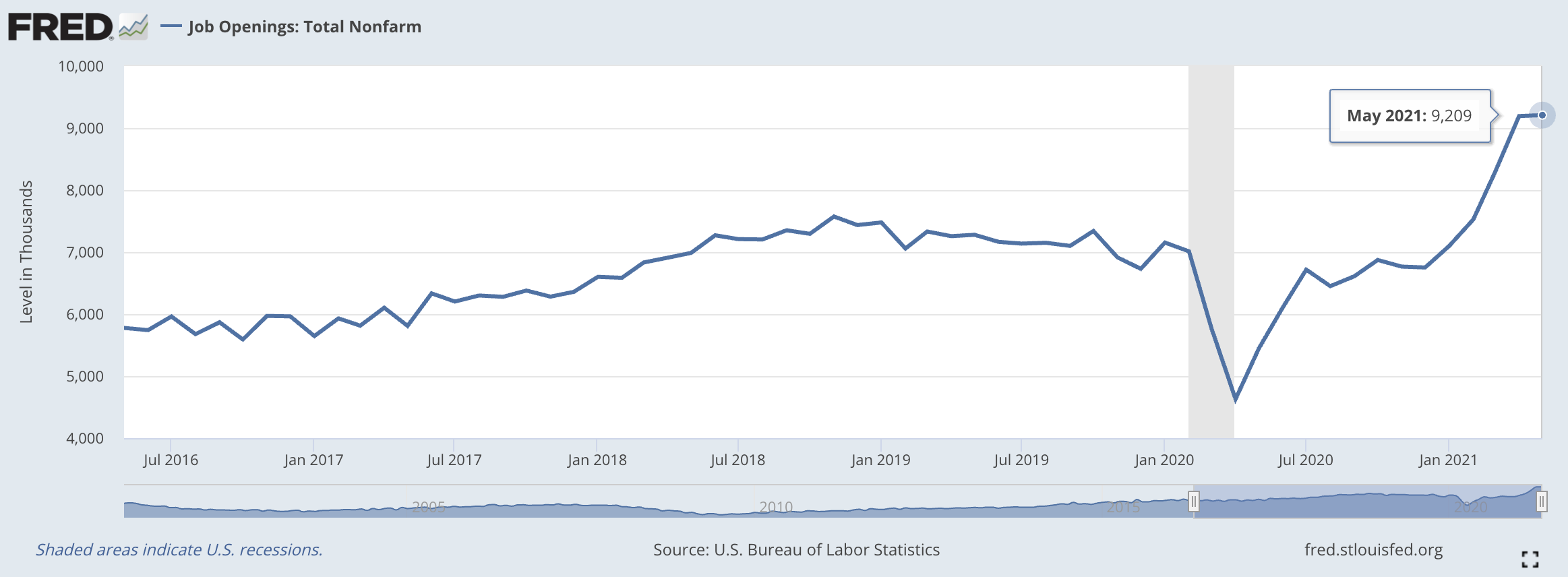

The May US government Bureau of Labor and Statistics Job Openings and Labor Turnover report showed over 9 million job openings available for the second straight month. The graph below charts the surge.

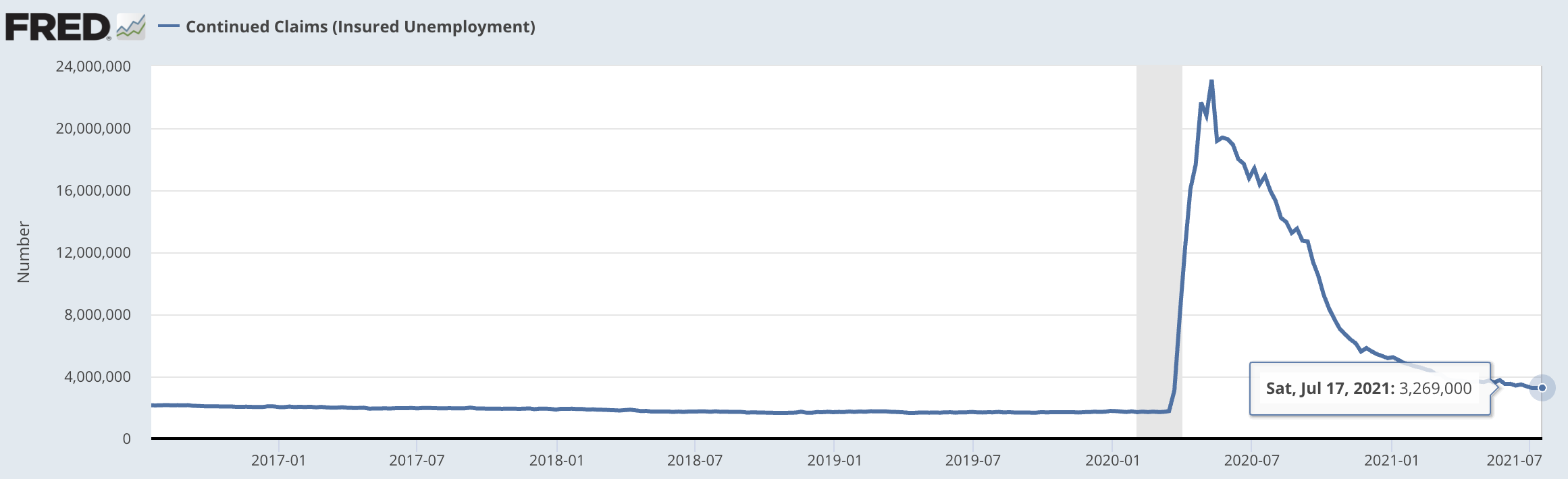

Finally, the U.S. Employment and Training administration’s weekly Continuing Claims (Insured Unemployment) data shows a dramatic fall in the claims after the reopening. But it appears to have made little headway since the end of May.

(Side note, I do audience surveys at my keynotes. In July when asked, “What is the biggest risk for the economy”, 45% of the attendees stated labor force shortage.)

The WSJ’s Jon Hilsenrath offers this explanation behind the situation. “Many workers moved during the pandemic and aren’t where jobs are available; many have changed their preferences, for instance pursuing remote work, having discovered the benefits of life with no commute; the economy itself shifted, leading to jobs in industries such as warehousing that aren’t in places where workers live or suit the skills they have; extended unemployment benefits and relief checks, meantime, are giving workers time to be choosy in their search for the next job.”

As Hilsenrath points out, there are many additional factors driving the change. I would add one more: housing costs. Austin, Denver and Charlotte are examples of housing markets that have dramatically risen in price over the last 2 years. Entry level and mid-level workers are getting priced out of these cities and likely staying out of applying for jobs. If you can only afford housing 45-60 minutes away, there’s little reason to seek employment in those areas.

But let’s focus on the extended unemployment benefits. These payments will end on September 6th. By the end of 2021, we’ll have enough data to do comparative analysis to see if this is having a significant impact on workers staying home instead of taking jobs. However, 24 states have already declined the extended benefits. Last week, McDonald’s said the labor shortage that has plagued its restaurants this year is showing signs of abating, especially in states that have already ended the extended unemployment benefits according to Fox Business.

“We’re seeing applications have increased pretty significantly. Applications in states that have ended early, the federal stimulus, those have tended to do even better. So I do think that there’s evidence that as the federal stimulus rolls off, that you’ll see an improvement in the application rate.” McDonald’s CEO Chris Kempczinski

We’ll need more data than just anecdotes to know if the extended unemployment benefits are driving the surge in unfilled jobs, but we do need to pay attention when a major employer points to it as an explanation. After September 6th, we’ll begin to get a much clearer picture.