Executive Summary:

- Sharp Differences in Trade Policy: This research analyzes the trade policy stances of top Republican candidates, revealing significant ideological divides. Trump and DeSantis favor a managed trade approach with a focus on bilateral agreements and strong measures against China. In contrast, Haley and Christie lean towards a more laissez-faire, market-led approach, emphasizing American business empowerment with minimal government intervention.

- Focus on China: All candidates recognize the importance of China in global trade, albeit with differing approaches. Trump and DeSantis propose aggressive measures, including tariffs and reshoring initiatives, while Haley and Christie suggest subtler strategies, focusing on leveraging market forces and alliances to counterbalance China’s economic influence.

- Implications for U.S. Economy and Global Trade Standards: The trade policies of these candidates have far-reaching implications for various U.S. economic sectors, particularly traditional manufacturing, and critical minerals. Additionally, their positions will significantly influence the U.S. role in setting global trade standards, with Trump and DeSantis likely to pursue an isolationist approach, while Haley and Christie likely advocate for U.S. leadership in shaping multilateral trade agreements.

In the Fall before a presidential election year, the thinning of the candidates comes as naturally as Americans gaining weight during the holidays. Since our last primer on the Republican field, Mike Pence, Tim Scott, and Doug Burgum have all called it quits. But while some candidates fade into oblivion before the Iowa caucus, Nikki Haley’s meteoric ascent stands out as an early narrative to closely watch.

The former South Carolina governor – and President Trump’s ambassador to the United Nations – has turned heads with impressive debate performances and confident policy pronouncements. Haley presents a more compassionate perspective on Republican policies while staying true to conservative principles. Her approach seems to resonate with a broader audience, showcasing a blend of empathy and strength. In a major blow to DeSantis, the powerful Koch political network formally endorsed Haley, throwing their considerable grassroots resources behind her campaign. As Haley emerges as a viable Trump alternative, she is articulating a distinct economic and foreign policy vision.

In line with Haley’s international focus, this article examines a key economic component: international trade. For much of the post-World War II era, US trade policy enjoyed a healthy bipartisan consensus that pushed trade liberalization into the far reaches of the globe. American leaders were the architects behind global trade institutions that seemed destined to usher in a Pax Americana, underpinned by the free flow of goods and services. The theoretical concept of countries that do business together rarely go to war with each other was another also a major driver for increased international trade.

Today, each US presidential candidate is acutely aware of the shadow cast by China, a central focus in their strategic considerations. Contrary to the initial optimism surrounding China’s 2001 accession to the World Trade Organization, it is now viewed as a dark stain on America’s trade policy history, far from the envisioned triumph of free trade or hope for democratic liberalism. This outcome has prompted a revaluation of global trade dynamics and prompted a repositioning of the American trade position from global to regional.

In this piece, we will cover some of the key challenges and policy choices facing the Republican candidates. President Trump was the first to harness disdain for China’s economic rise during his successful campaign for the White House in 2016. Now, every Republican candidate is playing a variation of this tune. All the Republicans left in the field promise action against China, but their points of emphasis reflect their divergent worldviews. Navigating the complexity of trade with China will not be simple, especially as the dynamic global economy continues to evolve and disentangling the two nations is almost impossible. For the US, it is a question of how-to de-risk not completely decouple from the world’s largest manufacturer.

We’ll examine the stance taken by each candidate and then dive into the implications for future economic growth,

Donald Trump

Donald Trump’s impact on global trade policies remains a subject of intense scrutiny and debate. To trade policy wonks, Donald Trump will forever be known as the president who upended the system of global trade. During his time in office, he shifted US priorities from multilateral to bilateral trade agreements; used little-known trade policy authorities to launch a trade war with China; erected tariff walls to protect domestic steel and aluminum production; and eschewed global trade institutions like the World Trade Organization. His supporters claimed his actions were a long overdue rebalancing of trade relationships that were tilted against America and to address China’s abuse of the WTO rules. To critics, his actions dangerously imperiled the hard-won global trading system, alienated allies, and raised costs for American consumers.

Love it or hate it, Donald Trump has promised more of the same if he wins a second term. Trump has stated he wants to impose a 10% tariff on not only all Chinese imports, but also all imports into the United States. He also wants to force China to live up to their full purchase commitments made in the Phase One trade agreement they signed at the height of the trade dispute which included intellectual property (IP) that strengthens protection and enforcement of IP in China. Finally, Trump has advocated for a “national reshoring plan” that would bring the production of essential medical and national security goods back onto American soil.

Trump also touts one of his signature achievements as a template for future action. He led the renegotiation of the North American Free Trade Agreement, which was replaced by the US-Mexico-Canada Agreement (USMCA). The USMCA is scheduled for a joint review by all the parties in 2026.

- Prepare for Aggressive Trade Measures: Businesses should be ready for a continuation of Trump’s hardliner stance on trade, especially with China. This includes potential increased tariffs and trade barriers. Expect US exports to receive the same treatment of 10% tariffs and a slowing of the global economy from this.

- Reshoring Initiatives: Companies should evaluate the feasibility of reshoring some production, especially in essential medical and national security goods, in line with Trump’s national reshoring plan.

- Focus on Bilateral Agreements: With Trump’s preference for bilateral over multilateral trade agreements, businesses should monitor and adapt to changes in these individual trade relationships. Understand what a scuttling of USMCA would do for trade between Canada, Mexico and the US.

Nikki Haley’s trade policy views must largely be inferred from her general economic plan and record as governor of South Carolina. Clearly, Haley supports enhanced trade and understands its connection to domestic prosperity, writing in 2020 that “trade is a fundamentally beneficial part of the American economy for both consumers and businesses.” That should come as no surprise since South Carolina enjoys one of the most export-oriented economies in the nation. The state’s export industries, particularly in sectors like automotive, aerospace, and medical devices, flourished under Haley’s tenure.

During her tenure as governor, Haley actively bolstered the state’s business climate by making investments to enhance its competitiveness. She advocated for infrastructure improvements on roadways and ports, prioritized technical college funding and skills training, and cut regulations and taxes. She also touted her “personal touch” in attracting businesses to the Palmetto State. These initiatives reflect her comprehensive strategy for economic advancement, emphasizing improvements in infrastructure, investments in education, and the cultivation of a regulatory landscape conducive to economic growth.

All that said, Haley’s “Freedom Plan” for the national economy does not mention trade specifically. Instead, she emphasizes China’s role as an “existential threat” and brands Bidenomics as a government-subsidized economy “on the road to socialism.” Her critiques in this regard largely align with her Republican counterparts.

Where Haley differs is in her overall orientation toward the role of government in economic policy. She acknowledges that China’s government is doing all that it can to “win the industries of the future.” However, she makes clear that her preferred antidote is a free market. Here she draws a contrast with Trump and DeSantis, noting that while some Republicans want industrial policy, “giving Washington more control is not the solution; it is the problem.”

Instead of directing economic development and providing government subsidies (“corporate welfare” in her parlance), Haley wants to create the best business environment and incentives to drive growth. In turn, then trust American entrepreneurs and innovators to find the areas of comparative advantage. Her case study on the textile industry in South Carolina underscores the point. Haley notes that when textile production jobs moved to China, many South Carolina factory towns were decimated. But rather than subsidize the textile industry, Haley worked with business and political leaders in the state to reimagine the manufacturing sector. Today, she boasts that South Carolina is home to a thriving network of automobile, aerospace, and medical device manufacturers. Haley trusts the market to develop the right solutions, provided the right business policy framework is in place.

- Market-Led Approach: Haley’s free-market approach suggests a less interventionist trade policy. Businesses should focus on innovation and finding comparative advantages in the global market.

- Bi-lateral trade agreements: While she doesn’t specifically mention them, her international views are aligned. These types of free trade agreements greatly benefit US companies and would contribute to enhanced partner economic growth.

- Emphasis on Entrepreneurship and Diversified Manufacturing Sector: Companies should leverage a potentially more business-friendly environment with minimized regulations and taxes.Haley’s record suggests support for diverse manufacturing sectors like automobiles, aerospace, and medical devices. Businesses in these areas might find growth opportunities.

Ron DeSantis espouses virtually the same trade policy priorities as Trump. Even the tagline of his signature economic plan, the Declaration of Economic Independence, is titled “We Win. They Lose.” – a clear nod to the former president who popularized the idea that China was winning on trade against the US.

The DeSantis plan picks up on several of Trump’s other focus areas, including a focus on reversing the goods trade deficit and limiting the ability of US companies to do business in China. DeSantis also aims to end China’s preferential trade status at the World Trade Organization. Finally, DeSantis would restrict the sale of farmland and other “strategic assets” to Chinese investors. These proposed measures reflect DeSantis’s intention to curtail China’s influence and investment opportunities within the US, particularly in critical sectors deemed strategically significant.

DeSantis also echoes Trump’s critique that multinational companies and other “elites” are prioritizing their own self-interest over the health of the American economy. While light on specifics, he vows to use trade and tax policy to secure supply chains and align US corporate actions with policy goals.

- Anticipate Strong Measures Against China: Like Trump, DeSantis emphasizes a hard stance against China. Businesses should be prepared for possible trade restrictions and limitations on investments in China.

- Supply Chain Security: With a focus on reversing goods trade deficits and securing supply chains, companies should consider diversifying their supply sources and reducing reliance on China.

Of all the remaining candidates, Chris Christie offers the fewest policy specifics. The few public statements he has made related to trade policy largely consist of criticizing former president Trump’s actions, advocating for an aggressive posture toward China, and supporting the launch of new trade negotiations.

Christie pulls no punches when talking about Trump’s record. He claims that Trump’s actions on trade “looked good on paper but fell short.” Still, he would keep the current tariffs on Chinese goods instituted by the Trump administration. He is also intent on “renegotiating” the trade relationship with China and is open to restricting Chinese investment in the US. However, he stopped short of advocating for restrictions on US private investment in China, noting that the government cannot be relied on to solve every problem. Overall, he claims his main trade policy focus would be on “negotiating better trade deals and enforcing them.”

Christie’s willingness to maintain certain Trump-era tariffs and explore renegotiations signals an intention to recalibrate trade relationships without advocating for extensive restrictions on investment, emphasizing negotiation and deal enforcement as primary objectives.

- Negotiation and Enforcement Focus: Christie’s strategy of renegotiating trade deals and enforcing them suggests a dynamic trade environment. Businesses should stay informed on new trade negotiations and adjust their strategies accordingly.

- Maintain Flexibility: Christie’s less specific policy approach suggests that businesses should maintain flexibility to adapt to potential changes in trade policy and regulations.

The remaining Republican candidates divide neatly along ideological lines. For Trump and DeSantis, the clear preference lies in managed trade. Under their vision, the federal government assumes a greater role in shaping trade relationships and supply chains through the muscular use of tariffs, import quotas, and bilateral trade negotiations. Traditional manufacturing industries, such as steel, aluminum, and automobiles, occupy the central role in their policy. Relying almost entirely on America’s economic (and military) might, buoyant consumer demand, and deep capital markets, the managed trade philosophy is mostly antagonistic to global trade institutions and potentially could reduce global growth. These bodies are viewed as an ineffective nuisance that constrains US action and provides reputational cover for non-market-based economies.

Haley and Christie have a lighter touch approach to trade policy. Neither proposes a full-throated defense of free trade principles popular in the pre-Trump era. Nonetheless, Haley and Christie appear more comfortable with empowering American businesses to conduct their affairs without overbearing industrial policy. Their focus is on supporting American innovation and businesses by minimizing regulations, taxes, and foreign trade barriers. As Haley’s textile industry example makes clear, the approach does not entail a “blank check” commitment to protecting domestic industries.

The competing visions have different implications for two of the central trade policy challenges that will face the next American president: competition with China and setting global trade standards. Let’s look at each in turn.

Approaching competition with China

All the candidates in the race have joined the chorus of criticizing China – or the Chinese Communist Party, as they are correct in saying. There is no question that China’s statist approach to economic development and government-directed stimulus can wreak havoc in global markets. But the simple us-versus-them rhetoric of China competition, employed frequently on the debate stage and in the press, masks the enormous complexity of the integrated economic and trade relationship. For all the talk of going it alone, America depends on China (and vice versa) for shared prosperity and economic growth. However, this interdependence doesn’t negate the challenges posed by China’s economic policies, which often impact global markets, trade dynamicsand manufacturing jobs.

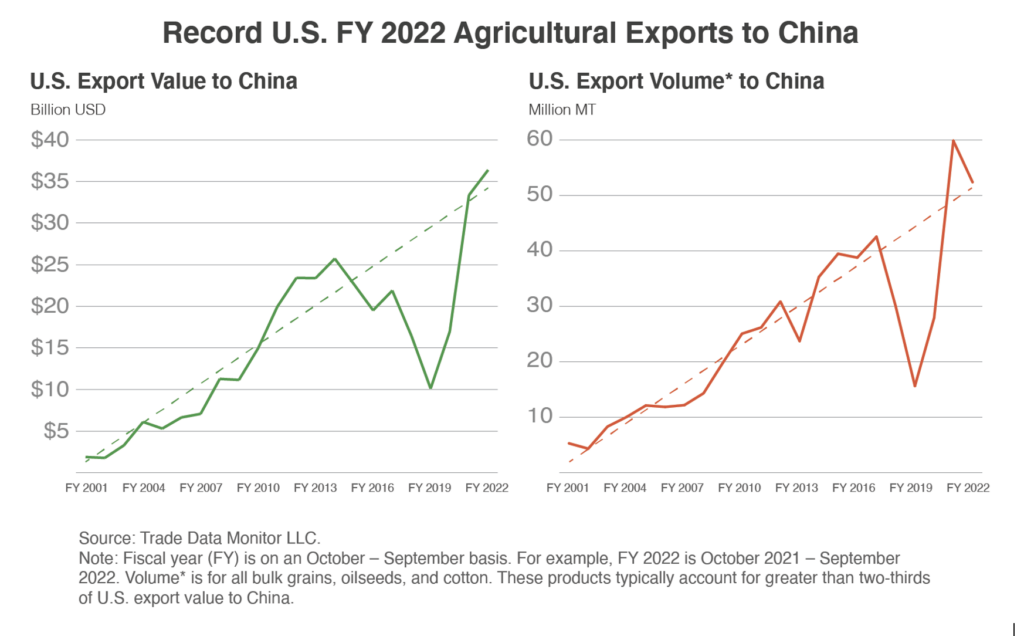

Consider the agriculture sector for example. Since China joined the World Trade Organization in 2001, American agricultural exports to China have taken off like the price of a Taylor Swift concert ticket . Starting from less than $5 billion annually in 2001, the US now sends over $35 billion worth of grains, meat, oils, and other foodstuffs to China’s massive consumer market each year. China’s increased spending on food and agriculture has lifted global crop prices, benefiting American farmers nationwide for the past twenty years.

When China targeted US agricultural products during the trade dispute with former President Trump, the backlash from the farm community was vocal and swift. The Trump Administration responded with a $12 billion aid package designed to help farmers impacted by the tariffs. The next US president will face a much more constrained fiscal environment, exacerbated by higher interest rates that raise the costs of government borrowing. Such large government stimulus may not be available to support US farmers if another US-China trade war breaks out.

Critical minerals are another sector where the US-China trade is not black and white. Critical minerals refer to a broad range of base materials that are essential building blocks for green technology and computing. Minerals like lithium, cobalt, and graphite are used to power electric vehicles, create long-lasting batteries, and facilitate solar energy transfer. Demand is expected to grow exponentially in the coming decades as more clean energy technology comes online. Yet China maintains a veritable stranglehold on critical mineral processing. Investment bank Goldman Sachs estimates that “China accounts for 85-90% of global rare earth element mine-to-metal refining.” In addition, China “refines 68% of the world’s cobalt, 65% of nickel, and 60% of lithium of the grade needed for electric vehicle batteries.”

China’s dominance in critical mineral processing, coupled with its immense manufacturing capabilities, provides the nation of 1.4 billion people with an incredible platform for green technology production. 75% of all batteries are made in China. Furthermore, China enjoys dominant market positions in electric vehicles, wind turbines, and solar panels. The economic reality of the green energy transition is that Chinese manufacturers stand to benefit greatly unless the US and allies can slowly shift global value chains away from China’s control. That is much easier said than done. China’s manufacturing prowess did not develop overnight. Many years and billions of dollars in capital expenditure will be required to move the needle. China’s decision in July to impose export restrictions on gallium and germanium was a global political wake-up call to the dangers of having one country with this much control over rare earths.

The Trump-DeSantis nexus is prepared to take drastic action to ratchet up the pressure on China’s economy at a time when China’s economy is under duress from a rapidly declining real estate sector. From Trump’s proposal to tax all imports from China at 10%, to DeSantis’ musings about restricting private US investment in China, both candidates seem willing to attack the established global economic order in pursuit of their goals. In addition to tariffs, they would not hesitate to use heavy government stimulus to incentivize manufacturing and production in the US. But as the examples of agriculture and critical minerals highlight, the next US president can only push China so far without jeopardizing other US economic goals. These potential strategies indicate a willingness to challenge the status quo, but they also underscore the delicate balance required between exerting pressure on China and safeguarding other vital economic interests.

For their part, the Haley-Christie philosophy would search for more subtle ways to target China’s economy and nudge supply chains towards friendlier nations. Current tariffs imposed on Chinese goods are now so ingrained that neither candidate would commit to removing them unilaterally. At the same time, both seem inclined to rely more on US allies and less on direct government subsidies to pursue their policy goals. Haley’s experience as a United Nations ambassador may be particularly impactful as the US seeks to deepen strategic alliances with Canada and the European Union on topics related to competition with China.

Setting global trade standards

The other major trade policy topic confronting the next US president will be the race to establish global trade standards. While tariffs tend to dominate the mainstream public dialogue on international trade, modern trade agreements address a wide range of non-tariff barriers that negatively impact US exports. Restrictive licensing requirements, health certificates, data localization mandates, and other regulatory quirks are often exploited by national governments to undermine the free flow of goods and services. The costs are hidden compared to tariffs, but the economic impact is no less real. One study by economists at the University of Chicago found that between 2017 and 2019, about half of the decline in US exports to China was due to higher non-tariff trade barriers.

Vital US economic interests are at stake as foreign nations seek to establish rules for the next era of global trade. One such agreement is the Trans-Pacific Partnership, a 12-nation trade pact that devotes over 10 chapters to addressing non-tariff trade barriers. The US helped negotiate nearly all the agreements but withdrew early in the Trump presidency. Another example is the Digital Economic Partnership Agreement, concluded in 2020 between Singapore, Chile, and New Zealand. The agreement sets out standards that protect cross-border flows and enables increased digitization in financial services, logistics, and telecommunications.

None of the 2024 presidential candidates have put forward concrete plans for shaping the rules of global trade or launching ambitious new negotiations. But the candidates ignore these emerging realms of trade policy at their own peril. According to the U.S. Chamber of Commerce, jobs tied to the digital economy support more than 2 million jobs and have outpaced overall job growth for the last decade. Furthermore, the US consistently runs a surplus in the services trade, standing in stark contrast to the decades of successive trade deficits in goods.

Given their general aversion to multilateral trade agreements and emphasis on traditional manufacturing, Trump and DeSantis are unlikely to lose much sleep over these global trade policy developments. The candidates see no reason why America should help write the rules of trade for everyone else or support global trade institutions. They prefer an isolationist approach where America focuses on achieving narrow trade policy goals through brute force and bilateral engagement.

For their part, Haley and Christie can be expected to acknowledge the positives of US leadership on global trade policy. Their orientation toward foreign affairs generally aligns with a view of America as a global superpower with the responsibility to shape policy on a worldwide scale. US efforts to pursue new multilateral trade agreements, whether with small groups of nations or under the auspices of the World Trade Organization, are likely to gain more traction in a Haley or Christie administration. Haley and Christie’s approach highlights a nuanced strategy focusing on leveraging alliances and exploring indirect measures while maintaining a cautious stance regarding existing tariffs.

Conclusion

No matter who takes the reins of America’s trade policy apparatus, shared concern over America’s competitiveness in global markets and ability to shape global supply chains will dominate.

In a Trump-DeSantis world, traditional manufacturing industries stand to gain. Knowledge-based workers and broad swathes of the consumer market, who largely benefit from cheap, imported goods, may see their interests jeopardized and worse, see a resurgence of inflation.

Meanwhile, Nikki Haley and Chris Christie propose a different worldview. America will flex its economic muscle, but in a more subtle, diplomatic way. Both candidates are less inclined to protect domestic firms or dole out subsidies to support export-oriented economies. Small businesses, consumers, and knowledge-based firms stand to gain from a slightly more hands-off trade policy.

Ultimately, the outcome of these competing narratives will transcend campaign podiums, shaping the trajectory of American trade policy and its position on the global stage. As voters attempt to understand these policies and the economic impact, their decisions at the ballot box will echo long after the election and cascade out beyond our borders.

References:

- https://www.msn.com/en-us/news/politics/billionaire-backed-koch-network-endorses-nikki-haley-for-president/ar-AA1kFAWY

- https://www.youtube.com/watch?v=1C3bqPe2Q9s (Nikki Haley Freedom Plan Speech)

- https://www.energy.gov/sites/default/files/2022-02/Neodymium%20Magnets%20Supply%20Chain%20Report%20-%20Final.pdf

- https://www.goldmansachs.com/intelligence/pages/resource-realism-the-geopolitics-of-critical-mineral-supply-chains.html

- https://www.uschamber.com/international/trade-agreements/the-digital-trade-revolution-how-u-s-workers-and-companies-can-benefit-from-a-digital-trade-agreement

- https://nikkihaley.com/the-freedom-plan/

- https://crsreports.congress.gov/product/pdf/IF/IF10156

- https://www.whitehouse.gov/briefing-room/statements-releases/2022/02/22/fact-sheet-securing-a-made-in-america-supply-chain-for-critical-minerals/

- https://www.piie.com/blogs/realtime-economics/next-steps-europe-and-us-their-green-agenda-steel-and-critical-minerals

- https://www.usda.gov/media/press-releases/2018/08/27/usda-announces-details-assistance-farmers-impacted-unjustified

- https://ustr.gov/trade-agreements/free-trade-agreements/transatlantic-trade-and-investment-partnership-t-tip/t-tip-2

- https://bfi.uchicago.edu/insight/research-summary/non-tariff-trade-barriers-in-the-u-s-china-trade-war/#:~:text=About%2050%25%20of%20the%20overall%20decline%20in%20US,trade%20war%20was%20due%20to%20non-tariff%20trade%20barriers.

- https://www.mti.gov.sg/Trade/Digital-Economy-Agreements/The-Digital-Economy-Partnership-Agreement

- https://www.uschamber.com/international/trade-agreements/the-digital-trade-revolution-how-u-s-workers-and-companies-can-benefit-from-a-digital-trade-agreement

- https://ag.purdue.edu/commercialag/home/paer-article/trade-and-trade-policy-outlook-2023/

- https://rondesantis.com/mission/Declaration-of-economic-independence/

- https://www.cnn.com/election/2024/presidential-candidates

- https://www.wsj.com/podcasts/opinion-potomac-watch/chris-christie-on-ukraine-trade-and-his-path-to-the-white-house/80841488-0077-4a45-bc3a-3b349e211929

- https://amp.cnn.com/cnn/2023/12/03/politics/nikki-haley-republican-primary-nomination/index.html

- https://www.bloomberg.com/opinion/articles/2023-10-01/nikki-haley-has-abandoned-trump-s-foreign-policy

- https://fortune.com/2020/07/18/ppe-manufacturing-jobs-companies-us/