President Donald Trump and Democratic presidential nominee Joe Biden have radically different plans for taxes and spending. Trump proposes tax cuts and tax credits to create economic growth. Biden promises to raise taxes on high income earners and corporations to use for a wide range of social spending programs. All of these proposals are being put forward in a complex and difficult time, with both candidates trying to “convince voters that each is better equipped to lift the nation out of one of the worst downturns in history.” (Barron’s)

While Trump and Biden have put forward proposals on tax policy, the real issue is likely to be one of political assent. As Otto Von Bismarck said, “Politics is the art of the possible.” It is unlikely either candidate will be able to enact his desired tax plans if there is a split Congress and therefore, what will be possible will likely be less than what the candidates want. Given the COVID-19 spending occurring today and the fiscal deficits created as a result, there will almost assuredly be a need in the future to raise taxes on a broad-based basis, such as a VAT or national sales tax. COVID-19 complicates all of these tax proposals.

Key takeaways:

- Biden’s policies would reverse many portions of Trump’s Tax Cuts and Jobs Act, and he promotes approaches that would increase taxes on corporations and the ultra-wealthy. He would raise taxes between $3.5T-$4T.

- Trump’s policies are rather sparse, with promises to cut taxes, implement “Made in America” tax credits, and provide tax credits for companies that bring back jobs from China.

- Trump’s policies on taxes and finance are more focused on corporate and American economic growth. Biden’s plans are more focused on social spending such as environmental protection; improving conditions for working families and minority groups; and affordable housing.

- The candidates have policies of forcing US companies to stay on US soil, employ US workers or face penalties. While this may appear to be positive in the short run, longer run this policy incentivizes foreign companies to buy the US companies, fire US workers and then move the production to the lowest cost/most efficient country.

Biden

We’ve covered Biden’s pre-COVID tax and spending policies before, particularly noting that Biden plans to reverse parts of Trump’s Tax Cuts and Jobs Act (TCJA), and increase taxes on corporations and high income earners. (Andrew Busch)

His plans also include:

- Taxing capital gains at ordinary income tax rates—up from a top rate of 23.8 percent today—for those earning over $1 million. Biden would also eliminate step-up in basis for inherited assets with capital gains, instead taxing those gains at death.

- Capping the value of itemized deductions to 28 percent for those in higher marginal tax brackets and restoring the Pease limitation on itemized deductions for those with taxable income above $400,000.

- Raising the corporate income tax from 21 percent to 28 percent.

- Imposing a 15 percent minimum book tax on corporations with $100 million or greater in income.

- Doubling the tax rate on Global Intangible Low Tax Income (GILTI) earned by foreign subsidiaries of U.S. firms, from 10.5 percent to 21 percent.

- Imposing the 12.4 percent Social Security payroll tax on wage and self-employment income earned above $400,000. (Tax Foundation)

- Imposing 10% tax penalty on companies that move operations overseas and a 10% tax credit for companies that create jobs in the U.S.

- An EO on directing the federal government to buy American goods and support American supply chains in their procurement processes.

Since the pandemic, Biden’s policies have been updated to cover a “Build Back Better” approach, covering four key areas including a Jobs and Economic Recovery Plan for Working Families. (Joe Biden) This plan is split into numerous pieces, and sits alongside his other, pre-existing plans. He has no dedicated tax plan, though policies on tax are spread throughout his other policies.

He states that the core of the Build Back Better plan is to “create millions of good-paying jobs and to give America’s working families the tools, choices, and freedom they need to build back better.”

This plan includes goals to:

- Mobilize American manufacturing and innovation to ensure that the future is made in America, and in all of America.

- Mobilize American ingenuity to build a modern infrastructure and an equitable, clean energy future.

- Mobilize American talent and heart to build a 21st century caregiving and education workforce which will help ease the burden of care for working parents, especially women.

- Mobilize across the board to advance racial equity in America. (Joe Biden)

The Jobs and Economic Recovery Plan for Working Families also includes creating a minimum wage of “at least $15 per hour, and ending the tipped minimum wage and sub-minimum wage for people with disabilities, and strong benefits so they can live a middle class life and provide opportunity for their kids.” (Joe Biden)

With regard to small businesses and entrepreneurs, as well as workers’ rights, he states that he would “ensure that corporate America finally pays their fair share in taxes, puts their workers and communities first rather than their shareholders, and respects their workers’ power and voice in the workplace.” This promise is followed with a statement that he would facilitate this by “reversing some of Trump’s tax cuts for corporations and imposing common-sense tax reforms that finally make sure the wealthiest Americans pay their fair share.” (Joe Biden)

Another arm of the Build Back Better plan covers clean energy. With a goal of producing jobs in the clean electricity industry, Biden includes a tax incentive. He sets out that he would:

- reform and extend the tax incentives we know generate energy efficiency and clean energy jobs;

- develop innovative financing mechanisms that leverage private sector dollars to maximize investment in the clean energy revolution; and

- establish a technology-neutral Energy Efficiency and Clean Electricity Standard (EECES) for utilities and grid operators. (Joe Biden)

He would also “double down on research investments and tax incentives for technology that captures carbon and then permanently sequesters or utilizes that captured carbon, which includes lowering the cost of carbon capture retrofits for existing power plants.” (Joe Biden)

Further on jobs, Biden has proposed specific funding for health care workers, “including 150,000 community health workers to work in the neediest communities and another 100,000 in a newly created Public Health Jobs Corps.” This is aimed at “identifying communities at risk of contracting and spreading infectious diseases and strengthening the public health infrastructure.” (American Action Forum)

With regard to green infrastructure, Biden would “restore the full electric-vehicle tax credit,” and would “reinstate tax credits for residential energy efficiency.” For business and corporate buildings, he would “expand tax deductions for energy retrofits, smart metering systems, and other emissions-reducing investments in commercial buildings.” He would also “reinstate the solar Investment Tax Credit (ITC).” (Joe Biden)

Finally, another new plan is the Biden Plan to Ensure the Future is “Made in All of America” by All of America’s Workers. This plan is intended to put policies in place “to bolster American industrial and technological strength.” (Joe Biden)

This plan includes steps to introduce a “special Manufacturing Communities Tax Credit that promotes revitalizing, renovating, and modernizing existing – or recently closed down – facilities.” To be eligible for the tax credit, projects will have to “benefit local workers and communities by meeting strong labor standards, including paying workers a prevailing wage, employing workers trained in registered apprenticeship programs, and aiming to utilize Project Labor and Community Workforce Agreements.” (Joe Biden)

He also states that he would “reverse tax policies that encourage outsourcing.” To do this, he will end tax rules established by the TCJA “that allow multinationals to dramatically lower taxes on income earned overseas and allow the largest, most profitable companies to pay no tax at all.” In particular, he states he will “eliminate the incentives for pharmaceutical and other companies to move production overseas.” He also promises to clamp down on tax havens, and tighten anti-inversion rules. (Joe Biden)

Finally, he plans to “expand the New Markets Tax Credit, make the program permanent, and double Community Development Financial Institutions (CDFI) funding.” This provides tax credits to investors in community development organizations, and CDI funding would support “local, mission-driven financial institutions in low-income areas” around the country. This policy also sets out that he would create tax credits and subsidies to “help businesses to upgrade equipment and processes, to invest in expanded or new factories, and to deploy low-carbon technologies.” (Joe Biden)

Trump

In late August, Trump released his “Fighting for You” plan, describing his second-term proposals for policy, including some tax and economic policies, among other things. (Donald Trump) Trump’s policies are set out in basic bullet-point lists, with little detail on how he plans to carry out these policies. Some of the bullets appear to be more aspirational than informational.

On the tax and spending front he proposes to:

- Create 10 Million New Jobs in 10 Months

- Create 1 Million New Small Businesses

- Cut Taxes to Boost Take-Home Pay and Keep Jobs in America

- Enact Fair Trade Deals that Protect American Jobs

- Provide “Made in America” Tax Credits

- Expand Opportunity Zones

- Build the World’s Greatest Infrastructure System

- Establish a National High-Speed Wireless Internet Network

- Continue Deregulatory Agenda for Energy Independence (Donald Trump)

In addition, Trump’s policy plan sets out a number of financial and tax incentives to move manufacturing jobs out of China and back to the US. He states that he plans to:

- Bring Back 1 Million Manufacturing Jobs from China

- Create Tax Credits for Companies that Bring Back Jobs from China

- Allow 100% Expensing Deductions for Essential Industries like Pharmaceuticals and Robotics who Bring Back their Manufacturing to the United States

- Grant No Federal Contracts for Companies who Outsource to China (Donald Trump)

Kiplinger outlines some of the likely policy approaches that Trump will take, despite the lack of detail in his plans. First, he has already deferred the payroll tax until 2021, though this is not currently a payroll tax cut. (Whitehouse) It’s possible that Trump will try to push for the payroll tax deferral to be completely forgiven, or may try to implement payroll tax cuts later. (Kiplinger)

In addition, they also note that Trump has hinted at a tax cut for middle-class Americans by lowering the current 22% tax rate for individuals to 15%, a second round of stimulus checks, and reducing taxes on capital gains by eliminating the top rate of 20% paid by the highest income individuals. Finally, he has suggested that he would lower the corporate income tax rate to 20%. (Kiplinger) Market Watch notes that Trump has promised further details on these plans “in the upcoming few weeks,” which may provide further information on how the capital gains tax and tax cuts for middle-income families would be carried out. (Market Watch)

He has also touched on the idea of supporting the airline, hotel, restaurant, and travel business industry by implementing or expanding a travel tax credit, such as through the American Tax Rebate and Incentive Program (TRIP) Act. The TRIP Act would “allow a tax credit for domestic travel expenses” that could help these industries to recover from the pandemic. (Kiplinger)

Summary

In general, Biden’s tax plans are focused around repealing portions of the TCJA, particularly those relating to individual income tax reductions for those earning over $400,000. This stems from his belief that the current tax code “rewards wealth more than work,” and a desire to shift the tax burden from lower-income to higher-income earners. (Wall Street Journal) In addition, he would restore the top marginal income tax rate to 39.6 and tax capital gains at the ordinary income rate for high earners. The Tax Foundation analyzed his policies in March, and found that they “would raise about $3.8 trillion over 10 years. The plan would also reduce long-run economic growth by 1.51 percent and eliminate about 585,000 full-time equivalent jobs.” (Tax Foundation)

This raise of nearly $4 trillion in taxes (primarily on businesses and high income households) can have three effects. First, it allows spending to occur in other parts of Biden’s plan that he has promoted. Second, it can have a dampening effect on new business creation, business revenues, and some potential impacts of costs being passed on to workers or consumers. Biden tackles the issue of impacts upon wages with his $15 minimum wage plan but does not include any consumer-focused policies to mitigate potential increase in prices for goods and services. Third, the plan depends heavily on tax revenues from corporations and high income individuals, making federal revenues pro-cyclical and volatile.

As important as the impacts of his plans, is the question of whether they will even be able to be passed by Congress. The Tax Policy Center notes that “straight-up tax increases may be a tough sell, but combining them with low- and middle-income tax cuts could make the job easier.” In addition, with lingering impacts from the COVID-19 pandemic, tax increases for businesses could be unpopular, and may result in difficulties for an already-struggling economy. (Tax Policy Center)

However, the Tax Policy Center also notes that there is an “opportunity” in Biden’s plans, when combined with other proposals from his running mate, Kamala Harris. They explain that “Biden isn’t only proposing tax increases. He’s also suggested a modest expansion of the earned income tax credit (EITC) for childless workers. And his running mate, Sen. Kamala Harris (D-CA) has proposed an ambitious $2.7 trillion tax credit for low- and moderate-income working families, called the LIFT the Middle Class Act.” This allows for a more palatable overall tax proposal that could “convince lawmakers to shift the burden of taxes up the economic food chain.” (Tax Policy Center)

With respect to Trump’s policies the Tax Foundation has also weighed in, noting primarily that “without further details or clarification, it is difficult to fully analyze President Trump’s second term tax policy agenda.” They go on to clarify that Trump’s proposals are able to be generally examined, with “broad themes of the president’s agenda [including] providing tax relief to individuals and tax credits to businesses that engage in desired activities.” (Tax Foundation)

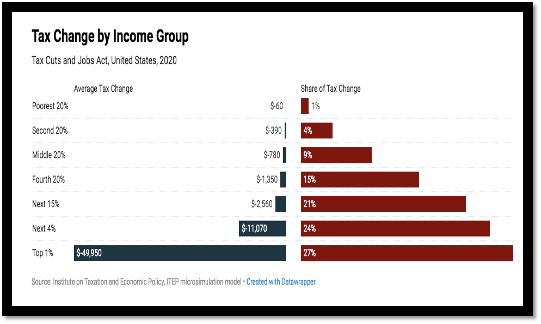

However, one major issue is that many of the TCJA provisions are set to expire in 2020, with the Trump campaign having proposed no suggestions or plan for what comes next. Assuming that the provisions in the TCJA are carried over, the impacts may be uneven. The Institute on Taxation and Economic Policy notes that the primary benefactors from Trump’s continued enactment of the TCJA will be those in the top 1%, and top 4% of the population. (Institute on Tax and Economic Policy)

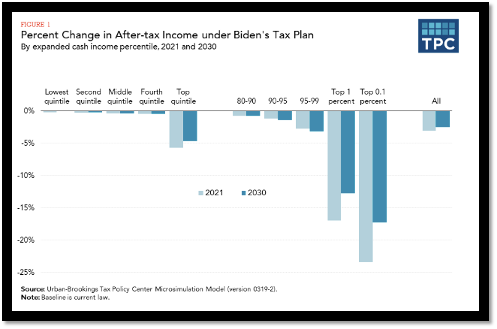

On the other hand, the Urban-Brookings microsimulation tax model shows that under Biden’s tax plan, as noted by the Tax Policy Center, most of his tax increases would be applied to these same groups. (Tax Policy Center)

This shows the fundamentally opposed tax proposals made by Biden and Trump, and the dramatically different impacts they will have on the top quintile of earners. The American Enterprise Institute notes that overall, Biden’s proposals “would make the US tax code more progressive,” and “would represent a significant increase to effective tax rates on high-income households and corporations.” (American Enterprise Institute)

In terms of broad economic impact, they also explain that his proposals “would result in a short-run reduction in gross domestic product (GDP) relative to the baseline, followed by a medium-run increase in GDP due to the reduction in debt and its reduced drag on investment. But the long-run effect of the Biden plan is a slight reduction in GDP relative to the baseline.” (American Enterprise Institute)

It is also important to note that under Biden’s tax proposals, even the lowest income groups may see take-home pay reduced in general. This is because while nearly all of Biden’s proposed tax increases affect households making $400,000 or more, with many of his tax cuts benefiting low- and moderate-income households, corporate taxes may end up being passed on to workers, with the Tax Policy Center noting that “ultimately people pay corporate taxes.” (Tax Policy Center)

The reality is likely slightly more complex than the individual tax cuts or increases may appear: “low- and middle-income households will pay little if any new direct taxes under Biden’s tax plan. But some may face a small decline in their after-tax incomes as they bear a modest share of his proposed corporate tax hikes.” (Tax Policy Center)

With regard to payroll tax deferrals implemented by Trump, it is yet to be seen whether these will be forgiven. This means that individuals may have to pay this money back at a later point. In addition, the Center on Budget and Policy Priorities notes that a payroll tax cut may be a poor and ineffective mechanism to provide economic relief and stimulus. A payroll tax cut will not affect anyone who has lost their job as a result of the pandemic (as the cut relates only to income from employment), and would not provide any benefits or relief to the elderly, students, and so on. In addition, as the tax cut is tied to earnings, it means that higher earners receive more relief than lower earners. (Center on Budget and Policy Priorities)

In addition, while Trump’s foreign policy approaches to financial dealings have primarily been in the form of applying tariffs, his primary statement going forward has been that he would continue to impose tariffs on “on companies that do not move jobs back to the United States from overseas.” The main lack of clarity in this proposal is that defining what constitutes “moving jobs back to the United States” has not been elaborated upon. (Tax Foundation)

Kiplinger explains that this lack of certainty can make things difficult for voters and for economic predictions, as “there are still serious problems with the U.S. economy right now – and tax policy is going to be an important part of any economic recovery in the future.” They note that “with the election right around the corner … voters need to know sooner rather than later where the president stands on taxes.” (Kiplinger)

To conclude, Biden has many comprehensive proposals for implementing tax reforms and hikes, as well as where that money will be spent. However, the main issue that Biden faces is that many of his spending proposals far outweigh the amount of money that will be brought in through this taxation, and his tax increases may be unpalatable in the current economic and political environment. This will partly depend on the make-up of Congress and the Senate in the coming year. On the other hand, Trump’s policies are problematic in a different way: they are vague, unpredictable, and do not provide enough detail for strong conclusions to be drawn. The candidates have policies of forcing US companies to stay on US soil, employ US workers or face penalties. While this may appear to be positive in the short run, longer run this policy incentivizes foreign companies to buy the US companies, fire US workers and then move the production to the lowest cost/most efficient country.

While Trump’s general proposals are likely to appear more acceptable to a Republican-controlled Senate, even a Democratic-controlled Senate may not like Biden’s proposals or be willing to pass them. For both candidates, the most likely scenario will be where they have to negotiate and compromise to enact their visions for tax and spending. Due to this, the art of the possible is more likely the art of the abstract, subject to interpretation over what the outcome and meaning will be.